Maximizing Your Financial Potential with Orbiter Finance: A Step-by-Step Guide

Are you looking to take control of your finances and unlock your true money-making potential? Look no further than Orbiter Finance. With our step-by-step guide, we’ll help you navigate the complex world of finance and revolutionize the way you grow your wealth.

What is Orbiter Finance?

Orbiter Finance is a revolutionary financial platform designed to help individuals maximize their financial potential and achieve their financial goals. Whether you’re a beginner looking to learn the ropes of personal finance or an experienced investor looking to take your portfolio to the next level, Orbiter Finance is here to guide you every step of the way.

At Orbiter Finance, we believe that everyone deserves the opportunity to achieve financial success. That’s why we’ve created a comprehensive step-by-step guide that covers all aspects of personal finance, from budgeting and saving to investing and retirement planning. Our platform provides you with the tools, resources, and expertise you need to make informed financial decisions and reach your financial goals.

With Orbiter Finance, you can access a wide range of features and benefits, including:

- Interactive financial tutorials and courses

- Personalized financial goal setting and tracking

- Real-time portfolio management

- Expert financial advice and recommendations

- Access to a community of like-minded individuals

Our user-friendly interface makes it easy for anyone to get started on their financial journey. Whether you have a basic understanding of personal finance or are completely new to the concept, Orbiter Finance is here to guide you every step of the way.

Don’t let your financial potential go untapped. Start maximizing your financial potential with Orbiter Finance today!

Benefits of Orbiter Finance

Orbiter Finance offers a range of benefits that can help you maximize your financial potential and achieve your goals. Whether you are a beginner looking to learn the basics of finance or an experienced investor seeking to enhance your portfolio, Orbiter Finance has something for everyone.

1. Comprehensive Financial Education

With Orbiter Finance, you gain access to a comprehensive step-by-step guide that covers all aspects of finance. From understanding basic financial concepts to advanced investment strategies, our platform equips you with the knowledge and skills needed to make informed financial decisions.

2. Personalized Investment Planning

Orbiter Finance understands that every individual has unique financial goals and circumstances. That’s why we offer personalized investment planning services to help you create a customized investment strategy. Our team of experts will work closely with you to understand your needs and create a plan that aligns with your goals.

3. Diverse Investment Opportunities

When it comes to investing, diversification is key. Orbiter Finance provides access to a wide array of investment opportunities, including stocks, bonds, mutual funds, real estate, and more. Our platform enables you to diversify your portfolio and minimize risk while maximizing potential returns.

4. Tools and Resources

Orbiter Finance offers a suite of tools and resources that can aid in financial planning and investment management. From budgeting tools to interactive financial calculators, our platform ensures that you have all the necessary resources at your disposal to make smart financial decisions.

5. Community Support

When you join Orbiter Finance, you become part of a vibrant community of like-minded individuals who are passionate about finance. Through our community forums and discussion groups, you can connect with others, share insights, and learn from each other’s experiences, which can further enhance your financial knowledge and understanding.

Don’t miss out on the opportunity to maximize your financial potential. Join Orbiter Finance today and take control of your financial future!

Maximize Your Financial Potential

Are you looking to take control of your financial future? Orbiter Finance is here to help you achieve your financial goals and maximize your potential. Whether you are just starting out or a seasoned investor, our step-by-step guide will provide you with the tools and knowledge you need to make informed financial decisions.

Plan for Success

Creating a solid financial plan is the first step towards maximizing your potential. Our guide will walk you through the process of setting realistic goals, managing your budget, and saving for the future. With a clear plan in place, you can stay on track and make progress towards your financial objectives.

Invest with Confidence

Investing can be intimidating, but with Orbiter Finance by your side, you can invest with confidence. Our guide will teach you the fundamentals of investing, including how to diversify your portfolio, analyze market trends, and minimize risk. Whether you are interested in stocks, bonds, or real estate, we will help you make smart investment decisions that align with your goals.

With Orbiter Finance, you don’t need to be a financial expert to succeed. We have simplified the complexities of personal finance into easy-to-understand steps that anyone can follow. Start maximizing your financial potential today and secure your future with Orbiter Finance.

Step-by-Step Guide

At Orbiter Finance, we believe in empowering individuals to take control of their finances and maximize their financial potential. Our step-by-step guide provides you with the knowledge and tools you need to achieve your financial goals.

