Maximizing Investment Opportunities with Orbiter Finance: Cross-Chain Liquidity Pools for Cosmos Chains

Introducing Orbiter Finance’s Cross-Chain Liquidity Pools for Cosmos Chains

Invest with confidence and unlock the full potential of your assets!

Are you tired of limited opportunities and missed chances for your investments? Look no further than Orbiter Finance’s revolutionary Cross-Chain Liquidity Pools for Cosmos Chains. We are proud to present an all-in-one solution that allows you to diversify your investment portfolio and maximize your returns.

With Orbiter Finance’s innovative technology, you no longer have to be bound by the limitations of a single chain. Our Cross-Chain Liquidity Pools enable seamless asset transfer and interaction across multiple Cosmos Chains, providing you with unprecedented flexibility and convenience.

Whether you are a seasoned investor or just starting your journey, our user-friendly platform ensures that you can easily navigate and make informed decisions. Take advantage of our advanced analytics and in-depth market insights to stay ahead of the game and make the most out of your investments.

But that’s not all! Orbiter Finance is committed to the highest standards of security and transparency. Rest assured that your assets are protected by state-of-the-art encryption and multi-layered authentication protocols. Our team of experienced professionals is constantly monitoring the market to identify potential risks and ensure a safe investment environment for our users.

Don’t miss out on this game-changing opportunity!

Join Orbiter Finance’s Cross-Chain Liquidity Pools today and unlock a world of endless investment possibilities. Start maximizing your returns and take control of your financial future now!

Disclaimer: Investment involves risks. Please conduct thorough research and consult with a financial advisor before making any investment decisions.

The Need for Cross-Chain Liquidity Pools

As the world of decentralized finance continues to expand, so does the need for efficient and seamless interoperability between different blockchain networks. This is where cross-chain liquidity pools come in.

