Earn Passive Income with Orbiter Finance The Advantages of Decentralized Lending and Borrowing

Looking for a reliable and profitable way to earn passive income? Look no further than Orbiter Finance!

With Orbiter Finance, you can take advantage of the exciting world of decentralized lending and borrowing. Gone are the days of relying on traditional financial institutions to grow your money. Now, you have the power to control and capitalize on your digital assets.

Why choose Orbiter Finance? We offer a range of benefits that set us apart from the competition. Firstly, our platform is built on blockchain technology, making it secure and transparent. Your funds are safe and verifiable at all times.

Secondly, our decentralized lending and borrowing system allows you to earn interest on your idle assets or borrow funds at competitive rates. You can lend out your cryptocurrencies and receive interest payments, creating a steady stream of passive income. Alternatively, you can borrow funds against your assets without the need for credit checks or lengthy application processes.

Furthermore, Orbiter Finance offers flexible loan terms and low fees, ensuring that you maximize your profitability. Our user-friendly dashboard makes it easy to track your earnings and manage your assets.

Take control of your financial future with Orbiter Finance. Join our platform today and start earning passive income through decentralized lending and borrowing!

Earn Passive Income with Orbiter Finance

Orbiter Finance offers a unique opportunity for individuals to earn passive income through decentralized lending and borrowing. By participating in the Orbiter Finance ecosystem, users can take advantage of various financial services and generate income without actively trading or investing.

One of the main advantages of Orbiter Finance is its decentralized nature. Unlike traditional lending and borrowing platforms, Orbiter Finance operates on a decentralized blockchain network, which means that transactions are transparent, secure, and free from intermediaries. This allows users to have complete control over their funds and eliminates the need to rely on a centralized authority.

