Introducing Orbiter Finance, the groundbreaking platform that is here to revolutionize asset management!

Gone are the days of complicated and outdated systems that hold you back from maximizing your investment potential. Orbiter Finance is here to break barriers and empower you.

With our cutting-edge technology and innovative solutions, we aim to completely transform the way you manage your assets. Say goodbye to tedious and time-consuming processes, and say hello to efficiency and effectiveness.

By leveraging artificial intelligence and machine learning algorithms, Orbiter Finance brings you unparalleled insights and recommendations. Our advanced analytical tools provide real-time data, giving you the power to make informed and profitable investment decisions.

But that’s not all. Orbiter Finance is more than just a platform – it’s a community.

Connect with experts and industry leaders, share ideas, and learn from the best. Our network of like-minded individuals is dedicated to your success, providing you with unparalleled support and guidance.

Join us today and experience the future of asset management with Orbiter Finance. Together, we can break barriers and unlock your full investment potential.

The Current Landscape

In today’s rapidly evolving financial landscape, the traditional asset management industry faces numerous challenges and obstacles. With outdated systems and processes, investors often find it difficult to navigate the complex world of finance and maximize their returns. Furthermore, the lack of transparency and high costs associated with asset management services further hinder the growth of individual and institutional investors.

Complexity and Inefficiency

The asset management industry is plagued by complexity and inefficiency. The vast amount of data and information available can be overwhelming, making it challenging for investors to make informed decisions. Additionally, the reliance on manual processes and paperwork leads to delays and errors, further exacerbating the problem.

Moreover, the fragmented nature of the industry means that investors must engage with multiple service providers, resulting in duplication of efforts and increased costs. This lack of integration and collaboration adds unnecessary complexity to asset management.

Lack of Transparency and High Costs

Transparency is a critical factor in building trust between investors and asset managers. Unfortunately, the current asset management landscape often lacks transparency. Investors are left in the dark when it comes to understanding how their assets are managed and the associated costs.

High fees and hidden charges are common in traditional asset management, eating into investors’ returns. The lack of clarity surrounding fees and expenses further erodes trust and makes it challenging for investors to assess the true value of the services they receive.

Furthermore, the high minimum investment requirements imposed by many asset management firms often exclude individual investors with limited capital from accessing professional asset management services.

The Need for Change

In light of the challenges posed by the current asset management landscape, there is an urgent need for change. Investors deserve an asset management solution that is transparent, efficient, and accessible.

By harnessing the power of blockchain technology, Orbiter Finance aims to revolutionize asset management. Through its innovative platform, investors can gain full transparency into their assets, enabling them to make informed decisions. Additionally, by automating processes and minimizing intermediaries, Orbiter Finance reduces costs and provides investors with better value for their money.

Orbiter Finance is committed to breaking barriers and empowering both individual and institutional investors to take control of their financial future. Together, we can reshape the asset management industry and create a more inclusive and transparent financial landscape.

Challenges in Asset Management

Asset management is a complex and dynamic field that requires constant adaptation and innovation to overcome its challenges. Here are some of the key challenges facing asset managers today:

1. Volatility and Uncertainty: The financial markets are inherently volatile and unpredictable, making it difficult for asset managers to accurately forecast market trends and make informed investment decisions. Managing risk and navigating through uncertain economic times is a constant challenge.

2. Regulatory Compliance: Asset managers operate in a heavily regulated environment, requiring them to comply with a myriad of rules and regulations. Staying compliant with changing regulatory frameworks is a significant challenge, as non-compliance can result in legal and financial consequences.

