Orbiter Finance is a revolutionary platform that offers users a unique and innovative way to engage with the cryptocurrency market. With its advanced technology and cutting-edge features, Orbiter Finance is quickly becoming a leader in the decentralized finance (DeFi) space.

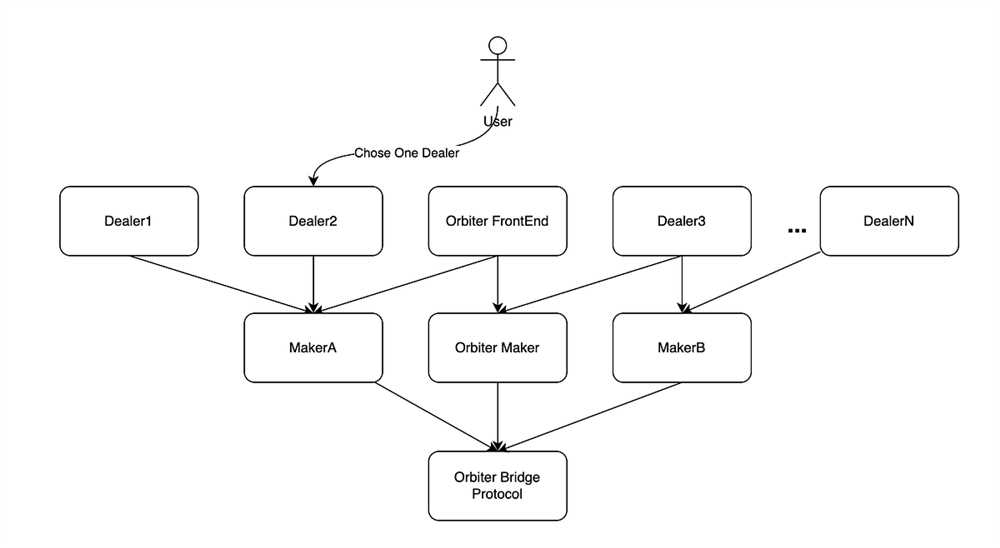

One of the standout features of Orbiter Finance is its decentralized exchange (DEX), which allows users to trade cryptocurrencies directly from their wallets without the need for intermediaries. This peer-to-peer trading system ensures that transactions are secure, transparent, and efficient.

Another key feature of Orbiter Finance is its yield farming mechanism, which allows users to earn passive income by providing liquidity to the platform. Through this process, users can stake their assets and earn rewards in the form of ORB tokens, the native currency of the platform.

What sets Orbiter Finance apart from other DeFi platforms is its unique gamification elements. The platform offers users the opportunity to participate in a variety of games and challenges, where they can earn additional rewards and unlock exclusive features. This gamified approach adds an exciting and interactive element to the user experience, making Orbiter Finance a standout platform in the market.

Overall, Orbiter Finance is pushing the boundaries of what is possible in the DeFi space. Its innovative features, user-friendly interface, and gamification elements make it a platform that is worth exploring for both new and experienced cryptocurrency users.

Exploring the Unique Features of Orbiter Finance:

Orbiter Finance is a revolutionary platform that offers a range of unique features to its users. In this article, we will dive deep into these features and explore how they set Orbiter Finance apart from other platforms in the market.

Decentralized Governance:

One of the standout features of Orbiter Finance is its decentralized governance model. Unlike traditional financial platforms that are controlled by a centralized authority, Orbiter Finance allows its users to actively participate in the decision-making process.

Through a voting mechanism, users can propose and vote on changes to the platform, including updates to the protocol, fee structures, and new features. This democratic approach ensures that the platform evolves according to the collective interests of its users.

Risk Management:

Orbiter Finance understands the importance of managing risks in the volatile world of decentralized finance (DeFi). To address this concern, the platform offers a range of risk management tools.

Users can access real-time risk assessment and analytics to make informed investment decisions. Moreover, Orbiter Finance provides users with advanced risk hedging options, allowing them to mitigate potential losses and protect their investments.

