Exploring the Benefits of Cross-Rollup for Asset Transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance

Orbiter Finance, a decentralized finance (DeFi) project built on Ethereum, has introduced a revolutionary solution for seamless asset transfer between Layer 1 Ethereum and Layer 2. This solution, known as Cross-Rollup, brings a host of benefits to users and developers alike. In this article, we will explore the advantages of Cross-Rollup and how it is transforming the DeFi landscape.

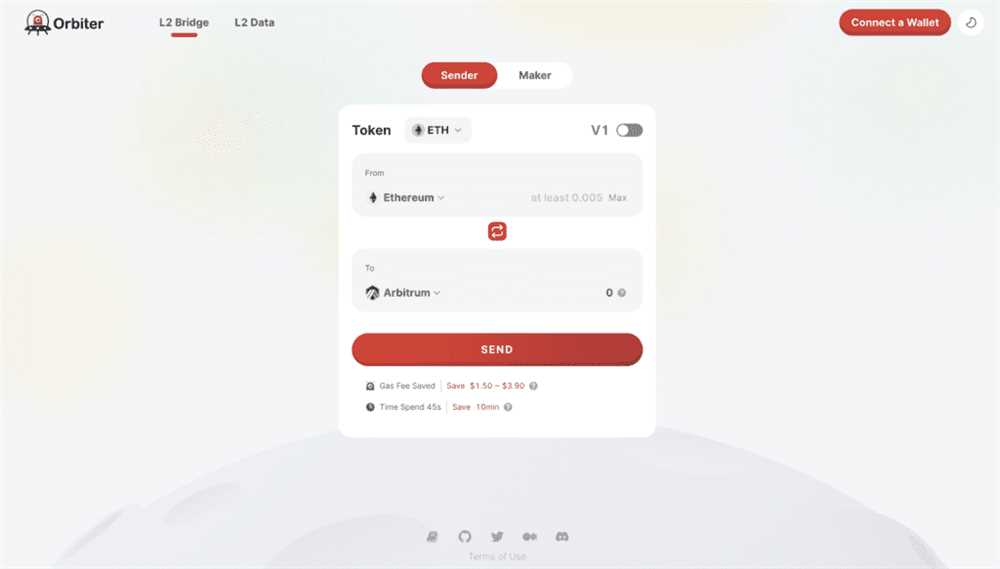

One of the key benefits of Cross-Rollup is the ability to transfer assets between Layer 1 Ethereum and Layer 2 in a frictionless manner. Previously, moving assets between different layers required complex and time-consuming processes, often involving multiple transactions and high gas fees. Cross-Rollup simplifies this process by enabling users to transfer assets instantly and at low cost, making it more efficient and accessible for everyone.

Another advantage of Cross-Rollup is its compatibility with existing Ethereum smart contracts. Unlike other solutions that require developers to rewrite or create new smart contracts, Cross-Rollup seamlessly integrates with the Ethereum ecosystem. This means that developers can leverage their existing smart contracts and build on top of them, without the need for additional coding or modification. This feature not only saves time and resources but also enhances interoperability between different layers of the Ethereum network.

Additionally, Cross-Rollup offers enhanced security and scalability. By leveraging Layer 2 solutions, such as zk-rollups, Cross-Rollup ensures that transactions are secured by the robustness of Layer 1 Ethereum while benefiting from the scalability of Layer 2. This combination provides users with a more secure and efficient platform for asset transfer, minimizing the risk of attacks and congestion on the Ethereum network.

In conclusion, Cross-Rollup is a game-changer for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance. Its seamless integration, low cost, and enhanced security make it a compelling solution for users and developers in the DeFi space. As more projects adopt Cross-Rollup and leverage its benefits, we can expect to see a significant shift in how assets are transferred and managed within the Ethereum ecosystem.

Benefits of Cross-Rollup for Asset Transfer

Cross-rollup technology offers several advantages for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance. These benefits include:

1. Improved scalability: By using cross-rollup, users can transfer assets between Layer 1 and Layer 2 more efficiently, reducing congestion on the Ethereum network and improving overall scalability. This can help to alleviate high gas fees and slow transaction confirmation times.

2. Enhanced speed: Cross-rollup enables faster asset transfers by leveraging the Layer 2 solution’s optimized architecture. With reduced latency and processing times, users can enjoy near-instantaneous asset transfers, making transactions more convenient and seamless.

3. Cost-effectiveness: By utilizing cross-rollup, users can save on transaction costs compared to conducting transfers solely on Layer 1 Ethereum. With lower gas fees and efficient asset transfers, cross-rollup technology offers a more cost-effective solution for sending and receiving assets.

4. Interoperability: Cross-rollup technology enables the seamless transfer of assets between different blockchains and Layer 2 solutions. This interoperability allows users to easily move their assets across multiple networks, promoting a more connected and versatile ecosystem for asset management.

