Diversifying assets and risk controls: Orbiter Finance’s approach to safeguarding investments

At Orbiter Finance, we understand the importance of safeguarding your investments and ensuring a diverse portfolio. With our comprehensive approach to asset allocation and risk controls, we provide unparalleled security and peace of mind.

Diversifying Assets: We believe in the power of diversification to mitigate risk and spread opportunities. Our expert team meticulously analyzes and identifies promising investment classes, strategically allocating your assets across different industries, geographies, and asset types.

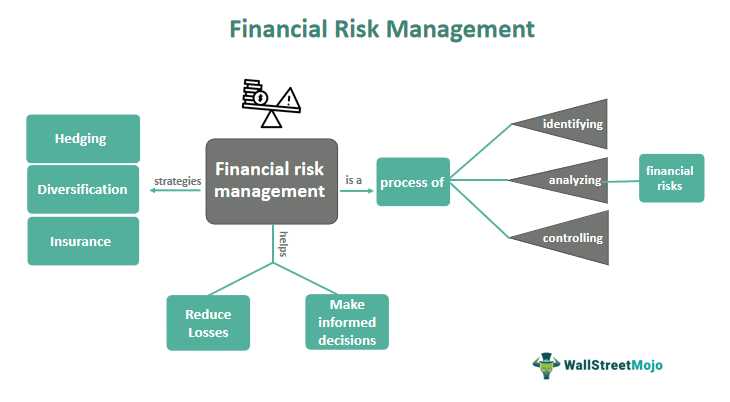

Risk Controls: We prioritize risk management as a critical component of investing. Our robust risk controls enable us to identify and assess potential risks, implementing proactive measures to protect your investments. We continuously monitor market conditions and employ cutting-edge risk management strategies to safeguard your assets.

Customized Solutions: Every investor has unique goals and risk tolerances. Orbiter Finance offers tailored solutions that align with your individual investment objectives. Our team works closely with you to understand your financial needs and create a personalized investment strategy that maximizes returns while minimizing risks.

Trust Orbiter Finance to safeguard your investments and provide you with a diversified portfolio that stands strong in any market condition. Contact us today to learn more about our comprehensive approach to asset management and risk controls.

Diversifying Assets

At Orbiter Finance, we understand the importance of diversifying assets in order to minimize risk and optimize investment returns. Our approach to diversification involves spreading investments across different asset classes, such as stocks, bonds, real estate, and commodities, both domestically and internationally.

By diversifying assets, we aim to reduce the impact of market fluctuations on our clients’ portfolios. This allows for a smoother ride when one asset class experiences a downturn, as the negative effects can be offset by the positive performance of other asset classes.

Our team of experienced financial professionals carefully analyze market trends and evaluate each investment opportunity based on its risk and return potential. This enables us to construct a well-diversified portfolio that is tailored to each client’s investment goals, time horizon, and risk tolerance.

In addition to diversifying across different asset classes, we also employ a strategy of diversifying within each asset class. This includes investing in a variety of industries, sectors, and geographic regions. By doing so, we further reduce concentration risk and increase the potential for consistent long-term growth.

| Asset Class | Diversification Example |

|---|---|

| Stocks | Investing in a mix of large-cap, mid-cap, and small-cap stocks across various industries |

| Bonds | Allocating funds to government bonds, corporate bonds, and municipal bonds with different maturities and credit ratings |

| Real Estate | Diversifying property investments by location, type (residential, commercial, industrial), and investment vehicles (REITs, rental properties) |

| Commodities | Investing in a range of commodities, such as gold, oil, natural gas, and agricultural products, to hedge against inflation and economic uncertainties |

In summary, diversifying assets is a fundamental principle of Orbiter Finance’s investment approach. It is a key strategy to mitigate risk, enhance returns, and provide our clients with a well-balanced portfolio that can withstand market fluctuations. Contact us today to learn more about how we can help you safeguard your investments through effective asset diversification.

Building a Strong Portfolio

At Orbiter Finance, we believe that building a strong portfolio is the foundation for success in the world of investments. We understand that a well-diversified portfolio is key to managing risk and maximizing returns.

To achieve this, our team of experienced professionals carefully analyze a variety of asset classes, such as stocks, bonds, real estate, and commodities. By spreading investments across multiple assets, we aim to reduce the potential impact of any single investment performing poorly.

We also emphasize the importance of risk controls in building a strong portfolio. Our approach includes implementing strict risk management strategies, such as stop-loss orders and position sizing, to protect investments from significant downside risks.

Furthermore, we continuously monitor the market and adapt our portfolio strategies accordingly. Our team keeps a close eye on market trends, economic indicators, and geopolitical events, allowing us to make informed decisions and adjust our portfolios to capitalize on potential opportunities and mitigate potential risks.

Moreover, we believe that flexibility is essential when it comes to portfolio management. Our clients have different investment goals, risk tolerances, and time horizons. Therefore, we tailor our portfolio recommendations to individual needs, ensuring that each client’s unique circumstances are taken into account.

