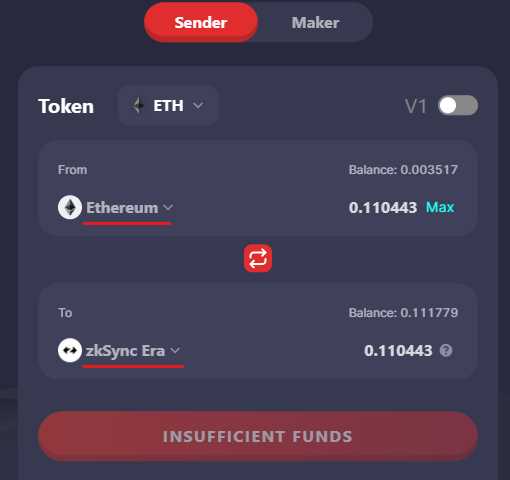

Welcome to Orbiter Finance, the revolutionary decentralized finance (DeFi) platform that is redefining the way we interact with digital assets. In order to fully harness the power of this platform, it is essential to have a clear understanding of the two key roles that drive the Orbiter ecosystem: the Sender and the Maker.

The Sender role plays a vital role in facilitating transactions on the Orbiter Finance platform. As a Sender, you have the ability to transfer digital assets to other participants within the network. This role ensures that transactions are executed efficiently and securely, allowing participants to seamlessly send and receive funds without the need for intermediaries.

On the other hand, the Maker role serves as the foundation of the Orbiter ecosystem. Makers are responsible for providing liquidity to the platform by depositing their digital assets into liquidity pools. By doing so, Makers earn passive income through collecting transaction fees generated by users who trade against their deposits. This mutually beneficial relationship between Makers and users drives the liquidity and efficiency of the Orbiter Finance platform.

Understanding the Sender and Maker roles is essential for maximizing your participation on Orbiter Finance. Whether you are looking to securely transfer assets or earn passive income through liquidity provision, our platform offers a user-friendly and intuitive experience. Join us today and explore the endless possibilities that Orbiter Finance has to offer!

Understanding Orbiter Finance

Orbiter Finance is a decentralized protocol built on the Ethereum blockchain that aims to provide users with a secure and transparent way to participate in decentralized finance (DeFi) activities.

The protocol is designed to enable users to lend, borrow, and earn interest on their crypto assets without relying on intermediaries or centralized institutions. It is built on smart contracts that automatically execute transactions and enforce the rules of the protocol, eliminating the need for trust in any third party.

Orbiter Finance leverages the power of blockchain technology to ensure that all transactions on the platform are transparent and immutable, providing users with a high level of security. Assets deposited into the protocol are tokenized, allowing users to easily trade and transfer them on the platform.

The Sender and the Maker roles play a crucial role in Orbiter Finance. The Sender is responsible for initiating transactions on the platform, while the Maker provides liquidity to the protocol by depositing assets into the liquidity pools.

The Sender role involves approving and sending transactions to the blockchain, while the Maker role involves supplying assets to the liquidity pools and earning interest from borrowers. Both roles are incentivized through the distribution of ORB tokens, the native token of Orbiter Finance.

By participating in Orbiter Finance, users can benefit from the decentralized nature of the protocol, earn interest on their assets, and have more control over their finances. However, it is important to understand the risks involved and to exercise caution when participating in decentralized finance activities.

Overall, Orbiter Finance offers a new way for users to engage in DeFi activities, providing a secure and transparent platform for lending, borrowing, and earning interest on crypto assets. By leveraging the power of blockchain technology, Orbiter Finance aims to revolutionize the financial landscape and empower individuals to take control of their finances.

Your Ultimate Guide

In the world of Orbiter Finance, it is important to understand the roles of the Sender and Maker. These roles play a crucial part in the functioning of the protocol and contribute to its overall efficiency and security. In this guide, we will delve into the details of these roles and explain how they work together to facilitate transactions on the platform.

The Sender Role:

When a transaction is initiated on Orbiter Finance, the Sender is the party responsible for initiating and funding the transaction. They play a pivotal role in ensuring that the Maker is able to execute the transaction successfully. The Sender may be an individual user or an entity, such as a decentralized exchange or a liquidity provider.

Key responsibilities of the Sender include:

- Initiating a transaction by submitting a request to the Maker.

- Funding the transaction by providing the necessary assets or liquidity.

- Monitoring the progress of the transaction and ensuring its successful completion.

The Maker Role:

Once the Sender has initiated a transaction, the Maker takes over and executes the transaction. The Maker acts as a liquidity provider and facilitates the exchange of assets based on the instructions provided by the Sender. Makers are responsible for creating and executing smart contracts that enable seamless and secure asset swaps.

