Breaking Down Orbiter Finance and Hop Protocol: Similarities and Differences

In the world of decentralized finance (DeFi), there are numerous protocols and platforms that offer different features and benefits to users. Two such protocols that have gained popularity are Orbiter Finance and Hop Protocol. While both aim to revolutionize the way we interact with DeFi, they have their own unique characteristics and use cases.

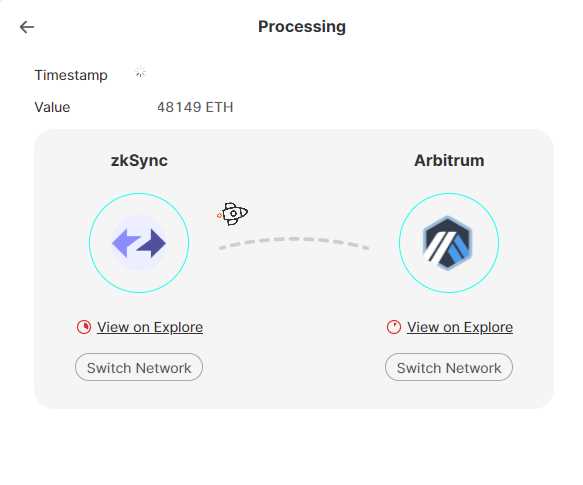

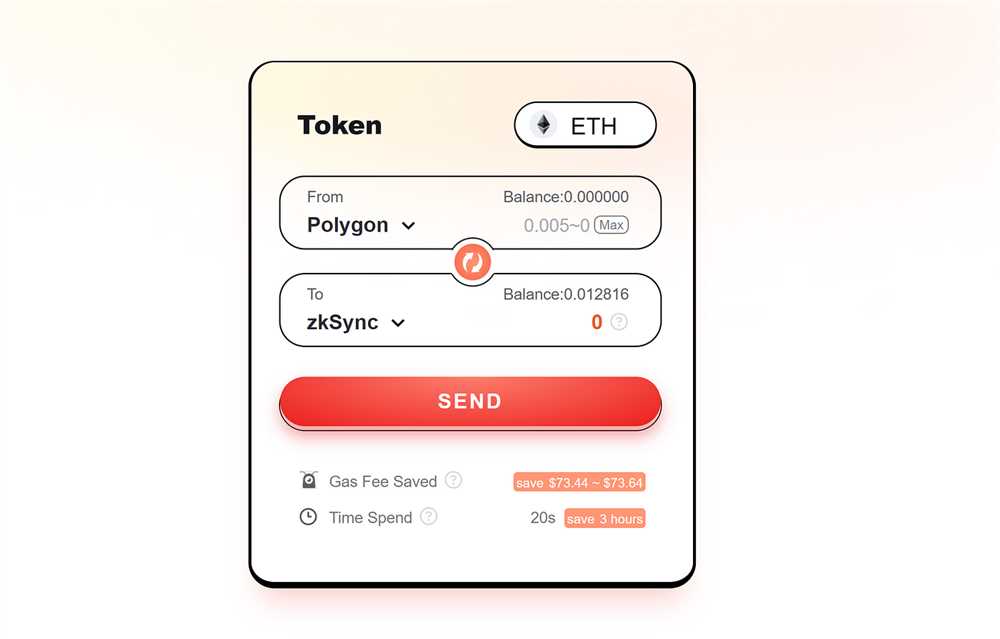

Orbiter Finance is a decentralized exchange (DEX) protocol that focuses on multi-chain interoperability. It allows users to seamlessly swap their tokens across various blockchain networks, such as Ethereum, Binance Smart Chain, and Polkadot. This cross-chain functionality opens up new possibilities for users, as they can now access different liquidity pools and trade assets that were previously isolated on separate chains.

