Diversification of Assets: How Orbiter Finance is Implementing Measures to Reduce Single Points of Failure

Are you tired of the endless search for reliable investment opportunities that won’t leave you vulnerable to single points of failure? Look no further than Orbiter Finance’s groundbreaking asset diversification approach.

Orbiter Finance understands the risks associated with having all your eggs in one basket. That’s why we’ve developed a unique strategy that spreads your investments across a variety of assets, mitigating the impact of any single point of failure.

With our advanced algorithms and expert team of financial analysts, Orbiter Finance identifies and selects a diverse range of high-performing assets across different industries and markets. From stocks and bonds to real estate and commodities, our portfolio is carefully curated to ensure stability and minimize risk.

Don’t let a single point of failure jeopardize your financial future. Take advantage of Orbiter Finance’s asset diversification approach and experience the power of a resilient investment strategy.

Importance of Asset Diversification

Asset diversification is a critical strategy for any investor looking to protect their financial resources and maximize their returns. It entails spreading investments across various types of assets in order to mitigate risk and enhance the potential for long-term growth.

By diversifying assets, investors can minimize the impact of a single investment’s failure on their overall portfolio. This is because different asset classes, such as stocks, bonds, real estate, and commodities, tend to perform differently under various market conditions.

Orbiter Finance recognizes the importance of asset diversification and has developed an innovative approach that focuses on mitigating single points of failure. Instead of putting all eggs in one basket, Orbiter Finance spreads investments across a diverse range of assets and sectors.

One of the key benefits of asset diversification is reduced volatility. When investments are diversified, the ups and downs of individual assets are often counterbalanced by the performance of others. This lowers the overall risk of the portfolio and provides stability during market fluctuations.

Furthermore, asset diversification allows investors to tap into different sources of potential returns. While some assets may experience temporary setbacks, others may perform exceptionally well, generating higher profits. This can help offset any losses and enhance the overall financial performance.

In summary, asset diversification is a crucial strategy for investors aiming to protect their investments and optimize their returns. Orbiter Finance’s asset diversification approach helps mitigate the risks associated with single points of failure and provides investors with stability and potential growth.

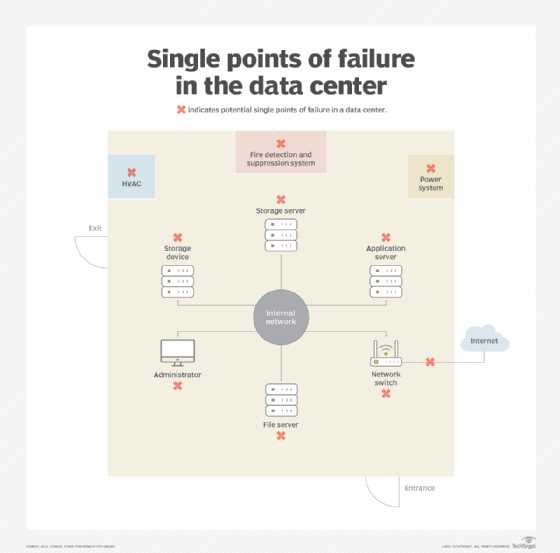

Understanding Single Points of Failure

In any system or process, a single point of failure can be a vulnerability that can lead to disastrous consequences. Identifying and mitigating single points of failure is crucial to ensure the smooth functioning of any operation, whether it be a business, a financial institution, or even a space program like Orbiter Finance.

What is a Single Point of Failure?

A single point of failure refers to a component, system, or process that, if it fails, can cause the entire operation to fail. It is a critical weakness that, when exploited, can result in significant disruptions, financial losses, or even the loss of life.

Examples of Single Points of Failure

In the context of Orbiter Finance’s asset diversification approach, some examples of single points of failure could include:

- A single investment that represents a significant portion of the portfolio

- Relying on a single market or sector for returns

- Having a single key employee responsible for critical tasks

- Utilizing a single technology platform without redundancy or backup systems

Why Mitigating Single Points of Failure is Important

By diversifying assets and avoiding single points of failure, Orbiter Finance minimizes its risk exposure and increases the resilience of its operations. This approach safeguards investors’ capital, ensures consistent returns, and enhances the overall stability and trustworthiness of the platform.

