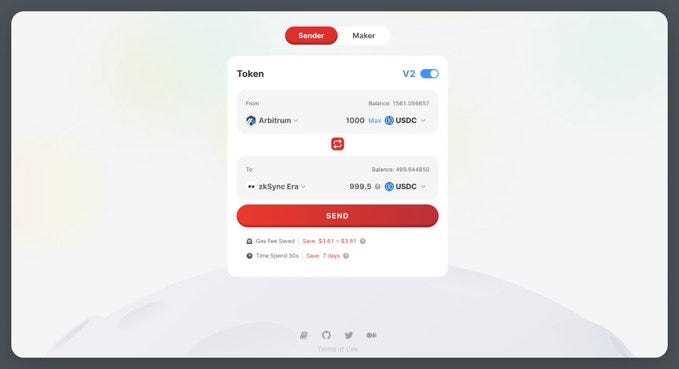

Explaining the Sender and Maker roles in Orbiter Finance – A Comprehensive Guide

Welcome to our comprehensive guide on the Sender and Maker roles in Orbiter Finance. In the decentralized finance (DeFi) ecosystem, understanding these roles is crucial for anyone looking to participate in the Orbiter Finance platform. By grasping the responsibilities and capabilities of these roles, users can make informed decisions and maximize their potential in the Orbiter Finance ecosystem.

Orbiter Finance is a decentralized lending protocol built on the Ethereum blockchain. It allows users to borrow and lend cryptocurrencies without the need for intermediaries. The protocol revolves around two main roles: the Sender and the Maker. These roles play a vital part in the functioning of the Orbiter Finance platform, ensuring the smooth operation of borrowing and lending activities.

The Sender role in Orbiter Finance refers to users who want to borrow funds from the platform. They initiate the borrowing process by creating and signing a transaction, specifying the details of the loan such as the amount, interest rate, and collateral. The Sender acts as the borrower and is responsible for providing sufficient collateral to secure their loan. They also need to repay their loan within the predefined period to avoid losing their collateral.

The Maker, on the other hand, is the user who provides liquidity to the Orbiter Finance platform. Makers deposit their funds into the protocol and earn interest on their holdings. In return for providing liquidity, Makers receive Orbiter Finance’s native token as a reward. Makers play a crucial role in ensuring the availability of funds for borrowing, contributing to the overall efficiency and stability of the platform.

Understanding the fundamentals of Sender role in Orbiter Finance

In Orbiter Finance, the Sender role plays a crucial role in the transactional processes of the platform. As a participant in the Orbiter Finance ecosystem, it is important to understand the fundamentals of the Sender role to ensure seamless and secure transactions.

What is a Sender?

A Sender in Orbiter Finance is an entity or individual responsible for initiating a transaction by sending cryptocurrency or tokens to another participant within the ecosystem. The Sender can be an individual user, a decentralized application, or even a smart contract.

Key responsibilities of a Sender

The primary responsibility of a Sender is to ensure the accurate and timely transmission of cryptocurrency or tokens to the intended recipient. This involves:

- Verifying the recipient’s address: Before initiating a transaction, the Sender must ensure that the recipient’s address is correct to avoid any misdirected funds.

- Calculating transaction fees: Depending on the network congestion and transaction priority, the Sender needs to calculate the appropriate transaction fees to include to ensure the transaction gets processed in a timely manner.

- Signing the transaction: The Sender must sign the transaction with cryptographic keys to authorize the transfer of funds.

- Confirming transaction completion: After initiating a transaction, the Sender should monitor the blockchain network to verify its completion and ensure the funds have been successfully transferred.

By fulfilling these responsibilities, the Sender ensures the seamless execution of transactions on the Orbiter Finance platform while maintaining the security and integrity of the ecosystem.

It is important for the Sender to be cautious and double-check all transaction details before initiating a transfer. Any error or mistake during the process can result in loss of funds or irreversible transactions.

The significance of Maker role in Orbiter Finance ecosystem

The Maker role plays a vital role in the Orbiter Finance ecosystem by providing liquidity and allowing users to mint stablecoins. As a Maker, users can lock their assets in smart contracts and create a pool of collateral to back their stablecoin issuance.

The Maker role is responsible for maintaining the stability of the Orbiter Finance ecosystem by ensuring that the value of the stablecoin remains pegged to a specific asset or currency. This is achieved through the use of algorithms that constantly monitor the value of the collateral and adjust the stability fees accordingly.

By participating as a Maker in Orbiter Finance, users can earn passive income in the form of stability fees. These fees are paid by borrowers who use the stablecoin for various purposes such as trading, investing, and borrowing. The stability fees are distributed among the Makers in proportion to their contribution to the supply of stablecoins.

The Maker role also provides a way for users to hedge against price volatility. By locking their assets as collateral, users can mint stablecoins that are not subject to market fluctuations. This allows users to hedge their risks and preserve the value of their assets in times of market uncertainty.

In addition, the Maker role in Orbiter Finance enables users to access decentralized finance (DeFi) services. By providing liquidity through the issuance of stablecoins, Makers contribute to the growth and accessibility of the DeFi ecosystem. This opens up opportunities for users to participate in lending, borrowing, and other financial activities on the Orbiter Finance platform.

| Benefits of being a Maker in Orbiter Finance: |

|---|

| 1. Earn passive income through stability fees. |

| 2. Hedge against price volatility with stablecoin issuance. |

| 3. Access decentralized finance (DeFi) services. |

| 4. Contribute to the growth and accessibility of the DeFi ecosystem. |

Overall, the Maker role in the Orbiter Finance ecosystem is crucial for maintaining stability, providing liquidity, and enabling users to participate in the decentralized finance revolution.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance platform built on the Ethereum blockchain. It aims to provide users with various financial services such as lending, borrowing, and liquidity providing.

What are the Sender and Maker roles in Orbiter Finance?

In Orbiter Finance, the Sender is the user who initiates a transaction, while the Maker is the user who provides liquidity for the transaction. The Sender can borrow assets from the Maker by locking collateral, and the Maker earns interest on their assets.

How does borrowing work in Orbiter Finance?

To borrow in Orbiter Finance, a user needs to lock collateral in the platform’s smart contract. The amount of assets a user can borrow is determined by the value of the collateral. The user can then use the borrowed assets as they see fit, but they will need to repay the loan with interest within a specified time period.