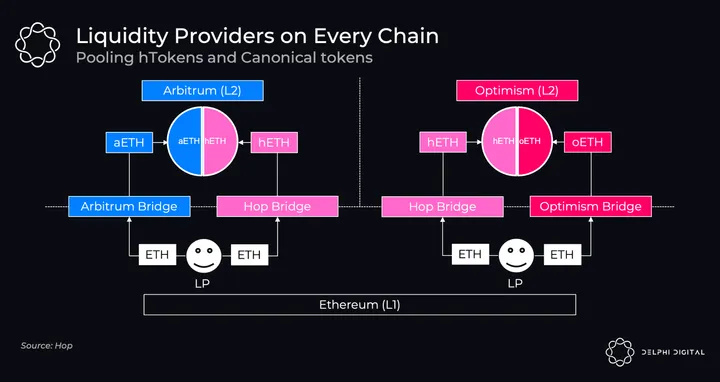

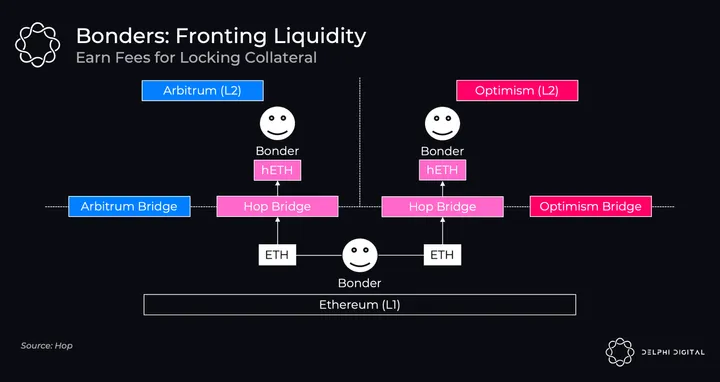

On the other hand, Hop Protocol is a layer 2 solution that aims to optimize and improve the efficiency of transactions in DeFi. It utilizes a technology called “bridging” to transfer assets between different layer 1 blockchains, such as Ethereum and Arbitrum. By leveraging these layer 2 networks, Hop Protocol is able to significantly reduce transaction fees and increase transaction speed, making it an attractive option for users looking for a more cost-effective and scalable solution.

Despite their differences, Orbiter Finance and Hop Protocol share a common goal: to make DeFi more accessible and user-friendly. They both offer interoperability between blockchain networks, allowing users to tap into a larger pool of liquidity and trade assets more easily. Whether you’re a trader looking to take advantage of different liquidity opportunities or a developer wanting to build cross-chain applications, both Orbiter Finance and Hop Protocol provide the tools and infrastructure needed to achieve your goals.

In conclusion, while Orbiter Finance and Hop Protocol have their own distinct features and functionalities, they ultimately have the same underlying objective of advancing the DeFi space. Whether you choose to use Orbiter Finance for its multi-chain interoperability or Hop Protocol for its layer 2 solutions, both protocols offer innovative solutions that contribute to the growth and development of the decentralized finance ecosystem.

What Makes Orbiter Finance and Hop Protocol Different?

While Orbiter Finance and Hop Protocol are both decentralized finance platforms, they have some key differences that set them apart:

1. Functionality:

Orbiter Finance focuses on providing a decentralized lending and borrowing platform that enables users to earn interest on their crypto assets or borrow against them. In contrast, Hop Protocol is primarily designed to optimize transaction routing across different Ethereum-based decentralized exchanges.

2. Use Case:

Orbiter Finance is suitable for individuals who want to earn passive income on their crypto holdings or borrow against them without relying on traditional financial institutions. Hop Protocol, on the other hand, is more oriented towards traders and liquidity providers who want to optimize their transactions and minimize costs.

3. Technology:

Orbiter Finance utilizes smart contracts to secure and automate lending and borrowing activities on its platform. Hop Protocol leverages smart contracts and off-chain relays to aggregate liquidity from various decentralized exchanges and find the most efficient path for executing trades.

4. Tokenomics:

Orbiter Finance has its native ERC-20 token, ORT, which is used for governance and incentivizing users to participate in the platform. Hop Protocol also has its native ERC-20 token, $HOP, which is used for governance and fee sharing within the protocol.

5. Community:

Orbiter Finance and Hop Protocol are built by different teams and have distinct communities of users and supporters. Each platform has its own ecosystem and actively engages with its community members through social media, forums, and other channels.

Overall, while Orbiter Finance and Hop Protocol are both innovative decentralized finance platforms, their focus, use case, technology, tokenomics, and community differ, making them suited for different needs and preferences within the crypto space.

Understanding the Basics of Orbiter Finance

Orbiter Finance is a decentralized finance (DeFi) protocol built on the Ethereum blockchain. It aims to provide users with a secure and reliable platform for accessing various financial services, including lending, borrowing, and yield farming.

