Enhancing Market Depth and Liquidity in the Cosmos Ecosystem with Orbiter Finance’s Cross-Chain Asset Transfers and Liquidity Pools

Welcome to Orbiter Finance, where we revolutionize the way you trade and access liquidity in the crypto market. With our advanced technology, we provide unparalleled opportunities to enhance market depth and liquidity.

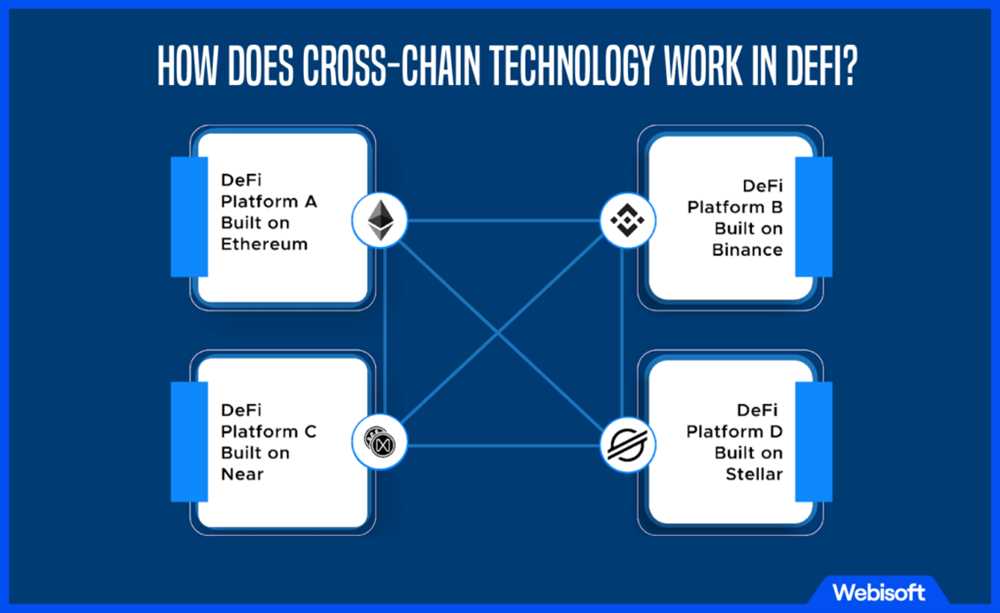

Cross-Chain Asset Transfers: Our platform enables seamless and secure transfers of assets across different blockchains. Say goodbye to the limitations of single-chain trading and explore a new world of possibilities with cross-chain asset transfers.

Liquidity Pools: Orbiter Finance offers innovative liquidity pool solutions that connect traders and market makers. By pooling together assets and providing sufficient liquidity, our platform ensures a vibrant trading environment for all participants.

With Orbiter Finance, you can trade with confidence, knowing that you have access to deep liquidity and a wide range of assets. Join us today and experience the future of decentralized finance!

Overview of Orbiter Finance

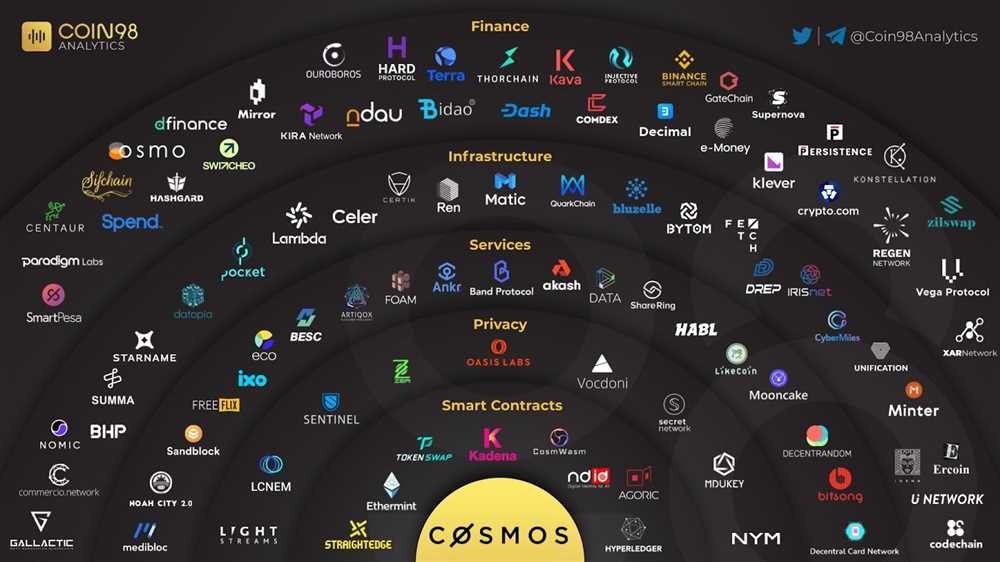

Orbiter Finance is a leading decentralized finance (DeFi) platform that aims to enhance market depth and liquidity in the cryptocurrency space. With its innovative cross-chain asset transfer and liquidity pool solutions, Orbiter Finance revolutionizes how cryptocurrency assets are traded and exchanged.