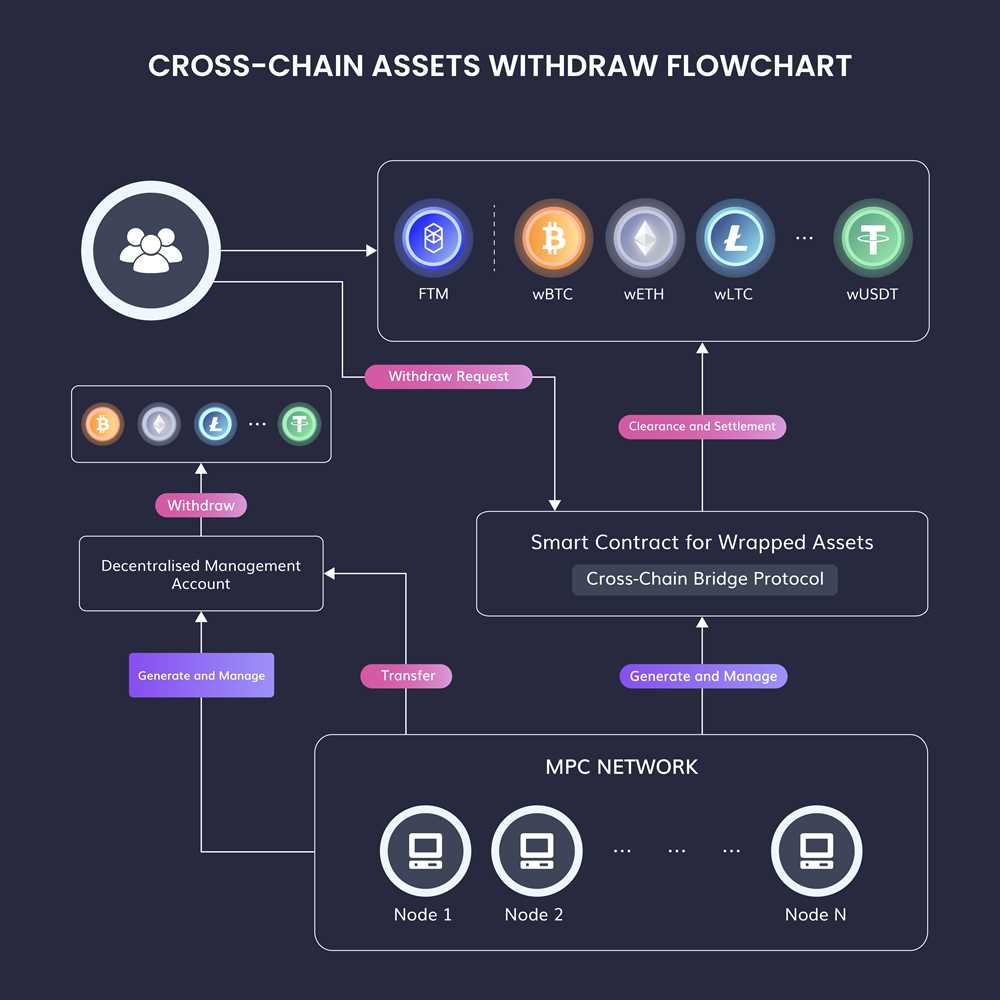

Cross-chain liquidity pools enable the seamless transfer of assets between different blockchain networks, making it easier for users to access and trade a wide range of digital assets. Without cross-chain liquidity pools, users are limited to trading within a single blockchain network, resulting in restricted market access and missed investment opportunities.

By providing a bridge between different blockchain networks, cross-chain liquidity pools open up a whole new world of possibilities for investors. They allow for the efficient transfer of assets and the pooling of liquidity, which in turn leads to increased market depth and improved price discovery.

Furthermore, cross-chain liquidity pools enhance the overall security and stability of decentralized finance by reducing reliance on a single blockchain network. By spreading liquidity across multiple chains, the risk of network congestion, high gas fees, and other bottlenecks is mitigated, ensuring a more robust and sustainable ecosystem.

Another key benefit of cross-chain liquidity pools is their ability to support the development and adoption of new blockchain networks. By providing a seamless interface for asset transfer, cross-chain liquidity pools make it easier for developers to launch and promote their chains, attracting more users and driving innovation in the decentralized finance space.

In conclusion, the need for cross-chain liquidity pools is evident in today’s fast-paced and interconnected world of decentralized finance. They enable users to access a wider range of assets, improve market depth and price discovery, enhance security and stability, and foster innovation across different blockchain networks.

Maximizing Investment Opportunities

Investing wisely is crucial for individuals looking to grow their wealth and secure their financial future. With the ever-changing market landscape, it is important to find innovative solutions that can help maximize investment opportunities.

At Orbiter Finance, we understand the challenges that investors face when it comes to navigating the complex world of cryptocurrency investments. That is why we have developed Cross-Chain Liquidity Pools for Cosmos Chains.

What are Cross-Chain Liquidity Pools?

Cross-Chain Liquidity Pools are a revolutionary concept that allows investors to pool their funds together to create a shared liquidity pool. This pool can then be used to provide liquidity to various Cosmos Chains, unlocking a plethora of investment opportunities.

By pooling funds together, investors can access a larger pool of liquidity and take advantage of various investment opportunities that may not have been accessible before. This allows for greater diversification and potentially higher returns on investments.

Why Choose Orbiter Finance’s Cross-Chain Liquidity Pools?

Orbiter Finance stands out in the market for several reasons. Firstly, our Cross-Chain Liquidity Pools are built on the highly secure and scalable Cosmos network, ensuring the safety and stability of your investments.

Additionally, our team of experienced professionals is dedicated to continuously researching and identifying new investment opportunities across various Cosmos Chains. This allows us to provide our investors with access to a wide range of investment options, ensuring that they can maximize their returns.

In conclusion, Orbiter Finance’s Cross-Chain Liquidity Pools offer investors a unique and innovative way to maximize their investment opportunities. By pooling funds together and leveraging the power of the Cosmos network, investors can access a wider range of investment options and potentially achieve higher returns. Take advantage of this groundbreaking solution and start maximizing your investment opportunities today.

Benefits of Orbiter Finance

Orbiter Finance offers a range of benefits to investors looking to maximize their investment opportunities on Cosmos Chains. Here are some key advantages of using Orbiter Finance:

1. Cross-Chain Liquidity

Orbiter Finance’s Cross-Chain Liquidity Pools provide seamless liquidity across multiple Cosmos Chains. By pooling together liquidity from different chains, investors can easily swap assets and access liquidity from previously isolated chains. This enhances the overall liquidity and efficiency of the Cosmos ecosystem, creating more opportunities for investors.

