Orbiter Finance: Safeguarding against Protocol Failures and Market Downturns

Secure your investments with Orbiter Finance:

What if the protocols you rely on fail, putting your hard-earned money at risk? What if the market takes a sudden downturn, causing your investments to plummet?

Introducing Orbiter Finance, the innovative solution that protects your assets in the unpredictable world of decentralized finance.

Unparalleled protection with Orbiter Finance:

At Orbiter Finance, we understand the importance of safeguarding your investments. Our cutting-edge technology monitors protocols in real-time, identifying potential vulnerabilities and mitigating risks before they affect your funds.

With Orbiter Finance, you can rest assured that your investments are secure, even in the face of protocol failures or market downturns. Our team of experts continuously assesses the market landscape, making strategic adjustments to preserve and optimize your assets.

Your financial safety is our top priority:

With Orbiter Finance, you regain control over your investments. No longer will you have to worry about unforeseen events impacting your wealth. We provide the peace of mind and confidence you deserve.

Don’t let protocol failures and market downturns hinder your financial growth. Choose Orbiter Finance and navigate the unpredictable world of decentralized finance with confidence and security.

About Orbiter Finance

Orbiter Finance is a cutting-edge platform that provides innovative solutions for safeguarding against protocol failures and market downturns. With a team of experienced professionals, Orbiter Finance offers advanced tools and strategies to protect your investments and mitigate risks in the volatile DeFi market.

At Orbiter Finance, we understand the importance of security and risk management in the decentralized finance landscape. Our mission is to empower investors and traders by providing them with the necessary resources to navigate the complex world of DeFi.

Our platform leverages advanced algorithms and machine learning techniques to monitor the health of protocols and detect potential vulnerabilities before they can be exploited. We believe that proactive risk management is crucial in a rapidly evolving market, and we strive to stay ahead of the curve.

With an emphasis on transparency and user empowerment, Orbiter Finance provides real-time updates and insights to help you make informed investment decisions. Our team of experts continuously analyzes market trends and monitors the performance of protocols to identify potential risks and opportunities.

Whether you are a novice investor or an experienced trader, Orbiter Finance is here to help you navigate the ever-changing DeFi landscape with confidence and peace of mind. Join us today and start protecting your investments against protocol failures and market downturns.

Trust Orbiter Finance to safeguard your assets and secure your financial future.

Disclaimer: Orbiter Finance does not provide financial advice. Always do your own research and consult with a professional advisor before making any investment decisions.

The Need for Safeguarding

As the decentralized finance (DeFi) space continues to grow and evolve, the need for safeguarding against protocol failures and market downturns becomes increasingly important. The Orbiter Finance platform understands this need and provides innovative solutions to protect users’ funds and investments.

User Protection

One of the primary reasons why safeguarding is essential in the DeFi space is to ensure user protection. Without adequate measures in place, users are at risk of losing their funds due to protocol failures, smart contract vulnerabilities, or market manipulation.

Orbiter Finance addresses these concerns by implementing robust security protocols, conducting thorough audits of smart contracts, and leveraging advanced risk management strategies. By doing so, users can have peace of mind knowing that their assets are protected against potential hazards.

Market Volatility

The cryptocurrency market is known for its volatility, and DeFi projects are not immune to sudden market downturns. In these situations, investors may experience significant losses if they do not have proper safeguards in place.

Orbiter Finance recognizes the need for risk mitigation and provides users with various tools and features to manage market volatility effectively. These include automated stop-loss mechanisms, portfolio diversification strategies, and real-time market analysis.

Additionally, the platform offers a unique insurance fund that acts as a safety net, providing compensation in case of unforeseen events or extreme market conditions. This further enhances users’ confidence in navigating the DeFi landscape.

Learning from Past Mistakes

The importance of safeguarding in the DeFi space stems from past incidents and failures that have exposed the risks associated with decentralized protocols. These incidents have highlighted the need for proactive measures to protect users and their investments.

