A Comprehensive Guide to Understanding the Cross-Rollup Process in Orbiter Finance

Orbiter Finance is a decentralized finance (DeFi) protocol that aims to provide users with seamless cross-chain transactions and yield farming opportunities. One of the key features of Orbiter Finance is its unique cross-rollup process, which plays a crucial role in enabling the interoperability and scalability of the platform.

What exactly is the cross-rollup process? Put simply, it is the mechanism by which assets are transferred between different rollup chains within the Orbiter Finance ecosystem. A rollup chain, in this context, refers to a layer 2 scaling solution that aggregates multiple transactions into a single batch and then submits it to the Ethereum mainnet.

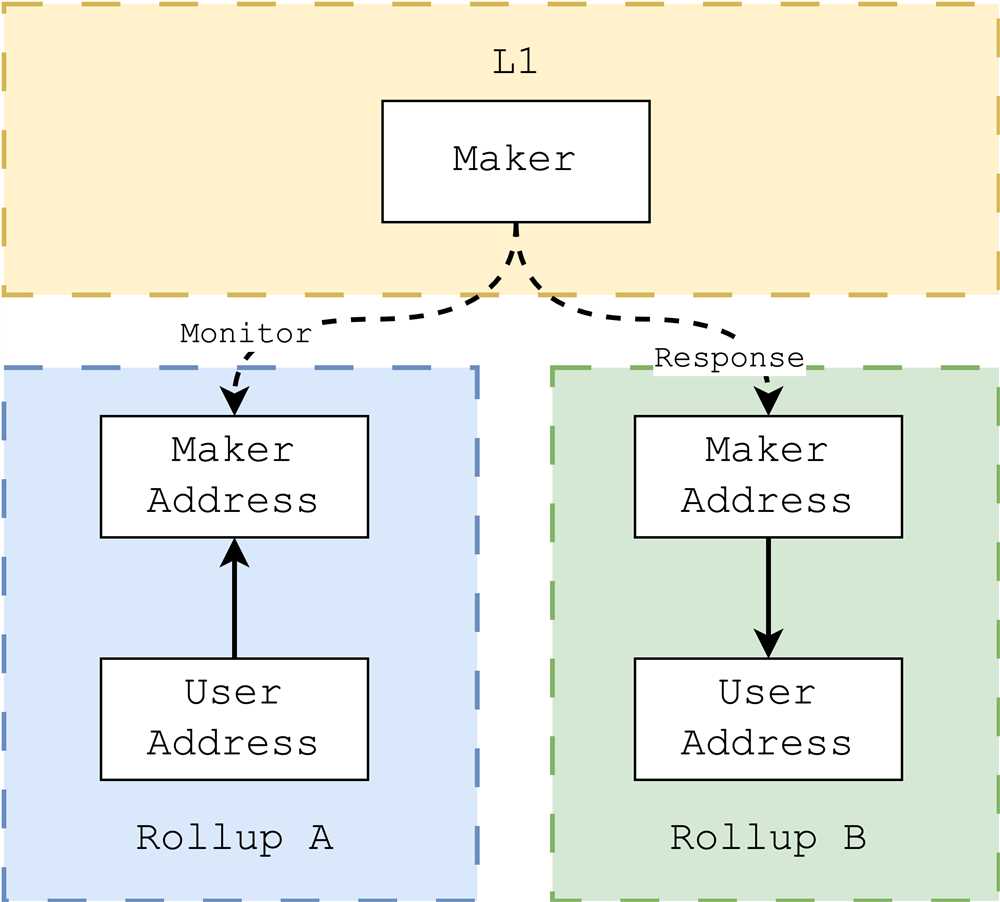

So, how does the cross-rollup process work? When a user initiates a transaction on Orbiter Finance, their assets are first deposited into a source rollup chain. This source chain could be Ethereum itself or another rollup chain integrated with Orbiter Finance. Once the assets are in the source chain, they can be converted into an equivalent representation on the destination rollup chain.

