Improving Overall Trading Efficiency Through Orbiter Finance: Enhancing Market Depth and Liquidity in the Cosmos Ecosystem

Orbiter Finance is revolutionizing the trading experience in the Cosmos ecosystem by offering a comprehensive solution that addresses the challenges of cross-chain asset trading and liquidity fragmentation. With its innovative technology and unique liquidity pools, Orbiter Finance is paving the way for a more efficient and seamless trading experience.

One of the main hurdles in the decentralized trading space is the lack of interoperability between different blockchain networks. This fragmentation of liquidity inhibits traders from capitalizing on opportunities across chains, resulting in inefficiencies and missed potential. Orbiter Finance aims to bridge this gap by enabling seamless cross-chain asset trading, allowing users to access a wide range of assets from different chains all on one platform.

Through its advanced technology, Orbiter Finance ensures that transactions are executed quickly and securely, minimizing the risks associated with trading across multiple chains. By leveraging the power of the Cosmos ecosystem, Orbiter Finance enables users to trade assets across various chains without the need for multiple wallets or cumbersome processes. This seamless experience greatly enhances trading efficiency and provides traders with more opportunities to capitalize on market movements.

What sets Orbiter Finance apart is its unique approach to liquidity provisioning. Instead of relying on a single liquidity pool, Orbiter Finance aggregates liquidity from multiple chains, creating a robust and deep pool that offers traders the best possible prices and execution. This cross-chain liquidity pooling mechanism not only enhances trading efficiency but also ensures that traders have access to the liquidity they need, regardless of the chain they are trading on.

In conclusion, Orbiter Finance is driving the evolution of trading in the Cosmos ecosystem by improving efficiency through cross-chain asset trading and innovative liquidity pooling. With its advanced technology and seamless trading experience, Orbiter Finance is empowering traders to explore new opportunities and maximize their potential in the decentralized trading space.

Enhancing Trading Efficiency through Orbiter Finance

Orbiter Finance aims to revolutionize the trading experience in the Cosmos ecosystem by leveraging cross-chain assets and liquidity pools. By providing a streamlined and efficient platform for traders, Orbiter Finance helps to optimize trading strategies and maximize returns.

One key feature of Orbiter Finance is its ability to seamlessly integrate with various blockchains within the Cosmos ecosystem. This allows traders to access a wide range of cross-chain assets, opening up new opportunities and diversification possibilities. Whether it’s trading between different tokens within a single chain or exploring new assets across different blockchains, Orbiter Finance provides a user-friendly interface for traders to execute their strategies.

Another advantage of Orbiter Finance is its focus on liquidity pools. By pooling together liquidity from different sources, the platform ensures that traders have access to deep pools of liquidity for their trades. This reduces slippage and improves execution efficiency, resulting in better trading outcomes. Traders can also earn passive income by providing liquidity to the pools, further enhancing their overall trading experience.

In addition, Orbiter Finance offers a range of trading tools and analytics to empower traders with valuable insights. Traders can access real-time market data, historical price charts, and advanced trading indicators to make informed decisions. This helps traders to stay ahead of market trends and optimize their trading strategies for better results.

Overall, Orbiter Finance aims to enhance trading efficiency in the Cosmos ecosystem by providing a comprehensive platform that leverages cross-chain assets, liquidity pools, and advanced trading tools. By simplifying the trading process and optimizing liquidity, Orbiter Finance empowers traders to make better decisions and achieve optimal trading outcomes.

Cross-Chain Assets for Seamless Transactions

One of the key challenges in the current blockchain ecosystem is the lack of interoperability between different chains. This makes it difficult for users to transfer assets across different blockchains, limiting liquidity and trading opportunities.

With Orbiter Finance, this problem is addressed through the use of cross-chain assets. Cross-chain assets are tokens that can be used across multiple chains, enabling seamless transactions between different chains within the Cosmos ecosystem.

How do Cross-Chain Assets Work?