Key responsibilities of the Maker include:

- Receiving and verifying the transaction request from the Sender.

- Providing liquidity for the transaction by holding the necessary assets.

- Executing the transaction by swapping the assets as per the instructions.

- Ensuring the secure and timely completion of the transaction.

By understanding the roles of the Sender and Maker in Orbiter Finance, users can gain a comprehensive knowledge of how transactions are made and executed on the platform. This knowledge can help users make more informed decisions and navigate the Orbiter Finance ecosystem with confidence and ease.

to the Sender Role

In the world of Orbiter Finance, the Sender plays a crucial role in financial transactions. As a Sender, you have the responsibility of initiating transfers to other addresses within the Orbiter ecosystem. This role allows you to send various types of assets, such as cryptocurrencies, stablecoins, and other tokens.

To become a Sender, you need to have a compatible wallet or platform that supports Orbiter Finance. This will enable you to connect to the Orbiter network and interact with other participants seamlessly. Once you have set up your wallet and connected it to Orbiter, you can start utilizing the functionality of the Sender role.

When you want to send assets to another address within the Orbiter ecosystem, you can use the Sender role. Firstly, you need to ensure that you have sufficient funds in your wallet to cover the transfer. Then, you can initiate the transfer by specifying the recipient’s address, the amount to be sent, and any additional details required by the Orbiter network.

In addition to sending assets, the Sender role may also involve other responsibilities, such as setting transaction fees, selecting appropriate gas limits, and managing transaction priorities. These factors can affect the speed and cost of your transfers within the Orbiter network.

It is essential to understand that the Sender role requires careful attention to detail and security. You should always double-check the recipient’s address to avoid sending assets to the wrong address. Additionally, it is advisable to use secure wallets and implement best practices for securing your private keys to minimize the risk of unauthorized access to your funds.

| Key Responsibilities of the Sender Role: |

|---|

| Sending assets within the Orbiter ecosystem |

| Ensuring sufficient funds for transfers |

| Specifying recipient’s address and transfer details |

| Setting transaction fees and gas limits |

| Managing transaction priorities |

As a Sender, you play a vital role in facilitating the movement of assets within the Orbiter Finance network. By understanding the responsibilities and precautions associated with this role, you can contribute to the efficient and secure functioning of the ecosystem.

to the Maker Role

The Maker role is an essential part of the Orbiter Finance ecosystem. In simple terms, a Maker is a user who deposits assets into a liquidity pool in order to earn rewards. By providing liquidity, Makers play a vital role in promoting the efficiency and stability of the decentralized finance (DeFi) platform.

What is a Liquidity Pool?

A liquidity pool is a smart contract that contains a certain amount of assets or tokens that users can deposit into. These pools serve as a source of liquidity for the platform, allowing users to easily trade between different assets without relying on traditional order books. Instead, trades are executed directly against the liquidity pool, which ensures continuous availability of assets for trading.

How Does the Maker Role Work?

As a Maker, your main responsibility is to provide assets to the liquidity pool. When you deposit your assets, they are added to the pool and become available for trading. In return for this service, Makers earn a share of the trading fees generated by the platform.

When you deposit assets into the liquidity pool, they are represented as liquidity tokens. These tokens serve as a proof of your share in the pool and can be redeemed to withdraw your assets at any time. The value of these tokens is directly proportional to the amount of assets you have deposited into the pool.

It’s important to note that as a Maker, you bear the risk of impermanent loss. Impermanent loss occurs when the value of your deposited assets deviates significantly from the value of the assets in the pool. This risk arises due to the dynamic nature of asset prices in the decentralized market.

Conclusion

The Maker role in Orbiter Finance is an opportunity to earn passive income by providing liquidity to the platform. By depositing assets into a liquidity pool and earning from trading fees, Makers contribute to the growth and stability of the decentralized finance ecosystem. However, it’s crucial to understand the risks associated with impermanent loss before participating as a Maker in Orbiter Finance.

What are the roles of the Sender and Maker in Orbiter Finance?

The Sender is responsible for sending assets to the Orbiter contracts, while the Maker creates and manages a vault by depositing assets and borrowing against them.

Can you explain in more detail how the Sender role works?

Of course! The Sender role in Orbiter Finance involves sending assets from your wallet to the Orbiter contracts. This can be done by utilizing the Orbiter user interface or interacting directly with the contracts using a wallet like MetaMask. When you send your assets, you become eligible to earn interest on them.

What is the purpose of the Maker role in Orbiter Finance?

The Maker role in Orbiter Finance involves creating and managing a vault. A vault is a way to deposit your assets and borrow against them. As a Maker, you can lock up your assets as collateral and borrow other assets at a specific borrowing rate. This allows you to leverage your assets and potentially earn even more through trading or other activities.