Smart Portfolio Optimization: Orbiter Finance’s cutting-edge algorithms enable smart portfolio optimization. By analyzing historical data and market trends, the platform automatically rebalances users’ portfolios to maximize returns and minimize risk.

Liquidity Mining Rewards: Orbiter Finance users can earn additional rewards through liquidity mining. By providing liquidity to the platform’s liquidity pools, users earn passive income in the form of ORB tokens. These rewards incentivize users to participate in the platform’s ecosystem and contribute to its overall liquidity.

In conclusion, Orbiter Finance sets itself apart from other platforms with its unique features. Its decentralized governance model, risk management tools, smart portfolio optimization, and liquidity mining rewards make it an attractive option for users seeking a user-centric and profitable DeFi experience.

A Deep Dive

In this section, we will explore the unique features of Orbiter Finance in more detail. We will take a closer look at its advanced trading algorithms, robust risk management system, and comprehensive analytics tools.

Advanced Trading Algorithms

Orbiter Finance employs cutting-edge trading algorithms that take advantage of artificial intelligence and machine learning techniques. These algorithms are designed to analyze market conditions in real-time and make informed trading decisions. By combining technical indicators with historical data, the algorithms can identify profitable trading opportunities and execute trades with precision.

One of the key features of Orbiter Finance’s trading algorithms is their adaptability. They are able to learn from past performance and adjust their strategies accordingly. This allows them to evolve and improve over time, ensuring consistent profits for investors.

Robust Risk Management System

To protect investors’ funds, Orbiter Finance has implemented a robust risk management system. This system includes various features such as stop-loss orders, margin controls, and position monitoring. These measures help mitigate potential losses and ensure the safety of investors’ capital.

The risk management system is designed to maintain a balanced portfolio and minimize exposure to risk. It constantly evaluates market conditions and adjusts trading strategies accordingly. This proactive approach helps protect against unexpected market fluctuations and ensures a stable and predictable investment experience.

Comprehensive Analytics Tools

Orbiter Finance provides investors with comprehensive analytics tools to help them make informed investment decisions. These tools include real-time market data, performance analytics, and risk assessment metrics. By analyzing these data points, investors can gain valuable insights into the market and adjust their investment strategies accordingly.

The analytics tools also provide investors with detailed performance reports, allowing them to track their investments’ progress over time. This transparency gives investors a clear understanding of their returns and helps them make well-informed decisions about their investments.

In conclusion, Orbiter Finance offers unique features that set it apart from other investment platforms. Its advanced trading algorithms, robust risk management system, and comprehensive analytics tools provide investors with a powerful and reliable investment solution. Whether you are a seasoned trader or a novice investor, Orbiter Finance can help you achieve your financial goals.

Innovative Investment Strategies:

Orbiter Finance offers a range of innovative investment strategies that set it apart from its competitors. These strategies are designed to maximize returns while minimizing risk, providing investors with the best chances of achieving their financial goals.

1. Yield Farming:

One of the unique investment strategies offered by Orbiter Finance is yield farming. Yield farming involves staking or lending cryptocurrencies on decentralized finance platforms to earn additional rewards. Orbiter Finance leverages the advanced technology of blockchain to enable users to securely participate in yield farming and earn passive income.

2. Liquidity Pools:

Liquidity pools are another innovative investment strategy offered by Orbiter Finance. Liquidity pools allow users to provide liquidity to decentralized exchanges in return for earning passive income. These pools provide a way for investors to contribute to the overall liquidity of the exchange and earn rewards in the form of trading fees.

By investing in liquidity pools through Orbiter Finance, investors can benefit from the potential returns generated by decentralized exchanges while minimizing the risks associated with volatility and slippage.

Orbiter Finance also offers a range of other investment strategies, including decentralized lending, flash loans, and token staking. These strategies provide investors with opportunities to profit from the growing decentralized finance ecosystem while diversifying their investment portfolio.

