Leveraging Orbiter Finance: A Detailed Guide to Cross-Rollup Asset Transfers

Welcome to the comprehensive guide on leveraging Orbiter Finance for cross-rollup asset transfers. Orbiter Finance is revolutionizing the way assets are transferred between different rollups on various Ethereum Layer 2 solutions. With its seamless integration and user-friendly interface, Orbiter Finance offers a simple and efficient method to transfer your assets securely.

Cross-rollup asset transfers allow users to move their assets from one rollup to another, providing flexibility and liquidity across different Layer 2 networks. Whether you are looking to diversify your portfolio or take advantage of specific opportunities on different rollups, Orbiter Finance is the solution for you.

With Orbiter Finance, you can leverage its cutting-edge technology to securely transfer your assets without the need for complex processes or lengthy wait times. The platform ensures the integrity and safety of your assets throughout the transfer, making it a reliable choice for all your cross-rollup asset needs.

By using Orbiter Finance, you can explore new investment opportunities, expand your access to decentralized applications, and enjoy the benefits of a seamless and efficient asset transfer process. Join the Orbiter Finance community today and unlock the full potential of cross-rollup asset transfers!

Understanding Cross-Rollup Asset Transfers

When it comes to the Orbiter Finance ecosystem, one of the most essential features is the ability to transfer assets across different rollups. These cross-rollup asset transfers enable users to move their assets seamlessly between different Layer 2 solutions, providing enhanced flexibility and interoperability.

What are Cross-Rollup Asset Transfers?

Cross-rollup asset transfers refer to the process of transferring assets from one rollup chain to another within the Orbiter Finance network. A rollup is a Layer 2 scaling solution that aggregates multiple transactions into a single batch that is then submitted as a single transaction on the Ethereum mainnet. By allowing assets to be transferred between different rollups, Orbiter Finance enhances the scalability and efficiency of its ecosystem.