2. Maximizing Investment Opportunities

With Orbiter Finance, investors can maximize their investment opportunities by participating in yield farming and liquidity mining programs. By staking their assets in Orbiter’s liquidity pools, investors can earn attractive yields and rewards. This allows them to leverage their existing assets to generate additional income and grow their investment portfolio.

Furthermore, Orbiter Finance’s smart routing technology ensures that investors always get the best possible swap rates and minimal slippage when trading. This optimization maximizes the value of investments and reduces trading costs, providing a competitive advantage in the market.

Overall, Orbiter Finance empowers investors to unlock the full potential of Cosmos Chains and take advantage of the growing decentralized finance (DeFi) opportunities. Its cross-chain liquidity and yield farming capabilities enable investors to diversify their portfolios, earn passive income, and stay at the forefront of the evolving crypto landscape.

Introducing Orbiter Finance

Orbiter Finance is pleased to introduce its cutting-edge platform that brings a new level of investment opportunities to Cosmos Chains. With our innovative Cross-Chain Liquidity Pools, you can maximize your returns and take advantage of the endless potential of the Cosmos ecosystem.

Unleash the Power of Cross-Chain Liquidity Pools

Our Cross-Chain Liquidity Pools provide a seamless and secure way to unlock the full potential of your investments. By pooling liquidity from multiple Cosmos Chains, Orbiter Finance creates a dynamic ecosystem where you can access a wide range of investment opportunities.

Whether you’re an experienced investor or just starting out, our platform offers a user-friendly interface that allows you to easily navigate and explore the various investment options available across Cosmos Chains. From staking to yield farming, Orbiter Finance empowers you to make informed decisions and maximize your returns.

Seamless Integration with Cosmos Chains

At Orbiter Finance, we understand the importance of interoperability. That’s why our platform seamlessly integrates with Cosmos Chains, ensuring a smooth and efficient experience for our users. With our advanced technology, you can easily manage your assets and participate in the vibrant Cosmos ecosystem.

With Orbiter Finance, you can diversify your portfolio, tap into new investment opportunities, and take full advantage of the incredible potential that Cosmos Chains have to offer. Join us today and start maximizing your investment opportunities!

How Orbiter Finance Works

Orbiter Finance is a revolutionary platform that maximizes investment opportunities through its Cross-Chain Liquidity Pools for Cosmos Chains. Here is a step-by-step guide on how Orbiter Finance works:

| Step 1 | Users connect their wallets to Orbiter Finance using their preferred wallet provider. |

|---|---|

| Step 2 | Once connected, users can explore the available Cosmos Chains and choose the one they want to invest in. |

| Step 3 | Users provide liquidity to the selected Cosmos Chain by depositing their assets into the Cross-Chain Liquidity Pools. |

| Step 4 | The deposited assets generate passive income for the users through liquidity mining rewards and trading fees. |

| Step 5 | Users can also participate in governance and decision-making processes by staking their Orbiter tokens. |

| Step 6 | Users can withdraw their assets at any time and easily exit the ecosystem. |

With Orbiter Finance, investors can diversify their portfolios and take advantage of the growing opportunities in the Cosmos Chains ecosystem. Start maximizing your investment potential today!

Cross-Chain Liquidity Pools for Cosmos Chains

Orbiter Finance is revolutionizing the way investors maximize their opportunities with the introduction of our innovative Cross-Chain Liquidity Pools for Cosmos Chains. In this cutting-edge financial ecosystem, we are bridging the gap between different blockchain networks within the Cosmos ecosystem, enabling seamless interaction and liquidity provision between chains.

By utilizing our Cross-Chain Liquidity Pools, investors can now unlock the potential of not just one chain but multiple Cosmos Chains simultaneously. This opens up a world of possibilities, allowing for diversified investments and enhanced returns.

Our Cross-Chain Liquidity Pools are designed to ensure maximum efficiency and security. With our advanced smart contract technology, we eliminate the need for intermediaries and unnecessary complexity, reducing costs and increasing trust.

Through our intuitive user interface, investors can easily navigate and participate in the Cosmos ecosystem, regardless of their technical expertise. Whether you are a seasoned blockchain investor or just starting out, Orbiter Finance provides a seamless and user-friendly experience.