Orbiter Finance leverages these lessons to create a secure and resilient platform that learns from past mistakes. By continuously improving its security measures and risk management strategies, Orbiter Finance aims to set a new standard for safety and reliability in the DeFi industry.

- Thorough security protocols

- Regular smart contract audits

- Advanced risk-management strategies

- Automated stop-loss mechanisms

- Portfolio diversification strategies

- Real-time market analysis

- Unique insurance fund

In conclusion, the need for safeguarding against protocol failures and market downturns cannot be understated in the DeFi space. Orbiter Finance recognizes this need and provides users with the necessary tools and features to protect their funds and investments, while also learning from past mistakes. With Orbiter Finance, users can navigate the DeFi landscape with confidence and peace of mind.

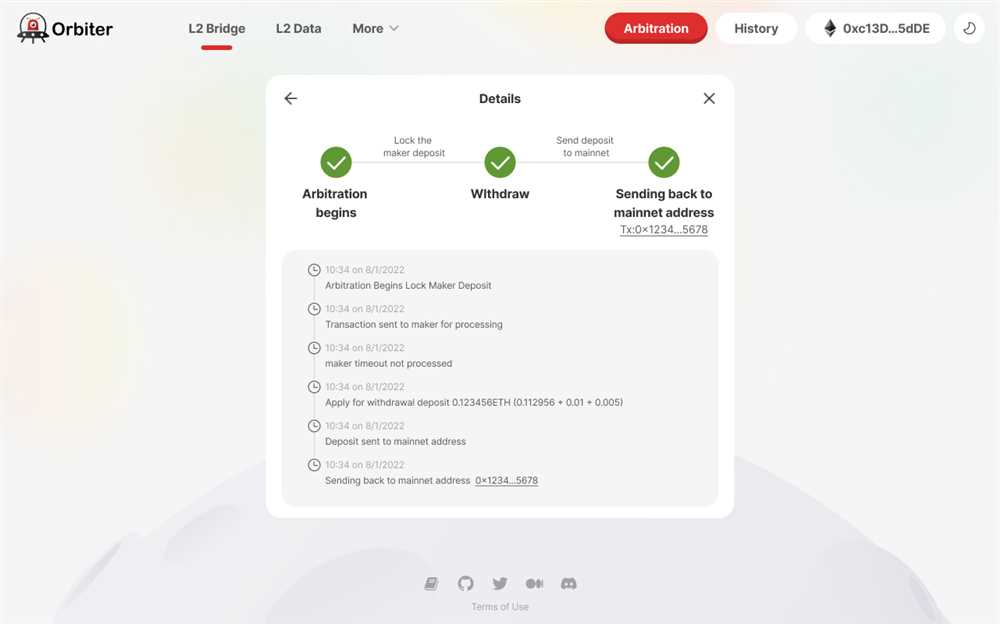

Protecting Against Protocol Failures

At Orbiter Finance, we understand the importance of safeguarding your investments against protocol failures. The decentralized finance (DeFi) space is constantly evolving, and with it comes the risk of unforeseen vulnerabilities in protocols.

Our team of experts closely monitors the DeFi landscape and conducts thorough audits to ensure that the protocols we support are secure and reliable. We believe in proactive risk management, which is why we work closely with developers to identify and mitigate potential vulnerabilities before they can cause any harm.

In addition to regular audits, we also offer insurance coverage for our users. This insurance provides an extra layer of protection in the event of a protocol failure, giving you peace of mind knowing that your assets are safeguarded.

Furthermore, our user-friendly platform provides real-time updates and notifications, keeping you informed about any protocol changes or updates that could affect your investments. We believe in transparency and strive to provide our users with the necessary tools and information to make informed decisions.

With Orbiter Finance, you can confidently navigate the DeFi space, knowing that your investments are protected against protocol failures. Join us today and experience the peace of mind that comes from investing with a trusted partner.

Understanding Protocol Risk

Investing in decentralized finance (DeFi) can be a lucrative opportunity, but it also comes with its fair share of risks. One of the key risks involved in DeFi is protocol risk.