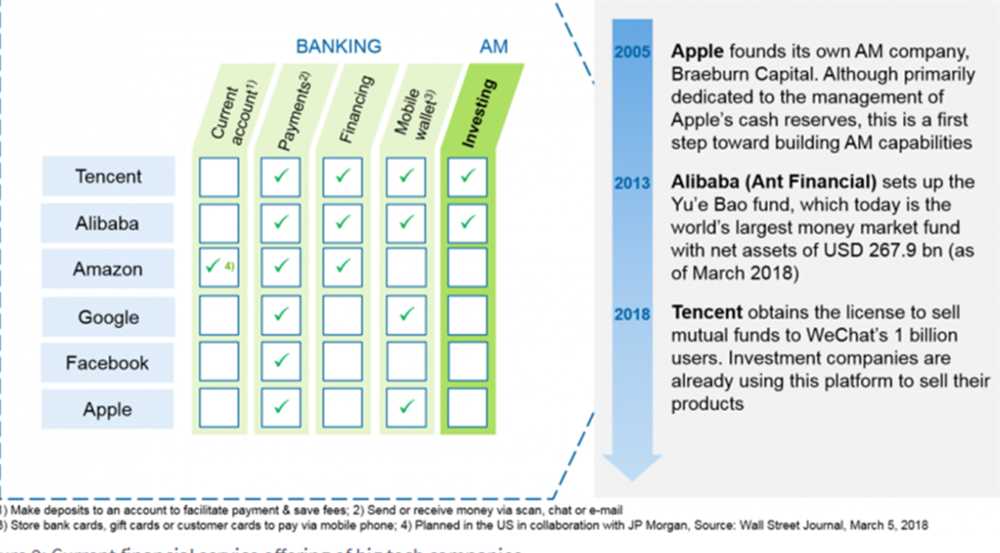

3. Technological Disruption: The rapid advancement of technology is revolutionizing the asset management industry. Asset managers need to stay abreast of the latest technological developments, such as artificial intelligence and machine learning, to enhance their investment strategies and streamline their operations.

4. Investor Expectations: Investors are becoming increasingly sophisticated and demanding, expecting higher returns and personalized investment solutions. Asset managers need to meet these expectations while also managing risk and adhering to regulatory requirements.

5. Globalization: Globalization has expanded investment opportunities but has also increased complexity and risk. Asset managers must navigate global markets and understand different regulatory environments, economic conditions, and cultural factors to effectively manage investments.

6. Environmental, Social, and Governance (ESG) Considerations: The growing emphasis on ESG factors, such as environmental sustainability, social responsibility, and corporate governance, presents a challenge for asset managers. Integrating ESG considerations into investment decisions requires extensive research and analysis.

7. Talent Management: Finding and retaining skilled professionals is a persistent challenge in asset management. The industry requires individuals with expertise in various disciplines, including finance, technology, and risk management.

Despite these challenges, asset managers who can successfully navigate them have the potential to deliver strong returns and create value for their clients. Orbiter Finance is at the forefront of revolutionizing asset management, offering innovative solutions that address these challenges and empower asset managers to thrive in an ever-changing landscape.

Breaking Barriers

Orbiter Finance is revolutionizing asset management by breaking down barriers that have traditionally hindered investors. With our innovative platform and cutting-edge technology, we aim to democratize access to the world of finance and empower individuals to take control of their financial future.

One of the key barriers Orbiter Finance is breaking is the high cost of entry. In the past, only wealthy individuals and institutional investors had access to the best investment opportunities. However, with our platform, anyone can invest with as little as $1, allowing for greater participation and opening up a whole new world of possibilities.

Another barrier we are breaking is the lack of transparency. Traditionally, asset management has been shrouded in mystery, with investors having limited visibility into how their funds are being managed. At Orbiter Finance, we believe in complete transparency. Our platform provides real-time updates on investment performance, fees, and holdings, giving investors full control and peace of mind.

We are also breaking the barriers of traditional financial institutions. With Orbiter Finance, there are no middlemen or intermediaries. Our platform utilizes blockchain technology, ensuring security, efficiency, and eliminating the need for expensive intermediaries. Investors can directly engage with the assets they choose, without any unnecessary fees or delays.

Lastly, Orbiter Finance is breaking the barriers of traditional investment options. Our platform provides a wide range of investment opportunities, from cryptocurrencies and stocks to real estate and commodities. This diversification allows investors to create a well-rounded portfolio and mitigate risk, all within one user-friendly platform.

Join Orbiter Finance today and be a part of the revolution. Together, we can break down barriers and transform the world of asset management.

Orbiter Finance’s Solution

Orbiter Finance offers a revolutionary solution to traditional asset management practices. Through cutting-edge technology and advanced algorithms, the platform aims to democratize access to financial markets and empower individuals to take control of their wealth.