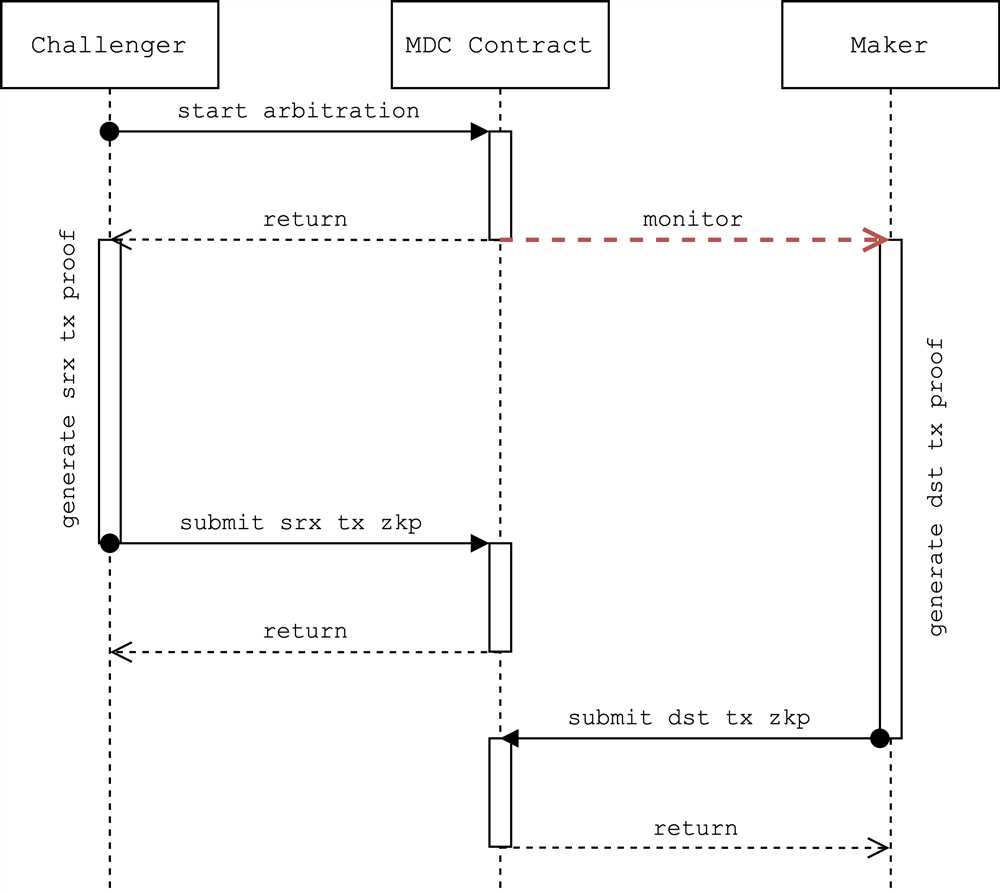

The cross-rollup process utilizes smart contracts and bridges to facilitate the seamless transfer of assets between rollup chains. These smart contracts ensure the security and integrity of the cross-chain transactions, preventing any unauthorized access or manipulation of user funds.

By enabling cross-rollup functionality, Orbiter Finance opens up a world of possibilities for users. They can now take advantage of multiple rollup chains and their unique features, such as faster transaction speeds and lower fees. Additionally, the cross-rollup process enhances the scalability of the platform, as it allows for the seamless transfer of assets between different chains, improving the overall efficiency and usability of Orbiter Finance.

Understanding the Cross-Rollup Process

In the world of decentralized finance (DeFi), interoperability between different blockchains is key for creating a seamless user experience. Cross-rollup is a process that allows users to transfer assets between different rollup chains, enabling them to take advantage of various protocols and opportunities available on each chain.

What is a Rollup Chain?

A rollup chain is a layer 2 solution that allows for scaling on the Ethereum blockchain. It aggregates multiple transactions into a single transaction, thereby reducing gas fees and improving scalability. Rollups are a popular choice for DeFi projects looking to enhance transaction throughput and lower costs.

A rollup chain acts as a sidechain or a layer 2 construction on top of the Ethereum mainnet. It achieves consensus through various mechanisms like Optimistic Rollups or Zero-Knowledge Rollups. These mechanisms ensure the security and integrity of transactions while mitigating the limitations of the Ethereum mainnet.

The Cross-Rollup Process

The cross-rollup process involves transferring assets from one rollup chain to another. This process requires the integration of the two rollup chains and the existence of bridging mechanisms. Cross-rollup can be achieved through two main methods:

1. Native Cross-Rollup: In this method, both the source and destination rollup chains support cross-rollup functionality. Assets can be directly transferred between the two chains without the need for additional bridge contracts or third-party involvement. This method is typically faster and more efficient, as it eliminates the need for intermediaries.

2. Bridge-based Cross-Rollup: In this method, a bridge contract is used to facilitate asset transfers between two rollup chains. The bridge contract acts as an intermediary, locking the assets on the source chain and minting corresponding wrapped tokens on the destination chain. The process is reversed when transferring assets back to the source chain. Bridge-based cross-rollup can be slower and more costly compared to native cross-rollup, as it involves additional steps and fees.

