Building a Thriving Liquidity Ecosystem with Orbiter Finance and Cross-Chain Liquidity

Discover the future of decentralized finance with Orbiter Finance!

Introducing Orbiter Finance, a groundbreaking platform designed to revolutionize the world of cross-chain liquidity. With Orbiter Finance, you can unlock the full potential of your digital assets and propel your investments to new heights.

Unleash Unlimited Opportunities:

Orbiter Finance brings together the power of blockchain technology and the convenience of cross-chain interoperability. Seamlessly swap assets across different blockchains, mitigating the limitations of traditional finance and opening doors to untapped opportunities.

Robust and Secure:

At Orbiter Finance, security is our top priority. Our platform is built on a robust infrastructure that utilizes advanced encryption and security protocols, ensuring your assets are safe at all times. With Orbiter Finance, you can trade with confidence and peace of mind.

Stay Informed, Make Informed Decisions:

With our intuitive user interface and comprehensive analytics, Orbiter Finance empowers you to stay informed and make informed decisions. Access real-time data, track your portfolio, and leverage cutting-edge analysis tools to optimize your investments.

Join Orbiter Finance now and take control of your financial future!

Benefits of Cross-Chain Liquidity

Cross-chain liquidity is a game-changing technology that has revolutionized the way we transact and exchange assets in the blockchain ecosystem. By enabling the seamless transfer of assets across different blockchains, cross-chain liquidity offers a wide range of benefits for both users and projects alike.

1. Enhanced Market Efficiency

With cross-chain liquidity, users can access a larger pool of liquidity, regardless of the blockchain they are using. This enhances market efficiency by increasing trading volume and reducing spreads, resulting in better prices and improved execution for users. It also enables projects to tap into new markets and reach a wider audience, expanding their potential for growth and adoption.

2. Diversification of Risk

By providing access to multiple blockchains, cross-chain liquidity helps spread the risk associated with relying on a single blockchain. Users and projects can diversify their exposure to potential network failures, congestion, or other issues that may arise on a specific blockchain. This reduces the risk of disruption and improves the overall resilience of the ecosystem.

3. Interoperability and Asset Portability

Cross-chain liquidity enables seamless interoperability between different blockchains, allowing assets to be easily transferred and utilized across different networks. This opens up new possibilities for applications and services that require the use of multiple blockchain platforms. It also allows users to easily move their assets between different chains, providing greater flexibility and convenience.

4. Innovation and Collaboration

With cross-chain liquidity, projects can collaborate more easily, sharing resources and building upon each other’s strengths. This fosters innovation and encourages the development of new products and services that leverage the benefits of multiple blockchains. It also creates opportunities for partnerships and collaborations between different projects, driving the growth and evolution of the overall blockchain ecosystem.

5. Regulatory Compliance

Cross-chain liquidity can facilitate regulatory compliance by enabling assets to be transferred and traded in a transparent and auditable manner. By leveraging the security and transparency of blockchain technology, cross-chain liquidity platforms can provide a high level of accountability and regulatory oversight. This can help foster trust and confidence among users and regulators, paving the way for wider adoption and integration of blockchain technology into traditional financial systems.

| Benefits | Description |

|---|---|

| Enhanced Market Efficiency | Access to a larger pool of liquidity, better prices, and improved execution. |

| Diversification of Risk | Spreading the risk associated with relying on a single blockchain. |

| Interoperability and Asset Portability | Seamless transfer of assets between different blockchains. |

| Innovation and Collaboration | Collaboration, sharing resources, and fostering innovation. |

| Regulatory Compliance | Facilitating transparent and auditable asset transfer and trading. |

Efficient Asset Transfers

At Orbiter Finance, we understand the importance of efficient asset transfers in building a thriving liquidity ecosystem. With our innovative technology and cross-chain interoperability, users can enjoy seamless and fast transfers of their assets across different blockchain networks.

Our decentralized platform leverages the power of smart contracts to enable secure and trustless asset transfers. Whether you are looking to transfer cryptocurrencies, tokens, or any other digital assets, Orbiter Finance ensures a reliable and frictionless experience.

Seamless Cross-Chain Transfers

With Orbiter Finance, users can easily transfer their assets between various blockchain networks, regardless of their compatibility. Our platform bridges the gap between different blockchains, allowing for seamless cross-chain transfers.

Whether you want to transfer assets between Ethereum, Binance Smart Chain, Polkadot, or any other supported blockchain, Orbiter Finance has got you covered. Say goodbye to the limitations and barriers of single-chain transfers and embrace the possibilities of cross-chain liquidity.

Fast and Cost-Effective Transactions

Orbiter Finance is committed to providing fast and cost-effective asset transfers. Our platform utilizes cutting-edge technology and optimized algorithms to ensure speedy confirmations and low transaction fees.

By leveraging layer 2 scaling solutions and advanced optimization techniques, we minimize the time and costs associated with asset transfers. Experience lightning-fast transactions and save on unnecessary fees with Orbiter Finance.

