Anatomy of a Successful Orbiter Finance Investment Strategies for Long Term Growth

Investing in the ever-expanding field of orbiter finance is a smart move for those looking to achieve long-term growth and financial stability. However, with so many investment options available, it’s crucial to have a solid understanding of the strategies that lead to success in this specialized sector. In this article, we will delve into the anatomy of a successful orbiter finance investment, exploring key factors that contribute to sustainable growth and profitability.

One of the first steps towards achieving success in orbiter finance investment is to thoroughly research potential investment opportunities. This involves analyzing the performance and track record of existing orbiter finance companies, as well as staying updated on industry trends and news. By gaining a comprehensive understanding of the market, investors can make informed decisions that maximize their chances of profiting from their investments.

To further optimize investment strategies in orbiter finance, diversification is key. By spreading investments across multiple companies or projects, investors can mitigate risks and capitalize on potential growth opportunities. It is important to carefully evaluate the risk vs. reward ratio of each investment, ensuring a well-balanced and diversified portfolio.

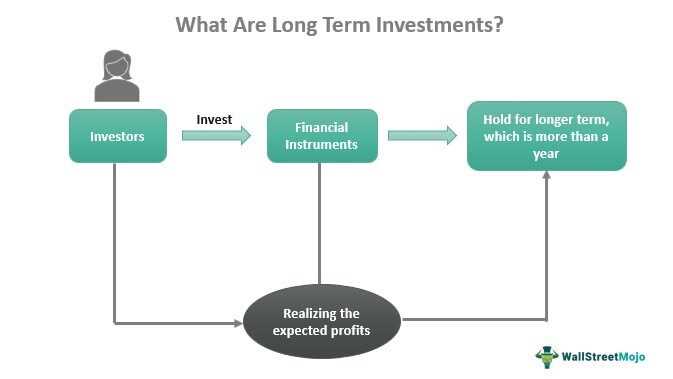

In addition, having a long-term perspective is crucial for success in orbiter finance investment. This sector requires patience, as returns may not be immediate. By adopting a long-term investment horizon, investors can take advantage of the compounding effect and benefit from the increasing value of their investments over time. This also enables investors to weather potential market fluctuations and capitalize on upward trends.

In conclusion, investing in orbiter finance presents unique opportunities for long-term growth and financial success. By conducting thorough research, diversifying investments, and adopting a long-term perspective, investors can create a strong foundation for sustainable growth and profitability. As with any investment, it is important to stay abreast of industry developments and adjust investment strategies accordingly. By following these guidelines, investors can navigate the complex world of orbiter finance with confidence and maximize their potential for success.

Diversification for Risk Management

Effective risk management is crucial for long-term growth and success in orbiter finance investment strategies. One powerful tool in managing risk is diversification. Diversification involves spreading investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment on the overall portfolio.

By diversifying your investments, you can mitigate the risk of extreme losses and potential volatility. If one investment performs poorly, the impact on the overall portfolio is limited because other investments can continue to generate positive returns. This helps to safeguard your funds from significant erosion.

Furthermore, diversification can enhance potential returns while reducing risk. By investing in a diverse range of assets, you can access opportunities in different sectors and countries that may be experiencing growth and can contribute to overall portfolio growth.

It’s important to note that diversification does not eliminate risk entirely, but it can help to manage and mitigate it. It’s still necessary to conduct thorough research and analysis to ensure that the investments chosen are stable and have the potential for long-term growth.

Key benefits of diversification for risk management:

- Reduces concentration risk: Diversification spreads risk across multiple investments, reducing the impact of any one investment on the portfolio.

- Increases potential for returns: By investing in a diverse range of assets, you increase your chances of accessing opportunities for growth and potential returns.

- Mitigates volatility: Diversification can help to smooth out market fluctuations and reduce the impact of isolated events on the overall portfolio.

- Preserves capital: By limiting the impact of any one investment, diversification can help to preserve capital and safeguard against significant losses.

Overall, diversification is an essential risk management strategy in orbiter finance investment. By spreading investments across different assets, industries, and regions, investors can mitigate risk, enhance potential returns, and safeguard their capital for long-term growth and success.