By leveraging advanced blockchain technology, Orbiter Finance enables seamless and secure transfers of assets across different blockchains. This cross-chain functionality allows users to easily access a wide range of markets, increasing market depth and liquidity. Whether it’s Bitcoin (BTC), Ethereum (ETH), or other popular cryptocurrencies, Orbiter Finance ensures that assets can be efficiently transferred and utilized.

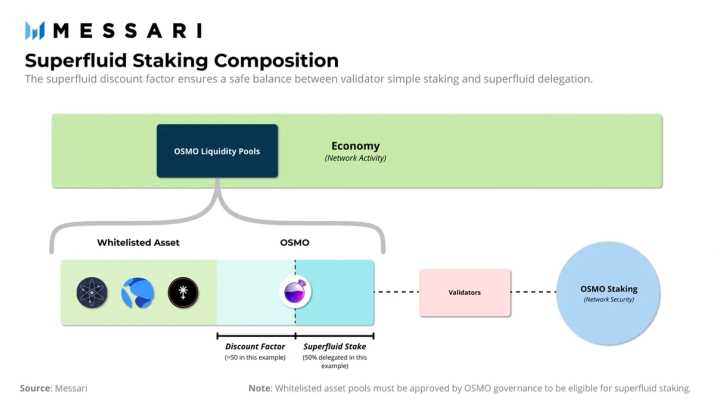

In addition to cross-chain asset transfers, Orbiter Finance offers robust liquidity pool solutions. These pools enable users to provide liquidity and earn passive income by contributing their assets to the platform. Through this mechanism, liquidity is increased, making it easier for traders to execute trades at competitive prices and reducing the impact of large market orders.

Orbiter Finance’s cross-chain asset transfers and liquidity pools are powered by its native token, ORB. ORB holders can participate in governance decisions, incentivize liquidity provision, and earn rewards. The utility of the ORB token further enhances the overall ecosystem and incentivizes active participation from the community.

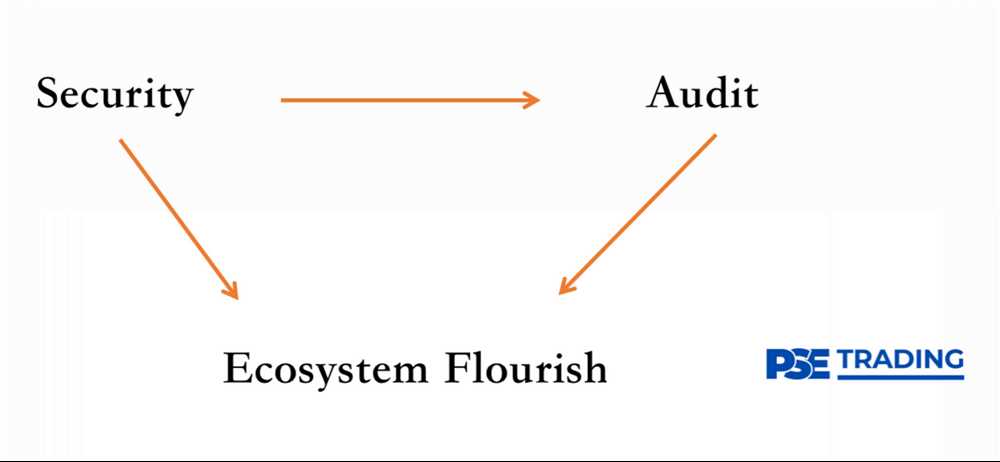

With an emphasis on security, transparency, and user experience, Orbiter Finance aims to provide a seamless and efficient trading environment for cryptocurrency enthusiasts worldwide. Whether you’re an experienced trader or a newcomer to the crypto space, Orbiter Finance’s innovative solutions can enhance your trading experience and help you achieve your financial goals.

Join the Orbiter Finance community today and experience the future of decentralized finance!

Market Depth and Liquidity

Market depth refers to the availability of buy and sell orders for a given asset or security at different price levels. Liquidity, on the other hand, represents the ease with which an asset can be bought or sold without significantly impacting its price. In the world of finance, market depth and liquidity are crucial factors that can directly impact the efficiency and stability of a market.

Importance of Market Depth

Having a deep market depth is essential for sustainable market growth. A deep market allows for large trade volumes, reduces price volatility, and provides investors with more options when executing trades. Moreover, it creates a favorable environment for effective price discovery, which aids in determining fair market values for assets.

