Orbiter Finance, the Decentralized Cross-Bridge Rollup Project, Faces Controversial Challenges

In the world of blockchain technology, innovation is a constant driving force. One such innovation that has recently gained attention is the decentralized cross-bridge rollup project called Orbiter Finance. This groundbreaking project aims to enhance scalability and interoperability within the blockchain ecosystem, allowing for seamless and secure transfer of assets across different chains.

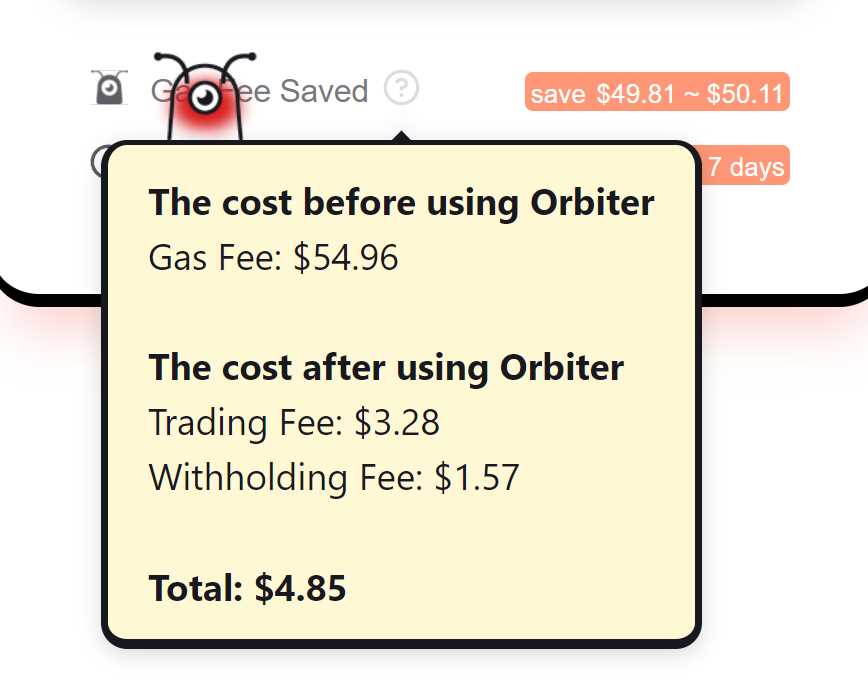

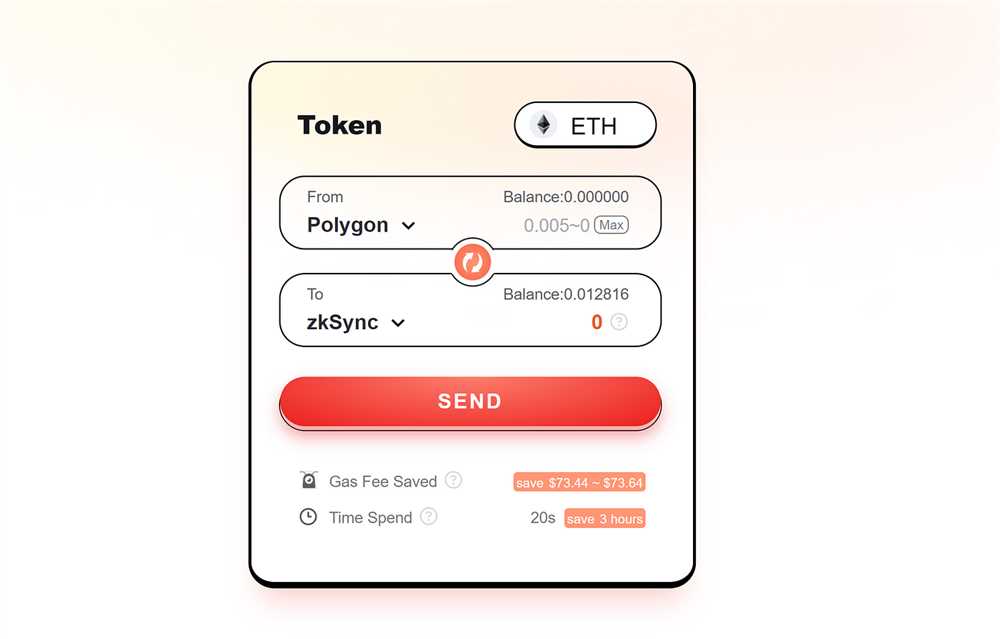

Orbiter Finance utilizes a unique combination of cross-chain bridges and layer-2 rollups, providing a decentralized solution for users to transact with various assets. By leveraging this technology, Orbiter Finance aims to address some of the major challenges faced by the blockchain industry, such as high transaction fees and slow confirmation times.

