Investing in the financial markets can be a daunting task, but it can also be a rewarding one if approached with the right mindset and strategies. Orbiter Finance, a leading investment firm, has provided key lessons for investors to consider when navigating the ever-changing landscape of finance.

Lesson 1: Diversification is key. One of the most crucial takeaways from Orbiter Finance is the importance of diversification in an investment portfolio. By spreading your investments across different asset classes and sectors, you can reduce the risk of significant losses and increase the potential for returns. This strategy ensures that your investments are not solely dependent on the performance of a single asset or industry.

Lesson 2: Stay informed and adapt. The financial markets are constantly evolving, and it is essential for investors to stay informed and adapt their strategies accordingly. Orbiter Finance emphasizes the significance of monitoring market trends, economic indicators, and political developments that may impact investment decisions. By staying informed, investors can make more informed choices and be better prepared for any market fluctuations.

Lesson 3: Patience is a virtue. When it comes to investing, patience is key. Orbiter Finance advises investors to adopt a long-term perspective and resist the urge to make impulsive decisions based on short-term market movements. By staying patient and adhering to a well-thought-out investment plan, investors can ride out market volatility and potentially benefit from long-term market growth.

Lesson 4: Risk management is essential. Orbiter Finance highlights the importance of effective risk management in investment strategies. Investors should assess their risk tolerance and establish risk management techniques, such as setting stop-loss orders or diversifying investments, to mitigate potential losses. By managing risk effectively, investors can protect their capital and potentially improve long-term investment performance.

Lesson 5: Seek professional advice. Lastly, Orbiter Finance reminds investors of the value of seeking professional advice. The financial markets can be complex and overwhelming, and working with a knowledgeable advisor can provide valuable insights and guidance. A professional advisor can help investors identify opportunities, manage risks, and make informed investment decisions that align with their financial goals.

By taking these key takeaways into consideration, investors can navigate the financial markets with greater confidence and increase their chances of achieving their investment objectives.

Lessons for Investors from Orbiter Finance

Orbiter Finance is a leading fin-tech company that provides innovative solutions for investors in the digital currency space. The company offers a platform that allows users to easily manage and diversify their crypto portfolios. In addition to its products and services, Orbiter Finance also provides valuable insights and lessons for investors looking to navigate the ever-changing crypto market.

1. Stay Informed

One of the key lessons for investors from Orbiter Finance is the importance of staying informed about the latest trends and developments in the crypto market. With new digital currencies and blockchain projects popping up every day, it’s crucial to keep up to date with the latest news and innovations. By staying informed, investors can make more informed decisions and stay ahead of the curve.

2. Diversify Your Portfolio

Orbiter Finance emphasizes the need for investors to diversify their crypto portfolios. The volatile nature of the crypto market means that investing all your funds in a single cryptocurrency can be risky. By spreading your investments across multiple digital currencies, you can protect yourself against sudden market fluctuations and reduce the risk of loss.

3. Set Realistic Goals

Setting realistic goals is another important lesson for investors from Orbiter Finance. It’s essential to have a clear understanding of your investment objectives and a realistic time frame for achieving them. By setting achievable goals, investors can avoid making impulsive decisions based on short-term market movements.

4. Practice Risk Management

Risk management is a crucial aspect of successful investing, and Orbiter Finance stresses the importance of implementing risk management strategies. This includes setting stop-loss orders, conducting thorough research before making investment decisions, and regularly reassessing and adjusting your portfolio based on market conditions.

5. Stay Patient

Lastly, Orbiter Finance reminds investors to stay patient. The crypto market can be highly volatile, with prices experiencing significant fluctuations in short periods. It’s important to remember that investing in cryptocurrencies is a long-term game. By maintaining a long-term perspective and staying patient, investors can increase their chances of achieving their investment goals.

In conclusion, Orbiter Finance provides valuable lessons for investors in the digital currency space. By staying informed, diversifying portfolios, setting realistic goals, practicing risk management, and staying patient, investors can navigate the crypto market with greater confidence and increase their chances of success.

Understanding Orbiter Finance’s Key Takeaways

Orbiter Finance has provided investors with valuable insights and lessons to consider. Here are some key takeaways:

1. Diversification is Essential

Diversification is a fundamental principle in investing. Orbiter Finance emphasizes the importance of spreading investments across different assets or sectors to reduce risk. By diversifying, investors can protect their portfolios from significant losses if one investment performs poorly.

