Are you tired of investing in a single financial instrument and constantly worrying about market volatility? Look no further, because Orbiter Finance has the perfect solution for you. Our platform is built on the principle that diversification is the key to mitigating risk and maximizing returns.

Why diversify?

Diversification is the practice of spreading your investments across different asset classes, industries, and geographic regions. By doing so, you reduce the impact of any single investment on your overall portfolio. This is important because different asset classes tend to perform differently over time.

For example, while stocks may offer higher returns in bull markets, bonds and other fixed-income investments tend to perform better during periods of market uncertainty.

How Orbiter Finance can help

At Orbiter Finance, we provide a wide range of investment options to help you achieve diversification effortlessly. Our platform allows you to invest in stocks, bonds, mutual funds, ETFs, and more, all in one place.

By investing in a diversified portfolio, you can reduce the risk of significant losses and ensure a smoother ride towards your financial goals.

Experience the power of diversification

Don’t let market volatility keep you up at night. Start investing with Orbiter Finance today and experience the power of diversification. Our team of experts will guide you in building a well-diversified portfolio tailored to your risk tolerance and financial objectives.

Remember, when it comes to investing, diversification is the key to mitigating risk and securing your financial future.

The Importance of Diversification

Diversification is a key strategy when it comes to mitigating risk on the Orbiter Finance Platform. By diversifying your investment portfolio, you can spread your risk across different assets, sectors, and geographic regions, reducing the impact of any one investment performing poorly. This is crucial for long-term financial stability and success.

When you diversify your portfolio, you are essentially creating a safety net. If one investment underperforms, others in your portfolio may be able to make up for the loss. This can help protect you from significant financial setbacks and minimize the potential for losses.

Not only does diversification help to mitigate risk, but it can also increase your opportunities for returns. By investing in a variety of assets, you have a greater chance of benefiting from those that perform well. It allows you to tap into different market trends and opportunities, potentially maximizing your gains.

In addition to spreading your risk and increasing your chances of returns, diversification also helps to manage volatility. Different asset classes and sectors tend to perform differently in different market conditions. By diversifying, you can offset the volatility of one asset with the stability of another, creating a more balanced and resilient portfolio.

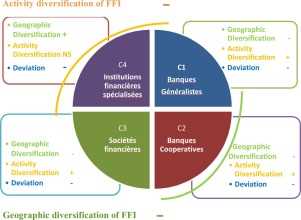

Moreover, diversification is not limited to just different asset classes. It can also extend to geographic diversification. By investing in assets from different regions, you can further reduce your exposure to regional economic downturns and geopolitical risks.

Overall, diversification is a fundamental principle of investing. It provides a solid foundation for mitigating risk, increasing returns, and managing volatility. By diversifying your investments on the Orbiter Finance Platform, you can improve your chances of achieving your financial goals and securing a more stable and prosperous future.

Strategies for Diversification

Diversification is a key strategy for mitigating risk on the Orbiter Finance platform. By spreading investments across different asset classes or industries, investors can reduce their exposure to any single investment and increase their chances of earning positive returns. Here are some strategies for effective diversification:

