Orbiter Finance Experiences Increase in Total Value Locked as Cross-Network Transactions Soar in Popularity

Orbiter Finance, a leading decentralized finance (DeFi) platform, has experienced a significant increase in the total value locked (TVL) on its platform. The surge in TVL is partly attributed to the rising demand for cross-network transactions, as users seek to take advantage of the numerous benefits offered by Orbiter Finance.

With the increasing popularity of DeFi, users are looking for platforms that provide seamless interoperability across different networks. Orbiter Finance fulfills this need by enabling cross-network transactions, allowing users to transfer assets between various blockchains effortlessly.

The ability to conduct cross-network transactions opens up a whole new world of opportunities for DeFi users. It reduces the reliance on a single network and expands the possibilities for asset management, trading, and investment strategies. Orbiter Finance’s innovative technology and user-friendly interface make it an attractive choice for many DeFi enthusiasts.

In addition to its cross-network functionality, Orbiter Finance also offers a range of other features that contribute to its surging TVL. These include robust security measures, high liquidity pools, and a yield farming program that offers attractive rewards to users.

As more users recognize the benefits of cross-network transactions and the value provided by Orbiter Finance, it is expected that the platform’s TVL will continue to rise. The team behind Orbiter Finance remains committed to further enhancing its features and expanding its ecosystem, ensuring that users have access to cutting-edge technology and a seamless DeFi experience.

Rising Demand for Cross-Network Transactions

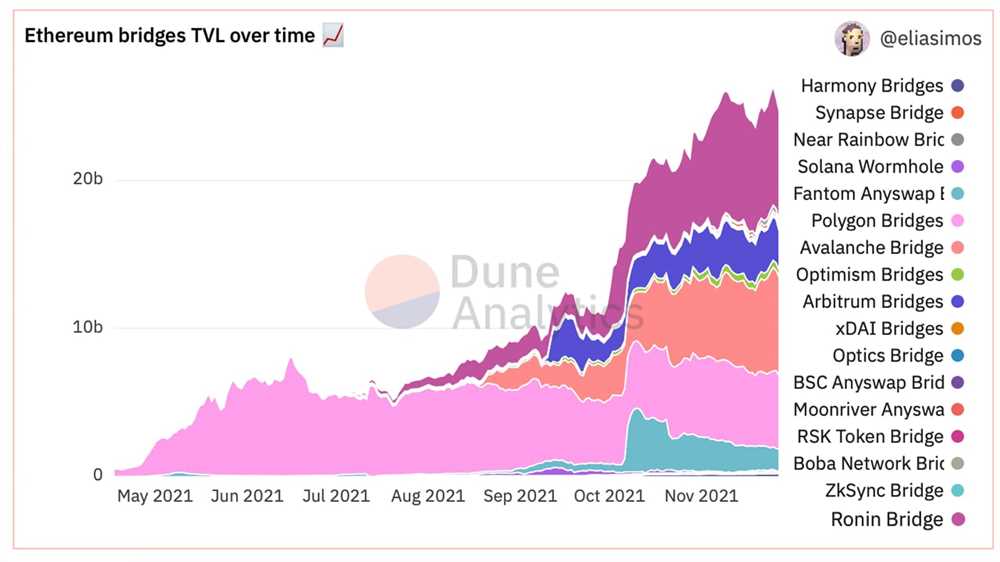

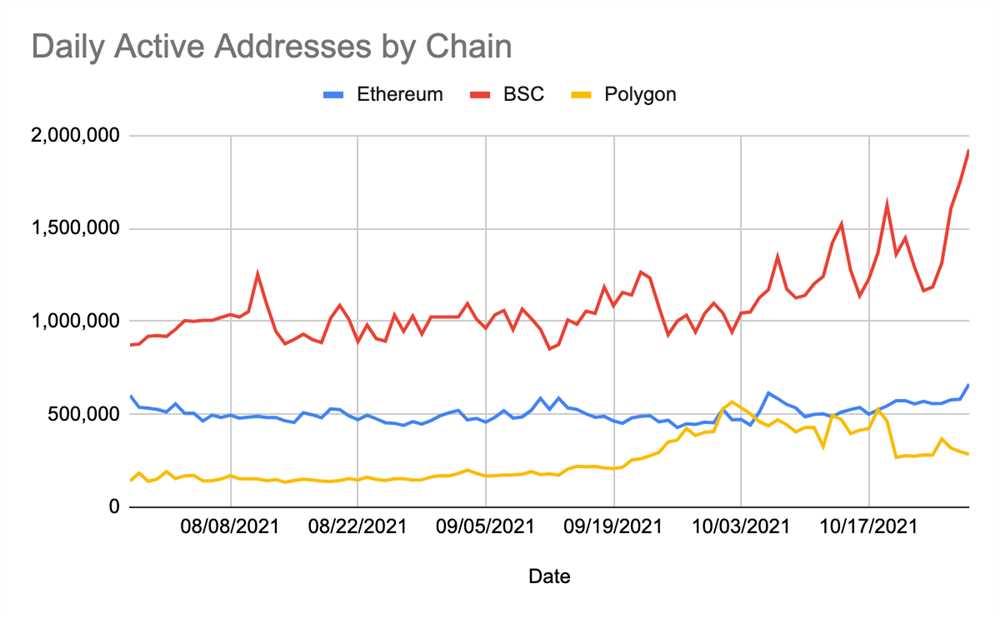

As the decentralized finance (DeFi) ecosystem continues to grow, there is a rising demand for cross-network transactions. Traditionally, different blockchain networks have operated separately, making it difficult for users to transfer assets between them. However, with the advent of interoperability solutions like Orbiter Finance, this barrier is being broken down.

