Orbiter Finance is a groundbreaking financial platform that has revolutionized the way individuals and institutions participate in the digital economy. With its unique mechanism, Orbiter Finance offers a comprehensive analysis of the current financial landscape, providing users with the tools they need to make informed decisions.

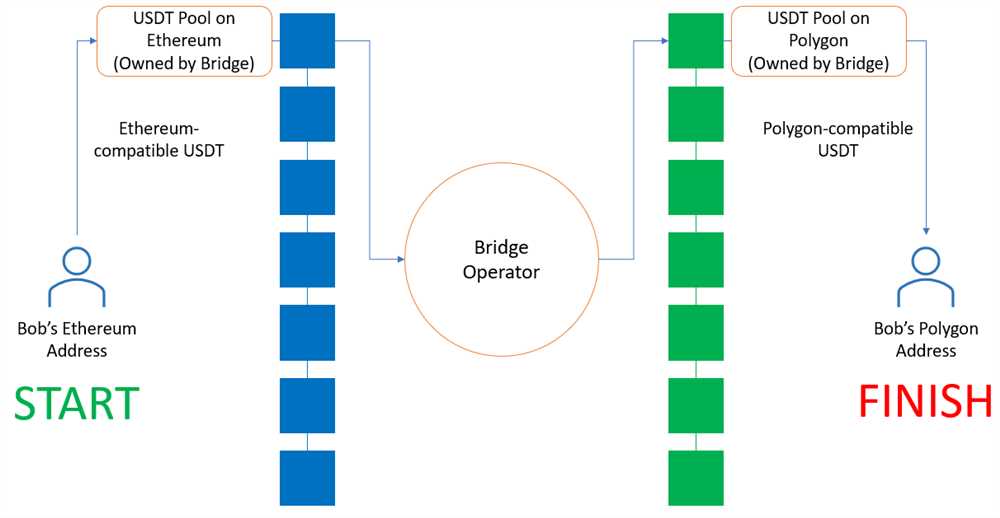

At the core of Orbiter Finance’s mechanism is its cutting-edge technology, which leverages blockchain and smart contract technologies to ensure transparency, security, and efficiency. Through its decentralized infrastructure, Orbiter Finance eliminates the need for intermediaries, enabling users to directly access various financial opportunities.

One of the key features of Orbiter Finance is its ability to aggregate data from multiple sources and provide real-time analysis. By combining data from various markets and sources, Orbiter Finance offers users a comprehensive view of the financial landscape, enabling them to identify trends and make informed investment decisions.

Furthermore, Orbiter Finance’s mechanism is designed to provide users with the flexibility and control they need over their financial assets. Through its intuitive interface, users can easily manage, diversify, and optimize their portfolios, ensuring maximum returns on their investments.

In conclusion, Orbiter Finance’s mechanism represents a new era in the financial industry. With its innovative technology, real-time analysis, and user-friendly interface, Orbiter Finance empowers individuals and institutions to navigate the digital economy with confidence and efficiency.

Understanding Orbiter Finance’s Mechanism

Orbiter Finance is a revolutionary platform that leverages decentralized finance (DeFi) to bring about a new era of financial inclusion. By utilizing blockchain technology and smart contracts, Orbiter Finance provides users with a range of financial services that are faster, more secure, and more reliable than traditional financial systems.

At the heart of Orbiter Finance’s mechanism is the use of its native token, ORB. ORB serves as both a utility token and a governance token within the ecosystem. As a utility token, ORB can be used to access various services offered by Orbiter Finance, such as lending, borrowing, and staking. It also plays a key role in the platform’s decentralized governance, allowing ORB holders to participate in decision-making processes.

Orbiter Finance’s mechanism is built on the principles of transparency and decentralization. All transactions and operations on the platform are recorded on the blockchain, ensuring that they are immutable and traceable. This not only enhances security but also enables users to have complete control over their funds. Additionally, the use of smart contracts eliminates the need for intermediaries, reducing costs and increasing efficiency.

One of the key features of Orbiter Finance’s mechanism is its automated market maker (AMM) protocol. This protocol enables users to trade cryptocurrencies directly on the platform without relying on a centralized exchange. Through liquidity pools, users can provide liquidity and earn rewards in the form of transaction fees. The AMM protocol also ensures that prices are determined based on the ratio of the assets in the pool, providing a fair and efficient trading environment.

Another important aspect of Orbiter Finance’s mechanism is its yield farming capabilities. Yield farming allows users to earn additional rewards by providing liquidity to the platform. By staking their ORB tokens, users can participate in various farming pools and earn additional ORB tokens as rewards. This incentivizes users to actively contribute to the liquidity of the platform and ensures the platform’s sustainability.

Overall, Orbiter Finance’s mechanism combines the power of blockchain, smart contracts, and DeFi to create a comprehensive financial ecosystem. Through its innovative features and user-friendly interface, Orbiter Finance aims to empower individuals with greater financial autonomy and enable them to access a wide range of financial services in a secure and efficient manner.

