Orbiter Finance Bridging the Gap Between Ethereum Native Assets and Rollups

Orbiter Finance is revolutionizing the way we interact with Ethereum-native assets by bridging the gap between Layer 1 and Layer 2 solutions. With the rise of layer 2 rollups, the scalability of the Ethereum network has significantly improved. However, there has been a lack of interoperability between these rollups and Ethereum-native assets, hindering the full potential of decentralized finance (DeFi).

With Orbiter Finance, this problem is being solved. By leveraging advanced bridging and wrapping technologies, Orbiter Finance allows users to seamlessly transfer their Ethereum-native assets between Layer 1 and Layer 2 solutions. This means that users can now enjoy the benefits of fast and low-cost transactions on layer 2 rollups without sacrificing the security and liquidity of their Ethereum-native assets.

But Orbiter Finance goes beyond just bridging assets. It also provides a powerful suite of tools and services for developers and users to interact with these assets in a seamless and efficient manner. From decentralized exchanges (DEX) to lending platforms, Orbiter Finance’s ecosystem is designed to support and enhance the growing DeFi ecosystem.

Powered by the Orbiter token (ORB), the platform incentivizes participants to contribute to the network’s security and functionality. By staking ORB tokens, users can earn rewards and participate in the governance of the platform, ensuring that it remains decentralized and community-driven.

With Orbiter Finance, the future of Ethereum-native asset interoperability is here. Join the revolution and experience a new era of decentralized finance.

Orbiter Finance: Bridging Ethereum-native Assets and Rollups

Orbiter Finance is a protocol designed to bridge the gap between Ethereum-native assets and rollups,

offering more efficient and seamless asset transfers between these two ecosystems. With the rise in popularity

of Layer 2 solutions like rollups, there is a growing need to facilitate the movement of assets between the

Ethereum mainnet and these scaling solutions. Orbiter Finance aims to address this challenge by providing

a reliable and secure bridge for Ethereum-native assets to seamlessly move between these networks.

The Need for Bridging Ethereum-native Assets and Rollups

Ethereum-native assets are assets that are native to the Ethereum network and adhere to its standards,

such as ERC-20 tokens. While Layer 2 solutions like rollups offer scalability benefits, their integration

with Ethereum mainnet presents certain challenges when it comes to asset transfers.

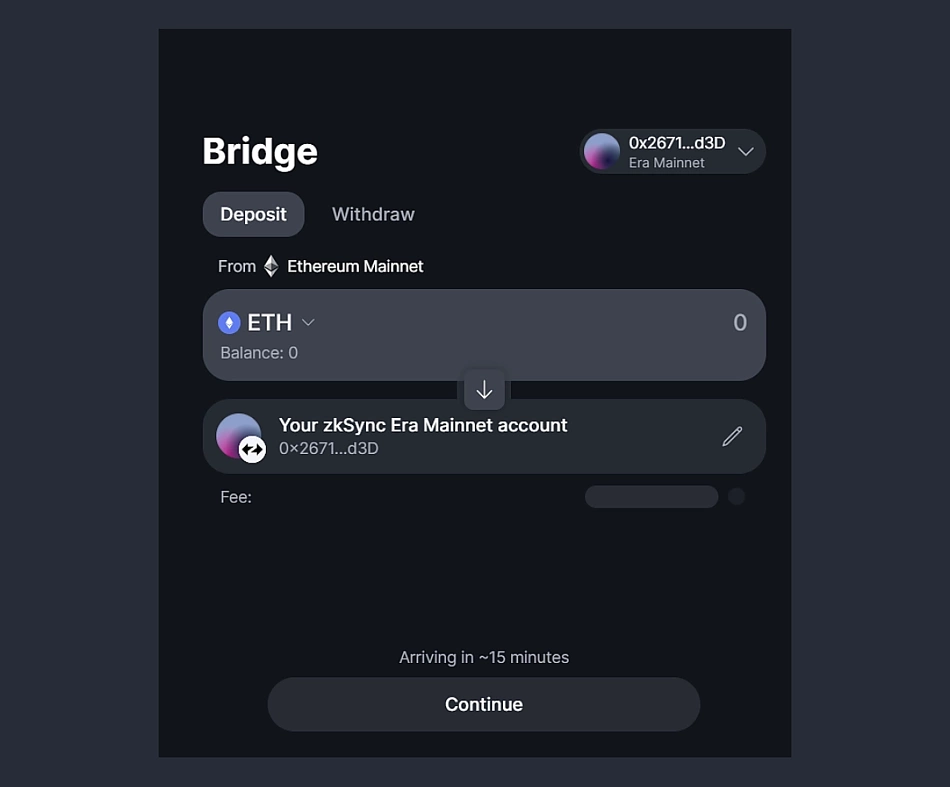

Currently, transferring assets from Ethereum mainnet to a rollup requires a user to go through a multi-step

process, involving depositing assets to the rollup, waiting for the transfer to be confirmed, and then

withdrawing the assets back to Ethereum mainnet if needed. This process can be time-consuming, cumbersome,

and costly due to gas fees.

The Orbiter Finance Solution

Orbiter Finance aims to simplify and streamline the asset transfer process between Ethereum-native assets

and rollups. By providing a reliable bridge, users can seamlessly transfer their assets between the Ethereum

mainnet and rollups, without the need for complicated and time-consuming steps.

The protocol achieves this by leveraging bridges and smart contracts to facilitate the movement of assets

between Ethereum-native networks and rollups. Users can initiate asset transfers through the Orbiter Finance

interface, and the protocol takes care of the rest, ensuring a secure and efficient transfer of assets.