Join us today and unlock the potential of efficient asset transfers with Orbiter Finance. Build a thriving liquidity ecosystem, harness the power of cross-chain liquidity, and take your digital asset transfers to new heights.

The Importance of Liquidity Ecosystem

In today’s fast-paced and interconnected world, liquidity plays a crucial role in the success of any financial ecosystem. A thriving liquidity ecosystem, like the one enabled by Orbiter Finance, is essential for unlocking the potential of cross-chain liquidity.

Liquidity refers to the ease with which assets can be bought or sold without causing significant price disruptions. It is a measure of how quickly and efficiently an asset can be converted into cash or another asset. A robust liquidity ecosystem ensures that there is a sufficient supply of buyers and sellers, reducing transaction costs and enabling smooth trading.

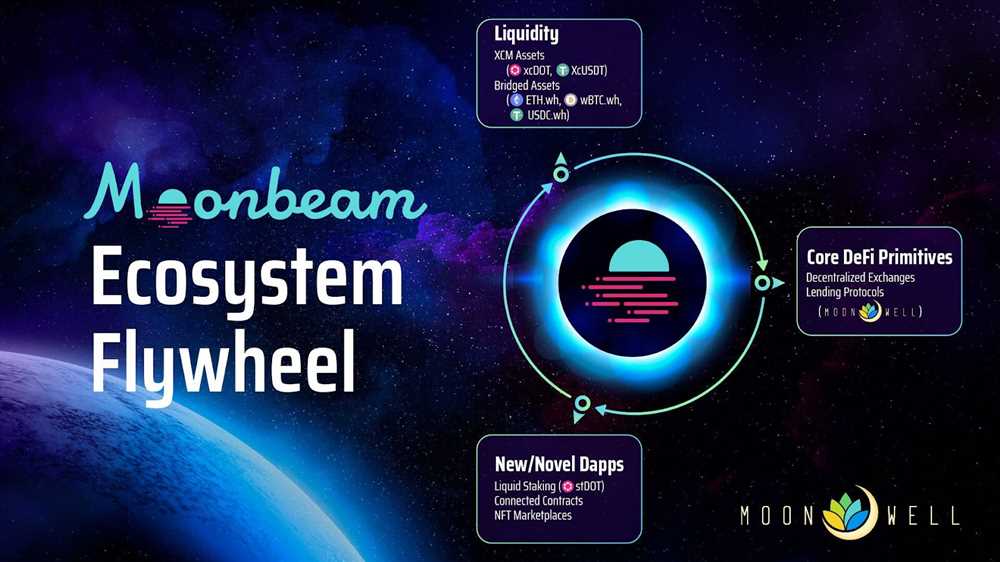

For decentralized finance (DeFi) projects and blockchain networks, a vibrant liquidity ecosystem is even more critical. It facilitates the seamless transfer of assets across different chains and protocols, allowing users to access various financial services and opportunities. Increased liquidity means a more efficient market, increased stability, and improved price discovery.

Furthermore, a healthy liquidity ecosystem attracts more participants, including traders, investors, developers, and liquidity providers. This increased participation leads to a virtuous cycle, as more liquidity attracts more users, which in turn increases liquidity even further. This positive feedback loop is vital for the growth and sustainability of the entire ecosystem.

With Orbiter Finance’s innovative solutions, building a thriving liquidity ecosystem becomes more accessible and efficient. By leveraging cross-chain bridges and liquidity pools, Orbiter Finance enables the seamless transfer and utilization of assets between different blockchains. This cross-chain interoperability unlocks new possibilities for liquidity providers and users, creating a dynamic and inclusive financial ecosystem.

In conclusion, the importance of a liquidity ecosystem cannot be overstated. It is the lifeblood of financial markets and blockchain networks, providing the necessary liquidity for trading and investment activities. Orbiter Finance’s commitment to building a thriving liquidity ecosystem is a significant step towards unlocking the full potential of cross-chain liquidity and driving the growth of the decentralized finance industry.

Building a Thriving Liquidity Ecosystem

In today’s rapidly evolving financial landscape, liquidity is the lifeblood of any successful financial ecosystem. Without liquidity, markets become stagnant, innovation is stifled, and opportunities for growth are missed. That’s why Orbiter Finance is dedicated to building a thriving liquidity ecosystem that unlocks the potential of cross-chain liquidity.

At Orbiter Finance, we understand that cross-chain liquidity is the key to unlocking the full potential of decentralized finance (DeFi). By connecting disparate blockchains and enabling seamless asset transfers, we empower users to access a wide range of financial instruments and services, regardless of the underlying blockchain technology.

Unlocking Cross-Chain Liquidity

To achieve this, Orbiter Finance leverages a combination of cutting-edge technology and innovative protocols. Our team of experienced blockchain developers works tirelessly to overcome the technical challenges associated with cross-chain transactions and liquidity provision.

By building bridges between different blockchains and developing interoperability solutions, we pave the way for a truly decentralized and liquid financial ecosystem. Our protocols ensure seamless asset transfers, efficient price discovery, and secure cross-chain transactions, all while preserving the privacy and security of user funds.

