Welcome to the ultimate guide to Orbiter Finance, a decentralized cross-rollup Layer 2 bridge that is revolutionizing the world of blockchain technology. In this guide, we will explore what Orbiter Finance is, how it works, and why it is the ultimate solution for decentralized cross-rollup transactions.

Orbiter Finance is a groundbreaking project that aims to solve the scalability and interoperability issues of traditional blockchain networks. Its cross-rollup Layer 2 bridge enables seamless and secure transfers of assets between different Layer 2 solutions, making it possible for users to easily move their assets across multiple blockchains.

Unlike traditional Layer 2 solutions, Orbiter Finance leverages the power of decentralization to ensure the trustless and secure transfer of assets. By utilizing smart contracts and cryptographic proof, Orbiter Finance eliminates the need for relying on centralized intermediaries, making it truly decentralized and censorship-resistant.

With Orbiter Finance, users can enjoy fast, low-cost, and private transactions while maintaining the security and trustlessness of the underlying blockchain network. Whether you are a trader looking to move assets between different Layer 2 networks or a decentralized application (DApp) developer seeking to expand the reach of your DApp, Orbiter Finance provides the ultimate solution.

Join us as we dive deep into the inner workings of Orbiter Finance and discover how this revolutionary cross-rollup Layer 2 bridge is transforming the world of blockchain technology.

The Ultimate Guide to a Decentralized Cross-Rollup Layer 2 Bridge

Welcome to the ultimate guide to a decentralized cross-rollup Layer 2 bridge! In this guide, we will explore the concept of a cross-rollup Layer 2 bridge and understand why it is considered a crucial solution for scaling Ethereum and other blockchain networks.

What is a Cross-Rollup Layer 2 Bridge?

A cross-rollup Layer 2 bridge is a decentralized infrastructure that allows users to transfer assets and information between different Layer 2 solutions. Layer 2 solutions are off-chain scaling solutions that aim to improve the scalability and transaction throughput of blockchain networks, such as Ethereum.

The term “rollup” refers to a technique of bundling multiple transactions together and submitting them as a single transaction on the main blockchain. Cross-rollup bridges enable interoperability between different rollup chains, allowing users to seamlessly transfer assets and data across these chains.

Why is a Cross-Rollup Layer 2 Bridge Needed?

The need for a cross-rollup Layer 2 bridge arises from the scalability limitations of Layer 1 blockchain networks, particularly Ethereum. Layer 1 networks have a limited transaction throughput, which leads to high fees and slow transaction confirmations during periods of high network congestion.

Layer 2 solutions, such as rollups, address these scalability issues by moving the majority of transactions off-chain. However, each Layer 2 solution operates independently, creating a fragmented ecosystem. A cross-rollup Layer 2 bridge bridges this fragmentation and enables interoperability between different Layer 2 solutions.

How Does a Cross-Rollup Layer 2 Bridge Work?

