Orbiter Finance is a leading provider of innovative financial solutions, helping individuals and businesses achieve their financial goals. With our exceptional team of experts and cutting-edge technology, we have established ourselves as a trusted name in the industry.

1. Expertise: Our team of financial professionals brings years of experience and deep industry knowledge to help our clients make informed decisions. We stay abreast of the latest market trends and leverage our expertise to deliver tailored solutions that meet our clients’ unique needs.

2. Technology: At Orbiter Finance, we believe in the power of technology to streamline financial processes and enhance the customer experience. Our advanced digital platform provides our clients with seamless access to a wide range of financial products and services, making it easier for them to manage their finances.

3. Client-Centric Approach: We prioritize our clients’ needs and goals above everything else. Our team takes the time to understand each client’s individual circumstances and aspirations, enabling us to provide personalized solutions that address their specific requirements.

4. Trust and Transparency: Trust is the foundation of our relationship with our clients. We are committed to maintaining the highest level of transparency in all our interactions, ensuring that our clients have complete visibility into their financial decisions and the associated risks.

In conclusion, Orbiter Finance’s success in generating revenue is driven by a combination of expertise, technology, a client-centric approach, and trust and transparency. We are dedicated to helping our clients achieve financial success and look forward to partnering with you on your financial journey.

Overview of Orbiter Finance

Orbiter Finance is a leading financial management platform that empowers individuals and businesses to achieve their financial goals. With our innovative tools and personalized approach, we strive to provide our clients with the highest level of financial expertise and guidance.

Our platform offers a comprehensive suite of financial services, including budgeting and expense tracking, investment management, debt consolidation, and retirement planning. We understand that managing finances can be overwhelming, so we have designed Orbiter Finance to streamline the process and make it accessible to everyone.

At Orbiter Finance, we believe that financial success is built on a strong foundation of knowledge and understanding. That’s why we provide our clients with educational resources and expert insights to help them make informed financial decisions. Whether you are just starting your financial journey or looking to maximize your investments, our team of experienced professionals is here to guide you every step of the way.

One of the key aspects that sets Orbiter Finance apart is our commitment to personalized service. We believe that each individual or business has unique financial needs and goals, so we tailor our services to address those specific requirements. Our team takes the time to understand your financial situation and develop a customized plan that aligns with your objectives.

With Orbiter Finance, you can have confidence in your financial future. Our platform provides you with the tools and support you need to take control of your finances and achieve your goals. Join us today and experience the difference that Orbiter Finance can make in your life.

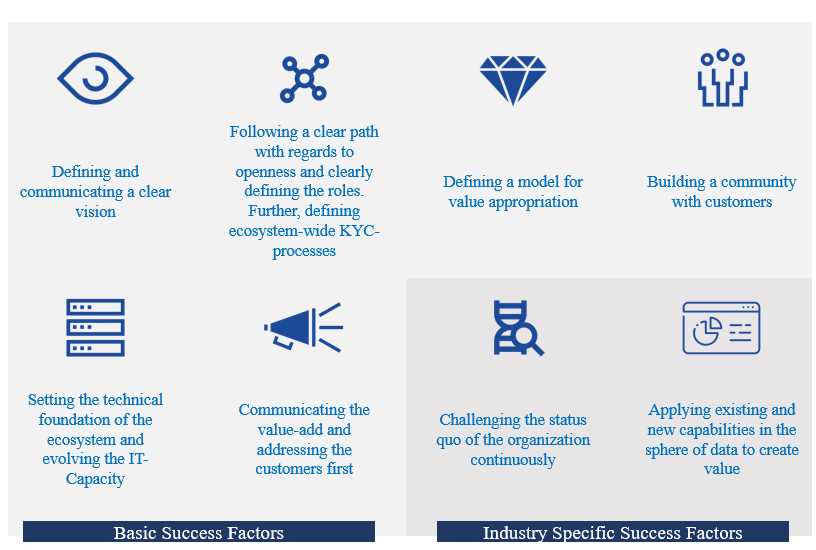

Key Factors Driving Revenue Success

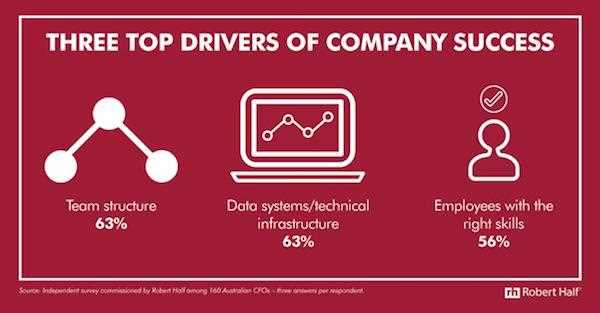

In today’s fast-paced business environment, there are several key factors that drive revenue success for companies like Orbiter Finance. These factors play a crucial role in establishing a strong financial foundation and ensuring long-term profitability.