However, with any pioneering project, there often comes controversy. Orbiter Finance has not been immune to this. Critics argue that the project raises concerns about centralization and security risks, as it relies on cross-chain bridges that require trust in third-party validators. Additionally, some skeptics question the long-term viability of rollup solutions, citing potential scalability issues as the project grows.

Despite the controversy surrounding Orbiter Finance, it remains an intriguing project that has the potential to revolutionize the blockchain industry. As the team behind the project continues to refine and improve its technology, it will be interesting to see how Orbiter Finance addresses these concerns and proves its value in the ever-evolving world of decentralized finance.

The Orbiter Finance Project Overview

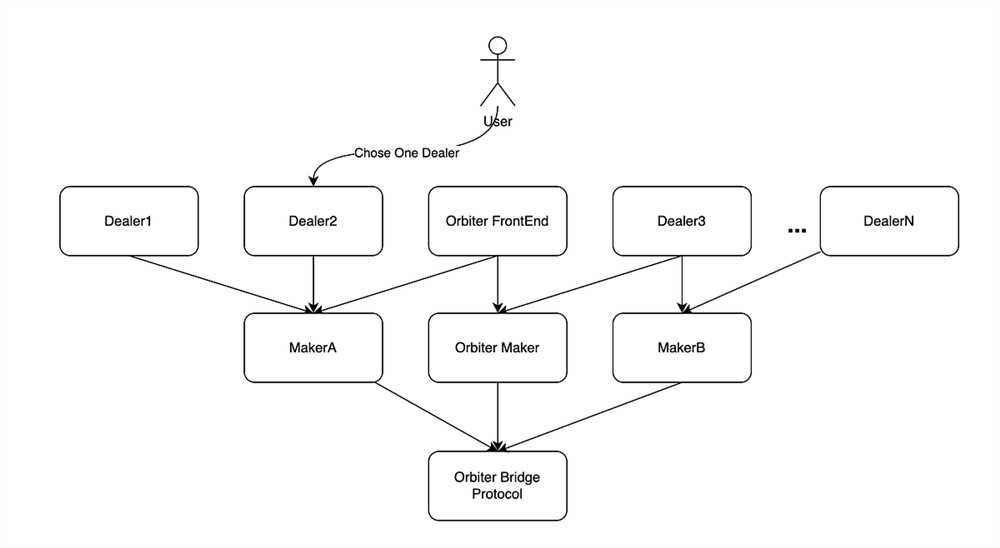

Orbiter Finance is a decentralized cross-bridge rollup project that aims to revolutionize the way users interact with different blockchain networks. It provides a seamless and efficient solution for cross-chain transactions and interoperability between various decentralized finance (DeFi) protocols.

The project utilizes innovative sharding and snark-based technology to offer faster, scalable, and secure transactions. By leveraging smart contracts and cryptography, Orbiter Finance ensures the integrity and privacy of every transaction conducted on its platform.