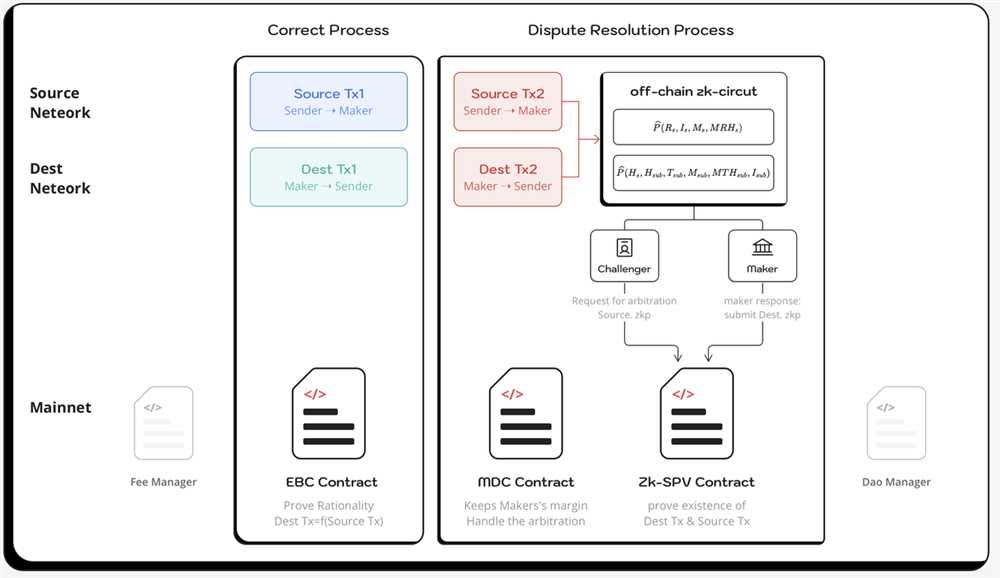

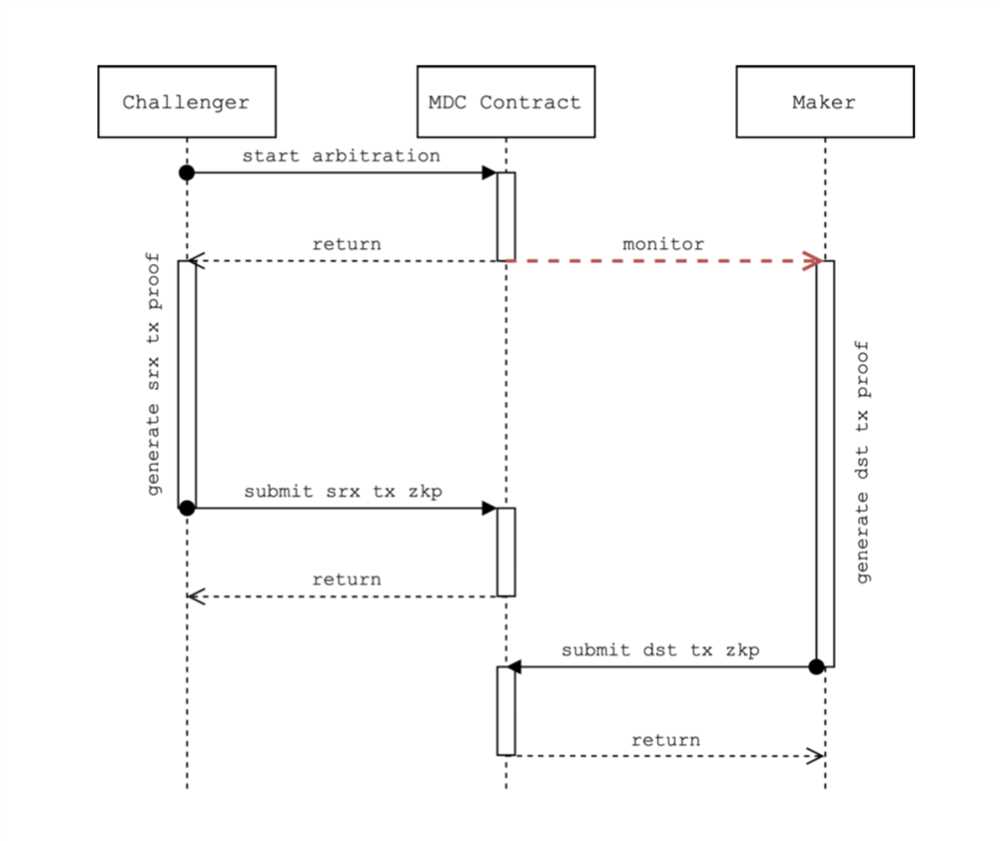

A cross-rollup Layer 2 bridge operates by creating a trustless and secure connection between different Layer 2 solutions. It achieves this by utilizing cryptographic proofs and smart contracts to ensure the validity and integrity of transferred assets and data.

When a user wants to transfer assets from one rollup chain to another, they initiate the transfer on the source rollup chain. The source chain generates cryptographic proofs that demonstrate the legitimacy of the assets being transferred.

These proofs are then submitted to the cross-rollup Layer 2 bridge, which verifies their authenticity and triggers the transfer process on the target rollup chain. Once the transfer is complete, the user can access their assets on the target rollup chain.