One of the key features of Orbiter Finance is its focus on offering users a user-friendly and intuitive interface. The platform aims to make it easy for both experienced and new DeFi users to navigate and interact with its features.

One of the core components of Orbiter Finance is its liquidity pool, which allows users to lend and borrow different cryptocurrencies. The protocol uses an algorithm to determine the interest rates for each asset based on supply and demand. This ensures that borrowers can access liquidity at competitive rates and lenders can earn interest on their deposited assets.

Key Features of Orbiter Finance:

Lending and Borrowing: Users can deposit their cryptocurrencies as collateral and borrow other assets. This allows users to unlock the value of their holdings and access liquidity without needing to sell their assets.

Yield Farming: Orbiter Finance offers users the ability to stake their assets and earn additional rewards. By participating in yield farming, users can earn interest or other tokens by providing liquidity to the protocol.

Orbiter Finance also features a governance protocol, allowing users to participate in the decision-making process by voting on proposals and changes to the platform. This ensures that the community has a voice in shaping the direction of the protocol.

In conclusion, Orbiter Finance is a user-friendly and feature-rich decentralized finance protocol that aims to provide users with easy access to lending, borrowing, and yield farming services. With its focus on user experience and community governance, Orbiter Finance stands out as a promising platform in the DeFi space.

Exploring the Key Features of Hop Protocol

Hop Protocol is a decentralized protocol designed to optimize liquidity across different Layer 1 blockchains. It offers a set of unique features that make it stand out in the crypto space.

1. Cross-Chain Swaps

One of the key features of Hop Protocol is its ability to enable cross-chain swaps. This means that users can seamlessly trade assets between different blockchain networks without the need for intermediaries. Cross-chain swaps provide users with increased liquidity options and open up possibilities for new trading strategies.

2. Liquidity Aggregation

Hop Protocol aggregates liquidity from various decentralized exchanges (DEXs) and sources it into a single pool, providing users with access to the best prices across different blockchains. By tapping into multiple DEXs, Hop Protocol ensures that users can always find the most optimal trading opportunities with minimal slippage.

3. Gas Optimization

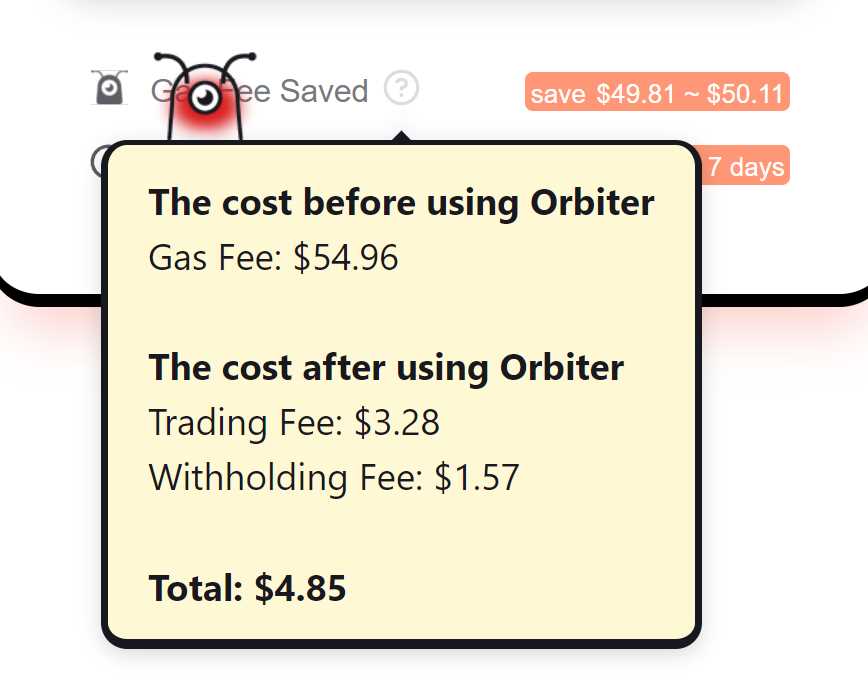

Gas fees can be a significant barrier to using decentralized protocols. Hop Protocol addresses this issue by optimizing gas usage across different blockchains, reducing the overall cost of transactions. By intelligently batching swaps and utilizing efficient routing, Hop Protocol minimizes gas fees, making it more affordable for users to access liquidity.