Additionally, Orbiter Finance also aims to provide liquidity solutions for rollups, enabling users to easily

convert their assets between different rollup networks. This not only enhances the interoperability between

rollups but also increases the usability and accessibility of Ethereum-native assets on these layer 2 solutions.

With Orbiter Finance, users can enjoy the benefits of rollups, such as scalability and reduced transaction

costs, without compromising on the ease and simplicity of asset transfers. This furthers the adoption of

Ethereum-native assets and rollups, making them more accessible and user-friendly for a wider audience.

In conclusion, Orbiter Finance plays a crucial role in bridging the gap between Ethereum-native assets and rollups. By providing a reliable and efficient bridge, the protocol simplifies the asset transfer process and enhances the usability of Ethereum-native assets on rollups. With the increasing popularity of rollups as a scaling solution, Orbiter Finance’s solution is well-positioned to support the growing demand for seamless asset transfers between these networks.

Connecting DeFi Assets

Orbiter Finance aims to revolutionize the way decentralized finance (DeFi) assets are connected. By leveraging the power of Ethereum-native assets and rollups, Orbiter Finance creates a seamless and efficient ecosystem for DeFi users.

Traditionally, DeFi assets have been isolated and siloed, with limited interoperability between different platforms. This has created barriers to innovation and restricted the potential of DeFi. Orbiter Finance seeks to break down these barriers by providing a comprehensive solution for connecting DeFi assets.

Ethereum-Native Assets

At the core of Orbiter Finance’s approach is the use of Ethereum-native assets. These assets are built on the Ethereum blockchain and can be seamlessly integrated with other protocols and platforms. By leveraging the existing infrastructure of Ethereum, Orbiter Finance ensures compatibility with a wide range of DeFi assets.

By connecting Ethereum-native assets, Orbiter Finance enables users to access a diverse range of DeFi protocols without the need for multiple wallets or complex integrations. This streamlines the user experience and simplifies the management of DeFi assets.

Rollups for Scalability

In addition to Ethereum-native assets, Orbiter Finance utilizes rollups to enhance scalability and reduce transaction costs. Rollups are Layer 2 solutions that bundle multiple transactions together and submit them as a single batch to the Ethereum mainnet. This significantly reduces the load on the Ethereum network and allows for faster and cheaper transactions.

By integrating rollups, Orbiter Finance ensures that transactions involving DeFi assets are efficient and cost-effective. This scalability opens up new possibilities for DeFi users, enabling them to navigate the rapidly expanding ecosystem with ease.

Overall, Orbiter Finance’s approach to connecting DeFi assets is poised to transform the DeFi landscape. By leveraging Ethereum-native assets and rollups, Orbiter Finance enables users to unlock the full potential of DeFi and harness the power of decentralized finance.

Enhancing Scalability with Rollups

Scalability has been a long-standing challenge in the Ethereum ecosystem. As the popularity of decentralized applications (dApps) has grown, so have the concerns over congestion and high transaction fees on the Ethereum mainnet. To address these issues, Layer 2 solutions like rollups have emerged as a promising solution.

Rollups work by bundling multiple transactions together and submitting them to the Ethereum mainnet as a single transaction. This significantly reduces the number of transactions that need to be processed on the mainnet, leading to increased scalability. The bundled transactions are verified off-chain and only the final state is stored on-chain, resulting in reduced gas fees and faster transaction times.

There are two types of rollups: optimistic rollups and zk-rollups. Optimistic rollups rely on the assumption that most transactions are valid and only rely on the Ethereum mainnet to settle disputes. This makes them more efficient but introduces some level of trust. On the other hand, zk-rollups use zero-knowledge proofs to ensure the validity of every transaction, eliminating the need for trust but requiring more computational resources.

The integration of rollups into the Orbiter Finance platform paves the way for enhanced scalability for Ethereum-native assets. By utilizing rollups, Orbiter Finance can process a large number of transactions off-chain, reducing congestion and lowering gas fees. This enables users to interact with Ethereum-native assets more seamlessly and cost-effectively.

Rollups also provide increased security for assets on the Orbiter Finance platform. By relying on the Ethereum mainnet for settlement, the final state of the bundled transactions is secured by the underlying Ethereum network. This ensures the integrity and safety of users’ assets, giving them peace of mind while transacting on Orbiter Finance.

In conclusion, rollups offer a scalable solution to address the challenges faced by the Ethereum ecosystem. By bundling transactions and verifying them off-chain, rollups enhance scalability, reduce gas fees, and improve transaction speeds. The integration of rollups into the Orbiter Finance platform further enhances its capabilities, providing users with a seamless and secure experience when interacting with Ethereum-native assets.

What is Orbiter Finance?

Orbiter Finance is a protocol that aims to connect Ethereum-native assets and Layer 2 rollups, improving scalability and affordability for users.

How does Orbiter Finance achieve its goal?

Orbiter Finance achieves its goal by allowing users to bridge their assets between Ethereum and Layer 2 rollups, enabling seamless transfer and utilization of assets across different networks.

What are Ethereum-native assets?

Ethereum-native assets are assets that are created and used solely on the Ethereum network, such as ETH, ERC-20 tokens, and NFTs.

What are Layer 2 rollups?

Layer 2 rollups are scaling solutions built on top of the Ethereum blockchain that aim to increase transaction throughput and reduce fees by processing transactions off-chain and then committing the final results on-chain.

Why is connecting Ethereum-native assets and rollups important?

Connecting Ethereum-native assets and rollups is important as it allows users to take advantage of the scalability and affordability benefits of Layer 2 solutions while still being able to access and use their assets on the Ethereum network.