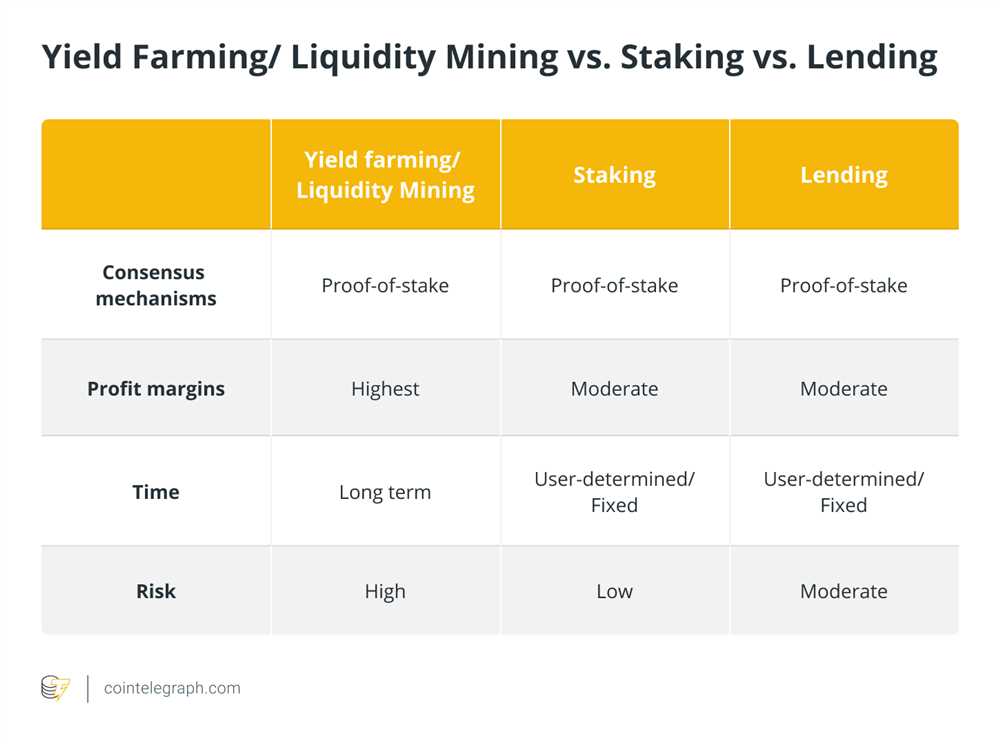

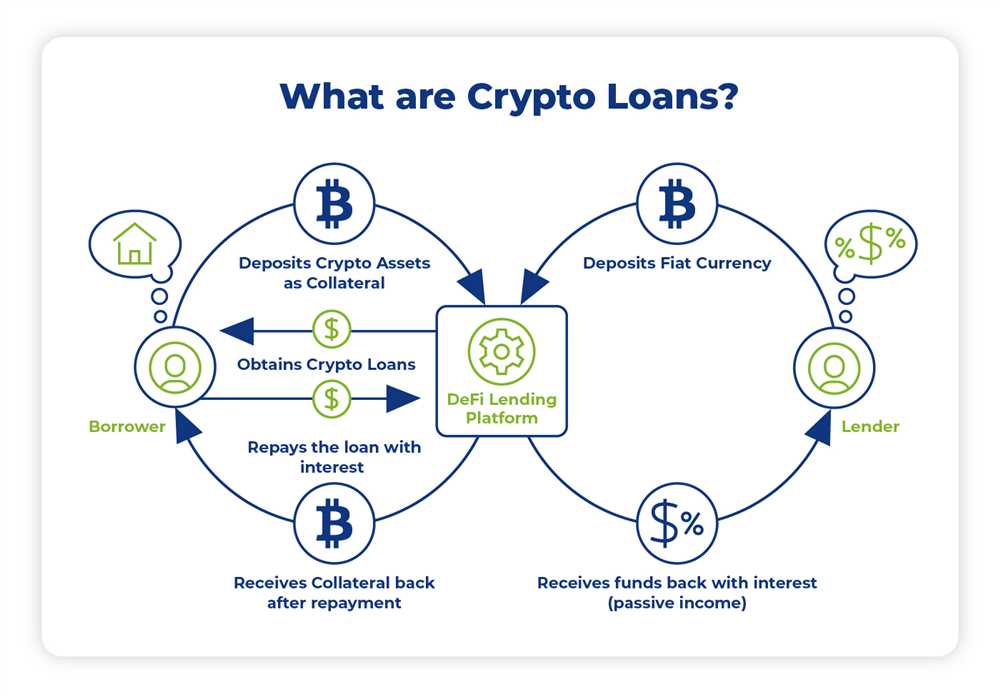

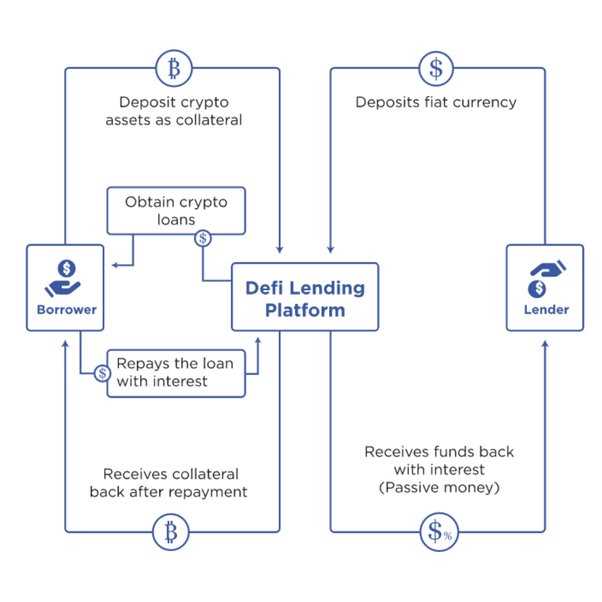

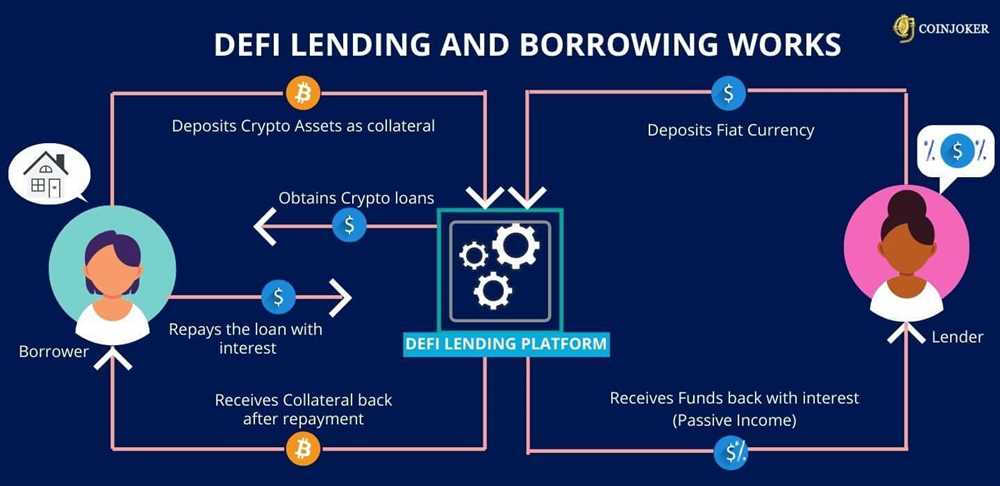

Another key advantage of Orbiter Finance is the ability to earn interest on your holdings through lending. Users can provide liquidity to the platform by lending their crypto assets, and in return, they earn interest on their loans. This creates a passive income stream for participants, as they can lend out their assets and receive regular interest payments without having to actively manage their investments.