4. Secure and Non-Custodial

Hop Protocol is designed with security in mind. It is a non-custodial protocol, which means that users always maintain full control over their assets. The protocol utilizes cryptographic primitives to ensure the integrity and privacy of user transactions.

Overall, Hop Protocol offers a range of features that enhance cross-chain liquidity and accessibility while minimizing costs and maintaining security. These features make it a promising solution for users looking to optimize their trading experience across different Layer 1 blockchains.

Comparing Investment Opportunities in Orbiter Finance and Hop Protocol

Investing in decentralized finance (DeFi) platforms has become increasingly popular as individuals seek higher returns and greater flexibility with their capital. Two prominent DeFi platforms that offer investment opportunities are Orbiter Finance and Hop Protocol. While both platforms operate in the DeFi space, they have some key similarities and differences that can impact an investor’s decision.

Similarities

- Both Orbiter Finance and Hop Protocol are built on the Ethereum blockchain, utilizing smart contracts to facilitate their investment services.

- Both platforms offer users the opportunity to participate in yield farming, allowing them to earn additional tokens by providing liquidity to specific pools.

- Investors on both platforms can stake their tokens to earn passive income through various mechanisms.

- Both Orbiter Finance and Hop Protocol provide users with a wide range of investment options, allowing them to diversify their portfolios.

- Both platforms employ advanced security measures to protect users’ funds and minimize the risk of hacks or exploits.

Differences

- Orbiter Finance focuses primarily on yield farming strategies, offering users a seamless and user-friendly interface to maximize their returns.

- Hop Protocol, on the other hand, is designed to optimize cross-chain transactions and reduce fees associated with transferring assets between different blockchain networks.

- Orbiter Finance has its native token, ORB, which is used for governance and staking purposes, while Hop Protocol has its token, $HOP, which serves as a utility and governance token.

- Hop Protocol utilizes a unique technology called Multi-Chain Router (MCR) to enable efficient and cost-effective cross-chain transactions.

- While both platforms offer attractive investment opportunities, the specific returns and risks associated with each platform may vary based on market conditions and user preferences.

Choosing the right investment opportunity ultimately depends on an individual’s investment goals, risk tolerance, and familiarity with different DeFi platforms. It is important for investors to conduct thorough research, evaluate the platforms’ offerings, and consider the potential risks before making any investment decisions.

Deciding Between Orbiter Finance and Hop Protocol: Factors to Consider

When choosing between Orbiter Finance and Hop Protocol, there are several key factors to consider. Both DeFi protocols offer unique features and benefits, so making an informed decision is crucial. Here are some important factors to keep in mind:

1. Functionality and Use Cases

Understanding the core functionality and use cases of both Orbiter Finance and Hop Protocol is essential. Orbiter Finance focuses on providing automated portfolio management and yield optimization strategies for crypto investors. On the other hand, Hop Protocol aims to enhance liquidity by creating cross-chain bridges and minimizing slippage in decentralized exchanges.

Consider whether your primary goal is to optimize your investment portfolio or enhance liquidity when evaluating these protocols.

2. Tokenomics and Governance

Tokenomics and governance play a significant role in the long-term success of a DeFi protocol. It is important to analyze the token distribution, token utility, and voting mechanisms of Orbiter Finance and Hop Protocol.

Do you prefer a protocol with a fair and transparent token distribution? Or are you more interested in actively participating in the governance of the protocol? Understanding these aspects will help you make an informed decision.

3. Security and Audits

Security should always be a top priority in the DeFi space. Prioritize protocols that have undergone thorough security audits and have a transparent approach to handling smart contract vulnerabilities.

Before deciding between Orbiter Finance and Hop Protocol, take into account their security measures, audit reports, and any incidents they may have experienced in the past.

Overall, carefully evaluating the functionality, tokenomics, governance, and security of both Orbiter Finance and Hop Protocol will assist you in deciding which protocol aligns with your investment goals and risk tolerance.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol built on the Ethereum blockchain. It aims to provide users with a safe and efficient way to lend, borrow, and earn interest on their cryptocurrency assets.

What is Hop Protocol?

Hop Protocol is also a decentralized finance (DeFi) protocol, but it is built on multiple blockchains, including Ethereum, Avalanche, and xDai. It is designed to enable seamless asset transfers and liquidity across different blockchain networks.