Key Strategies for Mitigating Single Points of Failure

To mitigate single points of failure, Orbiter Finance implements various strategies:

- Asset Diversification: By spreading investments across different asset classes, sectors, and geographies, Orbiter Finance reduces its reliance on any single investment.

- Redundancy and Backup Systems: Orbiter Finance utilizes redundant technology platforms, backup systems, and disaster recovery protocols to ensure uninterrupted operations.

- Team Structure: Orbiter Finance has a team-based approach with cross-functional expertise to avoid dependence on a single individual.

- Ongoing Monitoring and Risk Assessment: Orbiter Finance continuously monitors market conditions, adjusts investment strategies, and assesses potential risks to proactively address any emerging single points of failure.

By understanding and addressing single points of failure, Orbiter Finance provides its investors with a reliable and robust platform for managing their assets. With a proactive approach to risk management, Orbiter Finance sets itself apart as a trustworthy partner in the financial industry.

Explanation of Single Points of Failure

A single point of failure refers to a component or process in a system that, if it fails, can cause the entire system to fail. This vulnerability poses a significant risk to the reliability and continuity of operations.

In the case of financial systems, a single point of failure can occur when a critical asset or process is concentrated in one location or entity. This dependence on one element creates a potential risk as any disruption or failure in that component could have severe consequences for the overall system.

Orbiter Finance recognizes the dangers posed by single points of failure and has developed a comprehensive approach to mitigate this risk. Our strategy involves asset diversification, which aims to spread investments across various sectors, industries, and geographical locations.

By diversifying our assets, we reduce the likelihood that any single event, such as a market downturn or a company bankruptcy, will have a significant impact on our portfolio. This approach allows us to minimize risks and protect our clients’ investments from potential losses.

Furthermore, Orbiter Finance continuously monitors and analyzes the performance of our assets to identify any emerging single points of failure. This proactive approach enables us to take timely action, such as rebalancing or divesting certain assets, to ensure the robustness and resilience of our investment portfolio.

At Orbiter Finance, we understand the importance of safeguarding our clients’ wealth. Our commitment to mitigating single points of failure is just one aspect of our comprehensive risk management strategy, aimed at providing stability, security, and long-term growth for our clients.

Risks Associated with Single Points of Failure

A single point of failure refers to a system component or process that, if it fails, can lead to a complete breakdown of the entire system. In the context of financial assets, single points of failure can pose significant risks to investors and their portfolios. Mitigating these risks through asset diversification is crucial to ensure the stability and resilience of the investment portfolio.

Elevated Market Volatility

One of the risks associated with single points of failure is elevated market volatility. When a portfolio heavily relies on a single asset or a few highly correlated assets, any negative developments or market shocks affecting those assets can lead to severe price fluctuations. These fluctuations can result in significant losses for investors, compromising the overall value of the portfolio.

Diversifying investments across different asset classes, sectors, and geographical regions can help reduce the impact of market volatility. By spreading investments across various stocks, bonds, commodities, and real estate, investors can minimize their exposure to a single point of failure and increase the potential for stable returns.

Operational Risks

Another risk associated with single points of failure is operational risks. If a critical component or process fails within a financial institution, it can disrupt the normal operations and potentially lead to financial losses. For example, if a payment processing system fails, customers may not be able to withdraw or transfer funds, causing inconvenience and potential reputational damage for the institution.

Diversification of financial assets across multiple institutions can help mitigate operational risks. By entrusting funds to multiple reliable and well-established institutions, investors can reduce the likelihood of disruptions caused by a single point of failure. It helps ensure that even if one institution experiences operational issues, the other institutions can continue to operate smoothly, thus safeguarding investors’ assets.

In conclusion, the risks associated with single points of failure in the financial markets are significant. However, by adopting an asset diversification approach, investors can minimize their exposure to these risks and increase the overall stability and resilience of their portfolios.

Orbiter Finance’s Approach to Mitigating Single Points of Failure

In today’s fast-paced and interconnected world, the risk of single points of failure is ever-present. At Orbiter Finance, we understand the importance of mitigating these risks to ensure the stability and security of our clients’ assets. Our approach is rooted in asset diversification, complemented by robust risk management strategies.

