Exploring the Inner Workings of Orbiter Finance’s Cross-Rollup Transfer Support Mechanism

Orbiter Finance has recently announced the implementation of cross-rollup transfer support within its decentralized financial platform. This groundbreaking development brings a new level of interoperability to the cryptocurrency space, allowing users to seamlessly transfer assets across different rollup chains.

But what exactly is cross-rollup transfer support and why is it such a game-changer? To answer that, we first need to understand the concept of rollup chains. Rollup chains are Layer 2 solutions that enable high throughput and scalability on a blockchain network by bundling multiple transactions into a single batch. This significantly reduces transaction fees and improves overall network efficiency.

With cross-rollup transfer support, Orbiter Finance takes this concept a step further by allowing users to transfer their assets not only within a single rollup chain but also across different rollup chains. This means that users can now move their assets from one rollup chain to another seamlessly, without the need for complicated and time-consuming processes.

The Role of Orbiter Finance in the Cross-Rollup Transfer Space

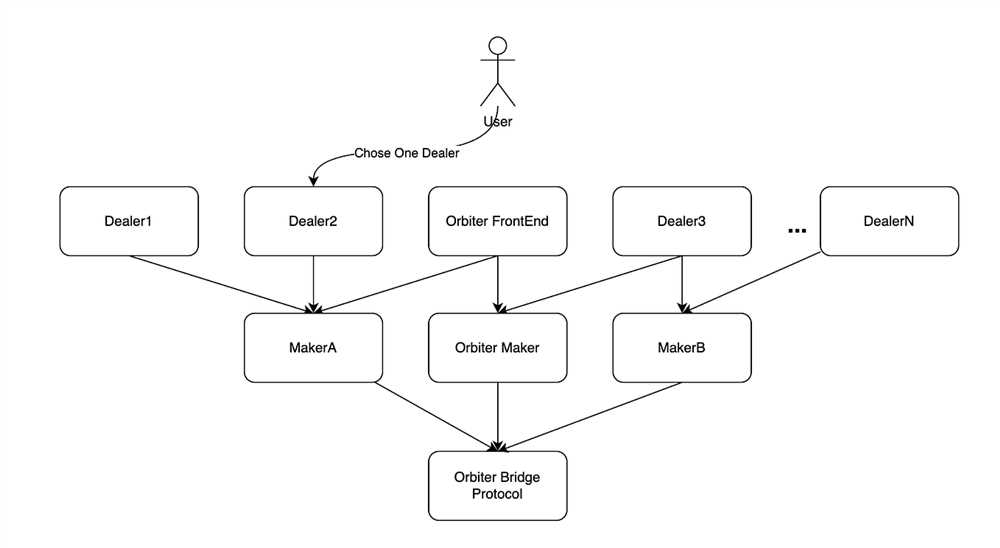

Orbiter Finance plays a significant role in facilitating cross-rollup transfers within the blockchain ecosystem. By utilizing its advanced technology and protocol, Orbiter Finance enables users to seamlessly and securely transfer assets between different rollups.

Rollups are Layer 2 scaling solutions that enable faster and cheaper transactions by batching multiple transactions together and then submitting them to the Ethereum mainnet. However, one limitation of rollups is the difficulty of transferring assets between different rollup networks.

This is where Orbiter Finance steps in. As a cross-rollup transfer facilitator, Orbiter Finance allows users to move assets across various rollup networks with ease. It achieves this by acting as a bridge between these networks, ensuring that assets can be transferred quickly and securely.

Orbiter Finance’s innovative approach leverages the power of smart contracts and cryptographic techniques to facilitate cross-rollup transfers. By using cross-rollup bridges, users can take advantage of the benefits offered by different rollup networks while maintaining the ability to freely move their assets between them.