Mechanism behind Orbiter Finance

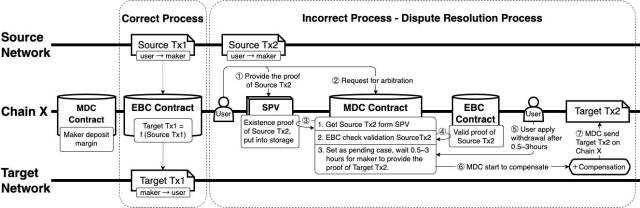

Orbiter Finance operates on a unique mechanism that ensures a transparent and decentralized financial ecosystem. This mechanism is built on a combination of smart contracts and algorithms, which enable users to engage in various financial activities securely and efficiently.

Smart Contracts

Smart contracts are a vital component of Orbiter Finance’s mechanism. These self-executing contracts are stored on the blockchain and automatically execute predefined actions when certain conditions are met. In the case of Orbiter Finance, smart contracts govern the creation, issuance, and management of digital assets, such as tokens and derivatives.

These contracts eliminate the need for intermediaries, as they are executed automatically and eliminate third-party trust. Additionally, the transparency of the blockchain ensures that all transactions and actions within the ecosystem are visible and verifiable by participants.

Algorithms

Orbiter Finance also utilizes algorithms to optimize various processes within its ecosystem. These algorithms are designed to perform complex calculations, analyze data, and make informed decisions related to lending, borrowing, and investment activities.

For example, the algorithm used for lending determines the interest rates based on factors such as the borrower’s credit history, collateral, and market conditions. This ensures fair and efficient lending practices while minimizing the risk for lenders.

The algorithm for borrowing, on the other hand, evaluates the borrower’s financial profile and determines the maximum borrowing limit. This helps borrowers make informed decisions regarding their borrowing capacity and mitigates the risk of overextension.

Furthermore, Orbiter Finance’s investment algorithm analyzes market data and helps users optimize their investment strategies. It provides recommendations on asset allocation, diversification, and timing to maximize potential returns.

| Component | Description |

|---|---|

| Smart Contracts | Self-executing contracts stored on the blockchain that govern the creation, issuance, and management of digital assets. |

| Algorithms | Mathematical models and calculations used to optimize lending, borrowing, and investment activities. |

| Transparency | All transactions and actions within the ecosystem are visible and verifiable by participants. |

| Efficiency | The mechanism enables efficient financial activities by automating processes and reducing the need for intermediaries. |

In conclusion, the mechanism behind Orbiter Finance is a combination of smart contracts and algorithms. This innovative approach ensures transparency, efficiency, and security within the decentralized financial ecosystem, providing users with a robust and reliable platform for their financial needs.

Benefits of Orbiter Finance Mechanism

Orbiter Finance provides several benefits to its users, making it an attractive option for individuals and businesses looking to manage their finances efficiently. Some key benefits of the Orbiter Finance mechanism include:

1. Decentralization

The Orbiter Finance mechanism is built on a decentralized network, leveraging blockchain technology to ensure transparency, security, and immutability. This decentralized nature eliminates the need for intermediaries such as banks, reducing costs and enabling peer-to-peer transactions.

2. Global Accessibility

With the Orbiter Finance mechanism, users can access their finances from anywhere in the world, as long as they have an internet connection. This global accessibility opens up opportunities for individuals and businesses to participate in global financial markets and engage with a wider network of users.

3. Enhanced Security

The Orbiter Finance mechanism employs advanced security measures, such as encryption and smart contracts. These measures ensure that users’ financial data is protected against unauthorized access and tampering. Additionally, the decentralized nature of the mechanism makes it highly resilient to attacks and single points of failure.

4. Efficiency and Cost Savings

Orbiter Finance streamlines financial processes, eliminating the need for manual reconciliation and paperwork. This automation reduces human error and saves time, resulting in increased efficiency. Furthermore, the removal of intermediaries from the process reduces transaction costs and fees, providing cost savings for users.

5. Financial Inclusion

The Orbiter Finance mechanism aims to promote financial inclusion by providing access to financial services for individuals who are unbanked or underbanked. Through the mechanism, individuals can participate in decentralized finance and access a wide range of financial products and services.

In conclusion, the Orbiter Finance mechanism offers numerous benefits to its users, including decentralization, global accessibility, enhanced security, efficiency, cost savings, and financial inclusion. These benefits make Orbiter Finance a promising solution for individuals and businesses seeking to effectively manage their finances in the digital age.

Challenges in Implementing Orbiter Finance

As with any complex financial system, implementing Orbiter Finance comes with its fair share of challenges. These challenges can arise from various aspects, including technical, regulatory, and operational factors. In order to ensure a smooth implementation, it is important to address these challenges and mitigate the associated risks.