In addition to lending, Orbiter Finance also offers borrowing services. Users can borrow assets from the platform using their deposited collateral, allowing them to access additional funds without having to sell their existing holdings. This can be particularly useful for individuals who want to leverage their crypto assets without losing ownership.

Orbiter Finance also prioritizes the safety and security of user funds. The platform utilizes advanced security measures, such as multi-signature wallets and decentralized smart contracts, to ensure the protection of user assets. Moreover, Orbiter Finance also conducts regular audits and security checks to maintain the integrity of its ecosystem.

Overall, Orbiter Finance provides a compelling opportunity for individuals to earn passive income through decentralized lending and borrowing. With its transparent and secure platform, users can confidently participate in the crypto economy and generate income without the need for active trading or investment management.

The Advantages of Decentralized Lending

In the world of finance, decentralized lending has emerged as a revolutionary concept that offers several advantages over traditional lending methods. With Orbiter Finance, you can take advantage of these benefits and earn passive income. Let’s explore the advantages of decentralized lending:

1. Increased Access to Funding

Decentralized lending platforms, like Orbiter Finance, provide individuals and businesses with increased access to funding. Unlike traditional banks that have strict eligibility criteria, decentralized lending platforms are more inclusive and often do not require extensive credit checks. This means that individuals who may not have access to traditional financial institutions can now obtain loans and invest in various opportunities.

2. Elimination of Intermediaries

Decentralized lending eliminates the need for intermediaries, such as banks or financial institutions, which often come with high fees and lengthy approval processes. By leveraging blockchain technology, decentralized lending platforms like Orbiter Finance create a direct peer-to-peer lending environment that eliminates the need for intermediaries. This results in lower costs and faster loan processing times.

3. Enhanced Transparency and Security

One of the key advantages of decentralized lending is the enhanced transparency and security it offers. Through the use of blockchain technology, all lending transactions are recorded on a public ledger, providing complete transparency. Additionally, the decentralized nature of the lending platform ensures that funds are securely stored and protected from potential hacking or unauthorized access. This level of transparency and security builds trust among lenders and borrowers, making decentralized lending a reliable and attractive option.

4. Flexible Loan Terms

Decentralized lending platforms like Orbiter Finance offer borrowers the flexibility to choose loan terms that best meet their needs. Borrowers can set the loan amount, interest rate, and repayment terms based on their individual preferences. This level of customization allows borrowers to access the funds they need while also ensuring that the loan terms align with their financial goals and capability to repay.

5. Global Accessibility

Unlike traditional lending methods that are limited by geographical boundaries, decentralized lending platforms are accessible to individuals from all over the world. This global accessibility opens up new investment opportunities and allows lenders to diversify their lending portfolios. Furthermore, borrowers can access funds from lenders around the world, increasing their chances of securing a loan that suits their specific needs.

With Orbiter Finance, you can enjoy all these advantages and start earning passive income through decentralized lending. Join our platform today and unlock a world of financial opportunities!

and Borrowing

Decentralized lending and borrowing is a revolutionary concept that is transforming the way we think about traditional finance. With Orbiter Finance, you can now access a wide range of lending and borrowing services on a decentralized platform.

One of the main advantages of decentralized lending and borrowing is the elimination of intermediaries. In traditional banking systems, borrowers had to go through multiple intermediaries such as banks, loan officers, and credit agencies, resulting in high fees and delays. With Orbiter Finance, you can directly interact with lenders and borrowers, cutting out the middlemen and reducing costs.

Another advantage is the flexibility and accessibility of decentralized lending and borrowing. Traditional financial institutions often have stringent eligibility criteria, making it difficult for people with limited credit history or collateral to get loans. With Orbiter Finance, anyone can participate in lending or borrowing activities, regardless of their credit score or financial background.

Decentralized lending and borrowing also offer increased transparency and security. The use of blockchain technology ensures that all transactions are recorded on a public ledger, making it virtually impossible to manipulate or falsify records. This level of transparency builds trust among participants and provides a more secure environment for lending and borrowing.