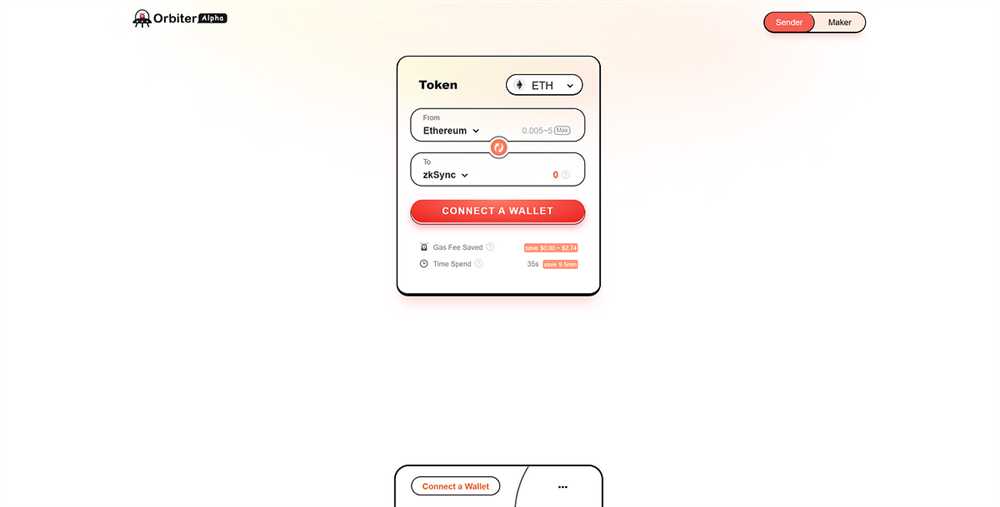

One of the main features of Orbiter Finance is its cross-bridge functionality, which allows users to easily transfer assets between different blockchains. This enables users to take advantage of the unique features and opportunities provided by each blockchain without the need for complex and time-consuming processes.

Additionally, the project aims to create a unified ecosystem for DeFi protocols, enabling seamless integration and collaboration among different applications. It provides a platform for developers to build and deploy new DeFi solutions, while also offering users a wide range of options to manage their digital assets and participate in various financial activities.

Moreover, Orbiter Finance is committed to fostering transparency and community governance. It empowers users by providing them with voting rights and decision-making capabilities, ensuring that the project evolves in a decentralized and collaborative manner.

In summary, Orbiter Finance is an ambitious project that seeks to bring about significant advancements in cross-chain interoperability and decentralized finance. Through its innovative technologies and user-centric approach, the project aims to unlock new possibilities and empower users in the rapidly evolving blockchain ecosystem.

The Cross-Bridge Rollup Technology

The Cross-Bridge Rollup technology is a groundbreaking innovation in the field of blockchain scalability. It addresses the main challenge of high fees and slow transaction times on popular blockchain networks such as Ethereum.

