When it comes to financing your orbiter project, it’s crucial to consider all the available alternatives to ensure that you make the best investment decisions. With the rapid advancements in technology and the increasing demand for space exploration, the options for orbiter finance have never been more diverse.

In this comprehensive guide, we will take you through some of the top orbiter finance alternatives, exploring their pros and cons, and providing you with valuable insights to help you navigate the complex world of space financing.

One alternative to consider is venture capital funding. This involves attracting investment from specialized firms or individuals who are willing to take risks in exchange for potential high returns. With venture capital, you can secure the necessary funds to develop and launch your orbiter, while also benefiting from the expertise and network of the investors.

Another option to explore is government grants and contracts. Governments around the world are eager to support space exploration initiatives, offering grants and contracts to companies and organizations involved in the development of orbiters. By taking advantage of these opportunities, you can receive substantial financial backing and access to valuable resources.

Additionally, crowdfunding has emerged as a popular choice for funding space-related projects. By leveraging online platforms, you can present your orbiter project to a wide audience and attract individuals who are passionate about space exploration. Through crowdfunding, you can raise the necessary funds while also building a community of supporters who are invested in the success of your mission.

These are just a few of the orbiter finance alternatives we will explore in this comprehensive guide. By diving deeper into each option, weighing their pros and cons, and considering your specific needs and goals, you will be well-equipped to make informed decisions that will pave the way for the successful financing of your orbiter project.

Evaluating the Top Orbiter Finance Options

When it comes to financing your orbiter project, it’s important to carefully evaluate your options to ensure you choose the best one for your needs. Here, we will explore the top orbiter finance options and provide you with the information you need to make an informed decision.

Option 1: Traditional Bank Loan

A traditional bank loan is a common option for financing orbiter projects. With this option, you borrow a specified amount of money from a bank and agree to repay it over a set period of time with interest. It’s important to compare interest rates, loan terms, and fees from different banks to determine the most favorable option for your project.

Option 2: Crowdfunding

Crowdfunding has become a popular way to finance various projects, including orbiter developments. Through crowdfunding platforms, you can pitch your project to a large audience and ask for financial contributions. In return, you may offer rewards, such as exclusive access to project updates or limited-edition merchandise. It’s crucial to create a compelling campaign and promote it effectively to attract potential backers.

Option 3: Venture Capital

For more ambitious orbiter projects, seeking venture capital funding might be a viable option. Venture capital firms invest in high-growth potential projects in exchange for equity or ownership in the company. However, securing venture capital funding can be competitive, and you may need to present a strong business plan and demonstrate the potential profitability of your orbiter project.

Option 4: Government Grants

Government grants can be an excellent source of financing for orbiter projects, especially those with a strong scientific or technological focus. Many government agencies offer grants to support space exploration and research. However, the grant application process can be complex and highly competitive. It’s essential to thoroughly research the eligibility criteria and requirements before applying.

| Option | Pros | Cons |

|---|---|---|

| Traditional Bank Loan | Relatively low interest rates, established repayment terms | Requirements for collateral or creditworthiness, lengthy approval process |

| Crowdfunding | Potential for large funding amounts, ability to engage with supporters | No guaranteed funding, requires effective marketing and promotion |

| Venture Capital | Potential for significant financial investment, access to industry expertise | Likely loss of ownership and control, selective and competitive application process |

| Government Grants | No repayment required, potential for significant funding | Complex application process, high competition for limited funding |

Each financing option has its own advantages and disadvantages. Consider your unique needs and resources, as well as the specific requirements of each option, when evaluating the top orbiter finance options. By doing thorough research and careful analysis, you can choose the option that will best support the success of your orbiter project.

Comparing the Benefits and Drawbacks of Orbiter Finance Platforms

When it comes to finding the best orbiter finance platform, there are several options to consider. Each platform comes with its own set of benefits and drawbacks that users should be aware of. In this section, we will compare the different orbiter finance platforms and highlight their key advantages and disadvantages.

Platform A

- Benefits:

- – Offers a user-friendly interface for easy navigation

- – Provides a wide range of investment options

- – Offers low fees and competitive interest rates

- Drawbacks:

- – Limited customer support

- – Requires a minimum account balance

- – Limited features for advanced investors

Platform B

- Benefits:

- – Robust set of features and tools for advanced investors

- – Extensive educational resources for beginners

- – Offers personalized investment recommendations

- Drawbacks:

- – Higher fees compared to other platforms

- – Complex interface that may be overwhelming for beginners

- – Limited investment options

Platform C

- Benefits:

- – Low fees and competitive interest rates

- – Wide variety of investment options

- – Excellent customer support

- Drawbacks:

- – Limited educational resources

- – Not suitable for advanced investors

- – Requires a significant initial deposit

It’s important to consider your individual investment goals and preferences when comparing orbiter finance platforms. Evaluating the benefits and drawbacks of each platform can help you make an informed decision and choose the best option that aligns with your needs.

Choosing the Right Orbiter Finance Solution for Your Business

When it comes to financing solutions for your business, choosing the right orbiter finance option is crucial. With so many options available, it can be overwhelming to make a decision. Here are some factors to consider when selecting the best orbiter finance solution for your business:

1. Needs and Goals: Start by identifying your business’s needs and goals. Are you looking for short-term financing to cover operational expenses or a long-term solution for growth and expansion? Understanding your specific needs will help narrow down the options.

2. Cost and Terms: Compare the cost and terms of different orbiter finance solutions. Consider factors such as interest rates, fees, repayment periods, and flexibility. Look for a solution that aligns with your budget and offers favorable terms.