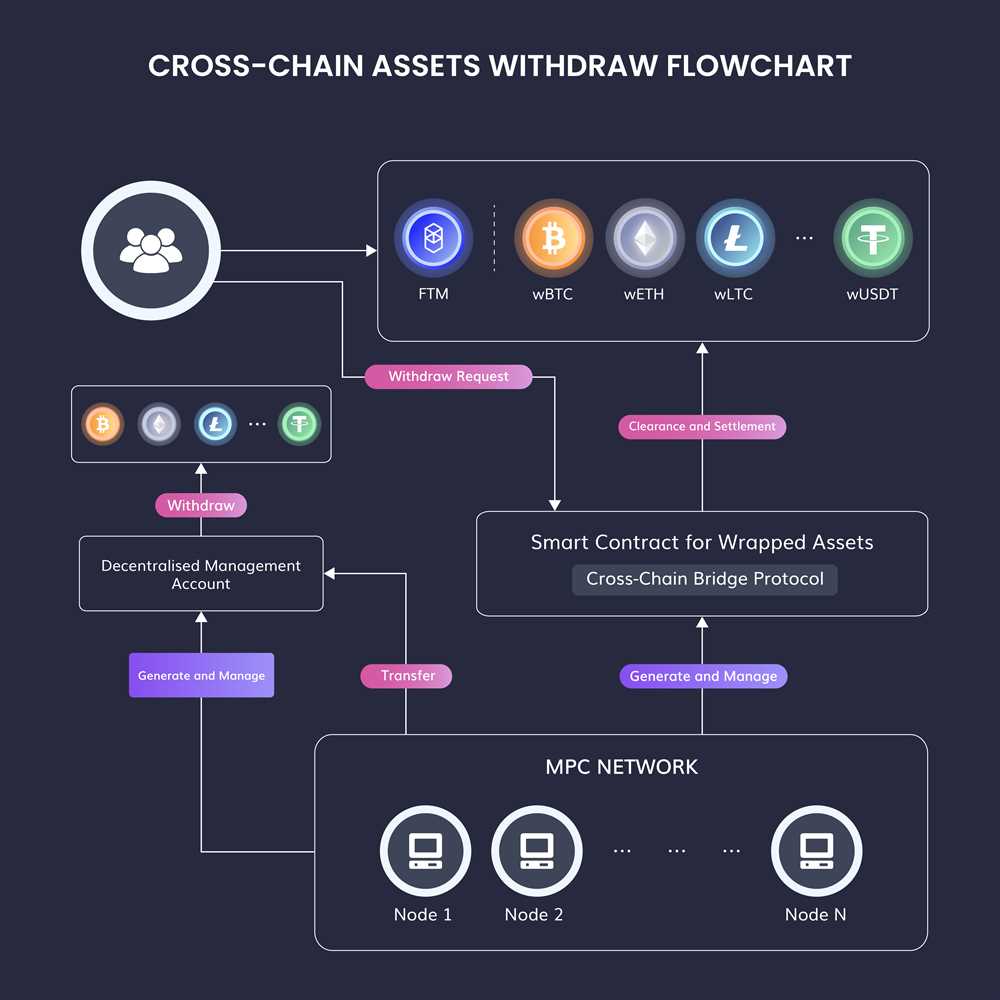

When a user wants to transfer an asset from one chain to another, they first need to deposit the asset into a cross-chain asset pool. This pool acts as a bridge between the two chains and holds the user’s assets temporarily. Once the asset is deposited, a corresponding cross-chain asset is minted on the receiving chain.

For example, if a user wants to transfer Ethereum (ETH) to the Cosmos ecosystem, they would need to deposit their ETH into the Ethereum cross-chain asset pool. Once the deposit is confirmed, a corresponding ETH cross-chain asset is minted on the Cosmos chain, which can then be used for trading and other activities within the Cosmos ecosystem.

The Benefits of Cross-Chain Assets

Cross-chain assets provide several benefits for users and the overall blockchain ecosystem:

- Improved Liquidity: By enabling seamless transactions between different chains, cross-chain assets increase liquidity by making it easier for users to access and trade assets across multiple chains.

- Expanded Trading Opportunities: With cross-chain assets, users can take advantage of trading opportunities that were previously limited to specific chains. This allows for greater flexibility and the ability to capitalize on market movements across different blockchains.

- Enhanced Security: Cross-chain asset pools are designed to ensure the security of user assets during the transfer process. These pools incorporate security measures such as multi-signature wallets and smart contract logic to protect user funds.