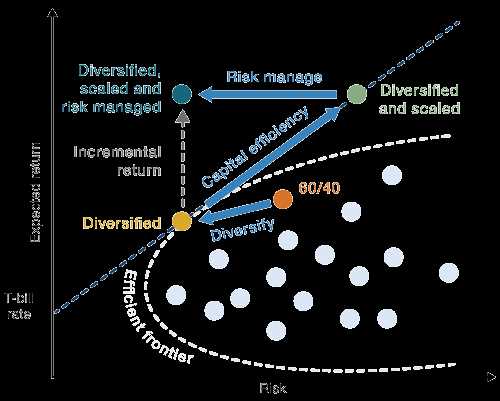

Diversification: A Key Pillar of Stability

One of the cornerstones of our approach is asset diversification. We believe in spreading investments across a wide range of asset classes, industries, and geographic regions. By doing so, we reduce the concentration of risk and minimize exposure to any single asset or market.

This approach allows us to capitalize on opportunities in different sectors while actively managing risk. We carefully select assets that have low correlation to each other, ensuring that a negative event impacting one asset or market does not have a significant impact on the overall portfolio.

Robust Risk Management Strategies

In addition to diversification, Orbiter Finance employs robust risk management strategies to further mitigate the risk of single points of failure. Our team of experienced professionals closely monitors the markets, conducts comprehensive risk assessments, and implements proactive risk mitigation measures.

We believe in staying ahead of the curve by anticipating potential risks and taking proactive steps to mitigate them. This includes rigorous stress testing, scenario analysis, and constant monitoring of the portfolio to identify any vulnerabilities. Our risk management strategies are designed to ensure the resilience and long-term success of our clients’ investments.

At Orbiter Finance, we understand that the world is constantly evolving, and with it, the risks that investors face. By adopting a comprehensive approach to mitigating single points of failure through asset diversification and robust risk management, we strive to provide our clients with peace of mind and financial stability.

Asset Diversification Strategy

At Orbiter Finance, we understand the importance of reducing risk and ensuring a stable financial future. That’s why we have developed a comprehensive asset diversification strategy that aims to mitigate single points of failure.

Our strategy involves spreading investments across a range of different asset classes, such as stocks, bonds, real estate, and commodities. This approach minimizes the impact of any single investment’s performance on the overall portfolio. By diversifying across asset classes, we aim to achieve a balance between potential returns and risk.

In addition to diversifying across asset classes, we also diversify within each asset class. For example, within the stock market, we invest in a mix of large-cap, mid-cap, and small-cap stocks. This diversification strategy helps capture gains from different market segments and reduces the potential impact of a single stock’s poor performance.

We also pay close attention to geographical diversification, investing in both domestic and international markets. This allows us to tap into global opportunities and avoid concentration risk in a single country or region. By diversifying geographically, we ensure that our investments are not overly exposed to the risks of a particular economy or political event.

Moreover, our asset diversification strategy takes into account the different risk profiles and investment objectives of our clients. We understand that each individual has unique financial goals, and our expert team tailors the diversification approach to align with these objectives. This personalized approach ensures that our clients benefit from a well-rounded portfolio that reflects their risk tolerance and investment preferences.

In conclusion, Orbiter Finance’s asset diversification strategy is a crucial component of our approach to managing risk and maximizing returns. By spreading investments across different asset classes, within each asset class, and across geographical regions, we strive to minimize the impact of any single point of failure. Our personalized approach ensures that our clients’ portfolios are well-diversified and aligned with their financial goals.

What is Orbiter Finance’s approach to asset diversification?

Orbiter Finance mitigates single points of failure by diversifying its assets across multiple categories, including cryptocurrencies, equities, real estate, and commodities. This approach helps to minimize the risk of losses and creates a more stable investment portfolio.

Why is asset diversification important for investors?

Asset diversification is crucial for investors because it helps to spread the risk across different types of investments. By diversifying their portfolio, investors can reduce their exposure to any single asset or market and increase their chances of achieving long-term financial success.

How does Orbiter Finance ensure asset diversification?

Orbiter Finance ensures asset diversification by carefully selecting a variety of investment opportunities in different asset classes. This includes investing in cryptocurrencies, equities, real estate, and commodities. The team analyzes the market conditions and identifies opportunities that complement each other, creating a well-rounded and diversified portfolio.