- Decentralized Lending: Investors can lend their cryptocurrencies to earn interest, similar to traditional lending but without intermediaries and with higher potential returns.

- Flash Loans: By leveraging smart contracts, Orbiter Finance allows users to take out flash loans, enabling them to access a large amount of capital instantly for various trading and investment opportunities.

- Token Staking: Orbiter Finance enables users to stake their tokens and earn passive income while contributing to the security and operations of the platform.

By offering these innovative investment strategies, Orbiter Finance has established itself as a leading platform in the decentralized finance space. Whether investors are looking to passively earn income through yield farming and liquidity pools or actively engage in decentralized lending and flash loans, Orbiter Finance provides a comprehensive suite of options to meet their investment needs.

Advanced Risk Management Tools:

Orbiter Finance provides a range of advanced risk management tools to help users effectively assess and mitigate potential risks in their investment strategies. These tools are designed to enhance decision-making processes and minimize losses in volatile market conditions.

1. Portfolio Analytics:

The platform offers powerful portfolio analytics that allow users to evaluate the performance and risk of their investment portfolios. With real-time data analysis and reporting, users can gain valuable insights into asset allocation, sector diversification, and other key metrics that impact portfolio risk.

By assessing the risk exposure of individual assets and the overall portfolio, users can identify potential vulnerabilities and make informed decisions to optimize their investment strategies.

2. Risk Scenarios and Stress Testing:

Orbiter Finance enables users to simulate various risk scenarios and conduct stress testing to gauge the resilience of their investment strategies. These tools evaluate the portfolio’s performance under adverse market conditions, such as market crashes or economic downturns.

By stress testing the portfolio, users can identify weaknesses and make adjustments to enhance its resilience. This proactive approach to risk management helps investors stay prepared for unexpected market events and minimize losses.

These risk management tools are complemented by Orbiter Finance’s advanced statistical models and data analysis capabilities, ensuring users have access to robust risk assessment tools.

3. Stop-loss Orders:

Orbiter Finance offers stop-loss orders, a popular risk management tool in trading and investing. Stop-loss orders allow users to automatically sell assets when they reach a specific predetermined price, limiting potential losses.

By setting these orders, users can protect their investments from substantial downside movements in the market. This tool is particularly useful in volatile markets where asset prices can experience rapid fluctuations.

Overall, Orbiter Finance’s comprehensive suite of advanced risk management tools empowers users to make informed investment decisions and effectively navigate market risks. By utilizing these tools, investors can improve their risk-adjusted returns and protect their portfolios from adverse market conditions.

Seamless User Experience:

One of the key features that sets Orbiter Finance apart from other platforms is its seamless user experience. From the moment users sign up, they are greeted with a simple and intuitive interface that makes navigating the platform a breeze.

Orbiter Finance is designed with the user in mind, focusing on providing a smooth and hassle-free experience. The platform’s clean and modern design ensures that users can easily find what they are looking for and understand how to use the various features.

One of the standout aspects of Orbiter Finance is its personalized dashboard, which allows users to customize their experience and access the information they need most. Whether it’s viewing their portfolio, tracking their investments, or analyzing market data, users can easily access all the relevant information in one place.

The platform also offers seamless integration with external wallets, making it easy for users to transfer funds and manage their assets. The process is quick and secure, ensuring that users can efficiently take advantage of investment opportunities without any delays.

In addition, Orbiter Finance provides a comprehensive knowledge base and responsive customer support to ensure that users have all the resources they need to navigate the platform. Whether users have questions about a specific feature or need assistance with a transaction, the support team is always ready to help.

Overall, the seamless user experience of Orbiter Finance sets it apart from other platforms, providing users with a hassle-free environment to explore, invest, and grow their assets.

Cutting-Edge Technologies:

Orbiter Finance utilizes a range of cutting-edge technologies to provide its users with a secure and efficient platform for decentralized finance (DeFi) activities. These technologies ensure that users can transact with minimal friction, while also enjoying the highest levels of security and privacy.