During the cross-rollup process, users need to consider factors such as bridge fees, transaction speeds, and security measures. It is also important to ensure that the rollup chains being used are compatible and interoperable with each other.

By leveraging the cross-rollup process, users can access a wider range of DeFi protocols, liquidity pools, and investment opportunities across different rollup chains. This enables them to optimize their financial strategies and maximize their returns in a decentralized and efficient manner.

Disclaimer: The information provided here is for informational purposes only and should not be taken as financial or investment advice.

In the Orbiter Finance Ecosystem

Orbiter Finance is a decentralized finance (DeFi) platform that provides users with a wide range of financial services through its ecosystem of smart contracts. Built on the Ethereum blockchain, Orbiter Finance enables users to access features such as cross-rollup capabilities, yield farming, liquidity provision, and more.

At the core of the Orbiter Finance ecosystem is the cross-rollup process, which allows users to seamlessly move their assets across different Layer 2 protocols. This innovative feature enhances scalability and efficiency by reducing congestion on the Ethereum mainnet.

To participate in the Orbiter Finance ecosystem, users first need to connect their wallets to the platform’s interface. Once connected, they can take advantage of various services, including staking their assets to earn passive income, providing liquidity to earn yield, and participating in cross-rollup transactions.

When users engage in cross-rollup transactions, they transfer their assets from one Layer 2 protocol to another. This process involves wrapping the assets in a layer-specific format compatible with the destination protocol. The wrapped assets are then transferred from the source to the destination protocol, where they can be utilized or further transferred within the Orbiter Finance ecosystem.

By enabling cross-rollup capabilities, Orbiter Finance is able to leverage the benefits of multiple Layer 2 protocols, such as lower transaction fees and faster transaction times. This flexibility allows users to optimize their DeFi strategies by accessing different ecosystems and protocols within the Orbiter Finance platform.

In addition to cross-rollup capabilities, Orbiter Finance also offers a range of features designed to enhance the user experience. These include a user-friendly interface, detailed analytics and reporting tools, and a responsive customer support team to assist users with any questions or issues they may have.

Conclusion

The Orbiter Finance ecosystem provides users with a comprehensive suite of DeFi services, including cross-rollup capabilities that facilitate seamless asset transfers across Layer 2 protocols. By leveraging multiple Layer 2 solutions, Orbiter Finance aims to enhance scalability, reduce transaction fees, and provide users with greater flexibility in optimizing their DeFi strategies.

With its innovative features and user-friendly interface, Orbiter Finance is well-positioned to contribute to the growing DeFi landscape and provide users with a seamless and efficient decentralized finance experience.

How Cross-Rollup Works

The cross-rollup process in Orbiter Finance is a mechanism that allows users to transfer assets between different rollup chains seamlessly. It ensures efficient and secure communication and interoperability between these chains, enabling users to enjoy the benefits of cross-chain functionality.

Here is a step-by-step breakdown of how the cross-rollup process works:

| Step | Description |

|---|---|

| 1 | User initiates a cross-rollup transfer |

| 2 | The user selects the source rollup chain and the target rollup chain for the transfer |

| 3 | The user specifies the asset and the amount to be transferred |

| 4 | A cross-rollup transaction is created and signed by the user |

| 5 | The transaction is submitted to the source rollup chain |

| 6 | The source rollup chain verifies the transaction and deducts the transferred amount from the user’s balance |

| 7 | The source rollup chain generates a proof of transfer |

| 8 | The proof of transfer is sent to the target rollup chain |

| 9 | The target rollup chain receives the proof of transfer and verifies its validity |

| 10 | The target rollup chain adds the transferred amount to the user’s balance |

| 11 | The cross-rollup transfer is complete, and the user can now access the transferred assets on the target rollup chain |

The cross-rollup process is designed to be transparent, efficient, and secure. By utilizing this mechanism, Orbiter Finance aims to provide users with a seamless and convenient cross-chain experience, enhancing the overall usability and interoperability of the platform.

Explained in Orbiter Finance

In Orbiter Finance, the cross-rollup process plays a vital role in ensuring the efficient transfer of assets between different rollup chains, providing users with a seamless experience in managing their funds. This process involves the movement of assets from one rollup chain to another while maintaining the integrity and security of the transactions.

How it works

The cross-rollup process starts with a user initiating a transaction to transfer their assets from one rollup chain to another. This could involve moving funds from the Layer 1 Ethereum chain to a Layer 2 rollup chain, or from one Layer 2 rollup chain to another.

When the transaction is initiated, the assets are locked on the source rollup chain. This ensures that the assets are securely held and cannot be accessed during the transfer process. The locked assets are then recorded as a pending transaction on the source rollup chain.