3. Reputation and Credibility: Research the reputation and credibility of the orbiter finance providers you are considering. Read reviews, ask for referrals, and check their track record. Choose a reputable provider that has experience working with businesses in your industry.

4. Support and Customer Service: Consider the level of support and customer service provided by the orbiter finance solution. Accessibility and responsiveness are important factors to consider, especially when you need assistance or have questions about the financing process.

5. Scalability: As your business grows, your financial needs may change. Look for an orbiter finance solution that offers scalability and can accommodate your future financing needs. This will save you time and effort in the long run.

6. Integration and Compatibility: If you are using other financial tools or software, consider the integration and compatibility of the orbiter finance solution. Choosing a solution that seamlessly integrates with your existing systems will streamline your financial processes.

7. Risk Assessment: Assess the risk involved in each orbiter finance solution. Consider factors such as collateral requirements, credit checks, and default penalties. It’s important to choose a solution that balances risk and reward for your business.

By carefully considering these factors, you can choose the right orbiter finance solution that meets your business’s unique financial needs and helps drive its success.

What are some alternatives to Orbiter Finance?

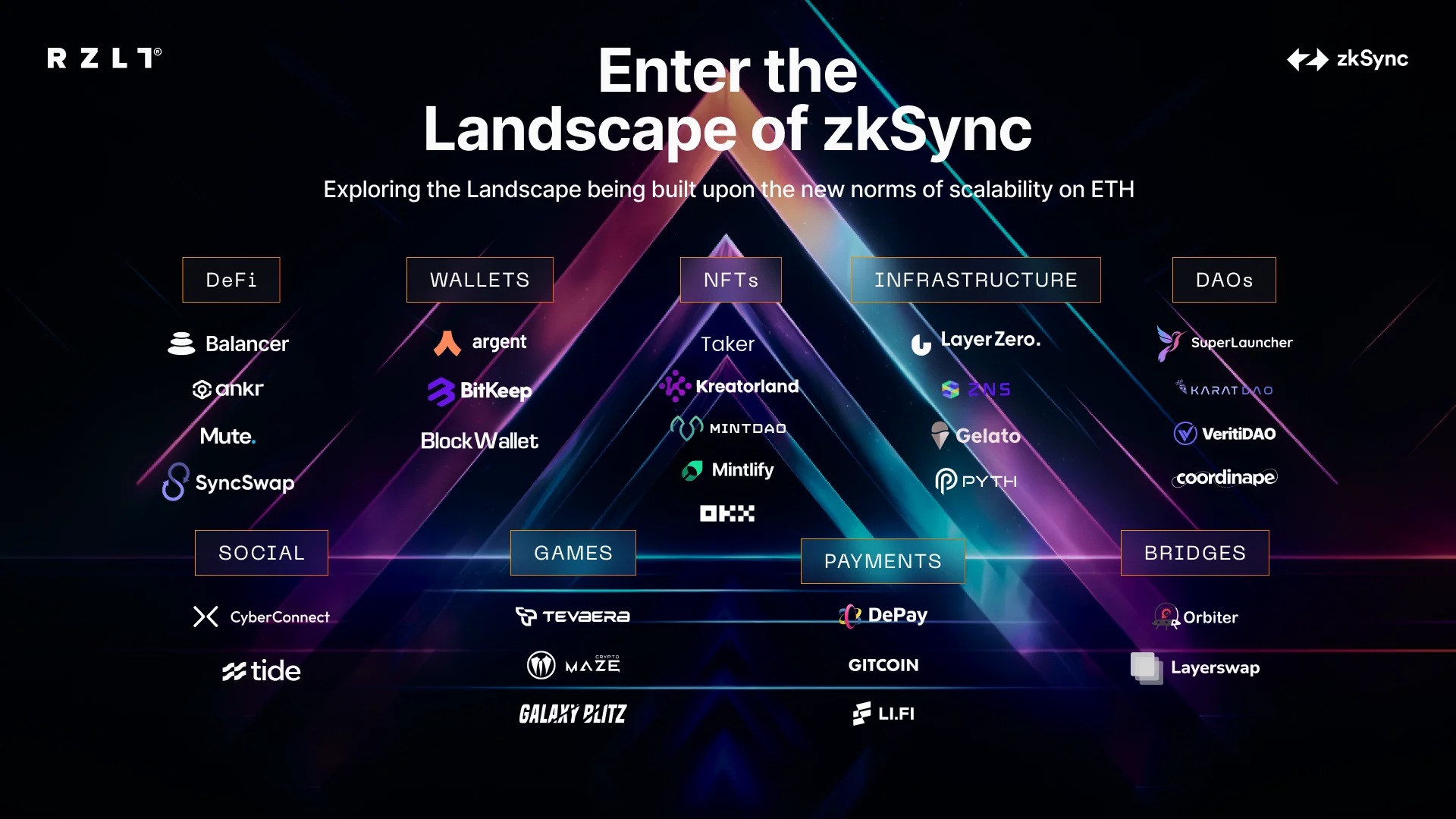

There are several alternatives to Orbiter Finance, including Stellar, Polkadot, and Solana. These platforms offer similar services and features, but with different underlying technologies and ecosystems.

Which is the best finance alternative for Orbiter?

The best finance alternative for Orbiter depends on your specific needs and preferences. If you value decentralization and security, Stellar might be the best choice for you. If you’re looking for a more scalable and interoperable platform, Polkadot could be the better option. Ultimately, it’s important to research and compare different alternatives to determine which one aligns best with your goals.