Automating Decision-Making: Orbiter Finance’s Algorithm-Driven Asset Allocation Optimization

Experience the future of investing with Orbiter Finance’s groundbreaking algorithmic asset allocation optimization. Say goodbye to outdated and manual investment strategies, and embrace the power of automation.

At Orbiter Finance, we understand that making investment decisions can be complex and time-consuming. That’s why we’ve developed an advanced algorithm that takes the guesswork out of asset allocation. Our cutting-edge technology combines historical data, market trends, and risk assessment to create personalized investment portfolios tailored to your unique financial goals.

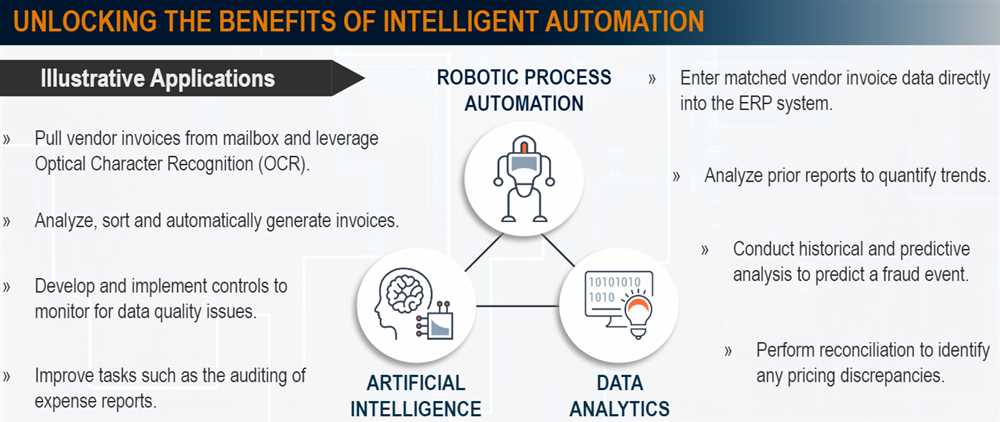

By leveraging artificial intelligence and machine learning, Orbiter Finance’s algorithm continuously analyzes market conditions and adjusts your portfolio allocation in real-time. This means that your investments are always optimized to maximize returns while minimizing risks.

Our algorithmic asset allocation optimization takes into account a wide range of factors, including your risk tolerance, investment timeline, and financial objectives. Whether you’re a seasoned investor or just starting your journey, we can help you achieve your financial goals with precision and efficiency.

With Orbiter Finance, you’ll benefit from:

- Unbiased Decision-Making: Our algorithm relies on data-driven analysis, removing human biases for more rational investment decisions.

- Real-time Portfolio Management: Your portfolio is continuously monitored and adjusted to capture emerging opportunities and mitigate potential risks.

- Customized Solutions: We understand that every investor is unique. Our algorithm creates portfolios based on your individual needs and preferences.

- Proven Results: Our algorithm has consistently outperformed traditional investment strategies, delivering impressive returns to our clients.

Don’t let emotions or outdated strategies dictate your investment decisions. Embrace the future of investing with Orbiter Finance’s algorithmic asset allocation optimization. Start maximizing your returns today!

Benefits

By utilizing Orbiter Finance’s Algorithmic Asset Allocation Optimization, you can unlock a range of benefits that will transform your decision-making process and enhance your overall financial performance:

|

1. Improved Profitability: Our algorithmic approach to asset allocation optimization allows you to make data-driven decisions that are more likely to result in increased profitability. |

|

2. Risk Mitigation: With our advanced algorithms, you can minimize risks and ensure a more stable financial portfolio. Our solution takes into account various risk factors and adjusts asset allocation accordingly. |

|

3. Enhanced Efficiency: Automating the decision-making process eliminates the need for manual calculations and reduces the potential for human error. This leads to improved efficiency, saving you valuable time and resources. |

|

4. Flexibility and Adaptability: Our algorithmic asset allocation optimization system provides you with flexibility and adaptability to changing market conditions. It continuously analyzes market trends and adjusts your portfolio accordingly, ensuring you stay ahead of the curve. |

|

5. Confidence in Decision-Making: With Orbiter Finance’s Algorithmic Asset Allocation Optimization, you can make decisions backed by solid data and advanced analytics. This will boost your confidence in your investment strategy and increase your chances of success. |

Improved Decision-Making

In today’s fast-paced world, making informed decisions is crucial to success. At Orbiter Finance, we understand the importance of accurate decision-making and have developed a cutting-edge algorithmic asset allocation optimization system to help our clients achieve their financial goals.