Benefits of a Decentralized Cross-Rollup Layer 2 Bridge

A decentralized cross-rollup Layer 2 bridge offers several key benefits:

- Scalability: By enabling interoperability between different Layer 2 solutions, a cross-rollup bridge significantly improves the scalability of blockchain networks.

- Reduced Fees and Faster Transactions: By moving majority of transactions off-chain and bypassing the limitations of Layer 1, users can experience lower fees and faster transaction confirmations.

- Enhanced User Experience: A cross-rollup bridge allows users to seamlessly transfer assets and data between different Layer 2 solutions, providing a better overall user experience.

- Increased Liquidity: Interoperability between different Layer 2 solutions increases liquidity by enabling users to access decentralized finance (DeFi) protocols and liquidity pools across different chains.

Conclusion

In conclusion, a decentralized cross-rollup Layer 2 bridge is a crucial technology for scaling blockchain networks and improving the overall user experience. By enabling interoperability between different Layer 2 solutions, a cross-rollup bridge offers increased scalability, reduced fees, faster transactions, and enhanced liquidity.

As the blockchain industry continues to evolve and mature, the development and adoption of decentralized cross-rollup Layer 2 bridges like Orbiter Finance are expected to play a significant role in shaping the future of decentralized finance (DeFi) and blockchain ecosystem as a whole.

What is Orbiter Finance?

Orbiter Finance is a decentralized cross-rollup layer 2 bridge that aims to provide seamless interoperability between different blockchain networks. It allows users to easily transfer assets and data across multiple chains, enhancing scalability and reducing transaction fees.

By utilizing rollup technology, Orbiter Finance is able to aggregate transactions from various chains and settle them on a single chain. This significantly improves the efficiency and speed of cross-chain transfers, making it easier for users to access and interact with different applications and ecosystems.

Moreover, Orbiter Finance employs a decentralized governance model, where decisions are made collectively by the community. This ensures transparency, fairness, and decentralization in the platform’s operations, making it more resilient to censorship and control.

Overall, Orbiter Finance plays a crucial role in bridging the gap between different blockchain networks, enabling the seamless transfer of assets and data across multiple chains. It offers a more scalable, efficient, and decentralized solution for cross-chain interoperability, unlocking a wide range of possibilities for decentralized finance (DeFi) and the broader blockchain ecosystem.

Why Do We Need a Cross-Rollup Layer 2 Bridge?

In the world of blockchain and decentralized finance (DeFi), scalability has always been a pressing issue. As more users and applications join the ecosystem, the strain on the underlying infrastructure becomes increasingly apparent. One potential solution to this problem lies in the use of Layer 2 scaling solutions, such as rollups.

Rollups are a type of Layer 2 solution that aims to alleviate the scalability issues of the Ethereum network by aggregating multiple transactions into a single batch and submitting them to the main chain. This approach significantly reduces the number of transactions that need to be processed on the main chain, thereby increasing overall scalability and reducing transaction costs.

However, while rollups offer significant improvements in scalability, they also introduce a new challenge – interoperability. Each rollup operates as its own isolated blockchain, which means that assets and applications on one rollup cannot directly interact with those on another rollup or the main chain. This lack of interoperability limits the potential of Layer 2 solutions and creates a fragmented ecosystem.

This is where a cross-rollup Layer 2 bridge comes into play. A cross-rollup Layer 2 bridge acts as a connection between different rollups, enabling seamless movement of assets and data between them. It allows users to transfer their assets from one rollup to another without having to go through the main chain and incur high transaction fees.

Furthermore, a cross-rollup Layer 2 bridge enables cross-rollup composability, allowing developers to build innovative applications that span across multiple rollups. It opens up a world of possibilities for decentralized finance, enabling users to access and utilize a wide range of assets and services across various rollups, all within a single user experience.

Overall, a cross-rollup Layer 2 bridge is essential for achieving greater scalability and interoperability in the blockchain ecosystem. It enables a seamless and efficient transfer of assets and data between different rollups, unlocking the full potential of Layer 2 solutions and paving the way for a more interconnected and vibrant decentralized finance ecosystem.