- Interoperability: Cross-chain assets promote interoperability between different blockchains, paving the way for more seamless integration and collaboration within the blockchain ecosystem.

In conclusion, cross-chain assets play a crucial role in improving trading efficiency within the Cosmos ecosystem. By enabling seamless transactions and expanding liquidity pools, cross-chain assets unlock new possibilities for users and contribute to the growth and development of the blockchain industry as a whole.

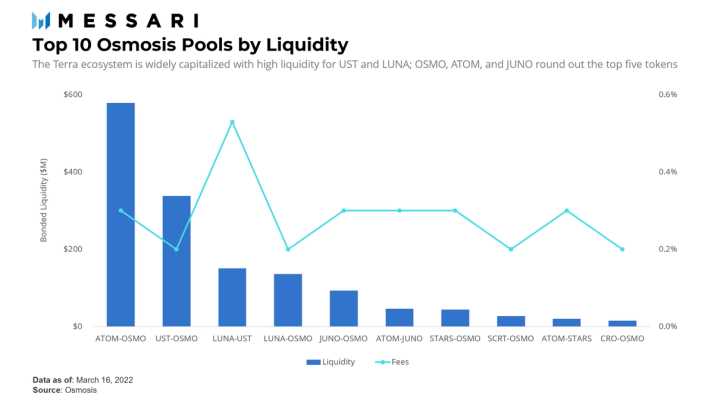

Liquidity Pools to Enhance Market Depth

One of the key challenges in trading is maintaining sufficient market depth, which refers to the amount of buy and sell orders available at different price levels. A shallow market depth can result in higher spreads and increased slippage, making it more difficult for traders to execute their desired trades at an optimal price.

With the Orbiter Finance platform, liquidity pools are used to enhance market depth. Liquidity providers contribute their assets to these pools, enabling other traders to easily buy and sell assets at competitive prices. By pooling together a diverse range of assets from various participants, liquidity pools ensure that there is always a sufficient supply of assets available for trading.

This enhanced market depth brings several benefits to traders. Firstly, it reduces the impact of large trades on the market, as the pool can absorb the liquidity demand without significantly affecting the price. This helps to prevent price manipulation and improves market fairness.

Secondly, liquidity pools enable traders to access assets that may have low trading volumes or limited availability on traditional exchanges. By aggregating liquidity from multiple sources, Orbiter Finance expands the market reach and accessibility for these assets.

Lastly, liquidity pools can also offer traders enhanced price stability. When there is a sufficient supply of assets in the pool, the price fluctuations are typically reduced, providing a more stable trading environment.

Overall, liquidity pools play a crucial role in improving trading efficiency by enhancing market depth. With Orbiter Finance, traders can benefit from increased liquidity, improved price stability, and enhanced access to a wide range of assets.

Orbiter Finance in the Cosmos Ecosystem

Orbiter Finance is a decentralized finance (DeFi) platform that aims to improve trading efficiency in the Cosmos ecosystem. Built on top of the Cosmos blockchain, Orbiter Finance provides users with cross-chain asset trading capabilities and access to liquidity pools.

By leveraging the Inter-Blockchain Communication (IBC) protocol, Orbiter Finance enables seamless token transfers between different blockchains within the Cosmos ecosystem. This allows users to trade assets across multiple chains, increasing liquidity and expanding the scope of available trading pairs.

One of the key features of Orbiter Finance is its liquidity pool system. Liquidity pools are created by users who contribute their assets to a pool, which can then be used for trading. By providing liquidity to these pools, users earn fees and rewards based on the trading activity in the pool. This incentivizes users to contribute to the liquidity of the platform and ensures that there is always ample liquidity available for trading.

In addition to trading and liquidity pools, Orbiter Finance also offers other features such as yield farming and governance. Yield farming allows users to earn additional rewards by staking their tokens in specific pools, while governance gives users the ability to participate in the decision-making process of the platform.

Overall, Orbiter Finance is a powerful tool for traders and investors in the Cosmos ecosystem. With its cross-chain asset trading capabilities and liquidity pools, the platform enhances trading efficiency and provides users with more opportunities to earn and grow their assets.

Bridging the Gap between Different Blockchains

The ability to connect and transfer value between different blockchains is an essential component in achieving a truly interoperable blockchain ecosystem. Without this capability, users are limited in their ability to access and utilize assets from other chains, hindering the potential of decentralized finance.