With our algorithmic system, we take into account a wide range of factors, including market trends, historical data, and current economic conditions. This allows us to analyze and process information at a speed and accuracy level that humans simply cannot match. By leveraging the power of automation, we are able to generate optimal asset allocation strategies tailored to each client’s unique goals and risk tolerance.

Our algorithmic asset allocation optimization system continuously learns and adapts to changing market conditions, ensuring that our clients’ portfolios are always aligned with the most up-to-date information. This real-time approach allows for quick adjustments in response to market fluctuations and helps to mitigate risk while maximizing returns.

With the help of our algorithmic system, you can say goodbye to guesswork and rely on data-driven decision-making. Our system takes the emotion out of investing and provides you with rational and objective recommendations based on facts and analysis. This allows you to make well-informed decisions with confidence, knowing that your investments are backed by a robust and proven methodology.

Choose Orbiter Finance for improved decision-making and let our algorithmic asset allocation optimization system work for you. Start maximizing your investment potential today and achieve your financial goals faster and more efficiently than ever before.

Optimal Asset Allocation

When it comes to investing, making the right decisions can be challenging. The global financial markets are complex and constantly changing, making it difficult to determine the best course of action. That’s where Orbiter Finance’s algorithmic asset allocation optimization comes in.

Our cutting-edge technology takes the guesswork out of asset allocation by analyzing a wide range of factors, including market trends, risk tolerance, and investment goals. By using advanced algorithms, Orbiter Finance is able to identify the optimal allocation strategy for your portfolio.

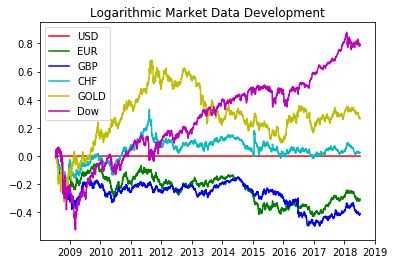

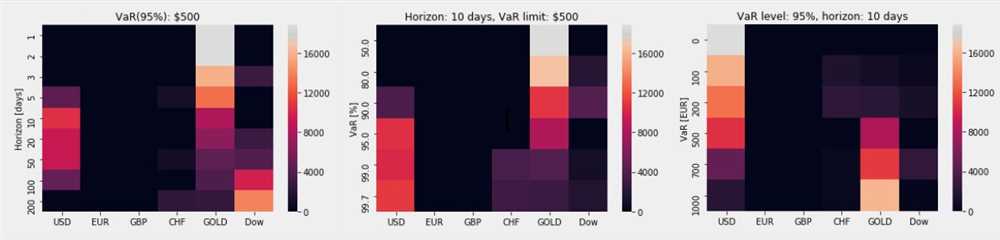

With optimal asset allocation, you can maximize returns while minimizing risk. Our algorithm takes into account various asset classes, such as stocks, bonds, and commodities, and determines the ideal distribution based on your unique circumstances. This approach helps to ensure that your investments are diversified and well-balanced, reducing the impact of volatility and potential losses.

By automating decision-making, Orbiter Finance’s algorithmic asset allocation optimization provides you with a strategic framework that adapts to changing market conditions. Our technology continuously monitors and adjusts your portfolio, taking advantage of new opportunities and mitigating risks in real-time.

Whether you are a novice investor or a seasoned professional, optimal asset allocation is crucial for long-term financial success. Let Orbiter Finance’s algorithmic asset allocation optimization be your guide and take the stress out of investment decision-making.

Features

Orbiter Finance’s Algorithmic Asset Allocation Optimization offers a range of powerful features that enable you to automate your decision-making process and optimize your asset allocation strategy.

Advanced Analytics

Our algorithm uses advanced analytics to analyze historical data and generate insights on market trends and asset performance. This enables you to make data-driven investment decisions and identify opportunities for maximizing your returns.

Diversification

Orbiter Finance’s algorithm ensures efficient diversification of your investment portfolio across different asset classes, industries, and geographical regions. This helps to minimize risk and maximize returns by spreading your investments across a variety of assets.

Customization

With Orbiter Finance’s Algorithmic Asset Allocation Optimization, you have the flexibility to customize your investment strategy based on your risk tolerance, investment goals, and time horizon. Our algorithm takes into account your preferences and constraints to provide you with a tailored asset allocation plan.