Once the transaction is confirmed on the source rollup chain, the assets are released and made available on the destination rollup chain. The user can then access and manage their assets on the new rollup chain, enjoying the benefits of faster transaction times and lower fees.

Benefits of Cross-Rollup Process

The cross-rollup process in Orbiter Finance offers several benefits to users. Firstly, it allows users to take advantage of the scalability and cost-effectiveness of Layer 2 rollup chains while still being able to access their assets on the Ethereum mainnet. This provides users with greater flexibility and choice when managing their funds.

Additionally, the cross-rollup process ensures the continuity and interoperability of assets across different rollup chains. This means that users can seamlessly move their assets between chains without having to worry about the compatibility or loss of value.

Overall, the cross-rollup process in Orbiter Finance empowers users with greater control and accessibility for managing their assets in a secure and efficient manner.

| Key Features | Benefits |

|---|---|

| Efficient asset transfer | Seamless movement of assets between different rollup chains |

| Enhanced scalability | Access the benefits of Layer 2 rollup chains while keeping assets on the Ethereum mainnet |

| Continuity and interoperability | Ability to transfer assets between chains without compatibility issues or loss of value |

The Benefits of Cross-Rollup Integration

Cross-rollup integration in Orbiter Finance brings a multitude of benefits to the decentralized finance (DeFi) ecosystem. By allowing seamless interoperability between different rollups, users can access a range of features and services that were previously not possible. Here are some of the key advantages of cross-rollup integration:

1. Enhanced Scalability

Integration of cross-rollup functionality allows for improved scalability within the DeFi ecosystem. By linking different rollups together, the overall capacity and efficiency of the network can be greatly increased. This means that more transactions can be processed simultaneously, reducing congestion and lowering gas fees for users.

2. Increased Liquidity

Cross-rollup integration also leads to increased liquidity in the DeFi market. By combining the liquidity pools of multiple rollups, users have access to a larger pool of funds, enabling higher trading volumes and better price discovery. This increased liquidity benefits both traders and liquidity providers, creating a more vibrant and efficient DeFi marketplace.

3. Expanded Functionality

The integration of different rollups offers expanded functionality and opens up new possibilities for DeFi applications. Developers can leverage the unique features of each rollup to create innovative financial products and services that were previously not feasible. This enables users to participate in a wider range of DeFi activities and opens up new avenues for investment and yield generation.

4. Improved User Experience

Cross-rollup integration enhances the overall user experience in the DeFi space. By enabling seamless transfer of assets and utilizing the benefits of different rollups, users can enjoy faster and more cost-effective transactions. The ability to interact with multiple rollups through a single interface also simplifies the user experience, making DeFi more accessible to a wider audience.

In summary, cross-rollup integration brings numerous advantages to the DeFi ecosystem, including enhanced scalability, increased liquidity, expanded functionality, and improved user experience. As the technology evolves and more rollups are integrated, the benefits of cross-rollup integration are likely to continue growing, driving the adoption and development of decentralized finance.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol built on the Ethereum blockchain. It aims to provide users with a seamless and efficient way to trade and invest in various assets.

What is the cross-rollup process in Orbiter Finance?

The cross-rollup process in Orbiter Finance refers to the mechanism by which assets are transferred between different rollup chains. It allows users to move their assets from one rollup chain to another, enabling them to access a wider range of trading and investment opportunities.

How does the cross-rollup process work in Orbiter Finance?