The Benefits of a Thriving Liquidity Ecosystem

A thriving liquidity ecosystem offers numerous benefits to users, developers, and the wider crypto community. By facilitating cross-chain liquidity, Orbiter Finance opens up new opportunities for decentralized applications (dApps), financial products, and services.

Developers can leverage our protocols to build innovative dApps that can tap into a larger pool of liquidity, attracting more users and accelerating adoption. Users, on the other hand, benefit from access to a wider range of assets, competitive prices, and improved trading experiences. The wider crypto community benefits from increased innovation, collaboration, and the growth of decentralized finance as a whole.

Conclusion

At Orbiter Finance, we believe that building a thriving liquidity ecosystem is crucial for the long-term success and growth of decentralized finance. By unlocking the potential of cross-chain liquidity, we empower users and developers to explore new frontiers, create innovative solutions, and transform the future of finance.

Join us on our journey as we revolutionize the world of decentralized finance and build a thriving liquidity ecosystem.

Cross-Chain Interoperability

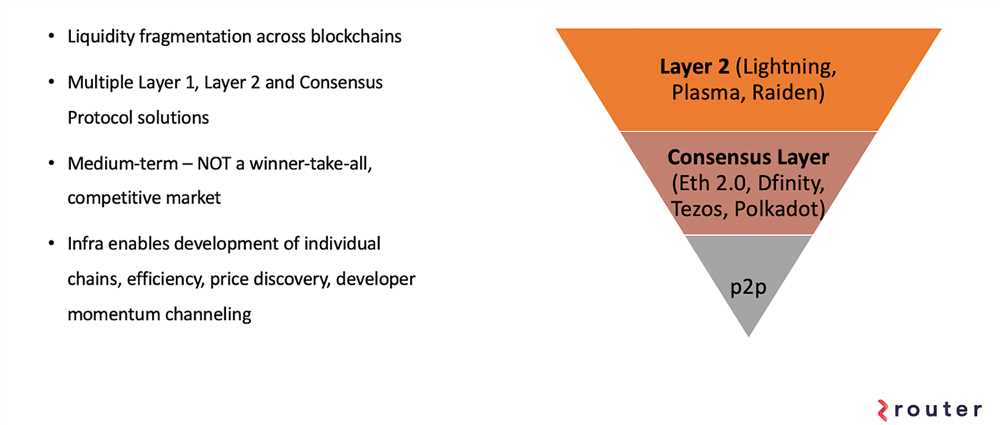

One of the key challenges in the decentralized finance (DeFi) space is the lack of interoperability between different blockchain networks. With each blockchain operating in isolation, it becomes difficult for users to transfer assets between chains and harness the full potential of cross-chain liquidity.

At Orbiter Finance, we recognize the importance of cross-chain interoperability in building a thriving liquidity ecosystem. That’s why we have developed innovative solutions that bridge the gap between different blockchain networks, enabling seamless asset transfers and unlocking new possibilities for DeFi applications.

Our cross-chain interoperability protocol allows users to easily move their assets between various blockchain networks, including Ethereum, Binance Smart Chain, and more. By leveraging secure and efficient cross-chain bridges, users can tap into a wider range of liquidity pools and access a diverse set of investment opportunities.

To ensure the highest level of security and transparency, our cross-chain interoperability protocol employs cutting-edge cryptographic techniques and smart contract technology. This ensures that asset transfers are executed in a trustless and decentralized manner, without the need for intermediaries or centralized authorities.

| Benefits of Cross-Chain Interoperability: |

| – Increased liquidity: By connecting different blockchain networks, cross-chain interoperability unlocks a larger pool of liquidity, allowing users to trade and access a wide range of assets. |

| – Expanded investment opportunities: With cross-chain interoperability, users can explore a diverse set of investment opportunities across different blockchain networks, tapping into various DeFi protocols and projects. |

| – Enhanced user experience: Seamless asset transfers between chains improve the overall user experience, making it easier and faster to participate in decentralized finance activities. |

| – Improved scalability: Cross-chain interoperability solutions contribute to the scalability of the DeFi ecosystem by reducing congestion on individual blockchain networks. |

| – Future-proofing: With the fast-paced evolution of blockchain technology, cross-chain interoperability ensures that users are not limited to a single blockchain network and can adapt to emerging trends and developments. |

By prioritizing cross-chain interoperability, Orbiter Finance is committed to creating a robust and inclusive ecosystem that empowers users and maximizes the potential of decentralized finance. Join us in building a more interconnected future!

What is Orbiter Finance?

Orbiter Finance is a platform that aims to build a thriving liquidity ecosystem by unlocking the potential of cross-chain liquidity. It provides innovative solutions to address the challenges of liquidity fragmentation and interoperability across different blockchain networks.

How does Orbiter Finance unlock cross-chain liquidity?

Orbiter Finance unlocks cross-chain liquidity by leveraging advanced technology and protocols. It enables seamless transfers of assets between different blockchain networks, allowing users to access and utilize liquidity from multiple sources. This helps to eliminate liquidity silos and increase efficiency in the decentralized finance (DeFi) space.