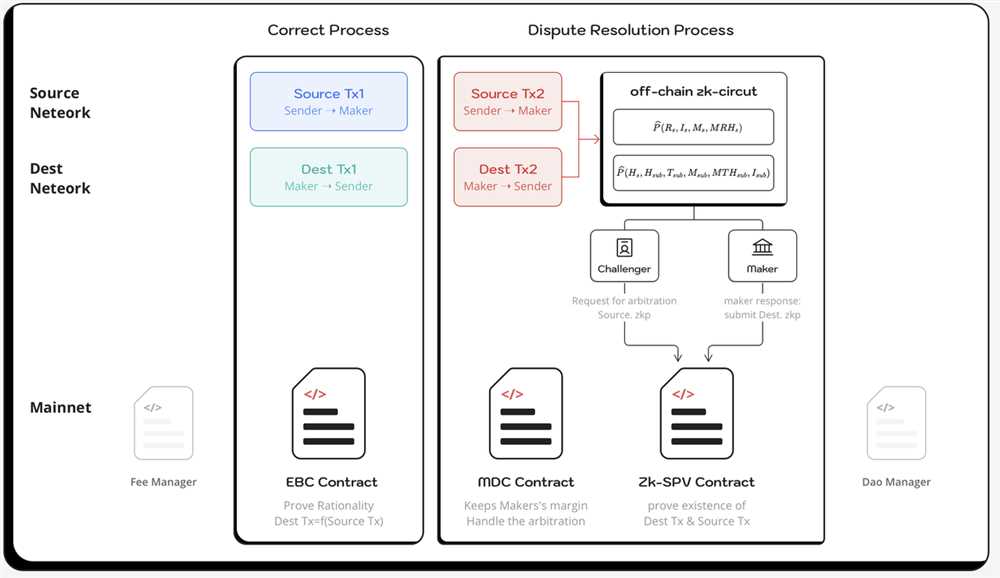

One of the key technologies employed by Orbiter Finance is blockchain. By leveraging the power of blockchain technology, Orbiter Finance is able to provide users with a transparent and immutable ledger of all transactions. This allows for greater transparency and trust in the system, as users can verify the authenticity and accuracy of their transactions at any time.

Another vital technology used by Orbiter Finance is smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute predefined actions once specified conditions are met. With smart contracts, Orbiter Finance is able to eliminate the need for intermediaries and automate various processes, making transactions faster and more efficient.

Additionally, Orbiter Finance incorporates the use of decentralized finance protocols, such as decentralized exchanges (DEXs), lending platforms, and liquidity pools. DEXs enable users to exchange cryptocurrencies directly without the need for a centralized intermediary, ensuring greater security and reducing the risk of hacks or manipulation. Lending platforms provide users with the ability to lend or borrow cryptocurrencies, creating opportunities for earning interest or accessing funds when needed. Liquidity pools enable users to provide liquidity to decentralized markets in return for yield, further incentivizing participation in the ecosystem.

To enhance user security and privacy, Orbiter Finance also incorporates advanced encryption technologies. These technologies ensure that user data remains protected and that sensitive information like private keys or passwords are securely encrypted. By prioritizing security and privacy, Orbiter Finance helps users feel confident and safe when transacting on its platform.

The combination of these cutting-edge technologies makes Orbiter Finance a powerful and innovative platform that is well-equipped to meet the demands of the rapidly evolving decentralized finance landscape. By leveraging blockchain, smart contracts, decentralized finance protocols, and advanced encryption, Orbiter Finance is able to provide its users with a secure, transparent, and efficient platform for all their DeFi needs.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) platform that offers a variety of unique features for the users. It allows users to earn rewards through yield farming, provides a seamless user experience, and offers low transaction fees.

How does Orbiter Finance ensure security?

Orbiter Finance ensures security through various measures. Firstly, it uses a decentralized architecture, which means that there is no single point of failure. Secondly, it employs advanced cryptography techniques to protect user data and transactions. Lastly, it undergoes regular security audits by external firms to identify and fix any vulnerabilities.