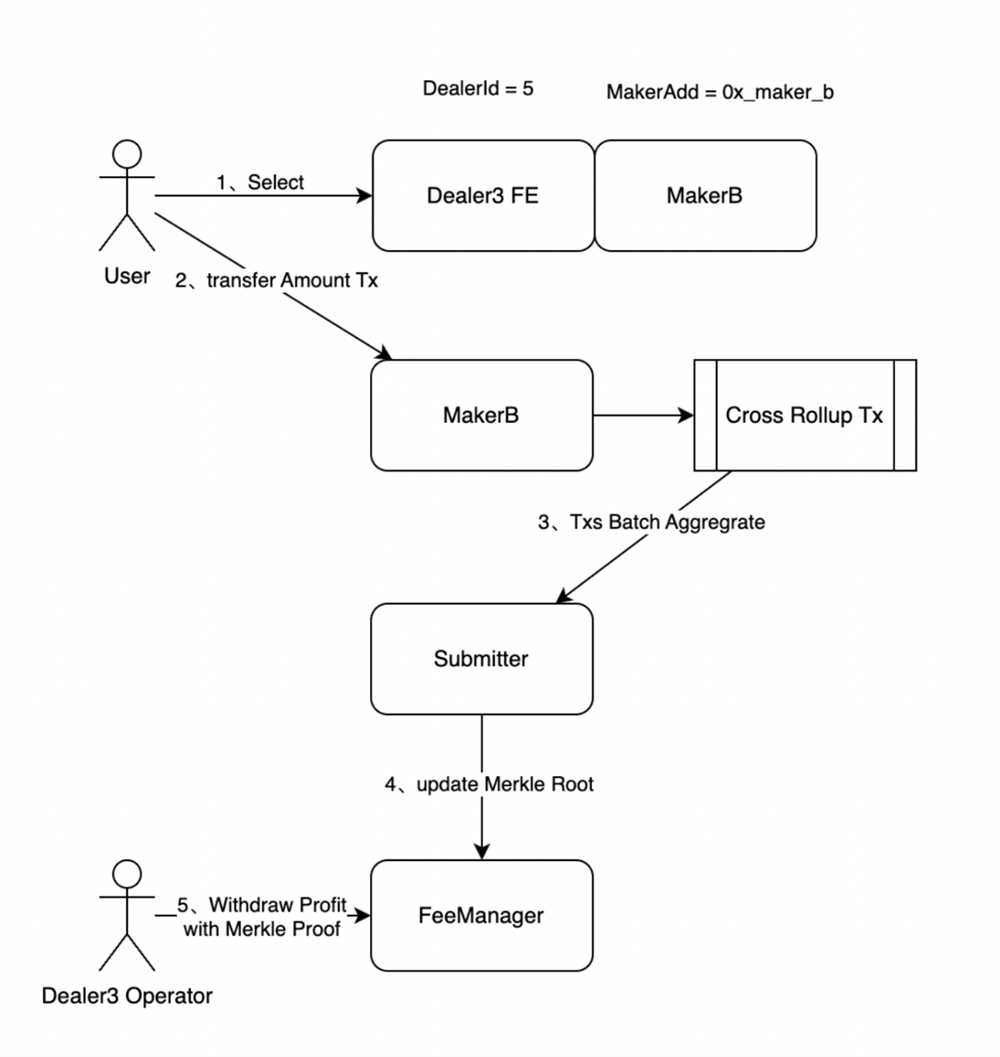

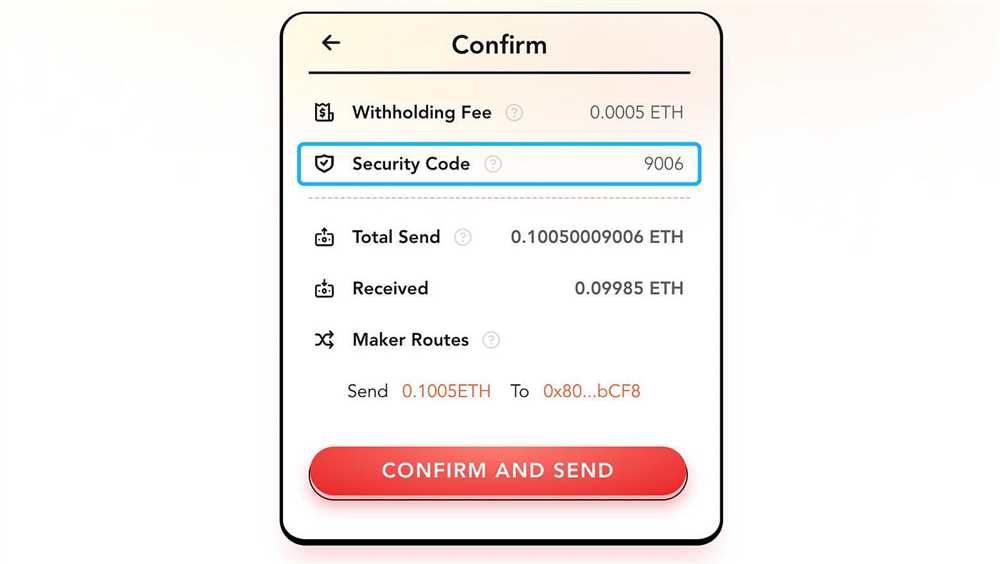

The cross-rollup process in Orbiter Finance involves several steps. First, users need to initiate a withdrawal request on the rollup chain where their assets are currently held. This request is then processed and confirmed by the network validators. Once the withdrawal request is confirmed, the assets are withdrawn from the original rollup chain and transferred to a cross-rollup bridge. From there, the assets are transferred to the desired rollup chain. Finally, the assets are deposited into the user’s account on the new rollup chain, where they can be used for trading or investment purposes.