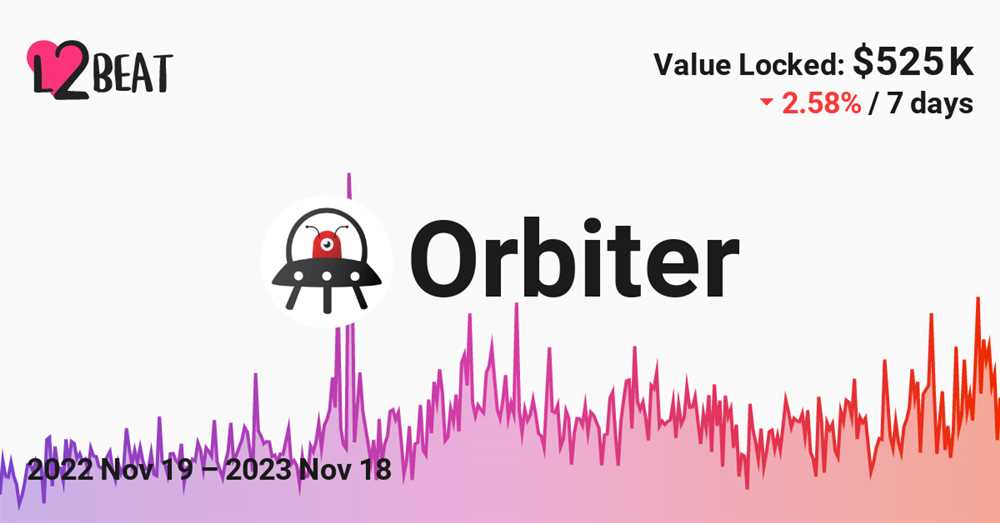

Orbiter Finance, a decentralized finance (DeFi) protocol, has seen significant growth in its Total Value Locked (TVL) recently, according to the latest report by L2 Beat. The report provides valuable insights into the factors contributing to Orbiter Finance’s success and sheds light on the protocol’s TVL growth strategies.

One of the key findings from the report is the impressive TVL growth rate of Orbiter Finance in the past few months. The protocol has experienced a steady increase in TVL, indicating a growing interest and adoption of the platform by DeFi users. This growth can be attributed to a combination of factors, including innovative features, strategic partnerships, and effective marketing strategies.

The report points out that Orbiter Finance’s success can be partly attributed to its unique features that differentiate it from other DeFi protocols. The protocol offers users a wide range of investment options and strategies, allowing them to diversify their portfolios and maximize their returns. Additionally, Orbiter Finance has implemented robust security measures to protect users’ funds, gaining trust and credibility within the DeFi community.

