The global landscape is constantly shaped by a myriad of events, both big and small. These events, ranging from natural disasters to political shifts, have far-reaching consequences that extend beyond borders and industries. One such industry is the space exploration sector, specifically the financing and operation of orbiters.

Orbiters, with their important scientific missions and technological advancements, rely heavily on financial support from governments, international organizations, and private investors. However, the effects of worldwide events on orbiter finances can have significant implications on the viability and sustainability of these ventures.

One key aspect to consider is the impact of natural disasters. Catastrophic events such as earthquakes, hurricanes, or tsunamis can not only result in loss of life and infrastructure, but also disrupt supply chains and affect the global economy. This, in turn, can lead to budget cuts or reallocation of funds away from space exploration programs, affecting the financial stability of orbiter missions.

Political shifts and conflicts are another factor that can influence the financial landscape for orbiters. Changes in government policies, trade agreements, or international tensions can directly impact funding sources and partnerships. Moreover, diplomatic disputes or economic sanctions can restrict access to certain technologies or collaborations, posing additional challenges for the financial viability of space missions.

Understanding the Global Impact

When analyzing the effects of worldwide events on Orbiter’s finances, it is crucial to understand the global impact of such occurrences. These events can range from economic downturns to natural disasters, political instability, or even pandemics. By comprehending the interconnectedness of the global economy and how events in one part of the world can ripple through multiple industries and markets, we can better grasp the implications for Orbiter’s financial standing.

An Interconnected World

In today’s modern age, it is evident that the world is more interconnected than ever before. Global economic systems, supply chains, and financial networks are deeply intertwined, making the effects of worldwide events more significant than ever. For example, a political crisis in one country can disrupt international trade, causing supply shortages, price fluctuations, and ultimately impacting Orbiter’s revenue streams.

Similarly, natural disasters such as hurricanes, earthquakes, or tsunamis can devastate entire regions and disrupt manufacturing and shipping processes. As a result, Orbiter may face challenges in procuring essential components or experience delays in product delivery. These disruptions can not only affect the company’s financial performance in the short term but also have long-term consequences on customer relationships and market position.

Multiple Industries Affected

The global impact of worldwide events is not limited to a single industry or sector. Financial crises, for instance, can have a domino effect on various sectors, including the aerospace industry. Reduced consumer spending and investor confidence may lead to decreased demand for space travel or satellite launches, directly impacting Orbiter’s revenue streams.

Moreover, pandemics, as we have witnessed with the recent COVID-19 outbreak, can profoundly impact the global economy and various industries. Travel restrictions, reduced consumer mobility, and disrupted supply chains all contribute to a decline in demand for space tourism or satellite services. Orbiter’s financial well-being is intrinsically linked to the overall health of the global economy and its ability to weather such events.

It is imperative for Orbiter to not only understand the global impact of worldwide events but also proactively assess potential risks, develop contingency plans, and diversify its business operations to mitigate financial vulnerabilities.

By closely monitoring global trends, economic indicators, and political developments, Orbiter can gain valuable insights into the potential financial implications of worldwide events. The company can then adapt its strategies, reduce risks, and take advantage of emerging opportunities to ensure its long-term financial stability and success in a rapidly changing global landscape.

Exploring the Interconnected Economy

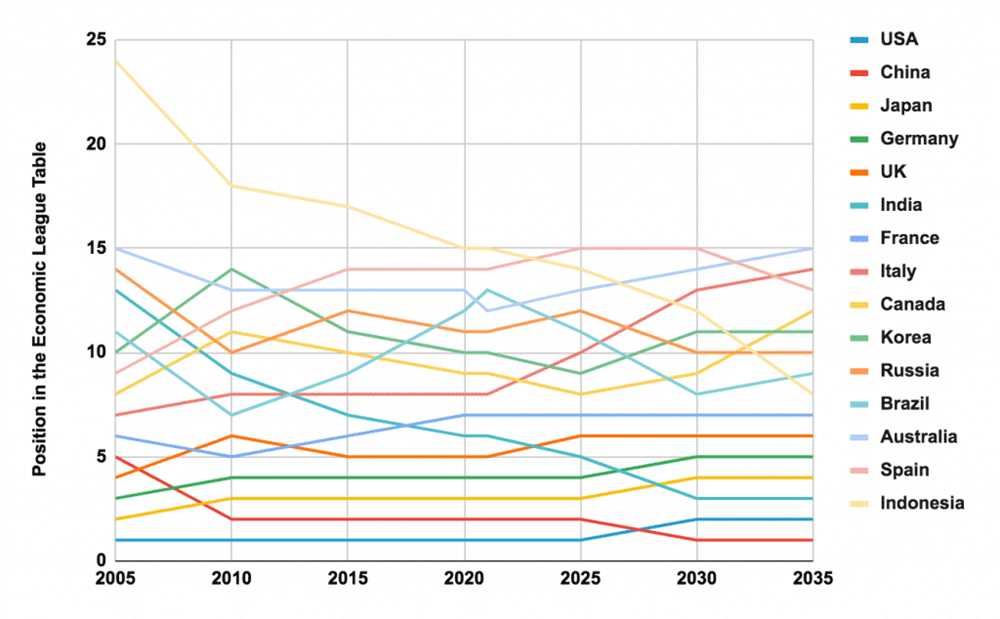

In today’s globalized world, the interconnected nature of economies around the world has become increasingly apparent. Events in one country can have significant impacts on the economies of others, creating a ripple effect that can spread across continents. This interconnectedness is particularly evident in the context of worldwide events and their effects on Orbiter finances.