Orbiter Finance aims to address this challenge by offering a cross-chain bridge that allows for seamless asset transfers between various blockchains within the Cosmos ecosystem. Using the Inter-Blockchain Communication (IBC) protocol, Orbiter Finance provides a secure and efficient way for users to interact with assets on different chains.

Through the cross-chain bridge, users can leverage their assets on one chain to access liquidity and trading opportunities on another. This functionality opens up a world of possibilities for decentralized finance, enabling users to participate in yield farming, liquidity provision, and other activities across multiple chains.

To ensure security and trust, Orbiter Finance utilizes a decentralized custodian model, where assets are held securely in smart contracts. This eliminates the need for users to trust a centralized authority with their funds and minimizes the risk of asset loss or theft.

In addition to enabling asset transfers, Orbiter Finance also aims to bridge the gap between liquidity pools on different chains. By creating a unified liquidity pool across multiple blockchains, Orbiter Finance enhances trading efficiency and reduces slippage, ultimately improving the overall trading experience for users.

| Key Features: | Benefits: |

|---|---|

| ✓ Cross-chain asset transfers | ✓ Access to liquidity on multiple chains |

| ✓ Decentralized custodian model | ✓ Enhanced security and trust |

| ✓ Unified liquidity pools | ✓ Improved trading efficiency |

With Orbiter Finance’s cross-chain capabilities and focus on security and efficiency, the Cosmos ecosystem is empowered with a comprehensive solution for accessing and utilizing assets across different blockchains. This enables users to fully explore the potential of decentralized finance and contributes to the growth and maturation of the blockchain industry as a whole.

Maximizing Profitability with Orbiter Finance

Orbiter Finance offers a range of tools and features that can help traders maximize their profitability in the Cosmos ecosystem. Whether you are a beginner or an experienced trader, Orbiter Finance provides an intuitive and user-friendly platform to optimize your trading activities.

One key feature of Orbiter Finance is its cross-chain asset capabilities. By leveraging the interoperability of the Cosmos ecosystem, Orbiter Finance allows traders to access and trade a wide range of assets across different blockchains. This opens up new opportunities for diversification and profit-making strategies.

The liquidity pools provided by Orbiter Finance also play a crucial role in maximizing profitability. By pooling together liquidity from various sources, Orbiter Finance ensures deep liquidity and tight spreads, leading to reduced slippage and better trading conditions. Traders can take advantage of this liquidity to execute trades quickly and efficiently, increasing their chances of making profitable trades.

Orbiter Finance further enhances profitability through its advanced trading tools and analytics. Traders can access real-time market data, perform technical analysis, and use automated trading strategies to make informed decisions. These tools help traders identify market trends, find potential trading opportunities, and optimize their trading strategies for maximum profitability.

Additionally, Orbiter Finance provides comprehensive portfolio management features. Traders can track their balances, monitor their performance, and analyze their trading history. This enables traders to assess their profitability, identify areas for improvement, and make data-driven decisions to enhance their trading performance.

Overall, Orbiter Finance is a powerful platform that helps traders maximize their profitability in the Cosmos ecosystem. With its cross-chain asset capabilities, liquidity pools, advanced trading tools, and portfolio management features, Orbiter Finance empowers traders to optimize their trading activities and achieve greater profitability.

What is Orbiter Finance?

Orbiter Finance is a platform built on the Cosmos ecosystem that aims to improve trading efficiency by providing cross-chain assets and liquidity pools.

How does Orbiter Finance improve trading efficiency?

Orbiter Finance improves trading efficiency by enabling cross-chain trading and providing liquidity pools, which increases the liquidity and accessibility of assets in the Cosmos ecosystem.

What are cross-chain assets?

Cross-chain assets refer to digital assets that can be transferred and utilized across multiple blockchain networks. Orbiter Finance allows users to trade and interact with cross-chain assets within the Cosmos ecosystem.

What are liquidity pools?

Liquidity pools are pools of funds locked in smart contracts that provide liquidity for decentralized exchanges. Orbiter Finance utilizes liquidity pools to ensure sufficient liquidity for trading activities within the Cosmos ecosystem.