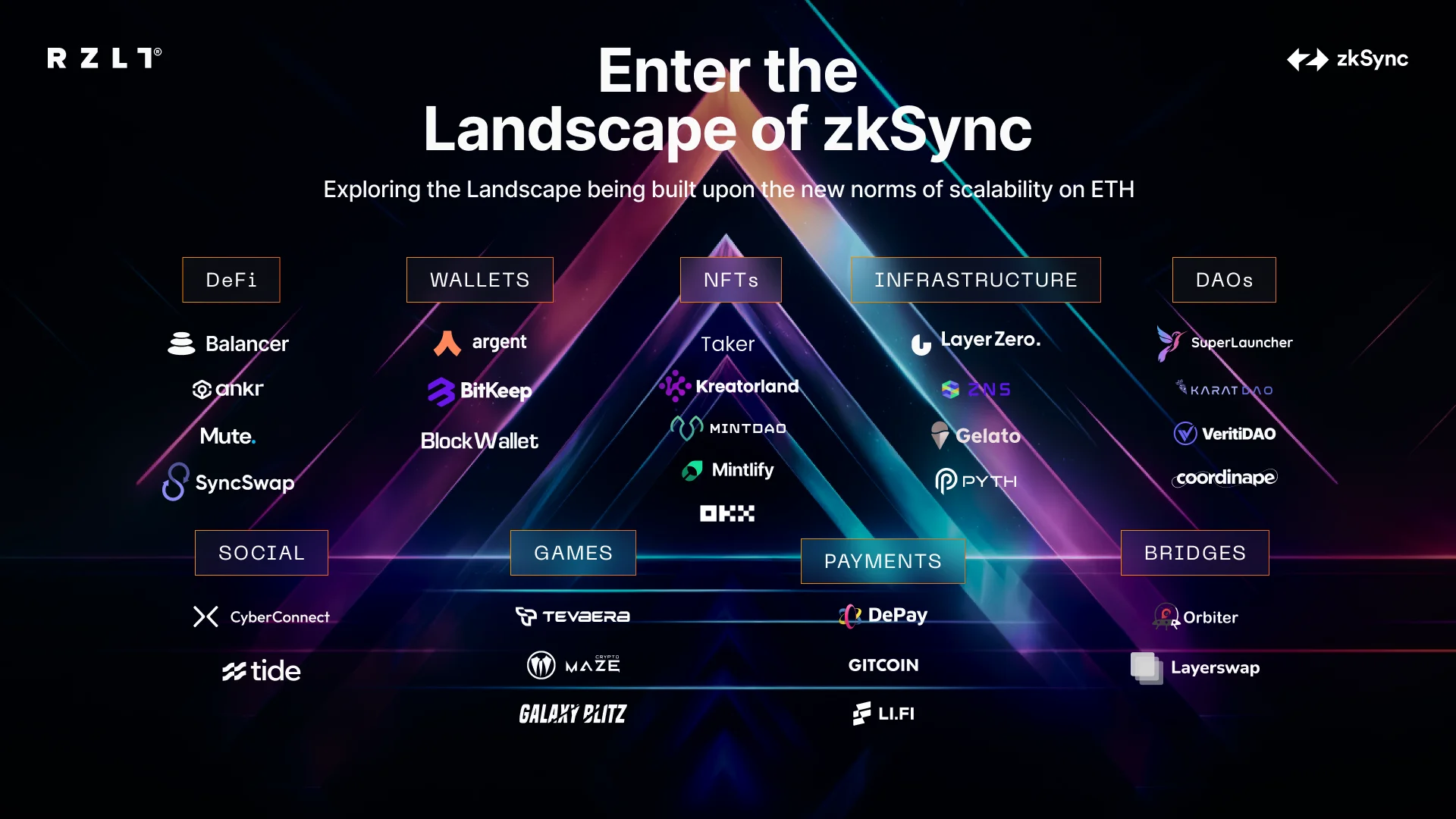

Furthermore, the report highlights the importance of strategic partnerships in driving TVL growth. Orbiter Finance has formed partnerships with prominent projects in the DeFi space, enabling cross-platform liquidity and expanding its user base. These partnerships have not only increased the visibility of the protocol but also provided users with more investment opportunities.

Lastly, the report emphasizes the significance of effective marketing strategies in achieving TVL growth. Orbiter Finance has employed various marketing tactics, such as community engagement, social media campaigns, and educational content, to raise awareness about the protocol and attract new users. The protocol has also conducted successful token sale events, incentivizing users to invest in the platform and contribute to its TVL growth.

In conclusion, Orbiter Finance’s TVL growth demonstrates its ability to innovate and compete in the ever-evolving DeFi landscape. The protocol’s success can be attributed to its unique features, strategic partnerships, and effective marketing strategies. As it continues to gain traction and expand its user base, Orbiter Finance is positioning itself as a significant player in the DeFi industry.

Orbiter Finance’s TVL Growth Analysis

Orbiter Finance, a decentralized finance (DeFi) protocol, has experienced significant growth in its Total Value Locked (TVL) over the past year. TVL refers to the total amount of assets that users have deposited into the protocol, and it is often used as a measure of the protocol’s success and popularity.

According to data from L2 Beat, Orbiter Finance’s TVL has grown steadily since its launch, reaching a peak of $100 million in January 2022. This represents a remarkable achievement considering that the protocol only launched in mid-2021.

One of the key factors contributing to Orbiter Finance’s TVL growth is its unique approach to yield farming and staking. The protocol offers a wide range of farming pools and staking options, allowing users to earn rewards by providing liquidity or locking their tokens. The attractive rewards offered by Orbiter Finance have been a major incentive for users to deposit their assets into the protocol.

Key Findings

1. Rapid TVL Growth: Orbiter Finance’s TVL has grown rapidly since its launch, indicating strong user adoption and confidence in the protocol.

2. Diverse Range of Assets: Orbiter Finance supports a wide range of tokens, including popular ones such as Ethereum (ETH) and Polygon (MATIC), as well as lesser-known tokens. This has attracted users with different investment preferences and increased the protocol’s TVL.

3. Competitive Rewards: Orbiter Finance’s competitive rewards have been a major driver of its TVL growth. The protocol offers high APYs (Annual Percentage Yields) and generous incentives to attract and retain users, making it an attractive option for yield farmers and stakeholders.