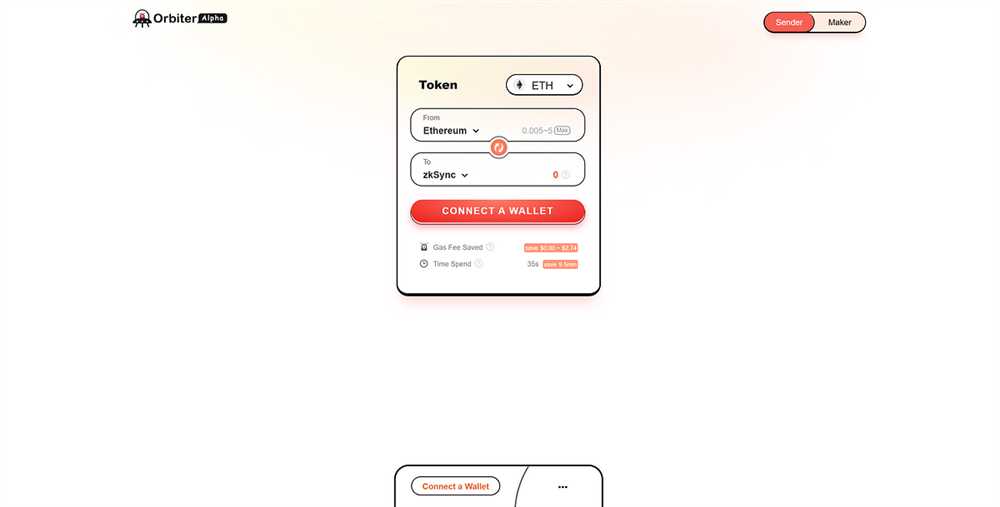

Furthermore, Orbiter Finance provides a user-friendly interface that simplifies the cross-rollup transfer process. Users can easily initiate transfers and monitor their progress, leveraging the seamless integration with their preferred wallets and dApps.

Through its robust infrastructure and well-designed protocols, Orbiter Finance is actively contributing to the growth and adoption of cross-rollup transfers. By removing the barriers to asset transfers between different rollup networks, Orbiter Finance is unlocking new possibilities for users and fostering a more interconnected blockchain ecosystem.

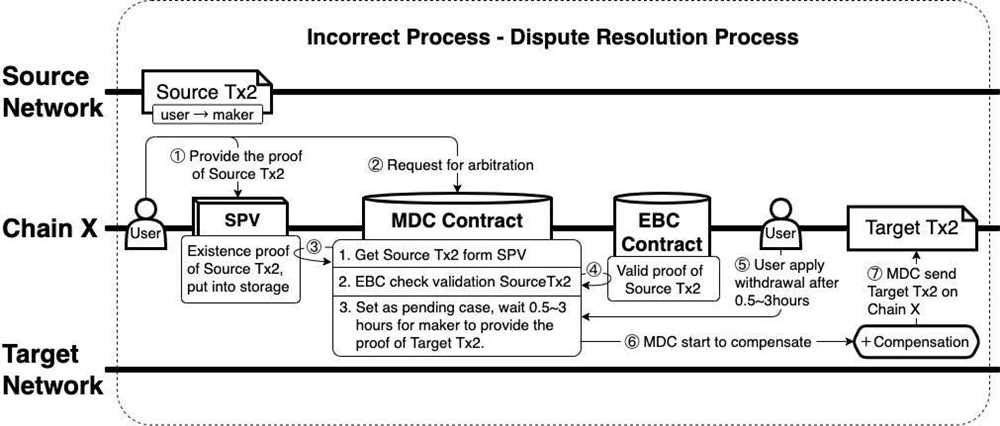

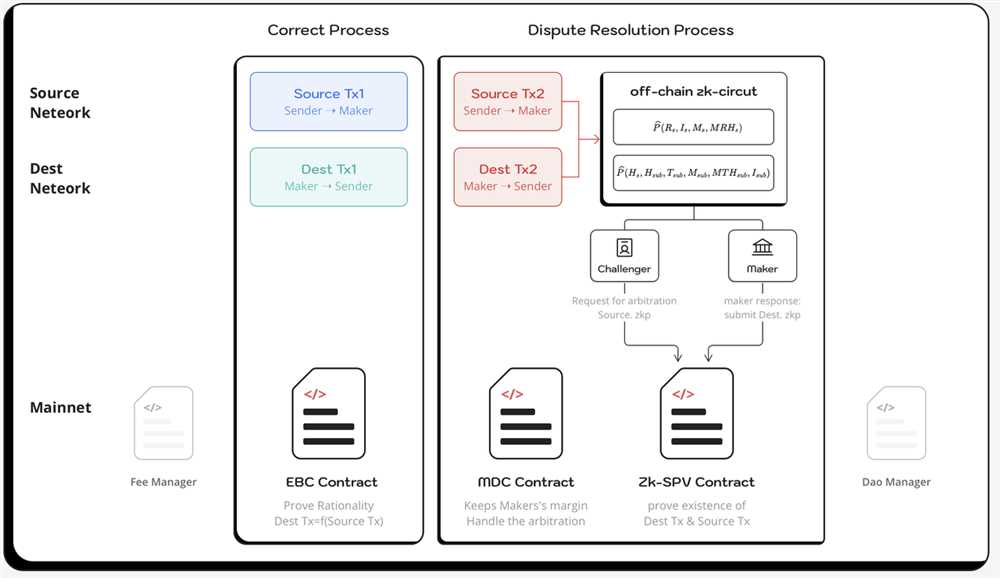

How Cross-Rollup Transfer Works

A cross-rollup transfer is a transaction that allows for the movement of assets between different layer 2 solutions or rollups. This enables users to transfer their assets quickly and efficiently without the need for expensive and time-consuming on-chain transactions.