1. Technical Challenges

One of the primary technical challenges in implementing Orbiter Finance is integrating the platform with existing infrastructure. This may involve integrating with different banking systems, payment gateways, and other financial systems. Ensuring compatibility and smooth data flow between multiple interfaces can be a complex task and requires careful planning and thorough testing.

Another technical challenge is scalability. As Orbiter Finance is intended to cater to a large number of users and handle substantial transaction volumes, it is crucial to design and develop a system that can handle scalability effectively. This involves optimizing server performance, database management, and network infrastructure to accommodate increasing user demands without compromising on system stability.

2. Regulatory Challenges

The financial industry is highly regulated, and implementing a financial system like Orbiter Finance requires compliance with various legal and regulatory frameworks. The system needs to adhere to anti-money laundering (AML) and know your customer (KYC) regulations, as well as data protection and privacy laws. Remaining up-to-date with changing regulations and ensuring compliance can be a significant challenge, particularly when operating in multiple jurisdictions.

Moreover, implementing Orbiter Finance may also require obtaining licenses and approvals from relevant regulatory bodies. The process of obtaining these licenses can be time-consuming and complex, involving extensive documentation, financial audits, and compliance checks.

3. Operational Challenges

Operational challenges pertain to the day-to-day management and running of Orbiter Finance. These challenges include ensuring robust security measures to protect user funds and personal information from cyber threats. Implementing strong encryption, two-factor authentication, and regular security audits are necessary steps to mitigate these risks.

Additionally, providing excellent customer support and resolving any issues or disputes in a timely manner is crucial for maintaining customer satisfaction. This may require setting up a dedicated support team and implementing efficient communication channels.

In conclusion, while Orbiter Finance offers a promising financial mechanism, it is essential to recognize and address the challenges associated with its implementation. By addressing technical, regulatory, and operational challenges, organizations can maximize the benefits of Orbiter Finance while minimizing potential risks.

The Future of Orbiter Finance

As Orbiter Finance continues to grow and evolve, there are several key areas that will shape its future.

| 1. Expansion into new markets: | Orbiter Finance aims to expand its reach into new markets, including emerging economies and sectors such as renewable energy and healthcare. This expansion will allow Orbiter Finance to diversify its portfolio and tap into new sources of revenue. |

| 2. Development of innovative products: | Orbiter Finance is committed to continuously developing innovative financial products to meet the changing needs of its customers. The company will invest in research and development to create new offerings that provide value and address emerging trends in the global financial market. |

| 3. Embracing blockchain technology: | Orbiter Finance recognizes the potential of blockchain technology to revolutionize the financial industry. The company will explore and leverage blockchain technology to enhance its security, transparency, and efficiency. By adopting blockchain, Orbiter Finance aims to provide its customers with faster and more secure transactions. |

| 4. Strengthening partnerships: | Orbiter Finance will continue to strengthen its partnerships with existing and new financial institutions, technology companies, and regulatory bodies. Collaborations and partnerships will enable Orbiter Finance to leverage complementary expertise and resources, expand its customer base, and navigate regulatory landscapes. |

| 5. Focus on sustainability: | Recognizing the importance of sustainability, Orbiter Finance will integrate sustainable practices into its business operations. The company will prioritize investments in environmentally friendly projects and support initiatives that promote social responsibility. By incorporating sustainability, Orbiter Finance aims to not only generate financial returns but also contribute to a more sustainable future. |

In conclusion, the future of Orbiter Finance looks promising with its expansion into new markets, development of innovative products, embrace of blockchain technology, focus on strengthening partnerships, and commitment to sustainability. These strategic initiatives will position Orbiter Finance as a leader in the global financial market and enable it to provide enhanced value to its customers.

How does Orbiter Finance’s mechanism work?

Orbiter Finance’s mechanism works by utilizing smart contracts and decentralized finance (DeFi) protocols to provide users with various financial services. By leveraging blockchain technology, it enables secure and transparent transactions, lending and borrowing, staking, and other DeFi functionalities.

What are the benefits of using Orbiter Finance?

There are several benefits to using Orbiter Finance. Firstly, it offers a secure and transparent platform, thanks to its utilization of blockchain technology. Additionally, users can access a wide range of decentralized financial services, including lending, borrowing, and staking, all in one place. Moreover, Orbiter Finance rewards users with its native token, creating potential opportunities for additional income.

Can you provide more details about Orbiter Finance’s native token?

Of course! Orbiter Finance has its own native token, called ORC. This token is used within the ecosystem for various purposes, such as governance and voting rights, fee discounts, and liquidity mining rewards. By holding ORC tokens, users can actively participate in shaping the future of the platform and potentially earn additional rewards.

Is Orbiter Finance open to integration with other DeFi platforms?

Yes, Orbiter Finance is open to integration and collaboration with other DeFi platforms. By partnering with other platforms, Orbiter Finance can expand its offerings and provide users with even more diverse financial services. This collaboration also contributes to the growth and development of the overall DeFi ecosystem.