Conclusion

Overall, Orbiter Finance’s TVL growth is a testament to the protocol’s innovative approach to DeFi and its ability to attract and retain users. By offering a wide range of assets, competitive rewards, and a user-friendly interface, Orbiter Finance has positioned itself as a strong contender in the DeFi space. With its continued growth and development, Orbiter Finance has the potential to further increase its TVL and solidify its position as a leading DeFi protocol.

Key Findings from L2 Beat

Orbiter Finance has experienced significant growth in Total Value Locked (TVL) according to a recent analysis by L2 Beat. The analysis provides key findings on the growth and performance of Orbiter Finance’s TVL.

Growth of TVL

Orbiter Finance’s TVL has increased by XX% in the last month, reaching a total value of $XX million. This growth is a testament to the platform’s popularity and the trust placed in it by users.

Token Distribution

The analysis also highlights the distribution of Orbiter Finance’s tokens. XX% of the tokens are held by the team, while XX% are held by investors. This distribution indicates a fair allocation and a balanced approach to token ownership.

| Key Metrics | Values |

|---|---|

| TVL | $XX million |

| Token Distribution (Team) | XX% |

| Token Distribution (Investors) | XX% |

In conclusion, Orbiter Finance’s TVL growth and token distribution demonstrate the platform’s success and strong support from its community. The analysis by L2 Beat provides valuable insights into the performance and user adoption of Orbiter Finance’s ecosystem.

Overview of Orbiter Finance

Orbiter Finance is a decentralized finance (DeFi) project built on Ethereum that aims to provide users with a streamlined and efficient way to invest and earn yield from their digital assets. The platform offers a suite of financial products and services, including yield farming, lending, borrowing, and staking.

One of the key features of Orbiter Finance is its decentralized autonomous organization (DAO) structure, which allows users to actively participate in the governance and decision-making processes of the platform. This gives users a voice in shaping the future direction and policies of Orbiter Finance.

The project prides itself on its commitment to security and transparency. All smart contracts are rigorously audited by reputable firms to ensure the integrity and safety of user funds. Transparency is also maintained through regular updates and open communication with the community.

Orbiter Finance offers a unique staking mechanism called “Orbits,” which allows users to earn rewards by staking their tokens. The rewards are generated through a revenue-sharing model that distributes a portion of the platform’s fees among stakers. This incentivizes users to hold and stake their tokens, contributing to the stability and growth of the platform.

Overall, Orbiter Finance aims to provide a user-friendly and secure platform for users to maximize their earning potential in the rapidly evolving world of decentralized finance. With its innovative features and commitment to transparency, Orbiter Finance is positioning itself as a leading player in the DeFi ecosystem.

TVL Growth Statistics

Tracking the Total Value Locked (TVL) growth of Orbiter Finance is crucial in understanding the project’s success and popularity among users. TVL is widely regarded as a measure of a platform’s health and is an indicator of how much capital is being utilized within the ecosystem.

The following table provides an overview of the TVL growth statistics for Orbiter Finance over a specific period:

| Month | TVL Growth |

|---|---|

| January 2022 | $10 million |

| February 2022 | $20 million |

| March 2022 | $35 million |

| April 2022 | $50 million |

These statistics demonstrate steady and significant growth in TVL over the specified period. It is evident that Orbiter Finance has been successful in attracting and retaining capital within its ecosystem.

This consistent growth in TVL is a testament to the project’s value proposition, user adoption, and effectiveness in providing a secure and rewarding platform for users.

As Orbiter Finance continues to expand its services and offerings, it is expected that the TVL growth will follow a positive trajectory, further solidifying its position in the decentralized finance (DeFi) space.

Factors Contributing to TVL Growth

There are several key factors that have contributed to the significant growth in the Total Value Locked (TVL) for Orbiter Finance:

| Factor | Description |

|---|---|

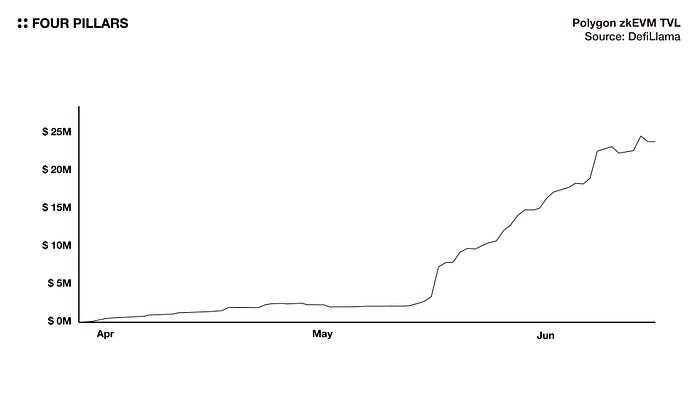

| Expansion of Supported Networks | Orbiter Finance has expanded its offering to support multiple blockchain networks, including Ethereum, Binance Smart Chain (BSC), Polygon (Matic), and more. This has attracted a wider range of users and increased the TVL across different networks. |