In conclusion, building a strong portfolio is a complex process that requires careful analysis, diversification, risk control, and flexibility. At Orbiter Finance, we leverage our expertise and experience to design portfolios that aim to safeguard investments and generate long-term value. Contact us today to discuss how we can help you build a strong portfolio tailored to your investment objectives.

Asset Allocation Strategies

At Orbiter Finance, we understand the importance of making informed investment decisions. One key aspect of our approach to safeguarding investments is our asset allocation strategies. By diversifying assets and carefully managing risk controls, we aim to maximize returns while minimizing potential losses.

Our team of experienced professionals uses a systematic approach to determine the optimal mix of asset classes for each client. We take into account factors such as risk tolerance, investment goals, and market conditions to create tailored allocation strategies that align with our clients’ unique needs.

Our asset allocation strategies include a combination of stocks, bonds, real estate, commodities, and other investment vehicles. By spreading investments across different asset classes, we aim to reduce the impact of market volatility and enhance long-term performance.

We believe that diversification is the key to building a resilient investment portfolio. By investing in a variety of asset classes, we can capture opportunities for growth in different sectors and mitigate the impact of any single investment performing poorly.

In addition to diversification, we also utilize risk controls to manage investments effectively. Our risk management strategies include setting appropriate risk targets, implementing stop-loss orders, and regularly monitoring and rebalancing portfolios. This proactive approach allows us to respond to market trends and adjust our asset allocation strategies accordingly.

Overall, our asset allocation strategies are designed to provide our clients with a comprehensive and diversified investment approach. By combining a range of asset classes and employing risk controls, we aim to protect capital, optimize returns, and achieve long-term financial goals.

Trust Orbiter Finance to help you navigate the complex world of investment. Contact us today to learn more about our asset allocation strategies and how we can safeguard your investments.

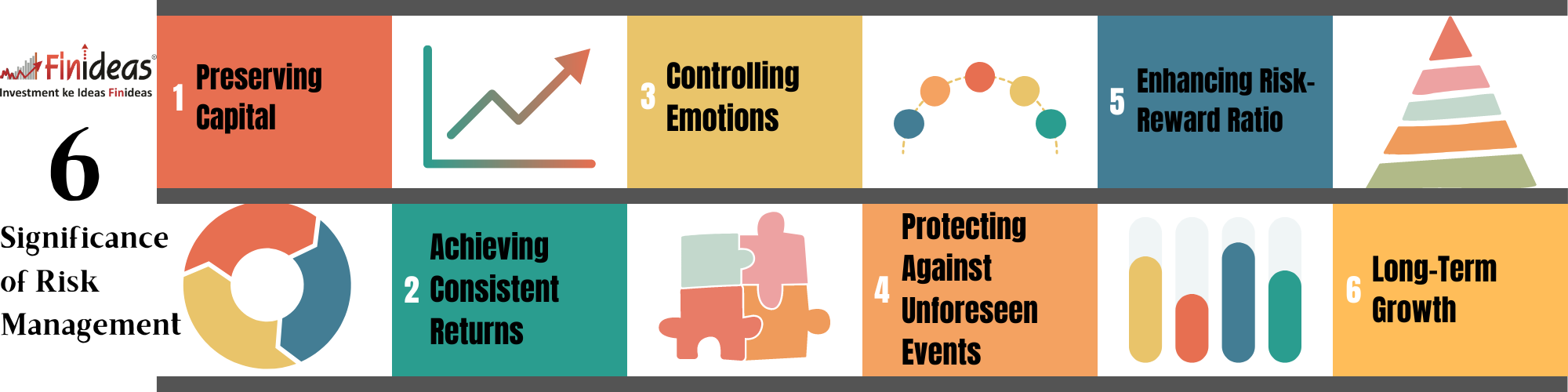

Risk Controls

At Orbiter Finance, we understand the importance of implementing robust risk controls to safeguard our clients’ investments. We believe that careful risk management is key to preserving capital and maximizing returns. Here are some of the risk controls we have in place:

- Diversification: We believe in diversifying investments across various asset classes, industries, and geographical regions. By spreading investments, we aim to reduce exposure to any single risk factor and minimize the impact of market volatility.

- Research-driven investment decisions: Our team of experienced professionals conducts thorough research and analysis before making any investment decisions. We carefully evaluate market trends, economic factors, and individual asset performance to ensure informed investment choices.

- Strict risk assessment: We apply a rigorous risk assessment process to identify and evaluate potential risks associated with each investment opportunity. By understanding the risks involved, we can make more informed decisions and adjust our strategies accordingly.

- Continuous monitoring: We continuously monitor the performance of the investments and the overall market conditions. This allows us to detect any changes or potential risks early on and take appropriate actions to mitigate them.

- Portfolio rebalancing: In order to stay aligned with our clients’ risk tolerance and investment objectives, we periodically rebalance their portfolios. This involves adjusting the allocation of assets to maintain the desired risk level and maximize returns.

- Compliance with regulations: Orbiter Finance strictly adheres to all relevant regulations and ensures legal compliance in our investment practices. This further enhances transparency and accountability, providing our clients with peace of mind.