Dynamic Rebalancing

Our advanced algorithm continuously monitors market conditions, asset performance, and your investment objectives to dynamically rebalance your portfolio. This ensures that your investments are aligned with your desired asset allocation and optimizes your returns while minimizing risk.

Real-Time Monitoring

You can track the performance of your investments in real-time with our intuitive dashboard. The dashboard provides comprehensive insights on your portfolio’s performance, asset allocation, and market trends, empowering you to make informed investment decisions.

Risk Management

Our algorithm incorporates sophisticated risk management techniques to analyze and mitigate various types of investment risks, including market risk, credit risk, and liquidity risk. This helps to protect your investments and ensures a risk-adjusted asset allocation.

Cost Efficiency

Orbiter Finance’s Algorithmic Asset Allocation Optimization minimizes costs associated with manual decision-making and traditional investment management. By automating your investment process, you can save time and reduce expenses, allowing you to focus on other important aspects of your financial strategy.

Algorithmic Optimization

Enhanced Precision

Our algorithmic optimization process leverages advanced mathematical models and data analysis to maximize the precision of asset allocations. By taking into account historical market trends, risk appetite, and individual investment goals, our algorithms identify the optimal allocation strategies that generate the highest returns.

Intelligent Rebalancing

Regular portfolio rebalancing is crucial to maintain the desired asset allocation and minimize risks. With our algorithmic optimization, the rebalancing process becomes intelligent and automated. Our algorithms monitor market conditions in real-time and identify potential deviations from the target allocation. They then execute trades to rebalance the portfolio, ensuring that it remains aligned with the investment objectives.

By leveraging algorithmic optimization, investors can:

- Minimize human biases and emotions in investment decision-making

- Achieve greater consistency and discipline in portfolio management

- React quickly to market changes and seize profitable opportunities

- Optimize risk-adjusted returns and enhance long-term performance

Experience the power of algorithmic optimization with Orbiter Finance. Revolutionize your investment strategies and stay ahead of the competition.

Automation of Processes

At Orbiter Finance, we understand the importance of automating processes to streamline operations and improve efficiency. Our algorithmic asset allocation optimization solution is just one example of how we utilize automation to transform decision-making in the financial industry.

By automating processes, we eliminate the need for manual intervention, reducing the potential for human error and increasing accuracy. Our advanced algorithm takes into account various factors, such as market trends, historical data, and risk profiles, to make informed investment decisions.

With our automated system, asset allocation optimization becomes a seamless and efficient process. The algorithm continuously analyzes and rebalances portfolios based on changing market conditions, ensuring that investments are optimized for maximum returns. This eliminates the need for manual portfolio adjustments and reduces the risk of missed opportunities.

Furthermore, automation allows for real-time monitoring and reporting, providing investors with up-to-date information and insights. With automated alerts and notifications, investors can quickly respond to market changes and make timely decisions, all without the need for manual tracking and analysis.

By embracing automation, Orbiter Finance revolutionizes decision-making in the financial industry. Our algorithmic asset allocation optimization solution brings efficiency, accuracy, and agility to the investment process, ensuring that portfolios are always optimized for success.

Experience the power of automation with Orbiter Finance’s algorithmic asset allocation optimization today!

What is Orbiter Finance’s Algorithmic Asset Allocation Optimization?

Orbiter Finance’s Algorithmic Asset Allocation Optimization is a software solution that automates the process of decision-making in terms of asset allocation. It uses advanced algorithms to analyze financial data and recommend the optimal distribution of investments across different assets.

How does Orbiter Finance’s Algorithmic Asset Allocation Optimization work?

Orbiter Finance’s Algorithmic Asset Allocation Optimization works by collecting and analyzing financial data from various sources, including market trends, historical performance, and risk levels. It then applies advanced algorithms to identify the most optimal allocation of assets based on predefined criteria, such as desired return and risk tolerance.

What are the benefits of using Orbiter Finance’s Algorithmic Asset Allocation Optimization?

There are several benefits of using Orbiter Finance’s Algorithmic Asset Allocation Optimization. First, it takes emotions out of the decision-making process, ensuring a more rational and consistent approach to asset allocation. Second, it saves time and effort by automating the analysis and recommendation process. Finally, it can potentially improve investment returns by identifying and exploiting opportunities that may be missed by human investors.