With our Cross-Chain Liquidity Pools, investors can choose from a wide range of investment options, tailored to their individual risk appetite and investment goals. From low-risk stablecoin pools to high-yield liquidity farming opportunities, Orbiter Finance offers something for everyone.

But it doesn’t stop there. Through our strategic partnerships and collaborations with other projects within the Cosmos ecosystem, we are constantly expanding our cross-chain capabilities and adding new investment opportunities for our users.

| Benefits of Orbiter Finance’s Cross-Chain Liquidity Pools: |

|---|

| 🌐 Seamless interaction between different Cosmos Chains |

| 💰 Diversified investments and enhanced returns |

| 🔒 Maximum efficiency and security |

| 👨💻 User-friendly interface for investors of all levels |

| 💼 Wide range of investment options |

| 🚀 Continuous expansion of cross-chain capabilities |

So why wait? Join Orbiter Finance today and maximize your investment opportunities with our game-changing Cross-Chain Liquidity Pools for Cosmos Chains.

Expanding Liquidity Options on Cosmos Chains

Orbiter Finance is excited to introduce its latest offering: Cross-Chain Liquidity Pools for Cosmos Chains. This innovative solution opens up a world of possibilities for investors, allowing them to maximize their investment opportunities and take advantage of the growing popularity of Cosmos Chains.

What are Liquidity Pools?

Liquidity pools are pools of tokens locked in smart contracts that enable efficient decentralized trading. By providing liquidity to a pool, investors can earn fees in return, based on their share of the total pool value. Traditionally, liquidity pools have been limited to a single blockchain network, but Orbiter Finance is changing that.

Expanding the Possibilities

By introducing Cross-Chain Liquidity Pools for Cosmos Chains, Orbiter Finance is expanding the liquidity options available to investors. This allows them to seamlessly transfer and trade their assets across different Cosmos Chains, enhancing liquidity and creating new trading opportunities.

With the growing number of Cosmos Chains and their increasing popularity, it has become crucial for investors to have access to diversified liquidity options. Orbiter Finance recognizes this need and is proud to provide a solution that addresses it.

The Benefits

Expanding liquidity options on Cosmos Chains brings several benefits to investors:

- Maximized Investment Opportunities: By accessing liquidity across different Cosmos Chains, investors can explore a wider range of investment opportunities and potentially maximize their returns.

- Enhanced Liquidity: Cross-Chain Liquidity Pools provide investors with increased liquidity, allowing them to easily buy, sell, and trade their assets without facing the limitations of a single blockchain network.

- Lower Transaction Costs: By utilizing Cross-Chain Liquidity Pools, investors can reduce transaction costs and enjoy more cost-effective trading options.

- Improved Flexibility: The ability to seamlessly transfer and trade assets across different Cosmos Chains provides investors with unparalleled flexibility and freedom.

Orbiter Finance’s Cross-Chain Liquidity Pools for Cosmos Chains revolutionize the way investors access liquidity and maximize their investment opportunities. Experience the benefits of expanded liquidity options and start exploring the possibilities today.

What is Orbiter Finance?

Orbiter Finance is a platform that offers cross-chain liquidity pools for Cosmos chains. It allows users to maximize their investment opportunities by providing liquidity between different Cosmos chains.

How do Orbiter Finance’s cross-chain liquidity pools work?

Orbiter Finance’s cross-chain liquidity pools work by allowing users to stake their tokens on one Cosmos chain and provide liquidity to another Cosmos chain. This enables users to earn rewards and fees from both chains, maximizing their investment opportunities.

What are the benefits of using Orbiter Finance?

Using Orbiter Finance offers several benefits, including the ability to diversify investments across different Cosmos chains, earn rewards and fees from multiple chains, and access previously unavailable investment opportunities. It also provides a seamless and user-friendly experience for managing cross-chain liquidity.

Are there any fees associated with using Orbiter Finance?

Yes, there are fees associated with using Orbiter Finance. These fees include transaction fees for staking and providing liquidity, as well as fees for withdrawing funds from the liquidity pools. The specific fee structure may vary depending on the Cosmos chain and the type of transaction being performed.