Evaluate Your Current Finances

The first step in our guide is to evaluate your current financial situation. Take a close look at your income, expenses, and debt. Understand where your money is going and identify areas where you can make adjustments.

By evaluating your current finances, you can create a solid foundation for building wealth and financial stability.

Create a Budget

Once you have evaluated your current finances, it’s time to create a budget. A budget is a financial plan that helps you track your income and expenses. It allows you to prioritize your spending and find areas where you can save.

In our step-by-step guide, we will show you how to create a budget that aligns with your financial goals. Whether you want to pay off debt, save for a house, or invest for the future, a budget is an essential tool to help you achieve these goals.

Our guide will provide you with tips and strategies to create a realistic budget that works for you.

Build an Emergency Fund

An emergency fund is a crucial component of a sound financial plan. It provides a safety net for unexpected expenses, such as medical bills or car repairs.

In our step-by-step guide, we will guide you on how to build an emergency fund and set aside money for unforeseen circumstances. We will show you how to determine the right amount for your emergency fund and provide strategies to help you reach your savings goals.

Pay Off Debt

Debt can be a significant burden on your financial well-being. Our step-by-step guide will help you develop a debt repayment plan and provide strategies to pay off your debt efficiently.

By paying off your debt, you can free up money for other financial goals and improve your overall financial health.

Invest for the Future

Investing is an essential part of building wealth and achieving your long-term financial goals. In our step-by-step guide, we will introduce you to the world of investing and provide you with the knowledge and tools you need to get started.

From understanding different investment options to creating a diversified portfolio, our guide will equip you with the skills to make informed investment decisions.

| Step | Summary |

|---|---|

| Evaluate Your Current Finances | Assess your income, expenses, and debt to understand your financial situation. |

| Create a Budget | Develop a budget to track your income and expenses and prioritize your spending. |

| Build an Emergency Fund | Set aside money for unexpected expenses to create financial security. |

| Pay Off Debt | Develop a debt repayment plan to eliminate debt and improve your financial health. |

| Invest for the Future | Learn about different investment options and create a plan for long-term wealth building. |

With Orbiter Finance’s step-by-step guide, you can take control of your finances and maximize your financial potential. Start your journey towards financial success today!

How to Get Started with Orbiter Finance

Welcome to Orbiter Finance, where we believe in helping you maximize your financial potential. Whether you are a seasoned investor or just starting out, our step-by-step guide will show you how to get started with Orbiter Finance and take control of your financial future.

