Orbiter Finance, a leading decentralized finance (DeFi) platform, is considering the introduction of a native token to enhance its ecosystem and provide additional benefits to its users. With its user-friendly interface and innovative features, Orbiter Finance has quickly become a popular choice among DeFi enthusiasts.

By launching a native token, Orbiter Finance aims to create a stronger community and incentivize participation within its platform. The native token would serve as a utility token, enabling users to access exclusive features, receive rewards, and participate in governance decisions. This would enhance user engagement and loyalty, as well as provide an avenue for users to benefit from the growth of the Orbiter Finance ecosystem.

The introduction of a native token would also provide Orbiter Finance with the opportunity to expand its partnerships and collaborations within the DeFi space. By leveraging the native token, Orbiter Finance could forge strategic alliances with other DeFi projects, further enhancing its value proposition and attracting a wider user base. This could result in a virtuous cycle of increased adoption, liquidity, and overall growth for Orbiter Finance.

Overall, the potential launch of a native token with Orbiter Finance represents an exciting step forward for the platform and its users. By adding a native token to its ecosystem, Orbiter Finance aims to strengthen its community, enhance user engagement, and explore new avenues for growth and collaboration within the decentralized finance landscape.

What is Orbiter Finance

Orbiter Finance is a decentralized finance (DeFi) platform built on the Ethereum blockchain that aims to provide a suite of financial services and products. It offers a range of features, including automated market making (AMM), yield farming, staking, and lending.

The platform is designed to empower users by giving them full control and ownership of their assets. By leveraging the power of blockchain technology and smart contracts, Orbiter Finance eliminates the need for intermediaries and enables users to participate in a trustless and transparent ecosystem.

One of the key features of Orbiter Finance is its automated market maker (AMM). This system allows users to trade tokens directly on the platform, without the need for centralized exchanges. By providing liquidity to the platform’s liquidity pools, users can earn fees and rewards, while also contributing to the overall stability of the ecosystem.

In addition to the AMM, Orbiter Finance also offers a range of yield farming opportunities. Users can lock their tokens in liquidity pools and earn additional tokens as rewards. These rewards are distributed to users based on their contribution to the pool, providing an incentive for them to participate in the platform’s ecosystem.

Staking and Lending

Another feature offered by Orbiter Finance is staking. Users can stake their tokens and earn staking rewards, which are distributed based on the amount of tokens staked and the duration of the stake. Staking provides users with a passive income stream and also helps to secure the network by incentivizing token holders to keep their tokens locked up.

Orbiter Finance also plans to introduce a lending feature in the future, allowing users to borrow and lend tokens. This will enable users to earn interest on their holdings or access capital when needed, further expanding the use cases and utility of the platform.

Overall, Orbiter Finance aims to provide a comprehensive and user-friendly DeFi platform that empowers individuals and promotes the growth and development of the decentralized finance ecosystem.

Exploring Tokenization

In the rapidly evolving world of blockchain technology, tokenization has emerged as a powerful and innovative concept. Tokenization refers to the process of converting real-world assets or rights into digital tokens that can be stored, traded, or transferred on a blockchain network. This concept has gained significant attention and traction in various industries, including finance, real estate, art, and intellectual property.

With tokenization, assets that were traditionally illiquid, such as real estate properties or fine art pieces, can be easily divisible and traded in smaller fractions. This increases liquidity and accessibility, allowing a broader range of investors to participate in markets previously accessible only to a limited few. Tokenization also offers the potential for fractional ownership, enabling investors to diversify their portfolios across multiple assets.

Moreover, tokenization enhances transparency and efficiency in the transfer of assets. Blockchain technology provides an immutable record of ownership, eliminating the need for intermediaries and reducing costs associated with traditional processes. This ensures that ownership rights are accurately recorded and can be easily verified, which is particularly relevant in industries where provenance and authenticity are crucial.

In addition to digitizing physical assets, tokenization can also be applied to intangible assets, such as intellectual property or copyrights. By converting these rights into tokens, creators can better protect their work, track its usage, and monetize it through different channels or licensing agreements. Tokenization opens up new possibilities for creators to directly engage with their audience and tap into new revenue streams.

While tokenization presents numerous opportunities, it also comes with challenges and considerations. Regulatory frameworks and compliance requirements vary across jurisdictions, adding complexity to the tokenization process. Security and custody of digital assets must be robustly addressed to safeguard against hacks or theft. Additionally, governance models and mechanisms for resolving disputes need to be established to ensure the smooth functioning of tokenized ecosystems.

As blockchain technology continues to mature and gain wider adoption, the potential applications and benefits of tokenization are likely to expand further. By exploring tokenization, businesses and individuals can unlock new possibilities, reshape industries, and create more inclusive and efficient financial systems.

Benefits of a Native Token

A native token has several benefits that can greatly enhance the functionality and value of a decentralized platform like Orbiter Finance. Here are some key advantages of having a native token:

1. Incentivizes participation and engagement:

A native token can be used to incentivize users to actively participate in the platform. By offering rewards, discounts, or exclusive access to certain features, the native token encourages users to engage with the platform, contributing to its growth and success.

2. Facilitates decentralized governance:

With a native token, the platform can implement decentralized governance mechanisms, allowing token holders to participate in decision-making processes. This ensures that the community has a voice and can influence the direction of the platform, making it more democratic and inclusive.