By incorporating these risk controls into our investment approach, we aim to provide our clients with a secure and reliable investment experience. At Orbiter Finance, we believe that minimizing risks and protecting investments are key elements in achieving long-term financial success.

Risk Assessment and Evaluation

At Orbiter Finance, we understand the importance of comprehensive risk assessment and evaluation when it comes to safeguarding your investments. Our team of experienced professionals meticulously analyzes potential risks associated with different investment options to ensure that your portfolio is well-balanced and protected.

We employ a systematic approach to risk assessment, taking into consideration various factors such as market volatility, economic conditions, and industry trends. By conducting thorough research and analysis, we are able to identify potential risks and develop appropriate strategies to mitigate them.

Our risk evaluation process involves assessing the likelihood of specific events occurring and the potential impact they may have on your investments. We use advanced risk modeling techniques and sophisticated tools to quantify and measure potential risks, allowing us to make informed decisions and effectively manage your portfolio.

Furthermore, we regularly review and update our risk assessment and evaluation strategies to adapt to changes in the market and industry. This proactive approach ensures that your investments remain protected and optimized for long-term growth.

With Orbiter Finance, you can have peace of mind knowing that your investments are in expert hands. Contact us today to learn more about our risk assessment and evaluation process and how we can help you safeguard your assets.

Implementing Risk Mitigation Measures

At Orbiter Finance, we understand the importance of implementing risk mitigation measures to protect and safeguard our clients’ investments. We have developed a comprehensive approach that includes the following strategies:

|

Diversification: |

We believe in spreading investments across different asset classes and markets to reduce the impact of any single investment on the overall portfolio. This approach helps mitigate the risk of significant losses and provides the potential for higher returns. |

|

Risk Assessment: |

Our team of experts rigorously assesses the risk associated with each investment opportunity. This includes evaluating factors such as market volatility, historical performance, and regulatory risk. By thoroughly analyzing these factors, we are able to identify potential risks and adjust our investment strategy accordingly. |

|

Active Monitoring: |

We closely monitor the performance of our clients’ investments on an ongoing basis. Our team utilizes advanced tools and technologies to track market trends, financial indicators, and news events that may impact the investments. By staying proactive, we can quickly identify and address any emerging risks. |

|

Regular Rebalancing: |

As market conditions and investment performances change, we regularly rebalance our clients’ portfolios to ensure that the asset allocation aligns with their risk tolerance and investment goals. This helps to maintain the desired risk profile and optimize the potential for returns. |

|

Contingency Planning: |

We develop comprehensive contingency plans to prepare for unexpected events and market disruptions. This includes establishing emergency liquidity reserves, diversifying counterparty risks, and implementing hedging strategies. By having a robust contingency plan in place, we are able to minimize the impact of unforeseen circumstances on our clients’ investments. |

By implementing these risk mitigation measures, Orbiter Finance aims to provide our clients with a secure and reliable investment experience. Our commitment to safeguarding investments is an integral part of our overall approach to wealth management.

What is the approach of Orbiter Finance in safeguarding investments?

Orbiter Finance’s approach to safeguarding investments is based on diversifying assets and implementing risk controls. They believe in spreading investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of any potential downturn in a specific market. Additionally, they employ various risk control measures, such as setting stop-loss orders and regularly monitoring the performance of investments, to ensure the security of their clients’ portfolios.

How does Orbiter Finance diversify assets?

Orbiter Finance diversifies assets by investing in a wide range of asset classes. They allocate their clients’ funds across stocks, bonds, real estate, and other alternative investments. By spreading investments across different asset classes, they aim to reduce risk and enhance the potential for returns. This diversification strategy helps to minimize the impact of any potential market downturn on the overall investment portfolio.

What risk control measures does Orbiter Finance employ?

Orbiter Finance employs various risk control measures to safeguard investments. They set stop-loss orders to automatically sell an investment if it reaches a predetermined price, thus limiting potential losses. They also regularly monitor the performance of investments and rebalance portfolios as needed. Additionally, they conduct thorough research and analysis before making investment decisions, and they diversify their clients’ portfolios to reduce exposure to any single investment. These risk control measures help to mitigate potential risks and protect investors’ capital.

Why is diversification important for safeguarding investments?

Diversification is important for safeguarding investments because it helps to reduce the impact of any potential downturn in a specific market or asset class. By spreading investments across different asset classes, such as stocks, bonds, and real estate, investors can lower their exposure to the risks associated with a single investment. This diversification strategy allows for a more balanced and resilient investment portfolio, as losses in one area can potentially be offset by gains in another. Overall, diversification helps to protect investors’ capital and enhance the potential for long-term returns.

How does Orbiter Finance monitor the performance of investments?

Orbiter Finance monitors the performance of investments through regular analysis and tracking. They use a combination of financial tools and software to monitor the performance of individual investments, as well as the overall portfolio. They assess key metrics, such as returns, volatility, and correlation, to evaluate the performance of different asset classes and make informed investment decisions. Additionally, they review market trends and conduct research to stay updated on market conditions and potential investment opportunities. This rigorous monitoring process helps to ensure the security and profitability of their clients’ investments.