Understanding Market Trends and Analysis

When it comes to making successful long-term investment strategies, understanding market trends and analysis is crucial. By staying informed about the current market conditions and analyzing past trends, investors can make better-informed decisions about their investments.

Market trends refer to the overall direction and movement of the market. These trends can be classified as bullish, bearish, or sideways. Understanding these trends can help investors identify potential investment opportunities and make appropriate investment decisions.

Market analysis involves examining various factors that can influence market trends, such as economic indicators, industry performance, and company-specific information. Analysts use various tools and techniques, such as technical analysis and fundamental analysis, to evaluate the market and identify potential investment opportunities.

Technical analysis involves studying historical price and volume data to identify patterns and trends in the market. This analysis is based on the belief that market trends tend to repeat themselves, and past performance can provide insights into future price movements.

Fundamental analysis, on the other hand, focuses on evaluating the intrinsic value of an investment by examining factors such as company financials, industry outlook, and competitive positioning. This analysis helps investors determine whether a particular investment is undervalued or overvalued.

In addition to understanding market trends and analysis techniques, investors should also consider the importance of diversification in their investment strategies. Diversifying investments across different asset classes and sectors can help mitigate risk and maximize potential returns.

Ultimately, successful investment strategies for long-term growth require a combination of understanding market trends, conducting thorough market analysis, and adopting a diversified approach. By staying informed and making informed decisions, investors can position themselves for long-term success in the market.

Importance of Fundamental Analysis

Fundamental analysis is a critical tool for investors looking to make informed investment decisions in the world of finance. It involves analyzing a company’s financial statements, industry trends, and economic factors to assess the intrinsic value of a stock or asset.

By focusing on the fundamental factors that drive a company’s performance, investors can gain a deeper understanding of its financial health, growth potential, and competitive position in the market. This analysis helps investors determine whether a stock is undervalued or overvalued, and whether it presents a good opportunity for long-term growth.

One of the key components of fundamental analysis is examining a company’s financial statements, such as its income statement, balance sheet, and cash flow statement. These documents provide a snapshot of the company’s financial position, profitability, and cash flow generation. By digging into the numbers and ratios presented in these statements, investors can assess the company’s earning power, debt levels, and ability to generate consistent cash flows.

Another important aspect of fundamental analysis is assessing the company’s industry and market dynamics. By examining industry trends, market share, and competitive landscape, investors can evaluate the company’s ability to withstand market fluctuations and maintain a competitive advantage. Understanding the broader economic factors, such as interest rates, inflation, and government policies, is also crucial for assessing the investment climate and the potential impact on a company’s operations.

Ultimately, fundamental analysis helps investors make rational investment decisions based on a thorough understanding of a company’s value and growth prospects. This analysis is particularly important for long-term investors who are looking for sustainable growth and steady returns over an extended period of time.

In conclusion, fundamental analysis is an essential tool for investors seeking to make sound investment decisions. It provides valuable insights into a company’s financial health, growth potential, and competitive advantage. By conducting a comprehensive analysis of the company’s financial statements, industry trends, and economic factors, investors can evaluate its intrinsic value and make informed choices for long-term growth.

Long-Term Perspective for Sustainable Growth

When it comes to investing in the stock market, taking a long-term perspective is essential for sustainable growth. Short-term fluctuations in the market can often be unpredictable and investors who focus on short-term gains may end up making impulsive investment decisions based on market trends.

Investing with a long-term mindset means looking beyond the day-to-day market volatility and focusing on the potential for long-term growth. This approach allows investors to ride out short-term market fluctuations and take advantage of compounding returns over time.

Benefits of Long-Term Investing

There are several benefits to adopting a long-term perspective for sustainable growth:

- Compounding returns: By holding investments for a longer period of time, investors can benefit from compounding returns. This is the process where the returns earned on an investment are reinvested and generate additional returns over time.