How Does Orbiter Finance Work?

Orbiter Finance is a decentralized cross-rollup layer 2 bridge that aims to provide users with a seamless and efficient way to transfer assets across different blockchain networks.

1. Interoperability

The core functionality of Orbiter Finance lies in its ability to enable interoperability between different layer 1 and layer 2 blockchains. By leveraging the power of cross-rollup technology, Orbiter Finance allows users to transfer their assets from one blockchain network to another without the need for traditional bridging solutions that often involve high transaction costs and slow processing times.

2. Cross-Rollup Technology

Orbiter Finance utilizes cross-rollup technology, which is a layer 2 scaling solution that bundles multiple transactions together and submits them as a single transaction on the layer 1 blockchain. This helps to greatly reduce transaction costs and increase the overall throughput of the network.

By leveraging cross-rollup technology, Orbiter Finance is able to achieve fast and efficient asset transfers between different blockchains, making it an ideal solution for users who want to move their assets quickly and cost-effectively.

3. Decentralization

Orbiter Finance is built on a decentralized infrastructure, which means that it does not rely on a central authority or intermediary to facilitate asset transfers. Instead, the network operates through a decentralized consensus mechanism that ensures the integrity and security of transactions.

This decentralized approach to asset transfers provides users with a high level of security, as there is no single point of failure that can be exploited by malicious actors. Additionally, it promotes transparency and trust, as all transactions on the network are verifiable and traceable.

4. Cross-Bridge Liquidity

One of the key features of Orbiter Finance is its ability to provide cross-bridge liquidity. This means that users can transfer their assets from one blockchain network to another and still maintain liquidity, allowing for seamless integration with various decentralized finance (DeFi) protocols.

By enabling cross-bridge liquidity, Orbiter Finance opens up a world of possibilities for users, allowing them to access different markets and maximize their investment opportunities.

In conclusion, Orbiter Finance aims to revolutionize the way assets are transferred between different blockchain networks. By leveraging cross-rollup technology and a decentralized infrastructure, Orbiter Finance provides users with a fast, cost-effective, and secure solution for cross-chain asset transfers.

Benefits of Using Orbiter Finance

Orbiter Finance offers a wide range of benefits for users who are looking to utilize a decentralized cross-rollup layer 2 bridge for their financial activities. Here are some of the key advantages:

1. Enhanced Scalability

Using Orbiter Finance allows users to overcome the scalability limitations of the Ethereum network. By utilizing cross-rollup technology, Orbiter Finance enables faster and more efficient transactions, ensuring that users can enjoy seamless and uninterrupted financial operations.

2. Lower Transaction Costs

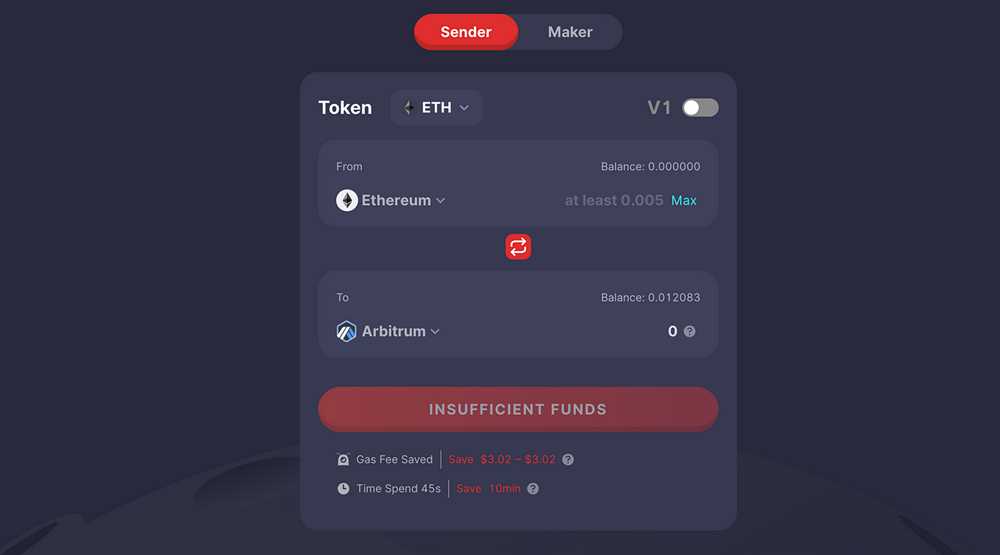

Orbiter Finance leverages the power of layer 2 solutions to significantly reduce transaction costs. With lower gas fees and faster transaction confirmations, users can save on fees and have more control over their finances.