When initiating a cross-rollup transfer, the first step is to select the assets that will be transferred. These assets can be any supported cryptocurrency or token that exists on the source rollup. Once the assets are selected, a transfer order is created.

The transfer order contains relevant information such as the sender’s address, the recipient’s address, and the amount of assets to be transferred. The order is then signed with the sender’s private key to ensure the authenticity and integrity of the transfer.

Once the transfer order is signed, it is submitted to the source rollup’s smart contract. The smart contract verifies the signature and validates the transfer order. If the order is valid, the contract deducts the transferred assets from the sender’s account and locks them in the contract’s storage.

With the assets locked in the source rollup’s smart contract, the transfer order is then propagated to the destination rollup. The destination rollup’s smart contract receives the transfer order and verifies its authenticity and validity.

Once the transfer order is verified on the destination rollup, the smart contract deducts the assets from the sender’s account on the source rollup and mints new assets on the destination rollup. These new assets are then credited to the recipient’s account on the destination rollup.

After the assets have been successfully transferred between the rollups, the source rollup’s smart contract releases the locked assets, making them available for further transactions on the source rollup.

Benefits of Cross-Rollup Transfer

There are several benefits to using cross-rollup transfer for asset movement. First and foremost, it provides a fast and efficient way to transfer assets between different layer 2 solutions. This is especially useful in situations where on-chain transactions are costly and time-consuming.

Additionally, cross-rollup transfer reduces the reliance on centralized exchanges and custodial solutions for asset movement. Users can have full control over their assets without needing to trust a third party with their funds.

Furthermore, cross-rollup transfer enhances the interoperability between different layer 2 solutions and rollups. It allows for seamless asset transfer between these solutions, promoting a more connected and efficient ecosystem.

In conclusion, cross-rollup transfer is a powerful mechanism that enables users to quickly and securely transfer assets between different layer 2 solutions. Its benefits include speed, security, and enhanced interoperability, making it an attractive solution for asset movement in the decentralized finance space.

Benefits of Orbiter Finance’s Cross-Rollup Transfer Support

Orbiter Finance’s Cross-Rollup Transfer Support offers several benefits that make it a valuable tool for users:

1. Seamless Asset Transfers

With Orbiter Finance’s Cross-Rollup Transfer Support, users can seamlessly transfer their assets across different rollups. This allows for greater flexibility and convenience, as users can easily move their assets between various Layer 2 solutions without any hassle. This feature eliminates the need for complex and time-consuming processes, providing a smooth experience for users.

2. Increased Liquidity

By enabling cross-rollup transfers, Orbiter Finance promotes increased liquidity across different Layer 2 solutions. Users can freely transfer their assets from one rollup to another, enhancing the overall liquidity of the ecosystem. This improved liquidity opens up more opportunities for users to participate in various DeFi protocols and interact with different applications within the Layer 2 space.

3. Enhanced Interoperability

Orbiter Finance’s Cross-Rollup Transfer Support enhances interoperability between different Layer 2 solutions. Users can easily bridge assets from one rollup to another, fostering a more connected and integrated ecosystem. This interoperability paves the way for new collaborations and synergies among Layer 2 solutions, encouraging innovation and growth within the space.

4. Reduced Costs and Faster Transactions

With Orbiter Finance’s Cross-Rollup Transfer Support, users can benefit from reduced costs and faster transaction times. By leveraging the capabilities of different rollups, users can choose the most cost-effective and efficient route for their asset transfers. This not only saves users money but also significantly reduces transaction times, enabling faster and more seamless transactions.

Overall, Orbiter Finance’s Cross-Rollup Transfer Support provides a range of benefits that enhance the user experience, promote liquidity, improve interoperability, and optimize cost and speed. It is a powerful tool that contributes to the development and advancement of the Layer 2 ecosystem.

Increase in Efficiency and Scalability

By supporting cross-rollup transfers, Orbiter Finance is able to significantly increase efficiency and scalability within the network. This feature allows for seamless movement of assets between different rollups, minimizing the need for multiple transactions and reducing the overall gas fees.

With traditional rollup solutions, users would often have to perform multiple transactions to move assets between different networks. This can be time-consuming and costly, especially during times of high network congestion. However, with Orbiter Finance’s cross-rollup transfer support, users can now easily transfer assets between different rollups in a single transaction, streamlining the process and saving both time and money.