- Reduced transaction costs: Frequent buying and selling of stocks can lead to higher transaction costs, such as commissions and fees. Long-term investors, on the other hand, tend to have lower transaction costs as they hold their investments for an extended period of time.

- Emotional stability: Taking a long-term perspective helps investors avoid making impulsive decisions based on short-term market fluctuations. This can lead to more emotional stability and a greater ability to stick to an investment strategy even during volatile market conditions.

Key Strategies for Long-Term Growth

Here are some key strategies that can help investors achieve long-term growth:

- Diversification: Spreading investments across different asset classes, sectors, and regions can help reduce risk and increase the potential for long-term growth.

- Regular monitoring and review: It’s important for investors to regularly review their investments and make adjustments if necessary. This can help ensure that the portfolio stays aligned with the investor’s long-term goals.

- Staying informed: Keeping up with market trends, economic indicators, and company news can provide valuable insights for long-term investors. This information can help identify investment opportunities and make informed decisions.

- Rebalancing: Periodically rebalancing the portfolio can help maintain the desired asset allocation and ensure that investments are aligned with the investor’s risk tolerance and goals.

By adopting a long-term perspective and implementing these strategies, investors can position themselves for sustainable growth and potentially achieve their long-term financial goals.

Key Factors for Successful Investment in Orbiter Finance

When making investments in Orbiter Finance, it is crucial for investors to consider a range of key factors that can contribute to the success of their investment strategy. These factors include:

| Factor | Description |

|---|---|

| Risk Assessment | Investors should carefully evaluate the level of risk associated with their investment in Orbiter Finance. They should consider factors such as the stability of the market, the financial health of the company, and the regulatory environment. Conducting a thorough risk assessment will help investors make informed decisions and manage their exposure to potential risks. |

| Long-Term Growth Potential | Investors should focus on identifying companies within Orbiter Finance that have strong long-term growth potential. This can include factors such as innovative products or services, a competitive market position, and a robust business model. Investing in companies with long-term growth potential can enhance the likelihood of generating substantial returns over time. |

| Financial Analysis | Performing a comprehensive financial analysis of Orbiter Finance and the companies within its portfolio is essential. This analysis should include evaluating key financial metrics such as revenue, profit margins, and cash flow. By understanding the financial health and performance of the company, investors can make well-informed investment decisions. |

| Management Team | The management team of Orbiter Finance plays a critical role in the overall success of the company. Investors should examine the experience, track record, and expertise of the management team. A strong and capable management team can navigate challenges, make sound strategic decisions, and drive sustainable growth. |

| Diversification | Investing in a diversified portfolio can help mitigate risk and maximize returns. Investors should consider diversifying their investments across a range of companies and industries within Orbiter Finance. This can help protect against market volatility and reduce the impact of any individual investment underperforming. |

| Market Research | Conducting thorough market research is crucial for successful investment in Orbiter Finance. Investors should stay informed about industry trends, market dynamics, and emerging opportunities. This research can inform investment decisions and help investors identify lucrative investment opportunities within Orbiter Finance. |

Considering these key factors can help investors make informed investment decisions and increase their chances of achieving long-term growth and success in Orbiter Finance.

What are the key strategies for long-term growth in orbiter finance investment?

The key strategies for long-term growth in orbiter finance investment include diversification, long-term investment horizon, risk management, and staying updated on market trends.

How important is diversification in orbiter finance investment?

Diversification is crucial in orbiter finance investment because it helps to spread out the risk across different assets, reducing the impact of any single investment on the overall portfolio.

What is the recommended investment horizon for orbiter finance investment?

The recommended investment horizon for orbiter finance investment is long-term, as it allows for the compounding of returns and provides a higher potential for growth.

Why is risk management important in orbiter finance investment?

Risk management is important in orbiter finance investment to protect the portfolio from potential losses and to manage the overall risk exposure. It involves strategies such as asset allocation, diversification, and setting stop-loss orders.

How can I stay updated on market trends for orbiter finance investment?

To stay updated on market trends for orbiter finance investment, you can regularly follow financial news, read industry reports, analyze historical data, and engage with investment professionals or advisors who specialize in the field.