3. Improved Security

With its decentralized nature, Orbiter Finance prioritizes security and privacy. By using cross-rollup technology, Orbiter Finance ensures that users can conduct their financial activities with peace of mind, knowing that their assets are secure and protected from hacks or fraudulent activities.

Furthermore, Orbiter Finance provides enhanced security measures such as smart contract audits, ensuring that the platform is reliable and trustworthy for users.

4. Seamless Interoperability

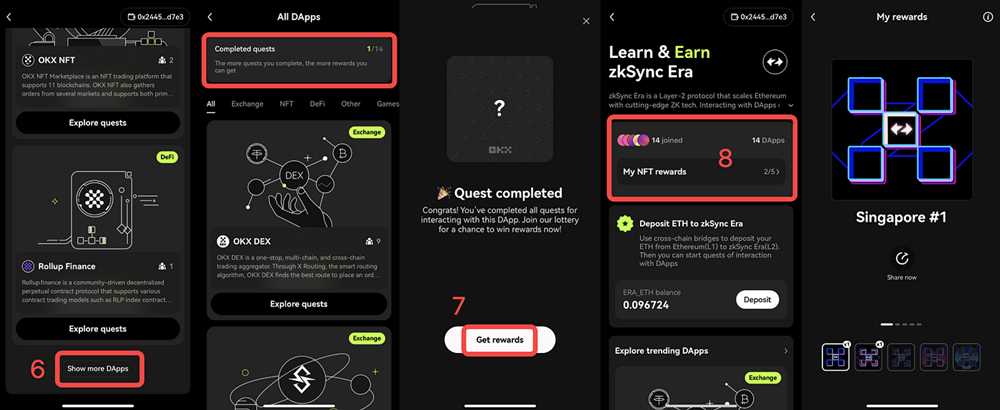

Orbiter Finance enables seamless interoperability between different blockchain networks. This allows users to easily bridge assets between blockchains, accessing a wide range of financial opportunities without being confined to a single network. The cross-rollup layer 2 bridge provided by Orbiter Finance acts as a gateway, connecting users to various DeFi protocols and services.

By leveraging Orbiter Finance’s interoperability features, users can take advantage of the growing ecosystem of decentralized finance, maximizing their investment potential and exploring new avenues for financial growth.

In conclusion, Orbiter Finance offers numerous benefits for users who are seeking to optimize their financial activities using a decentralized cross-rollup layer 2 bridge. With enhanced scalability, lower transaction costs, improved security, and seamless interoperability, Orbiter Finance is paving the way for a more efficient and accessible decentralized finance ecosystem.

What is Orbiter Finance?

Orbiter Finance is a decentralized cross-rollup Layer 2 bridge that allows for seamless and efficient transfer of assets across different Ethereum Layer 2 networks.

Why is cross-rollup Layer 2 bridging important?

Cross-rollup Layer 2 bridging is important because it enables users to move their assets across different Layer 2 networks, which can help increase liquidity and accessibility, and improve overall user experience in the Ethereum ecosystem.

How does Orbiter Finance work?

Orbiter Finance works by utilizing bi-directional bridges that allow users to transfer assets from one Layer 2 network to another. It uses a combination of smart contracts and oracles to ensure the security and transparency of the bridging process.

What are the benefits of using Orbiter Finance?

There are several benefits of using Orbiter Finance. Firstly, it provides fast and low-cost asset transfers between Layer 2 networks. Secondly, it enhances liquidity and accessibility by allowing users to easily move their assets across different networks. Lastly, it improves the overall user experience by simplifying the bridging process.