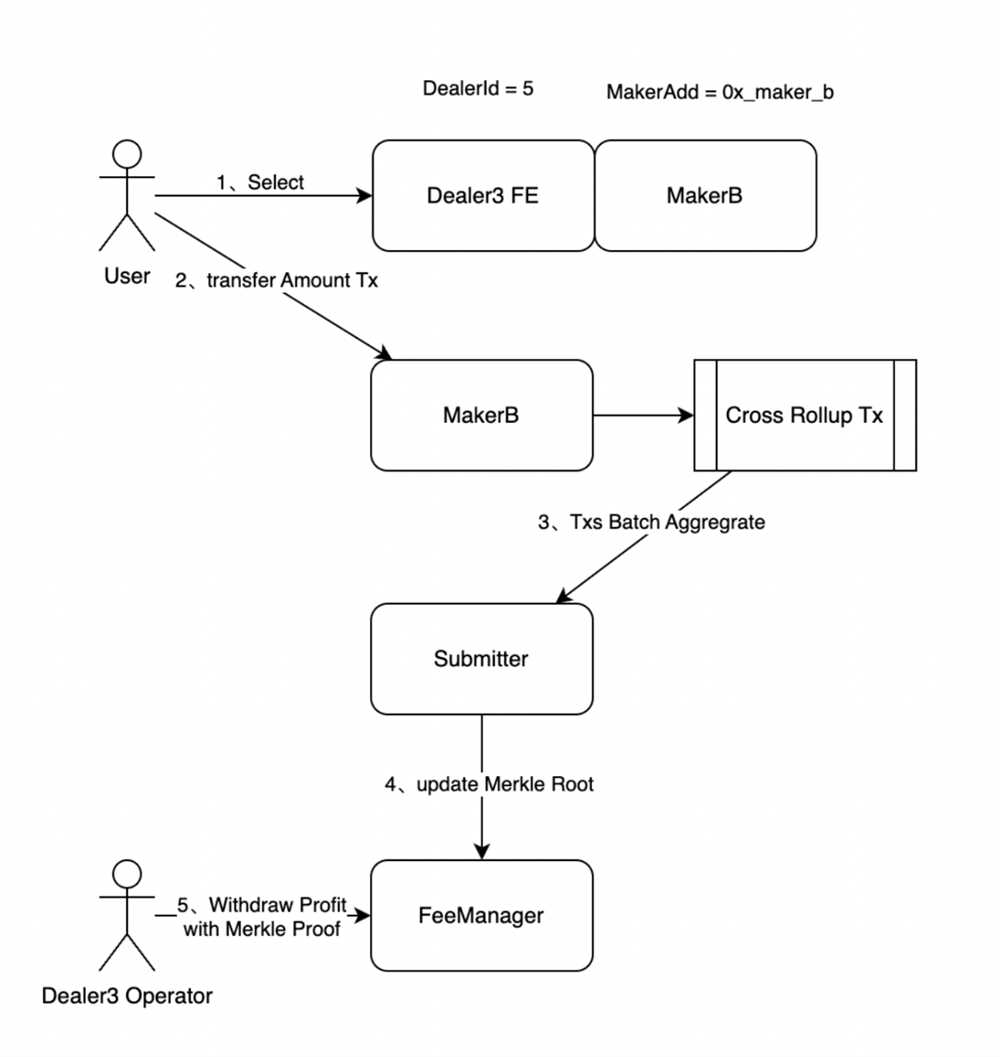

How do Cross-Rollup Asset Transfers work?

The process of cross-rollup asset transfers involves several steps. First, the user initiates the transfer by specifying the source and destination rollup chains, as well as the amount and type of asset they want to transfer. This information is then submitted to the respective rollup chains.

Next, the source rollup chain locks the assets to be transferred, ensuring that they cannot be spent or moved on the source chain while the transfer is in progress. The locked assets are then transferred to a designated cross-rollup bridge, which acts as an intermediary between the rollup chains.

Once the assets reach the cross-rollup bridge, they are then unlocked and made available on the destination rollup chain. The user can then access and utilize the transferred assets on the destination rollup chain according to their needs.

| Benefits of Cross-Rollup Asset Transfers |

|---|

|

Overall, cross-rollup asset transfers play a crucial role in enabling seamless asset movement and enhancing the overall functionality of the Orbiter Finance ecosystem. By providing enhanced scalability, interoperability, flexibility, and efficiency, these transfers empower users to make the most of the benefits offered by the Orbiter Finance network.

Benefits of Leveraging Orbiter Finance

1. Improved Cross-Rollup Asset Transfers:

By leveraging Orbiter Finance, users can enjoy a seamless and efficient process of transferring assets across different rollups. This increases convenience and eliminates the need for complicated and time-consuming procedures.

2. Cost Savings:

Orbiter Finance provides a cost-effective solution for cross-rollup asset transfers. With reduced fees and transaction costs, users can save money and maximize their returns.

3. Increased Liquidity:

By leveraging Orbiter Finance, users can unlock additional liquidity by bridging assets between multiple rollups. This allows for more opportunities to trade and access a wider range of liquidity pools.

4. Enhanced Security:

Orbiter Finance prioritizes the security and safety of users’ assets. By leveraging its technology, users can enjoy a high level of protection against potential risks such as hacking and unauthorized access.

5. Seamless Integration:

Orbiter Finance offers seamless integration with various rollup solutions, making it easier for users to connect and transfer their assets. This enhances usability and eliminates compatibility issues.

6. User-Friendly Experience:

Orbiter Finance is designed with the user in mind, providing a user-friendly interface and intuitive features. This makes it easy for both beginner and experienced users to navigate and utilize the platform effectively.

7. Support for Diverse Assets:

Orbiter Finance supports the transfer of diverse assets across different rollups, including cryptocurrencies, tokens, and other digital assets. This allows users to manage and diversify their portfolio seamlessly.

8. Community and Ecosystem Integration:

By leveraging Orbiter Finance, users can become part of a growing community and ecosystem. This provides opportunities for collaboration, learning, and accessing new investment opportunities.

9. Advanced Monitoring and Analytics:

Orbiter Finance provides advanced monitoring and analytics tools, allowing users to track their transfers, analyze performance, and make informed decisions. This enhances transparency and helps users optimize their asset management strategies.

10. Future-Focused Innovation:

Orbiter Finance is continuously developing and innovating to meet the evolving needs of the decentralized finance (DeFi) space. By leveraging this platform, users can stay ahead of the curve and benefit from future advancements in cross-rollup asset transfers.

How to Perform Cross-Rollup Asset Transfers with Orbiter Finance

Orbiter Finance provides a seamless and efficient way to transfer assets between different rollup chains, enabling users to optimize their decentralized finance (DeFi) strategies and maximize their returns. In this guide, we will walk you through the process of performing cross-rollup asset transfers with Orbiter Finance.