3. Enables economic and financial interactions:

A native token serves as the medium of exchange within the ecosystem, facilitating economic transactions and financial interactions between users. This creates a self-sustaining economy where users can transact, trade, and invest using the native token, adding liquidity and value to the platform.

Furthermore, the native token can be integrated with other DeFi protocols, enabling seamless interoperability and unlocking new possibilities for users.

4. Enhances platform security:

By using a native token, the platform can reinforce security measures, such as implementing token-based access controls, conducting audits, or implementing anti-fraud mechanisms. This enhances the overall security of the platform, protecting user assets and data from potential threats.

5. Drives network effects and adoption:

A native token can create network effects, attracting more users to the platform and increasing its adoption. As the token gains value and popularity, it becomes an attractive investment opportunity, drawing in new users and fostering a thriving ecosystem.

In conclusion, a native token offers numerous benefits that can significantly enhance the functionality, security, and adoption of a decentralized platform like Orbiter Finance. By leveraging these advantages, the platform can create a vibrant ecosystem that fosters participation, economic interactions, and community governance.

The Future of Orbiter Finance

As Orbiter Finance continues to develop and grow, the future of the platform holds great promise. With its innovative approach to decentralized finance and the potential launch of a native token, Orbiter Finance aims to revolutionize the way people interact with digital assets.

Expanding the Ecosystem

One of the primary goals for the future of Orbiter Finance is to expand its ecosystem. By partnering with other DeFi projects and building strong relationships within the cryptocurrency community, Orbiter Finance aims to create a vibrant ecosystem that offers a wide range of financial solutions.

This expansion will not only benefit the existing Orbiter Finance users but will also attract new users to the platform. By providing a diverse set of services and opportunities, Orbiter Finance strives to become a one-stop-shop for all decentralized finance needs.

Enhancing the Native Token

If the launch of a native token becomes a reality, Orbiter Finance plans to continuously enhance its features and functionalities. The native token will play a crucial role within the ecosystem, allowing users to participate in governance decisions and access exclusive benefits and rewards.

Orbiter Finance aims to establish a strong and active community of token holders who actively contribute to the platform’s growth and development. By regularly engaging with the community through voting mechanisms and feedback channels, Orbiter Finance will ensure that the native token remains a valuable asset within the ecosystem.

| Benefits of the Native Token |

|---|

| 1. Governance rights: Holders of the native token will have the power to vote on important decisions regarding the platform’s future. |

| 2. Rewards and incentives: Token holders will be eligible for exclusive rewards and incentives, encouraging active participation and engagement. |

| 3. Staking and liquidity mining: The native token can be staked or used for liquidity mining, allowing users to earn additional tokens by participating in the platform. |

In summary, the future of Orbiter Finance looks promising, with plans to expand the ecosystem and enhance the native token. By creating a robust and community-driven platform, Orbiter Finance aims to revolutionize the decentralized finance space and provide users with innovative financial solutions.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance platform built on the Ethereum blockchain. It aims to provide users with a seamless and secure way to trade, invest, and earn yield on different cryptocurrencies.

Why is Orbiter Finance considering launching a native token?

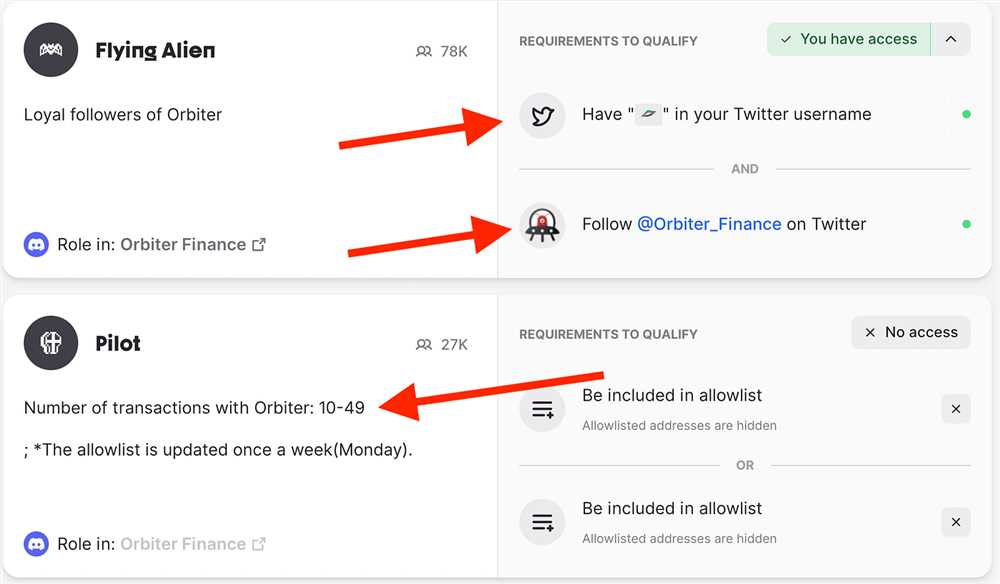

Orbiter Finance is considering launching a native token to provide additional benefits and incentives to its users. The native token can be used for governance, voting, and earning rewards within the Orbiter Finance ecosystem.

How will the launch of a native token benefit Orbiter Finance users?

The launch of a native token will benefit Orbiter Finance users in several ways. Firstly, it will provide them with a say in the platform’s decision-making through governance and voting rights. Moreover, holding the native token will grant users access to exclusive features and rewards within the ecosystem, which can enhance their overall trading and investment experience.