Protocol risk refers to the potential for smart contracts and protocols to fail or be exploited, resulting in financial losses. While developers strive to create secure and robust protocols, it is important for investors to understand the potential risks they face.

There are several factors that contribute to protocol risk. One of the main factors is code vulnerability. Smart contracts are written in code, and any vulnerability or bug in the code can be exploited by malicious actors. This can lead to funds being stolen or manipulated.

Another factor to consider is the risk of a protocol being hacked. As DeFi becomes more popular and valuable, it attracts the attention of hackers. They may try to identify vulnerabilities in protocols and exploit them to their advantage.

Market risk is also an important consideration. Market downturns can have a significant impact on DeFi protocols. If the value of collateral decreases significantly or if there is a lack of liquidity, it can lead to protocol failures and financial losses.

To mitigate protocol risk, it is important for investors to do their due diligence. This includes thoroughly researching the protocol, understanding its codebase, and assessing the security measures in place. Investors should also diversify their investments across multiple protocols to spread their risk.

At Orbiter Finance, we understand the importance of safeguarding against protocol failures and market downturns. Our platform is designed to provide investors with a comprehensive risk assessment and monitoring solution. With our advanced technology and expertise, we aim to minimize protocol risk and maximize returns for our users.

Invest wisely, safeguard your investments.

Choose Orbiter Finance.

How Orbiter Finance Mitigates Risk

At Orbiter Finance, we understand that the DeFi space can be volatile and unpredictable. That’s why we have implemented a range of strategies to mitigate risk and protect our users’ investments.

1. Protocol Audits

We conduct thorough audits of the protocols we integrate with to ensure their security and reliability. Our team of experts evaluates the codebase and smart contracts, looking for any potential vulnerabilities or weaknesses. By partnering only with audited protocols, we reduce the risk of protocol failures and exploits.

2. Diversification

We believe in the power of diversification to reduce risk. Instead of relying on a single protocol, Orbiter Finance spreads investments across multiple platforms and protocols. This diversification strategy helps to protect against market downturns and decreases the potential impact of any single protocol failure.

3. Risk Management Strategies

Orbiter Finance has developed sophisticated risk management strategies to minimize exposure to market fluctuations. Through careful analysis and monitoring, we adjust our investment strategies in real-time to respond to changing market conditions. This proactive approach allows us to mitigate risk and maximize returns for our users.

In conclusion, Orbiter Finance is dedicated to safeguarding against protocol failures and market downturns. Through protocol audits, diversification, and risk management strategies, we strive to provide a secure and reliable platform for our users to invest in the decentralized finance ecosystem.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol that focuses on safeguarding against protocol failures and market downturns.

How does Orbiter Finance protect against protocol failures?