Furthermore, Orbiter Finance provides a variety of innovative lending and borrowing products. You can choose from different loan types, including collateralized loans, uncollateralized loans, and peer-to-peer loans. These options allow you to tailor your borrowing experience to suit your specific needs and risk appetite.

Overall, decentralized lending and borrowing with Orbiter Finance opens up a world of opportunities for investors, borrowers, and lenders alike. Whether you want to earn passive income by lending your assets or need a loan to fund your projects, Orbiter Finance offers a decentralized, transparent, and inclusive platform for all your financial needs.

What is Orbiter Finance?

Orbiter Finance is a decentralized lending and borrowing platform built on the blockchain. It allows users to earn passive income by lending their cryptocurrencies and borrow assets from other users.

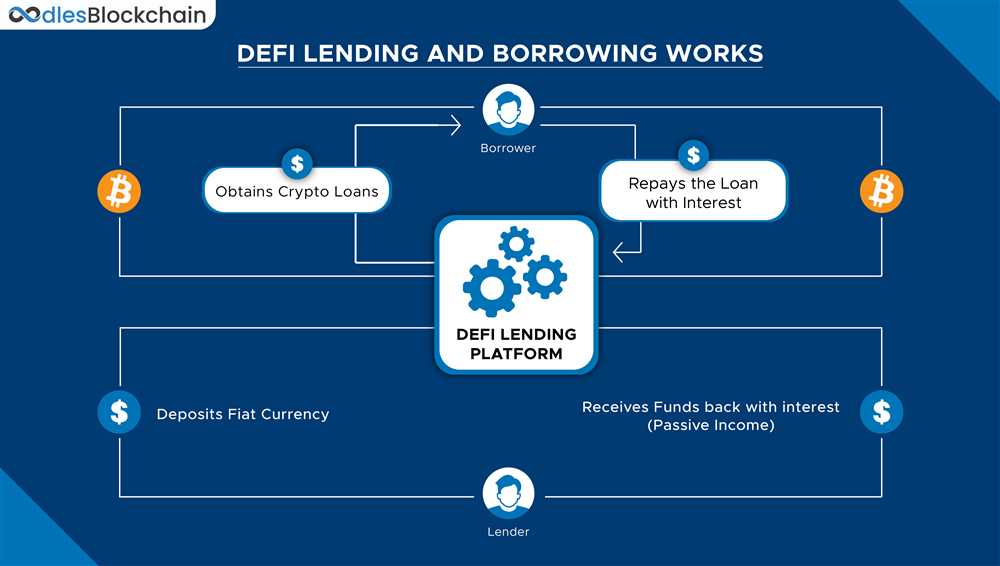

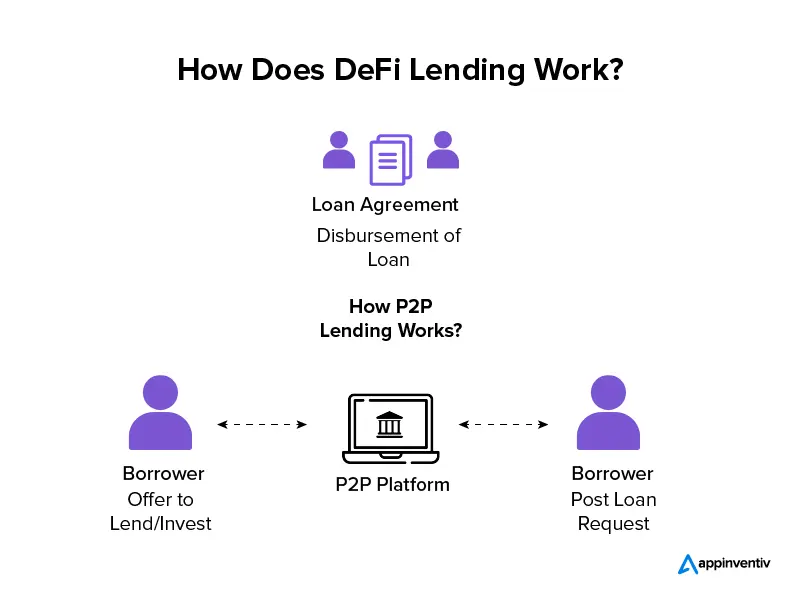

How does decentralized lending work?

Decentralized lending works by allowing users to lend their cryptocurrencies to other users through a smart contract on the blockchain. This eliminates the need for intermediaries such as banks and allows for greater transparency and security.

Can I earn interest on my idle cryptocurrencies?

Yes, with Orbiter Finance, you can earn interest on your idle cryptocurrencies by lending them to other users on the platform. The interest rate is determined by supply and demand and can be higher than traditional financial institutions.