First and foremost, effective marketing strategies are essential in driving revenue success. By understanding the target audience and developing compelling advertising campaigns, Orbiter Finance is able to attract new customers and retain existing ones. Furthermore, the company invests in market research and analyses industry trends to stay ahead of the competition and identify new revenue opportunities.

A robust sales team also contributes significantly to revenue success. Orbiter Finance empowers its sales force with extensive product knowledge and training, enabling them to effectively communicate the unique value propositions to potential clients. Additionally, the company incentivizes its sales team with attractive commission structures, motivating them to exceed sales targets and drive revenue growth.

Another crucial factor driving revenue success is maintaining strong customer relationships. Orbiter Finance recognizes the importance of customer satisfaction and strives to provide exceptional service at every touchpoint. By nurturing long-term relationships and providing prompt assistance, the company builds trust and loyalty, leading to repeat business and referrals.

Continuous innovation is yet another key factor that sets Orbiter Finance apart. By constantly improving and expanding its product offerings, the company stays relevant in a rapidly changing market. This not only attracts new customers but also encourages existing customers to explore other services, resulting in increased revenue streams.

Furthermore, effective cost management and efficient operations contribute to revenue success. Orbiter Finance regularly reviews its expenses and identifies opportunities to streamline processes, reduce waste, and improve productivity. This allows the company to optimize its resources and allocate them towards revenue-generating activities.

In conclusion, the key factors driving revenue success for Orbiter Finance include effective marketing strategies, a strong sales team, maintaining strong customer relationships, continuous innovation, and effective cost management. By focusing on these aspects, Orbiter Finance is well-positioned for sustained growth and profitability.

Innovative Technology Solutions

At Orbiter Finance, we understand the importance of staying ahead in the fast-paced world of finance. That’s why we invest heavily in innovative technology solutions that set us apart from the competition.

Advanced Data Analytics

Our team of experts utilizes cutting-edge data analytics tools and techniques to gather and analyze large volumes of financial data. By leveraging machine learning and artificial intelligence, we are able to identify patterns, trends, and insights that assist our clients in making informed investment decisions.

Robust Security Measures

We understand that security is of paramount importance when it comes to handling financial transactions. That’s why we have implemented robust security measures to ensure the safety and confidentiality of our clients’ sensitive information. From encryption and secure data storage to multi-factor authentication, we take every precaution to safeguard against cyber threats.

Furthermore, our innovative technology solutions enable us to detect and prevent fraudulent activities, providing our clients with peace of mind knowing that their investments are protected.

Streamlined User Experience

Orbiter Finance strives to provide a seamless user experience through our innovative technology solutions. Our intuitive and user-friendly platform allows clients to easily navigate through their accounts, access real-time market data, and execute trades with just a few clicks.

We continuously update and enhance our technology to ensure that our clients stay connected and can easily manage their portfolio anytime, anywhere.

With our innovative technology solutions, our clients can stay ahead in the ever-changing financial landscape, maximize their investment returns, and achieve their financial goals.

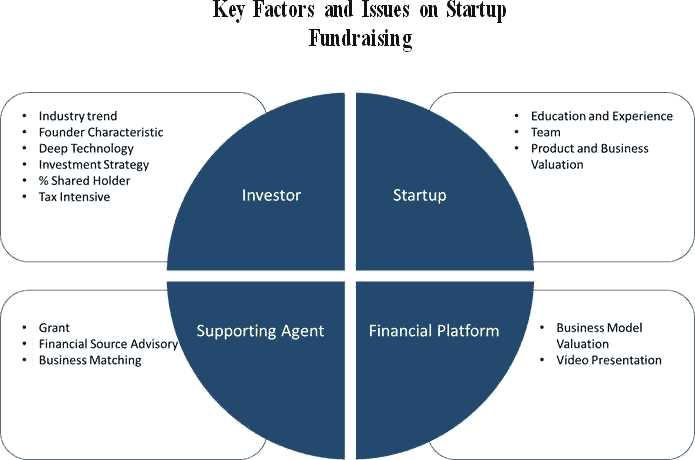

Strong Partnerships and Collaborations

At Orbiter Finance, we understand the value of strong partnerships and collaborations in driving success. We believe that by forging strategic alliances with key industry players, we can create a mutually beneficial ecosystem that accelerates revenue growth and enhances customer satisfaction.

Through our partnerships and collaborations, we are able to leverage our combined expertise and resources to develop innovative financial solutions that empower individuals and businesses to thrive in today’s dynamic market.