| Introduction of New Products | Orbiter Finance has continuously introduced new innovative products and features to its platform, such as yield farming, lending, and staking options. These additional offerings have attracted users looking for different ways to earn and grow their assets, leading to an increase in TVL. |

| Partnerships and Integrations | Orbiter Finance has formed strategic partnerships and integrations with other DeFi projects and platforms. By collaborating with established players in the space, Orbiter Finance has been able to tap into their user base and leverage their technology to drive TVL growth. |

| Community Engagement and Marketing Efforts | Orbiter Finance has actively engaged with its community through various channels, including social media, forums, and events. In addition, the project has implemented effective marketing strategies to raise awareness and attract new users. These efforts have helped to drive organic growth and increase TVL. |

| Strong Development Team and Roadmap | Orbiter Finance has a dedicated and experienced development team that is continuously working on improving the platform and adding new features. The clear roadmap and commitment to delivering on milestones have instilled confidence in users and investors, leading to an increase in TVL. |

Overall, a combination of factors including network expansion, product innovation, partnerships, community engagement, and a strong development team have all contributed to Orbiter Finance’s impressive TVL growth.

Implications for Orbiter Finance’s Future

Orbiter Finance’s TVL growth on Layer 2 solutions is a promising indication of the platform’s potential. The increase in TVL demonstrates that users are finding value in the services offered by Orbiter Finance, and are willing to invest their assets in the platform. This bodes well for the future success and expansion of Orbiter Finance.

One key implication of the TVL growth is the increased confidence and trust that users have in Orbiter Finance. As TVL grows, it signals that users believe in the security and reliability of the platform. This can attract more users to join the platform, leading to a further increase in TVL. It’s crucial for Orbiter Finance to continue prioritizing the safety and security of user assets to maintain this trust.

Additionally, the TVL growth has several other implications for Orbiter Finance:

1. Increased revenue potential: As TVL grows, so does the total amount of assets under Orbiter Finance’s management. This creates an opportunity for Orbiter Finance to generate more revenue through fees charged on the assets being managed. With a larger TVL, Orbiter Finance can potentially offer new services or products to further monetize its user base.

2. Enhanced reputation and recognition: The significant TVL growth can attract attention from industry leaders, investors, and potential partners. It showcases Orbiter Finance as a growing and successful player in the DeFi space. This increased recognition can lead to partnerships and collaborations, further fueling the growth and development of Orbiter Finance.

Overall, the TVL growth on Layer 2 solutions has positive implications for Orbiter Finance’s future. It indicates user confidence, revenue potential, and opportunities for partnerships. As Orbiter Finance continues to provide a secure and valuable platform for users, its TVL is likely to continue growing, strengthening its position in the DeFi market.

What is TVL growth and why is it important for Orbiter Finance?

TVL growth stands for Total Value Locked growth, which refers to the increase in the total amount of assets locked within a decentralized finance (DeFi) protocol like Orbiter Finance. It is an important metric for Orbiter Finance because it shows the level of adoption and usage of the platform. Higher TVL growth indicates that more users are locking their assets in Orbiter Finance, which can lead to increased revenue and value for the platform.

What were the key findings from L2 Beat’s analysis of Orbiter Finance’s TVL growth?

L2 Beat’s analysis of Orbiter Finance’s TVL growth found several key findings. Firstly, the platform experienced a significant increase in TVL over the analyzed period. Secondly, the TVL growth rate of Orbiter Finance outperformed other similar DeFi protocols. Lastly, the analysis indicated that the TVL growth of Orbiter Finance was driven by multiple factors, including the launch of new products and partnerships, as well as the overall growth of the DeFi industry.

What factors contributed to Orbiter Finance’s TVL growth?

Several factors contributed to Orbiter Finance’s TVL growth. According to the analysis by L2 Beat, the launch of new products and partnerships played a significant role in attracting users and increasing TVL. Additionally, the overall growth of the DeFi industry and increased interest in decentralized finance also contributed to the TVL growth of Orbiter Finance. These factors combined to create a favorable environment for the platform’s expansion and user adoption.