Additionally, cross-rollup transfer support enables greater scalability within the network. By allowing for the movement of assets between different rollups, Orbiter Finance expands the possibilities for users, developers, and dApps. This increased scalability means that the network can handle a higher volume of transactions, making it more robust and capable of supporting a growing user base.

Benefits of Increased Efficiency and Scalability

The increase in efficiency and scalability provided by Orbiter Finance’s cross-rollup transfer support offers several benefits to users and the network as a whole. Firstly, it improves the user experience by simplifying asset transfers and reducing costs. Users can now easily move assets between different rollups without the need for multiple transactions or paying excessive gas fees.

Secondly, the increased scalability enables a wider range of use cases within the network. Whether it’s for decentralized finance (DeFi) applications, gaming platforms, or any other dApp, the ability to seamlessly transfer assets between different rollups opens up new possibilities for developers and users alike.

Furthermore, the increased efficiency and scalability also contribute to the overall growth and sustainability of the network. With a streamlined asset transfer process and a higher transaction capacity, Orbiter Finance is well-equipped to handle increased demand and accommodate a larger user base. This robustness and scalability make the network more attractive to potential users and developers, fostering its long-term success.

Reduced Transaction Fees

Orbiter Finance’s cross-rollup transfer support not only offers improved scalability and interoperability between layer 1 and layer 2 solutions, but it also brings about reduced transaction fees. This reduction in fees is a result of the layer 2 solution’s ability to process a larger number of transactions off-chain, alleviating the burden on the layer 1 network.

By utilizing the cross-rollup transfer mechanism, users can enjoy lower transaction costs compared to traditional layer 1 transactions. This is because the majority of the processing and verification of transactions occurs on the layer 2 solution, which is inherently more efficient and cost-effective. The fee savings can be significant, particularly for frequent traders or large volume transfers.

Furthermore, the reduced transaction fees make decentralized finance (DeFi) applications built on Orbiter Finance more accessible and affordable for a wider range of users. Lower fees enable smaller transactions to be economically viable, allowing users with fewer resources to participate in the ecosystem and access the benefits of decentralized financial services.

Benefits of reduced transaction fees:

1. Cost-effectiveness: Reduced fees make transactions more affordable, increasing the overall cost-effectiveness of using Orbiter Finance’s cross-rollup transfer support.

2. Inclusivity: Lower fees allow users with limited resources to participate in decentralized finance, fostering inclusivity and enabling greater access to financial services.

By implementing cross-rollup transfer support, Orbiter Finance prioritizes the user experience by reducing transaction fees and ensuring that the benefits of decentralized finance are accessible to a wider audience.

Enhanced Security and Privacy

Orbiter Finance’s cross-rollup transfer support offers enhanced security and privacy features for its users. The platform employs several measures to ensure that user funds and information are safeguarded.

- End-to-End Encryption: All communication between users and the platform is encrypted using industry-standard encryption protocols. This ensures that sensitive data, such as private keys or transaction details, are protected from unauthorized access.

- Decentralized Key Management: Orbiter Finance utilizes decentralized key management systems, which distribute and store private keys across multiple nodes in a secure and verifiable manner. This reduces the risk of a single point of failure and enhances the security of user funds.

- Non-Custodial Approach: The platform operates on a non-custodial basis, meaning that users have full control over their funds at all times. User assets are never held by the platform, reducing the risk of centralized hacking or mismanagement.

- Transparent Audit Trail: Orbiter Finance maintains a transparent audit trail of all transactions and activities conducted on the platform. This provides users with a verifiable record of their transactions and enhances accountability.

- Multiple Factor Authentication: To further enhance security, Orbiter Finance supports multiple factor authentication methods, such as biometrics or hardware wallets. This adds an extra layer of protection to user accounts and reduces the risk of unauthorized access.

By implementing these security and privacy measures, Orbiter Finance aims to provide its users with a secure and trustworthy environment for cross-rollup transfers.

What is Orbiter Finance’s cross-rollup transfer support?

Orbiter Finance’s cross-rollup transfer support refers to the ability of the Orbiter protocol to facilitate the transfer of assets across different rollup solutions.

How does cross-rollup transfer support work in Orbiter Finance?

In Orbiter Finance, cross-rollup transfer support works by leveraging the capabilities of Ethereum’s Layer 2 rollup solutions, such as Optimism and Arbitrum. The protocol allows users to seamlessly transfer assets from one rollup to another, enabling greater liquidity and interoperability.