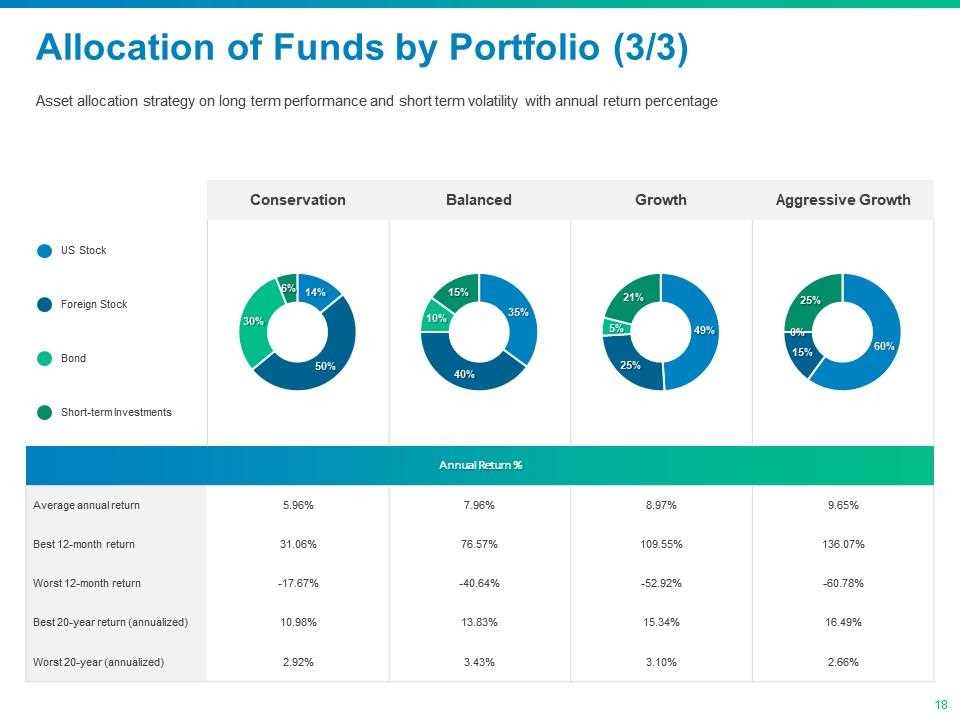

1. Asset Allocation

One of the most common diversification strategies is asset allocation. This involves dividing investments among different asset classes, such as stocks, bonds, real estate, and commodities. By having a mix of assets that have historically shown different patterns of performance, investors can reduce the impact of a single negative event on their overall portfolio.

2. Geographic Diversification

Another important aspect of diversification is geographic diversification. Investing in assets across different regions and countries can help reduce the risk of being affected by regional economic downturns or geopolitical events. By having exposure to a mix of developed and emerging markets, investors can increase their chances of finding growth opportunities while mitigating risks associated with a single country or region.

It’s also important to consider the following strategies:

3. Sector Diversification

Investing in a variety of sectors can help reduce the risk of being heavily impacted by a decline in a single industry. By spreading investments across sectors such as technology, healthcare, consumer goods, and finance, investors can benefit from the growth potential of different sectors while minimizing losses in case of a downturn in a specific industry.

4. Time-Based Diversification

Another strategy is time-based diversification, which involves investing systematically over a period of time, regardless of market conditions. This approach allows investors to benefit from dollar-cost averaging, where they buy more shares when prices are low and fewer shares when prices are high. By spreading investments over time, investors reduce the risk of making poor timing decisions and maximize their chances of earning positive returns.

Remember, diversification does not guarantee profits or protect against losses, but it can help reduce risk and improve the chances of reaching investment goals.

What is Orbiter Finance Platform?

Orbiter Finance Platform is a financial platform that allows users to invest their funds and earn profits through various investment opportunities.

How does diversification help in mitigating risk on Orbiter Finance Platform?

Diversification on Orbiter Finance Platform involves spreading your investments across different assets or investment options. By diversifying your portfolio, you reduce the risk of loss in case one investment performs poorly. This helps mitigate risk and protect your overall investment.

What are the investment opportunities available on Orbiter Finance Platform?

Orbiter Finance Platform offers a wide range of investment opportunities, including but not limited to stocks, bonds, mutual funds, real estate investments, and cryptocurrency investments. Users can choose the investment options that best suit their risk appetite and financial goals.

Can I start investing with a small amount of funds on Orbiter Finance Platform?

Yes, Orbiter Finance Platform allows users to start investing with small amounts of funds. This allows individuals with limited capital to participate in investment opportunities and potentially earn profits. However, it is important to note that the return on investment may vary depending on the amount invested.