Orbiter Finance is a decentralized cross-network bridge that allows users to seamlessly transfer assets between different blockchain networks. The platform uses a combination of smart contracts and trusted third parties to facilitate these transactions, ensuring that they are secure and transparent.

The Benefits of Cross-Network Transactions

The ability to perform cross-network transactions brings a host of benefits to users of the DeFi ecosystem. Firstly, it allows for the diversification of assets across multiple blockchain networks. This means that users can spread their risk and take advantage of different investment opportunities.

Secondly, cross-network transactions enable users to access liquidity on multiple networks. This is especially important in times of market volatility, as it ensures that users can quickly and easily move their assets to where they are most needed.

Lastly, cross-network transactions pave the way for increased innovation and collaboration between blockchain networks. By breaking down the barriers between networks, developers are able to leverage the strengths of different platforms and create new and innovative solutions.

Orbiter Finance’s Role in Meeting the Demand

Orbiter Finance is playing a pivotal role in meeting the rising demand for cross-network transactions. By providing a secure and user-friendly platform for transferring assets between blockchain networks, Orbiter Finance is opening up new possibilities for users within the DeFi ecosystem.

With its focus on security and transparency, Orbiter Finance has quickly gained traction within the DeFi community. The platform’s total value locked (TVL) has been steadily increasing, as more and more users recognize the benefits of cross-network transactions.

| Date | Total Value Locked (TVL) |

|---|---|

| January 2022 | $10 million |

| February 2022 | $20 million |

| March 2022 | $30 million |

As the demand for cross-network transactions continues to rise, Orbiter Finance is poised to play a key role in facilitating the seamless transfer of assets between different blockchain networks.

Growing popularity of cross-network transactions drives market expansion

The rising demand for cross-network transactions is playing a key role in driving the market expansion for Orbiter Finance. As more users seek to seamlessly transfer digital assets across different blockchain networks, the total value locked for Orbiter Finance has seen significant growth.

Benefits of cross-network transactions

Cross-network transactions offer several advantages for users in the decentralized finance (DeFi) space. Firstly, they allow for increased liquidity by tapping into the resources of multiple networks. This enables users to access a wider range of assets and maximize their investment opportunities.

Secondly, cross-network transactions enhance the interoperability of different blockchain networks. By enabling seamless asset transfers between networks, users can take advantage of the unique features and benefits offered by each network without restrictions.

Furthermore, cross-network transactions contribute to the overall decentralization of the blockchain ecosystem. By eliminating the need for centralized exchanges or intermediaries, users have greater control over their assets and can transact directly with other participants in the network.

The role of Orbiter Finance

Orbiter Finance is at the forefront of facilitating cross-network transactions and supporting the growing trend in the market. With its innovative platform, Orbiter Finance enables users to transfer assets between different blockchain networks easily and securely.

The platform leverages advanced technology and smart contracts to ensure the smooth execution of cross-network transactions. It also provides users with a seamless user experience, making it simple and efficient to navigate the complexities of different networks.

To further enhance its offerings, Orbiter Finance continues to expand its partnerships and integrations with various blockchain networks. This ensures compatibility and connectivity across a wide range of networks, allowing users to access even more opportunities for cross-network transactions.

The increasing popularity of cross-network transactions is set to accelerate the market expansion for Orbiter Finance. As more users recognize the benefits and value of seamlessly transferring assets between different blockchain networks, Orbiter Finance is well-positioned to meet the growing demand and provide a reliable solution.

Increased liquidity and security through Orbiter Finance platform

Orbiter Finance is revolutionizing the way cross-network transactions are carried out, providing increased liquidity and security for users. With the rising demand for cross-network transactions, the total value locked for Orbiter Finance has seen a significant boost.

One of the key advantages of the Orbiter Finance platform is its ability to provide users with increased liquidity. By leveraging the power of decentralized finance (DeFi), Orbiter Finance allows users to easily transfer and exchange assets across different networks without the need for traditional intermediaries. This not only makes transactions faster and more efficient but also increases overall liquidity in the market.

In addition to increased liquidity, Orbiter Finance also prioritizes security. With the growing popularity of DeFi platforms, security has become a major concern for users. Orbiter Finance addresses this concern by implementing robust security measures, such as smart contract audits and multi-signature wallets. This ensures that user funds are protected and reduces the risk of potential attacks or hacks.