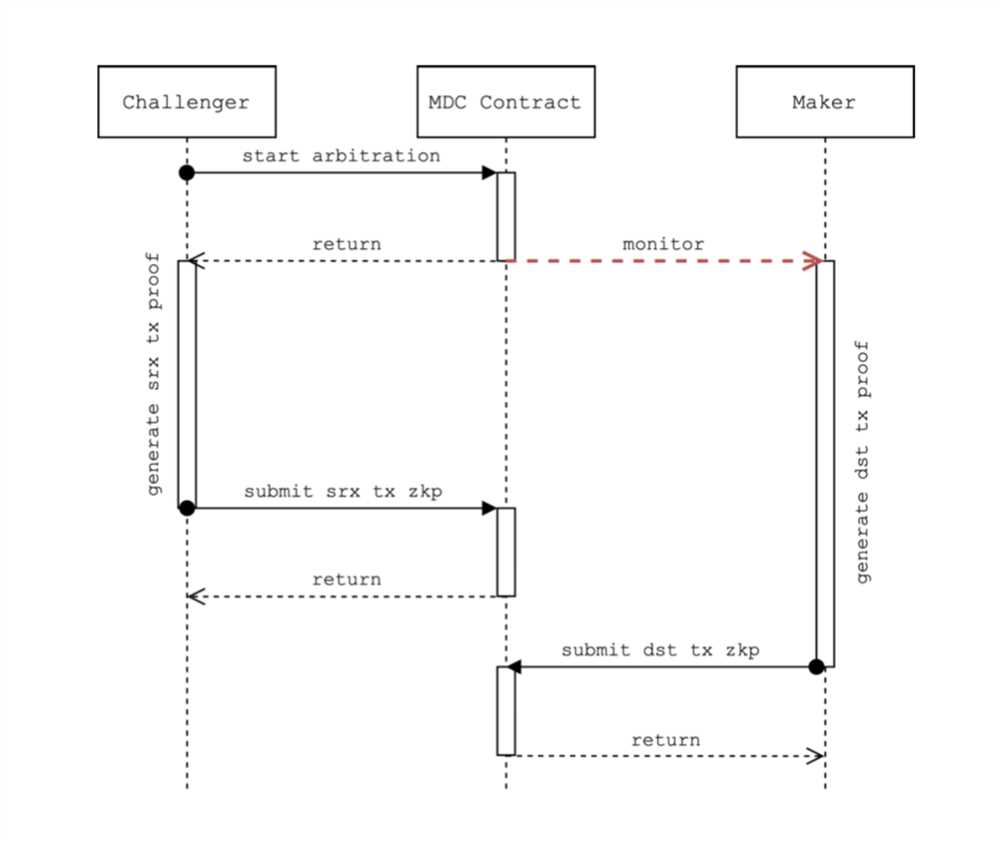

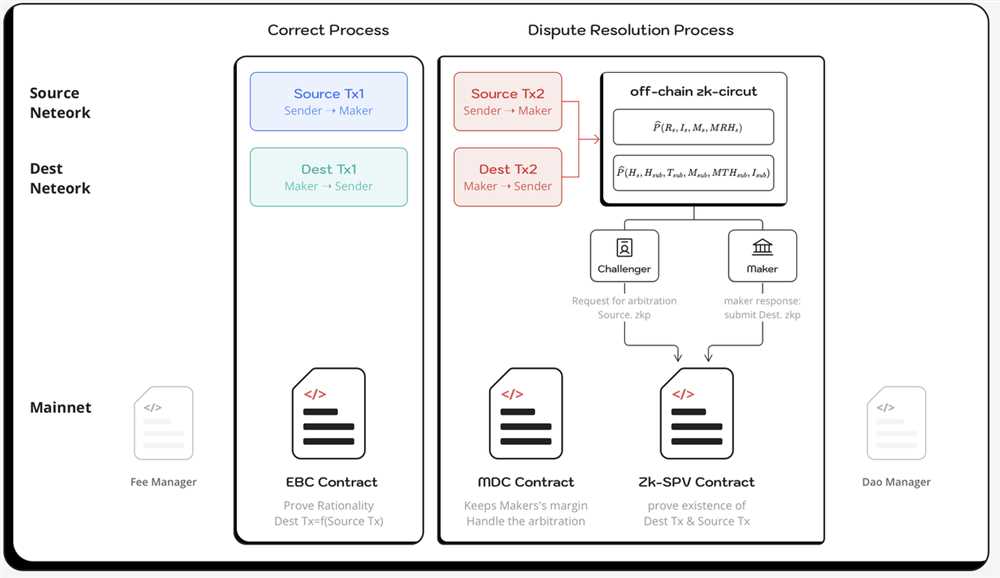

Orbiter Finance uses a combination of audits, monitoring tools, and careful risk management strategies to identify and mitigate potential protocol failures.

What does Orbiter Finance offer to protect against market downturns?

Orbiter Finance offers a dynamic market hedge feature that automatically adjusts the portfolio composition based on market conditions to protect against downturns.

Can I earn passive income with Orbiter Finance?

Yes, you can earn passive income by providing liquidity to the Orbiter Finance liquidity pools and by participating in the governance of the protocol.

Is Orbiter Finance audited?

Yes, Orbiter Finance has undergone multiple audits by reputable third-party firms to ensure the security and reliability of the protocol.