2. Risk Appetite and Time Horizon

Risk appetite and time horizon are crucial factors when making investment decisions. Orbiter Finance advises investors to assess their risk tolerance and consider their investment goals and timeframes before making any investment. This ensures that the chosen investments align with the investor’s risk profile and financial objectives.

3. Research and Due Diligence

Before investing, conducting thorough research and due diligence is essential. Orbiter Finance highlights the significance of understanding the fundamentals and potential risks associated with each investment. This includes analyzing market trends, examining financial statements, and evaluating the management team.

Furthermore, Orbiter Finance recommends staying updated with the latest news and developments that may impact investments. This proactive approach allows investors to make informed decisions and anticipate potential market shifts.

In conclusion, Orbiter Finance’s key takeaways highlight the importance of diversification, considering risk appetite and time horizon, and conducting comprehensive research and due diligence before making investment decisions. By incorporating these lessons, investors can enhance their chances of achieving their financial goals and managing risk effectively.

Important Lessons for Investors

Investing can be a complex and challenging endeavor, but there are some important lessons that can help investors navigate the financial markets:

Diversification is Key

One of the most important lessons for investors is the concept of diversification. Diversifying your investment portfolio can help reduce risk by spreading your investments across different asset classes, industries, and geographic regions. This can help protect your investments during periods of volatility and provide more stable returns over the long term.

Do Your Research

Before investing in any asset or company, it is crucial to do thorough research. This includes understanding the company’s financial health, future prospects, and potential risks. By conducting your own research, you can make informed investment decisions and avoid unnecessary losses.

Additionally, it is important to stay updated with the latest news and market trends. This information can provide valuable insights into market conditions and help you make more informed investment decisions.

While it is tempting to follow the advice of others or rely on tips and rumors, it is essential to conduct your own due diligence to ensure you are making well-informed investment choices.

Remember to consider both quantitative and qualitative factors when researching potential investments. Financial metrics like revenue growth and profitability are important, but it is also vital to assess factors such as industry trends, competitive advantages, and management capabilities.

Ultimately, doing your research can help you identify investment opportunities with strong growth potential and manage risk effectively.

These important lessons for investors can help individuals make more informed investment decisions and achieve their financial goals. By diversifying their portfolio and conducting thorough research, investors can increase their chances of success in the financial markets.

Implementing Orbiter Finance’s Strategies for Success

Orbiter Finance has established itself as a leader in the investment industry with its successful strategies. To implement these strategies for your own investment journey, there are several key takeaways to consider.

First and foremost, diversification is of utmost importance. Orbiter Finance emphasizes the need to spread your investments across different asset classes, industries, and geographical regions. This helps mitigate risk and provides opportunities for growth in various sectors.

Another strategy to implement is thorough research and analysis. Orbiter Finance recommends conducting comprehensive due diligence before making any investment decisions. This includes studying the company’s financials, analyzing market trends, and assessing the competitive landscape. By doing so, you can make informed choices and increase your chances of success.

Furthermore, Orbiter Finance encourages a long-term investment mindset. Rather than focusing on short-term market fluctuations, it is important to have a vision for the future and stick to your investment strategy. This allows you to take advantage of compounding returns and potentially ride out periods of volatility.

Effective risk management is also key to Orbiter Finance’s success. Implementing strategies such as setting stop-loss orders, diversifying within asset classes, and regularly reassessing your portfolio can help protect your investments and minimize losses.

Lastly, Orbiter Finance emphasizes the importance of staying disciplined and not letting emotions drive investment decisions. Following a well-defined investment plan and sticking to it even during challenging times is crucial for long-term success.

| Key Strategies for Success: |

|---|

| Diversification |

| Thorough research and analysis |

| Long-term investment mindset |

| Effective risk management |

| Discipline in adhering to the investment plan |

By implementing these strategies in your own investment approach, you can increase your chances of achieving success and reaching your financial goals, just like Orbiter Finance.

What is Orbiter Finance?