By collaborating with leading financial institutions, technology providers, and industry experts, Orbiter Finance is able to stay at the forefront of financial innovation. We work closely with our partners to identify emerging trends, anticipate customer needs, and develop tailored solutions that address the unique challenges of our target markets.

Through our strong partnerships, we are also able to expand our reach and access new customer segments. By combining our respective networks and customer bases, we can tap into previously untapped markets and unlock new growth opportunities.

Furthermore, our collaborations enable us to enhance our product offerings and provide comprehensive financial solutions to our customers. By integrating our products and services with those of our partners, we are able to deliver a seamless and holistic experience that meets the diverse needs of our customers.

At Orbiter Finance, we are committed to fostering long-term, mutually beneficial partnerships that drive revenue success. We believe that by working together with our partners, we can achieve greater outcomes and create value for our customers, stakeholders, and the wider community.

Effective Marketing Strategies

Orbiter Finance’s success in generating revenue can be attributed to its effective marketing strategies. These strategies have allowed the company to reach a wide audience and engage potential customers in meaningful ways.

- Digital Advertising: Orbiter Finance utilizes targeted digital advertising campaigns to reach its desired audience. By leveraging platforms like social media, search engines, and display networks, the company is able to maximize its visibility and attract potential customers.

- Content Marketing: The company understands the importance of providing valuable and relevant content to its audience. Through blog posts, articles, and informative videos, Orbiter Finance positions itself as an industry leader and builds trust with its potential customers.

- Influencer Partnerships: Orbiter Finance has formed partnerships with influential individuals in the finance industry. By collaborating with these influencers, the company is able to leverage their credibility and reach a wider audience. These partnerships not only increase brand awareness but also generate valuable leads.

- Email Marketing: The company utilizes email marketing to stay connected with its audience. By sending relevant and personalized content to subscribers, Orbiter Finance is able to nurture relationships with potential customers and drive conversions.

- Social Media Engagement: Orbiter Finance actively engages with its audience on social media platforms. By responding to comments, addressing customer concerns, and sharing valuable content, the company fosters long-term relationships with its customers and builds brand loyalty.

These effective marketing strategies have contributed to Orbiter Finance’s revenue success by allowing the company to reach and engage a wide audience. By continuously refining and optimizing its marketing efforts, Orbiter Finance is able to stay ahead of the competition and achieve sustainable growth.

Customer Satisfaction and Retention

At Orbiter Finance, we prioritize customer satisfaction and retention as crucial factors for our continued success. We understand that a happy customer is a loyal customer, and we are committed to providing an exceptional financial experience that keeps our clients coming back.

Here are some key aspects of our approach to customer satisfaction and retention:

- Personalized Services: We believe in tailoring our financial solutions to meet the unique needs and goals of each individual client. By taking the time to understand their specific circumstances, we are able to provide personalized recommendations and advice that resonate with our customers.

- Timely Communication: We value clear and timely communication with our clients. Whether it’s answering their queries, providing updates, or addressing any concerns they may have, we strive to be responsive and transparent throughout the entire customer journey.

- Ongoing Support: Our commitment to customer satisfaction extends beyond the initial transaction. We provide ongoing support and guidance to our clients, ensuring that they have access to the resources and assistance they need along their financial journey.

- Rewards and Incentives: To show our appreciation for our loyal customers, we offer various rewards and incentives. These may include exclusive discounts, special offers, or access to premium services that enhance their overall experience with Orbiter Finance.

- Continuous Improvement: We are constantly striving to improve our services and processes based on feedback and insights from our customers. By actively listening to their suggestions, we can refine our offerings and provide a better customer experience.

At Orbiter Finance, our main goal is to build long-lasting relationships with our clients. We believe that by prioritizing customer satisfaction and retention, we can not only grow our revenue but also create a community of satisfied customers who trust us for their financial needs.

What are the key factors driving Orbiter Finance’s revenue success?

The key factors driving Orbiter Finance’s revenue success are strong customer demand for their financial products, effective marketing strategies, and a focus on providing exceptional customer service.

How does customer demand contribute to Orbiter Finance’s revenue success?

Customer demand plays a crucial role in driving Orbiter Finance’s revenue success. When customers have a high demand for their financial products, it leads to increased sales and ultimately higher revenue for the company.

What marketing strategies does Orbiter Finance use to drive revenue?

Orbiter Finance utilizes a combination of online and offline marketing strategies to drive revenue. They have a strong online presence through social media advertising and targeted email campaigns. Additionally, they also invest in traditional marketing channels such as TV and radio advertisements to reach a wider audience.

How does Orbiter Finance ensure exceptional customer service?

Orbiter Finance places a high emphasis on providing exceptional customer service. They have a dedicated customer service team that is available to help customers with any queries or concerns. Additionally, they actively seek feedback from customers to continually improve their services and ensure customer satisfaction.