With Orbiter Finance’s cross-chain asset transfers, investors can enhance market depth by seamlessly transferring assets across different blockchain networks. This provides market participants with access to a larger pool of liquidity, enabling them to execute trades more efficiently and with reduced slippage.

Enhancing Liquidity with Liquidity Pools

Orbiter Finance’s liquidity pools further contribute to enhancing liquidity in the market. These pools are created by users who deposit their assets into a smart contract, which in turn provides liquidity for trading. Liquidity providers are rewarded with fees generated from trading activities within the pool.

The presence of liquidity pools allows for increased liquidity in the market, as they provide a constant source of liquidity for traders. This not only improves market efficiency but also reduces the risk of market manipulation as the liquidity within the pool is continuously available for trading.

By utilizing Orbiter Finance’s cross-chain asset transfers and liquidity pools, market participants can enjoy enhanced market depth and liquidity. This empowers them to execute trades more efficiently, access a larger pool of liquidity, and participate in a more stable and transparent market environment.

The Importance of Market Depth

Market depth is a critical factor in determining the liquidity and stability of financial markets. It refers to the number and size of buy and sell orders available at different price levels.

High market depth indicates a large number of buy and sell orders, providing a greater opportunity for traders to enter and exit positions without significantly impacting the market price. This creates a more efficient trading environment and reduces the likelihood of significant price swings.

In contrast, low market depth can result in increased price volatility and less efficient trading. It means that a small number of buy or sell orders can have a significant impact on the market price, leading to potential price manipulation and decreased confidence in the market.

Benefits of High Market Depth:

1. Increased Liquidity: High market depth ensures that there are enough buyers and sellers in the market, making it easier for traders to execute their orders at desired prices.

2. Narrower Bid-Ask Spread: With more buy and sell orders available at different price levels, the bid-ask spread, which represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, tends to be narrower. This means that traders can buy and sell assets at more competitive prices.

Impact of Low Market Depth:

1. Higher Volatility: In a market with low market depth, even a small trade can have a significant impact on the market price, leading to increased price volatility.

2. Reduced Liquidity: Low market depth means that there are fewer buyers and sellers in the market, making it harder for traders to find counterparties for their orders and execute trades at desired prices.

3. Price Manipulation: When market depth is low, it becomes easier for large market participants to manipulate the market by placing a few strategically positioned orders to create the appearance of market activity and influence prices.

In conclusion, market depth plays a critical role in ensuring liquidity, stability, and fairness in financial markets. By providing a greater number and size of buy and sell orders, it enhances the efficiency and confidence of traders, allowing them to execute their trades at competitive prices. Moreover, high market depth reduces the risk of price manipulation and excessive price volatility, creating a more trustworthy trading environment.

Orbiter Finance’s Cross-Chain Asset Transfers

One of the key features offered by Orbiter Finance is cross-chain asset transfers. This innovative solution enables users to seamlessly transfer their assets across different blockchain networks, allowing for unrestricted liquidity and expanded market depth.

Through Orbiter Finance’s cross-chain asset transfers, users can unlock a whole new level of convenience and flexibility. Say goodbye to the limitations imposed by a single blockchain network – now you can freely move your assets between various chains with ease.

Whether you want to move your assets from Ethereum to Binance Smart Chain, or from Polkadot to Avalanche, Orbiter Finance’s cross-chain asset transfers have got you covered. No longer will you be bound by the constraints of a single blockchain – explore the vast opportunities presented by multiple chains.

With Orbiter Finance, the cross-chain asset transfer process is seamless and efficient. Thanks to our advanced technology, you can initiate asset transfers with just a few clicks. Our platform ensures the utmost security and transparency, so you can trust that your assets will be safely transferred to the desired chain.

Unlock the potential of cross-chain transfers and experience enhanced market depth and liquidity. Join Orbiter Finance today and revolutionize your asset management strategy.

Seamless Transfer of Assets

Orbiter Finance provides a secure and efficient solution for the seamless transfer of assets. With our advanced cross-chain technology, users can transfer their assets across different blockchain networks effortlessly.

By leveraging our cutting-edge protocol, which is built on the principles of interoperability and decentralization, users can easily move their digital assets between various blockchain ecosystems. This eliminates the need for complicated and time-consuming manual processes, ensuring a smooth and hassle-free experience.

With our cross-chain asset transfer functionality, users gain access to a broader range of investment opportunities and liquidity. By seamlessly moving assets between different chains, investors can tap into new markets, increase market depth, and optimize their trading strategies.