Advanced Algorithm-driven Asset Allocation

At the core of Orbiter Finance’s solution is its advanced algorithm-driven asset allocation system. By analyzing market data and utilizing artificial intelligence, the platform optimizes the allocation of assets across different investment opportunities.

Through this sophisticated approach, Orbiter Finance aims to maximize returns while minimizing risk. The algorithm continuously adapts to changing market conditions, ensuring that investments are always aligned with the most desirable assets to achieve optimal performance.

Intuitive Portfolio Management

Orbiter Finance provides users with an intuitive and user-friendly portfolio management interface. The platform offers real-time data and analytics, enabling users to track the performance of their investments with ease.

Users can customize their portfolios based on their risk appetite, investment goals, and time horizon. With the ability to diversify across various asset classes, including stocks, bonds, and cryptocurrencies, Orbiter Finance enables users to create well-balanced portfolios that suit their individual financial needs.

Transparency and Security

Orbiter Finance places a strong emphasis on transparency and security. All investment decisions made by the algorithm are communicated to users, providing a clear understanding of the underlying rationale.

The platform also implements robust security measures to safeguard user information and assets. The use of encryption technology and multi-factor authentication ensures that user data remains secure at all times.

Access to a Global Marketplace

Orbiter Finance opens up a world of investment opportunities by providing access to a global marketplace. Through partnerships with leading financial institutions and exchanges worldwide, the platform enables users to invest in a diverse range of assets from different geographies.

By breaking geographical barriers, Orbiter Finance allows individuals to capitalize on emerging markets and gain exposure to international stocks, bonds, and other financial instruments.

| Key Features of Orbiter Finance’s Solution: |

|---|

| Advanced algorithm-driven asset allocation |

| Intuitive portfolio management interface |

| Transparency and security |

| Access to a global marketplace |

What is Orbiter Finance?

Orbiter Finance is a revolutionary platform that aims to transform asset management. It leverages blockchain technology and smart contracts to provide transparent, efficient, and decentralized financial services.

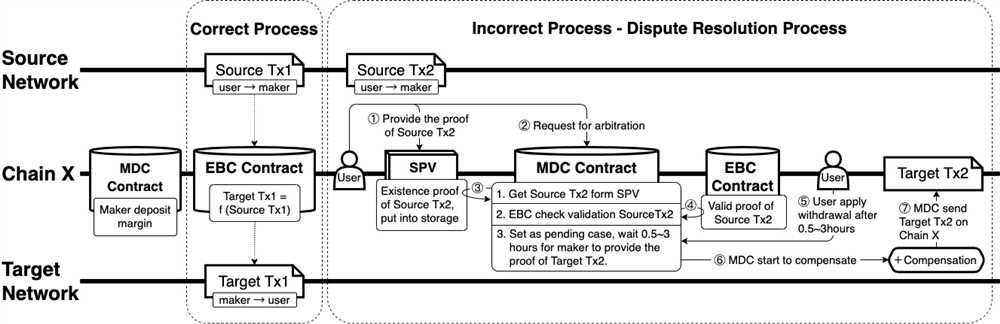

How does Orbiter Finance work?

Orbiter Finance works by utilizing blockchain technology to enable trustless and transparent asset management. Users can interact with the platform through smart contracts, which automatically execute predefined rules and eliminate the need for intermediaries.

What are the benefits of using Orbiter Finance?

Using Orbiter Finance offers several benefits. Firstly, it provides a high level of transparency, as all transactions and asset allocation are recorded on the blockchain. Additionally, it eliminates the need for intermediaries, which reduces costs and increases efficiency.

Can anyone use Orbiter Finance?

Yes, anyone can use Orbiter Finance. It is an open platform that is accessible to individuals and institutions alike. Whether you are a retail investor looking to manage your own assets or a professional asset manager, Orbiter Finance can cater to your needs.

What types of assets can be managed on Orbiter Finance?

Orbiter Finance supports a wide range of assets, including cryptocurrencies, traditional fiat currencies, stocks, bonds, and commodities. The platform provides a comprehensive solution for managing various asset classes in a decentralized manner.