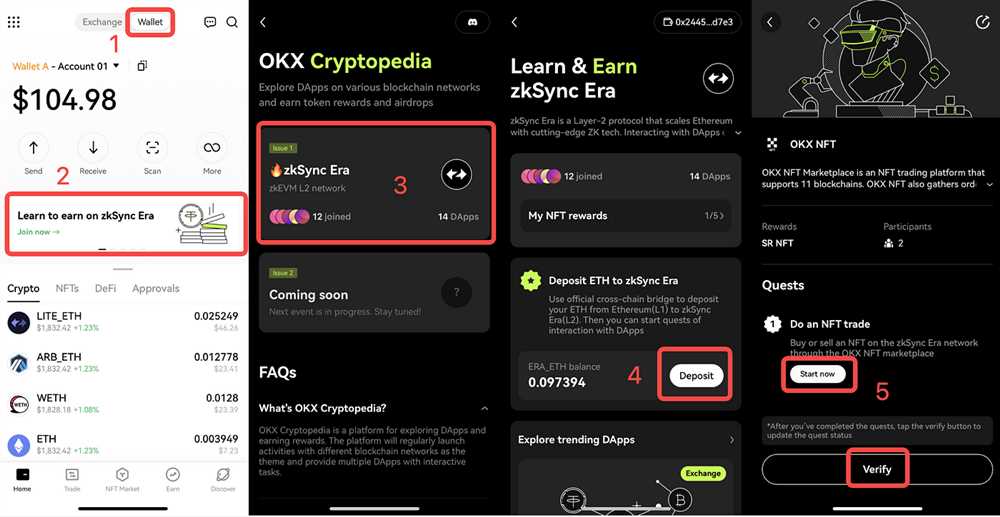

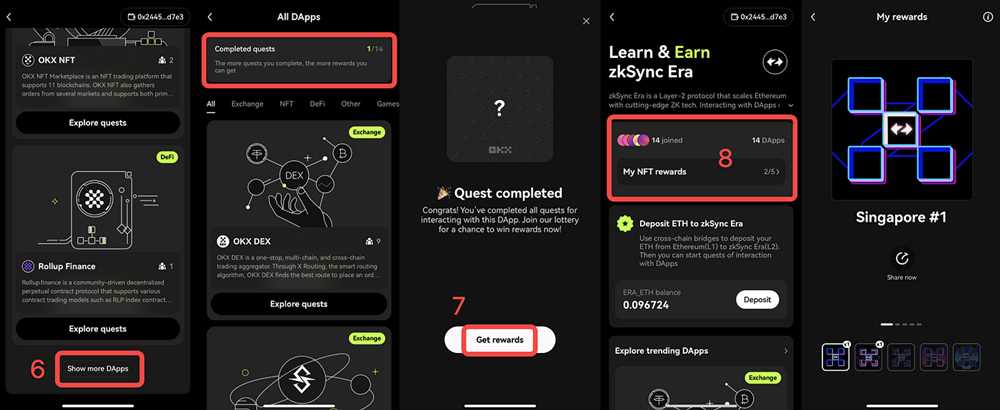

1. Sign Up for an Account

The first step to getting started with Orbiter Finance is to sign up for an account. Simply visit our website and click on the “Sign Up” button. Fill out the required information and create a secure password. Once your account is created, you will have access to all the features and tools that Orbiter Finance has to offer.

2. Explore Your Dashboard

After signing up, you will be directed to your personalized dashboard. This is where you will find all the information and tools you need to manage your finances effectively. Take some time to familiarize yourself with the different sections of your dashboard, such as your portfolio, financial goals, and performance charts. This will help you track your progress and make informed investment decisions.

3. Set Your Financial Goals

Before you start investing, it’s important to set your financial goals. Ask yourself what you hope to achieve with your investments and how much risk you are willing to take. Orbiter Finance offers a variety of investment plans, each with its own level of risk and potential return. Assess your risk tolerance and choose a plan that aligns with your financial goals.

4. Start Investing

Once you have set your financial goals and chosen an investment plan, it’s time to start investing. Orbiter Finance offers a wide range of investment options, including stocks, bonds, mutual funds, and more. Our platform provides you with the tools and resources you need to research and select the best investment opportunities for your portfolio. Start with small investments and gradually increase your portfolio as you gain confidence and experience.

By following these steps, you will be well on your way to maximizing your financial potential with Orbiter Finance. Take control of your financial future today and start investing with confidence.

Note: Investing involves risk, and past performance does not guarantee future results. It’s important to do your own research and consult with a financial advisor before making any investment decisions.

Disclaimer: The information provided in this guide is for informational purposes only and should not be considered as financial advice. Orbiter Finance is not a registered investment advisor and does not provide investment advice. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

What is Orbiter Finance?

Orbiter Finance is a comprehensive guide that helps you maximize your financial potential. It offers step-by-step strategies and techniques to improve your financial situation and achieve your financial goals.

Who is Orbiter Finance suitable for?

Orbiter Finance is suitable for anyone who wants to improve their financial situation and achieve their financial goals. Whether you are just starting out or have some experience with personal finance, this guide can help you take your finances to the next level.

What topics are covered in Orbiter Finance?

Orbiter Finance covers a wide range of topics related to personal finance. It includes budgeting, saving, investing, debt management, retirement planning, and more. It provides a comprehensive roadmap to help you navigate the complexities of personal finance.

How can Orbiter Finance help me?

Orbiter Finance provides you with practical tips and strategies to improve your financial situation. It helps you create a budget, save money, invest wisely, manage your debt effectively, and plan for your retirement. By following the step-by-step guide, you can maximize your financial potential and achieve your financial goals.

Is Orbiter Finance suitable for beginners?

Yes, Orbiter Finance is suitable for beginners. It provides clear and easy-to-understand explanations of personal finance concepts and offers step-by-step guidance. Even if you have no prior knowledge of personal finance, this guide can help you build a strong foundation and take control of your financial future.