5. Enhanced user experience: With the benefits of improved scalability, faster transactions, lower costs, and increased interoperability, cross-rollup technology ultimately enhances the user experience. Users can enjoy a smooth and efficient asset transfer process, enabling them to engage more actively in decentralized finance and other blockchain-based activities.

In conclusion, cross-rollup technology offers a range of benefits for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance. From scalability to speed, cost-effectiveness, interoperability, and user experience, cross-rollup enhances the overall efficiency and effectiveness of asset transfers in the blockchain ecosystem.

Efficient and Fast Transfer

One of the key benefits of Cross-Rollup for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance is its efficiency and speed. With traditional asset transfers between Layer 1 and Layer 2, there can be delays and high transaction fees.

However, with Cross-Rollup, the transfer process is optimized to be highly efficient and fast. By leveraging the power of Layer 2 solutions, Cross-Rollup minimizes the transaction fees and reduces the time it takes for assets to be transferred between Layer 1 and Layer 2.

This efficiency is achieved through the use of Rollups, which are Layer 2 solutions that bundle multiple transactions together and process them off-chain. By doing so, Cross-Rollup significantly reduces the amount of on-chain activity required, resulting in faster and cheaper asset transfers.

Additionally, Cross-Rollup also benefits from the scalability of Layer 2 solutions. With Layer 2, it is possible to process a much larger volume of transactions compared to Layer 1. This scalability ensures that asset transfers can be completed quickly, even during times of high network congestion.

The combination of efficiency and speed offered by Cross-Rollup makes it an attractive option for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance. By reducing transaction fees and processing times, Cross-Rollup provides a seamless experience for users looking to transfer their assets between different layers of the Ethereum ecosystem.

Reduced Costs and Fees

One of the major benefits of utilizing cross-rollup for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance is reduced costs and fees. Traditionally, transferring assets between different layers or chains can incur significant expenses due to gas fees and network congestion. However, with cross-rollup technology, these costs are significantly reduced.

By leveraging Layer 2 solutions like Orbiter Finance, users can enjoy lower fees and faster transaction processing times. This is achieved by batching multiple transactions together and submitting them as a single rollup transaction. As a result, the gas fees are divided among the participants, reducing the individual cost for each transfer.

Furthermore, cross-rollup solutions eliminate the need for expensive and time-consuming inter-chain bridges or cross-chain swaps. Instead, users can seamlessly transfer their assets between Layer 1 Ethereum and Layer 2 on Orbiter Finance without incurring additional costs or delays.

Overall, the reduced costs and fees associated with cross-rollup technology make it an attractive option for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance. Users can save money and time while enjoying the benefits of a scalable, efficient, and cost-effective solution for managing their assets.

Improved Scalability and Interoperability

One of the major benefits of implementing Cross-Rollup for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance is improved scalability. Layer 1 Ethereum has faced challenges with scalability due to its limited capacity to process a large number of transactions at once. With Cross-Rollup, the processing capacity is significantly increased, allowing for faster and more efficient asset transfer between different layers.

Furthermore, Cross-Rollup enhances interoperability between Layer 1 and Layer 2 networks. Previously, transferring assets between different layers required complex and slow processes, often involving multiple intermediaries. With Cross-Rollup, asset transfer becomes seamless and efficient, enabling users to easily move assets between layers without the need for intermediaries or complicated procedures.

By improving scalability and interoperability, Cross-Rollup opens up new possibilities for decentralized finance (DeFi) applications. Users can leverage the benefits of both Layer 1 and Layer 2 networks, enjoying the speed and efficiency of Layer 2 while still benefiting from the security and liquidity of Layer 1 Ethereum.

In addition, Cross-Rollup promotes a more inclusive and interconnected blockchain ecosystem. It allows developers and users to easily build and utilize applications across different layers, fostering collaboration and innovation. This interconnectedness also contributes to the growth and adoption of Ethereum as a whole.

Overall, implementing Cross-Rollup for asset transfer between Layer 1 Ethereum and Layer 2 on Orbiter Finance offers improved scalability and interoperability, unlocking new possibilities for DeFi applications and promoting a more connected blockchain ecosystem.

What is Cross-Rollup?

Cross-Rollup is a technology that allows for the transfer of assets between Layer 1 Ethereum and Layer 2 solutions.

Why is Cross-Rollup important for asset transfer?

Cross-Rollup is important for asset transfer because it enables faster and cheaper transactions compared to using Layer 1 Ethereum alone.

How does Cross-Rollup benefit users?

Cross-Rollup benefits users by providing them with improved scalability, reduced transaction fees, and faster confirmation times.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) platform that utilizes Cross-Rollup technology to facilitate asset transfer between Layer 1 Ethereum and Layer 2 solutions.

What are the advantages of using Orbiter Finance for asset transfer?

The advantages of using Orbiter Finance for asset transfer include lower transaction fees, faster transaction speeds, and improved scalability compared to traditional Layer 1 Ethereum transfers.