Global events, such as economic crises, political shifts, natural disasters, and pandemics, can have profound implications for Orbiter’s financial stability. For example, a recession in one country can lead to decreased consumer confidence and spending, which can in turn impact Orbiter’s sales and revenue. Similarly, political instability in a major market can create uncertainty and hinder investment, affecting Orbiter’s expansion plans and profitability.

The Role of Trade

Trade is a key driver of the interconnected economy. The exchange of goods and services between countries facilitates economic growth and allows nations to specialize in areas where they have a comparative advantage. However, disruptions in global trade can have far-reaching consequences for Orbiter and other companies.

Trade barriers, such as tariffs and trade wars, can lead to increased costs for Orbiter’s supply chain and reduce profitability. Changes in trade policies can also disrupt established supply chains and force companies to find new markets or sources of raw materials. These factors can introduce uncertainty and volatility into Orbiter’s financial projections.

Global Financial Institutions

The interconnected economy is also reflected in the presence of global financial institutions such as the International Monetary Fund (IMF) and the World Bank. These organizations play a crucial role in supporting global financial stability and providing assistance to countries facing economic challenges.

Orbiter’s finances can be affected by the actions of these institutions. For example, measures taken by the IMF to stabilize ailing economies may involve strict austerity measures that can lead to reduced consumer spending and economic contraction. These effects can trickle down to Orbiter through decreased demand for its products.

| Factors | Impact on Orbiter Finances |

|---|---|

| Economic Crises | Decreased consumer confidence and spending |

| Political Shifts | Uncertainty and hindered investment plans |

| Natural Disasters | Disruptions in supply chains and increased costs |

| Pandemics | Reduced consumer spending and economic contraction |

In conclusion, the interconnected economy is a complex web of relationships and dependencies that can greatly affect Orbiter’s finances. Understanding the impact of worldwide events on the global economy is crucial for Orbiter to navigate potential risks and seize opportunities for growth.

Analyzing Market Volatility

Market volatility refers to the degree of uncertainty or rapid change in the prices of financial assets. It represents the speed and magnitude of price fluctuations in the market. Analyzing market volatility is crucial for understanding the financial impact of worldwide events on Orbiter finances.

There are several key factors to consider when analyzing market volatility:

- Macroeconomic indicators: Factors such as GDP growth, inflation rates, and interest rates can greatly influence market volatility. Monitoring these indicators can provide insights into the overall health of the global economy and its potential impact on Orbiter finances.

- Geopolitical events: Geopolitical events, such as political instability, trade wars, and conflicts, can have a significant impact on market volatility. Understanding the potential risks and opportunities associated with these events can help Orbiter make informed financial decisions.

- Investor sentiment: Investor sentiment plays a crucial role in market volatility. It refers to the overall attitude and emotions of investors towards a particular market or asset class. Positive sentiment can drive up prices, while negative sentiment can lead to sharp declines.

- Volatility indexes: Volatility indexes, such as the CBOE Volatility Index (VIX), measure market expectations for future volatility. Tracking these indexes can provide insights into market participants’ expectations and help Orbiter assess the potential risks in the market.

- Historical data: Analyzing historical market data can help Orbiter identify patterns and trends in market volatility. By studying past episodes of market volatility, Orbiter can gain valuable insights into how markets react to different events.

By analyzing market volatility and its underlying factors, Orbiter can better understand and manage the financial impact of worldwide events. This can help them make informed decisions and adapt their financial strategies to navigate through turbulent market conditions.

Assessing Orbiter Financial Stability

In order to understand the effects of worldwide events on Orbiter finances, it is crucial to assess the financial stability of the organization. This involves examining various factors and metrics that determine the financial health of the Orbiter.

One important aspect to consider is the revenue generated by the Orbiter. This can come from various sources, such as ticket sales, sponsorships, and merchandise sales. By analyzing the revenue streams, it is possible to determine the organization’s ability to generate income and sustain its operations.

Another crucial factor is the organization’s expenses. This includes costs associated with maintaining and operating the Orbiter, as well as salaries and wages for staff. Assessing the expenses allows us to determine if the organization is managing its resources efficiently and making prudent financial decisions.

Furthermore, it is important to analyze the Orbiter’s assets and liabilities. This includes assets such as property, equipment, and investments, as well as liabilities such as loans and debts. By evaluating the organization’s balance sheet, we can gain insights into its financial position and long-term sustainability.

Additionally, it is essential to consider the organization’s financial performance over time. This involves analyzing financial statements such as income statements and cash flow statements. By comparing financial data from different periods, we can identify trends and patterns that provide insights into the Orbiter’s financial stability.

Lastly, assessing Orbiter financial stability also involves considering external factors that may impact its finances. This includes worldwide events such as economic recessions, natural disasters, and political instability. By understanding the potential risks and challenges posed by these events, the organization can take proactive measures to safeguard its financial stability.

- Overall, assessing Orbiter financial stability is a comprehensive process that involves analyzing various factors, such as revenue, expenses, assets, liabilities, financial performance, and external risks. By conducting a thorough assessment, we can gain a comprehensive understanding of the organization’s financial health and make informed decisions to ensure its long-term stability.

What are the main factors that can affect the finances of an orbiter?

The main factors that can affect the finances of an orbiter include worldwide events, such as economic recessions or political conflicts, changes in government funding and priorities, and technological advancements.

How do worldwide events impact the finances of an orbiter?

Worldwide events can impact the finances of an orbiter in various ways. For example, during an economic recession, governments may reduce their funding for space exploration programs, which can result in budget cuts for orbiters. Similarly, political conflicts can divert funding away from space projects. On the other hand, certain events, such as advancements in technology or the discovery of new resources, may lead to increased investments in orbiters and their missions.