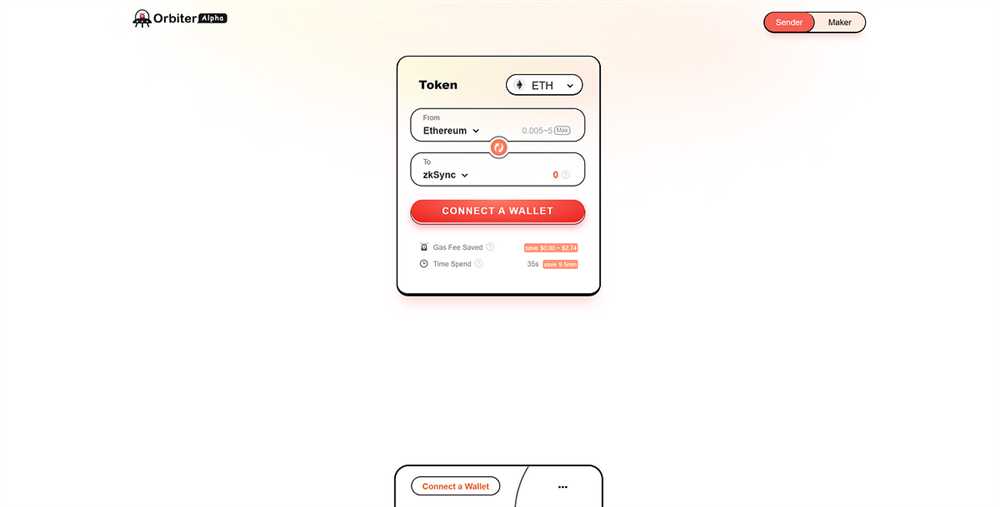

Step 1: Connect Your Wallet

The first step is to connect your Web3 wallet to the Orbiter Finance platform. Make sure you have a compatible wallet such as MetaMask installed and connected to the rollup chain you want to transfer assets from.

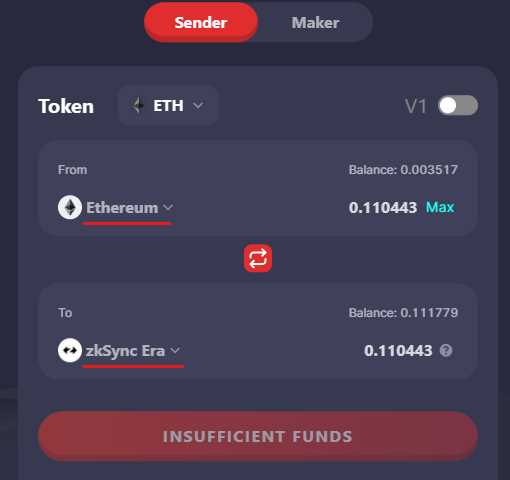

Step 2: Select the From and To Rollup Chains

Select the rollup chain you want to transfer assets from in the “From” dropdown menu. Then, choose the rollup chain you want to transfer assets to in the “To” dropdown menu. Orbiter Finance supports various rollup chains, such as Arbitrum, Optimism, and Polygon, among others.

Step 3: Choose the Asset and Amount

Next, choose the asset you want to transfer from the “Asset” dropdown menu. You will see a list of supported assets available for transfer on the selected rollup chain. Select the asset you want to transfer and enter the desired amount in the “Amount” field.

Step 4: Approve and Initiate the Transfer

After confirming the asset and amount, click on the “Approve” button to grant Orbiter Finance permission to transfer the asset on your behalf. Once the approval transaction is confirmed on the blockchain, click on the “Initiate Transfer” button to start the cross-rollup asset transfer process.

Step 5: Confirm the Transfer

A pop-up will appear asking you to confirm the transfer. Verify the details, such as the asset, amount, and rollup chains, and click on the “Confirm” button to initiate the transfer. The transfer transaction will be submitted to the selected rollup chain for processing.

Step 6: Monitor the Transfer

You can monitor the progress of your cross-rollup asset transfer by checking the transaction status on the blockchain explorer. Once the transfer is completed, you will see the assets reflected in your wallet on the destination rollup chain.

By leveraging Orbiter Finance’s innovative technology, users can easily and securely transfer assets between different rollup chains, unlocking new opportunities for decentralized finance and optimizing their investment strategies. Follow these steps to perform cross-rollup asset transfers and take full advantage of Orbiter Finance’s capabilities.

How does cross-rollup asset transfer work in Orbiter Finance?

In Orbiter Finance, cross-rollup asset transfer works by utilizing layer 2 rollups, which are scaling solutions built on top of the Ethereum network. The process involves transferring assets between different rollups, allowing users to access and trade assets across multiple Layer 2 networks.

What are the benefits of leveraging cross-rollup asset transfers in Orbiter Finance?

Leveraging cross-rollup asset transfers in Orbiter Finance provides several benefits. Firstly, it allows for increased scalability and lower transaction fees, as rollups are designed to handle a large number of transactions off-chain. Additionally, users can access a wider range of assets across different Layer 2 networks, expanding their trading options. Lastly, cross-rollup asset transfers enhance interoperability between different rollups, creating a more connected and efficient ecosystem.