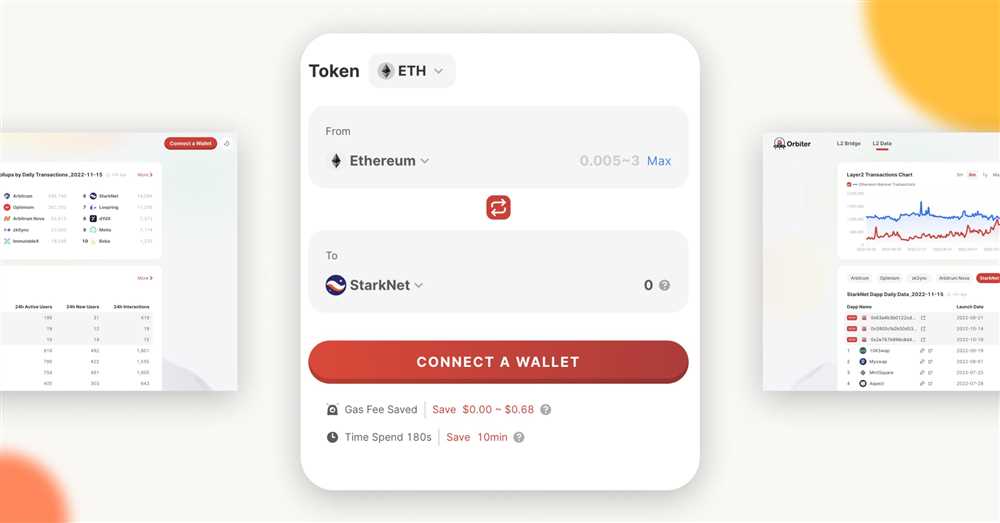

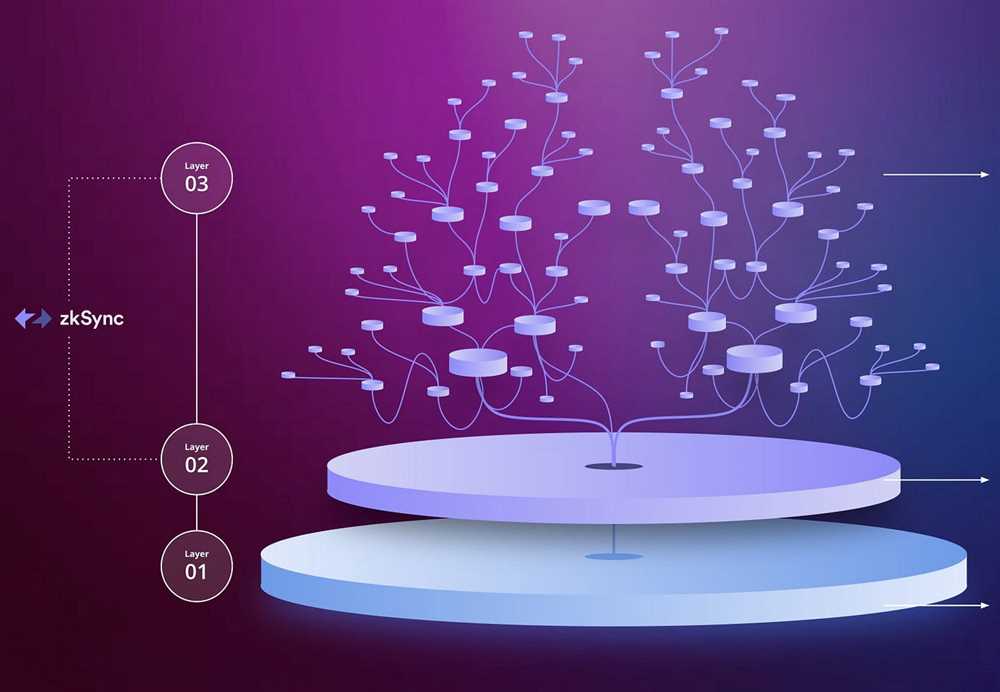

Orbiter Finance is a platform that provides decentralized finance (DeFi) solutions for investors. It offers various investment opportunities and tools to help individuals make informed decisions and maximize their returns in the crypto market.

What are some key takeaways from the Orbiter Finance article?

Some key takeaways from the Orbiter Finance article include the importance of conducting thorough research before making investment decisions, the benefits of diversifying one’s investment portfolio, and the potential risks and rewards of participating in decentralized finance.

How can Orbiter Finance help investors maximize their returns?

Orbiter Finance provides investors with access to a wide range of investment opportunities in the crypto market. By utilizing the platform’s tools and conducting thorough research, investors can make informed decisions and potentially maximize their returns by capitalizing on the growth of various cryptocurrencies.