Orbiter Finance’s cross-chain asset transfer technology also enhances market liquidity. By enabling the movement of assets between liquidity pools across different blockchains, we ensure that there is a constant flow of liquidity, minimizing slippage and improving overall market efficiency.

| Key Benefits of Seamless Asset Transfer: |

| 1. Enhanced market depth and liquidity |

| 2. Access to a wider range of investment opportunities |

| 3. Improved trading strategies |

| 4. Minimized slippage and improved market efficiency |

With Orbiter Finance’s seamless transfer of assets, users can unlock the full potential of blockchain technology, harnessing its power to optimize their investments and maximize their returns.

Liquidity Pools

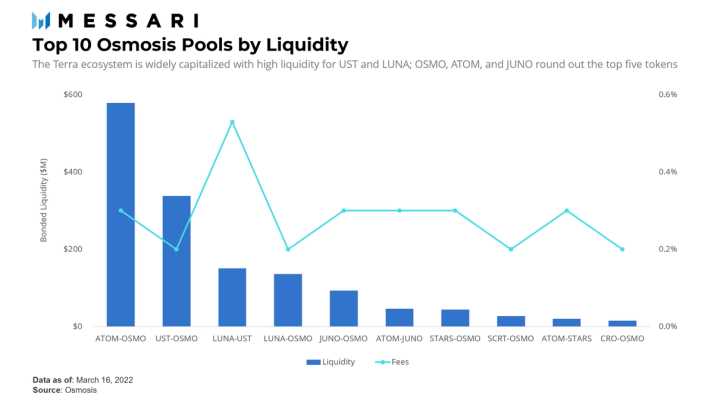

Orbiter Finance offers innovative liquidity solutions through its advanced cross-chain asset transfer technology and liquidity pools. Liquidity pools are essential components of decentralized finance (DeFi), providing increased market depth and accessibility for traders and investors.

By participating in Orbiter Finance’s liquidity pools, users can provide their digital assets as liquidity and earn passive income. This process involves depositing tokens into a pooled fund, which is then used to facilitate trading activities on various blockchain networks.

When users deposit their tokens into a liquidity pool, they receive LP (liquidity provider) tokens in return. These tokens represent the user’s stake in the pool and can be used to redeem their share of the pool’s total value, including any accrued interest.

Orbiter Finance’s advanced technology ensures that liquidity providers can easily and securely access their funds whenever needed. Additionally, the automated smart contract protocols used by Orbiter Finance optimize the allocation and management of assets within the liquidity pools, leading to minimized risks and maximizing returns.

Benefits of participating in Orbiter Finance’s liquidity pools include:

- Enhanced Market Depth: Liquidity pools improve the overall liquidity of the market, allowing traders to execute larger transactions without significantly impacting the price.

- Increased Market Accessibility: Liquidity pools provide a more inclusive trading environment, enabling users to trade a wide range of digital assets across different blockchains.

- Passive Income Opportunities: By providing liquidity to the pools, users can earn a share of the trading fees generated within the liquidity pools, incentivizing long-term engagement.

- Diversification Opportunities: Liquidity pools support a wide range of tokens, offering users the flexibility to diversify their holdings and manage risk.

- Secure and Transparent: Orbiter Finance’s cross-chain asset transfer technology and smart contract protocols ensure the security and transparency of all transactions within the liquidity pools.

Overall, Orbiter Finance’s liquidity pools play a crucial role in enhancing market depth and liquidity, fostering a vibrant and efficient trading ecosystem for users across different blockchain networks.

What is Orbiter Finance?

Orbiter Finance is a platform that offers cross-chain asset transfers and liquidity pools. It aims to enhance market depth and liquidity in the cryptocurrency market.

How does Orbiter Finance enhance market depth and liquidity?

Orbiter Finance achieves this by facilitating cross-chain asset transfers and providing liquidity pools. Cross-chain asset transfers allow users to easily move assets between different blockchain networks, increasing their availability and accessibility. Liquidity pools, on the other hand, help provide a more liquid market by pooling together assets from multiple users.

What are the benefits of cross-chain asset transfers?

Cross-chain asset transfers offer several benefits. They allow users to diversify their investments across different blockchain networks, reducing risk. They also make it easier to access assets on networks that may have different functionalities or applications. Additionally, cross-chain transfers can improve market efficiency by increasing the availability of assets and reducing the need for intermediaries.

Can I earn rewards by providing liquidity to the Orbiter Finance liquidity pools?

Yes, you can earn rewards by providing liquidity to the Orbiter Finance liquidity pools. When you contribute assets to a liquidity pool, you become a liquidity provider, and you are rewarded with a share of the fees generated by the pool. These rewards can be an additional source of income for users.

Is Orbiter Finance compatible with all blockchain networks?

Orbiter Finance aims to be compatible with multiple blockchain networks. While it may not support every network, the platform strives to expand its compatibility over time. By offering cross-chain asset transfers, Orbiter Finance aims to bridge different blockchain ecosystems and provide users with greater flexibility and options when it comes to managing their assets.