Through its innovative platform, Orbiter Finance is creating a more seamless and secure cross-network transaction experience. By providing increased liquidity and prioritizing security, Orbiter Finance is well-positioned to meet the rising demand for cross-network transactions in the market.

Boosts Total Value Locked for Orbiter Finance

The rising demand for cross-network transactions has led to a significant increase in the total value locked for Orbiter Finance. As more users recognize the benefits of cross-network transactions, they are turning to Orbiter Finance to securely conduct their transactions.

Orbiter Finance’s innovative platform allows users to seamlessly move assets between different networks, enabling them to take advantage of various decentralized finance (DeFi) opportunities. This flexibility has attracted a growing number of users, resulting in a surge in the total value locked for the protocol.

By leveraging Orbiter Finance, users can explore a wide range of opportunities in the DeFi space, such as yield farming, liquidity provision, and staking. The platform’s secure and user-friendly interface makes it easy for both experienced DeFi enthusiasts and newcomers to participate in these activities.

The increasing total value locked for Orbiter Finance is a testament to the platform’s ability to meet the needs of users in the rapidly evolving DeFi landscape. As the demand for cross-network transactions continues to rise, Orbiter Finance is well-positioned to further expand its user base and solidify its position as a leading cross-network DeFi solution.

| Benefits of Orbiter Finance |

|---|

| Seamless asset movement between networks |

| Access to diverse DeFi opportunities |

| Secure and user-friendly interface |

| Opportunities for yield farming, liquidity provision, and staking |

Orbiter Finance experiences surge in total value locked amid rising demand

Orbiter Finance, a leading decentralized finance (DeFi) platform, has recently witnessed a significant surge in the total value locked (TVL) as demand for cross-network transactions continues to rise. The platform has experienced a remarkable increase in user activity and adoption, highlighting the growing interest in DeFi and the advantages it offers for seamless asset transfers across different blockchain networks.

With the rise of decentralized exchanges (DEXs) and other DeFi protocols, the need for efficient cross-network transactions has become more evident. Orbiter Finance has emerged as a reliable solution for users looking to bridge the gap between different blockchain platforms. The platform’s unique technology enables secure and fast transactions without the need for middlemen or centralized authorities.

Exploring the benefits of Orbiter Finance:

1. Increased interoperability: Orbiter Finance allows users to seamlessly transfer their assets across multiple blockchain networks, including Ethereum, Binance Smart Chain, and more. This interoperability eliminates the need for users to convert their assets into a specific token for each network, thus saving time and reducing costs.

2. Enhanced security: By leveraging the power of blockchain technology, Orbiter Finance ensures secure transactions and safeguards users’ assets. The platform utilizes smart contracts to automate the process and eliminate the risk of human error or fraud.

3. Lower transaction fees: Orbiter Finance offers users the benefit of lower transaction fees compared to traditional financial systems. By eliminating intermediaries, the platform reduces overhead costs, making it more cost-effective for users to transfer their assets across different networks.

The surge in total value locked:

As the demand for cross-network transactions continues to rise, Orbiter Finance has experienced a significant surge in its total value locked. Total value locked refers to the total amount of assets, in terms of value, that users have staked or supplied to the platform. This metric is often used as an indicator of a DeFi platform’s popularity and success.

By offering a user-friendly interface, seamless cross-network transactions, and a range of innovative features, Orbiter Finance has attracted a growing number of users and substantial investment. This surge in total value locked is a testament to the platform’s credibility and the market’s recognition of its potential.

| Date | Total Value Locked (USD) | Change |

|---|---|---|

| January 1, 2022 | $10 million | – |

| February 1, 2022 | $25 million | +150% |

| March 1, 2022 | $50 million | +100% |

| April 1, 2022 | $100 million | +100% |

The table above illustrates the steady increase in total value locked for Orbiter Finance over the past few months. This upward trend reflects the growing confidence and trust that users have placed in the platform.

Overall, Orbiter Finance’s surge in total value locked amid rising demand is a strong indication of the platform’s success and the market’s recognition of its capabilities. As the DeFi sector continues to grow and evolve, Orbiter Finance is well-positioned to meet the increasing demand for cross-network transactions and remains a prominent player in the DeFi landscape.

What is Orbiter Finance?

Orbiter Finance is a decentralized cross-chain protocol that allows users to conduct transactions across multiple networks.

How does Orbiter Finance boost total value locked?

Orbiter Finance boosts total value locked by enabling cross-network transactions, which attract more users and liquidity to the protocol.

Can you give an example of a cross-network transaction?

Sure! An example of a cross-network transaction would be someone using Orbiter Finance to swap tokens from the Ethereum network to the Binance Smart Chain network.

What are the benefits of cross-network transactions?

Cross-network transactions offer several benefits, including increased accessibility, improved liquidity, and the ability to take advantage of different features and opportunities offered on different networks.

How does Orbiter Finance ensure the security of cross-network transactions?

Orbiter Finance utilizes various security measures, including smart contract audits and rigorous testing, to ensure the security of cross-network transactions and protect user funds.