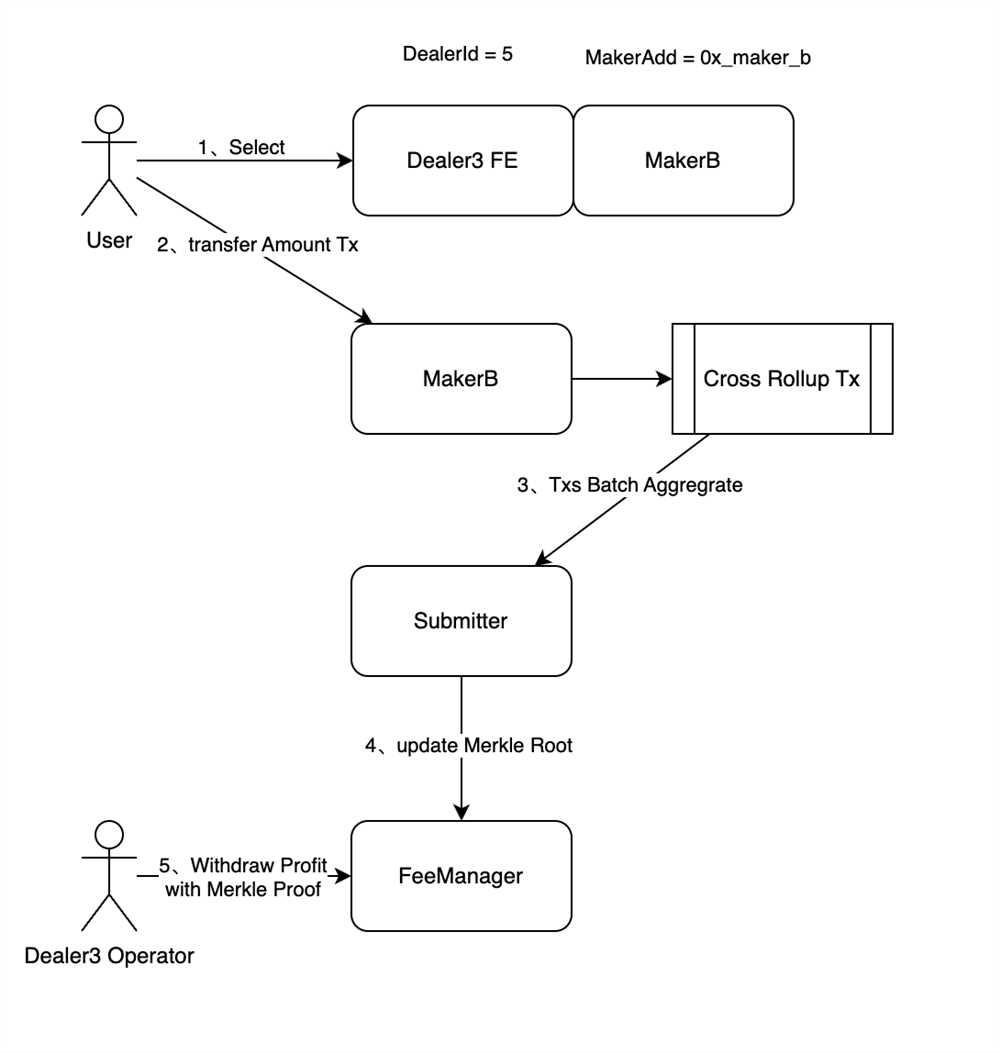

With the Cross-Bridge Rollup technology, multiple transactions are bundled together and processed off-chain, reducing the load on the main blockchain network. This approach allows for faster and cheaper transactions while leveraging the security guarantees of the underlying blockchain.

How does it work?

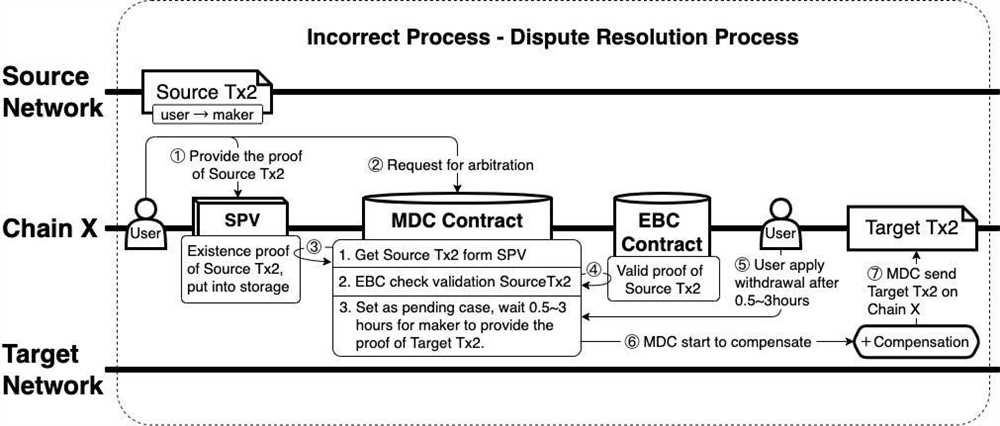

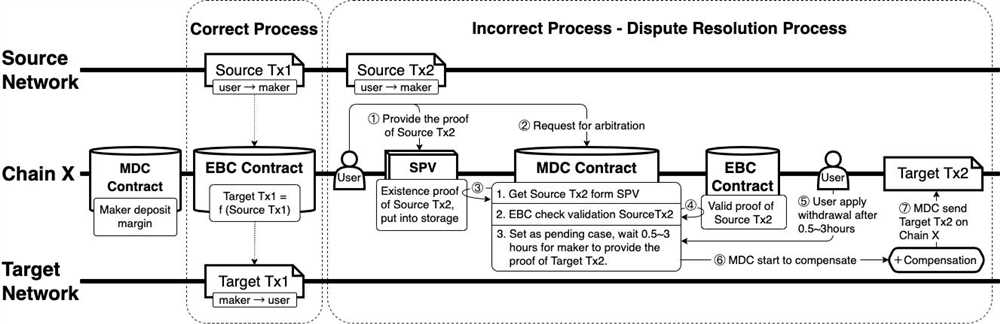

The Cross-Bridge Rollup technology utilizes a two-layer architecture. The first layer is the main blockchain network, which serves as a trust anchor and provides the ultimate security and decentralization. The second layer is the rollup chain, which processes a large number of transactions off-chain.

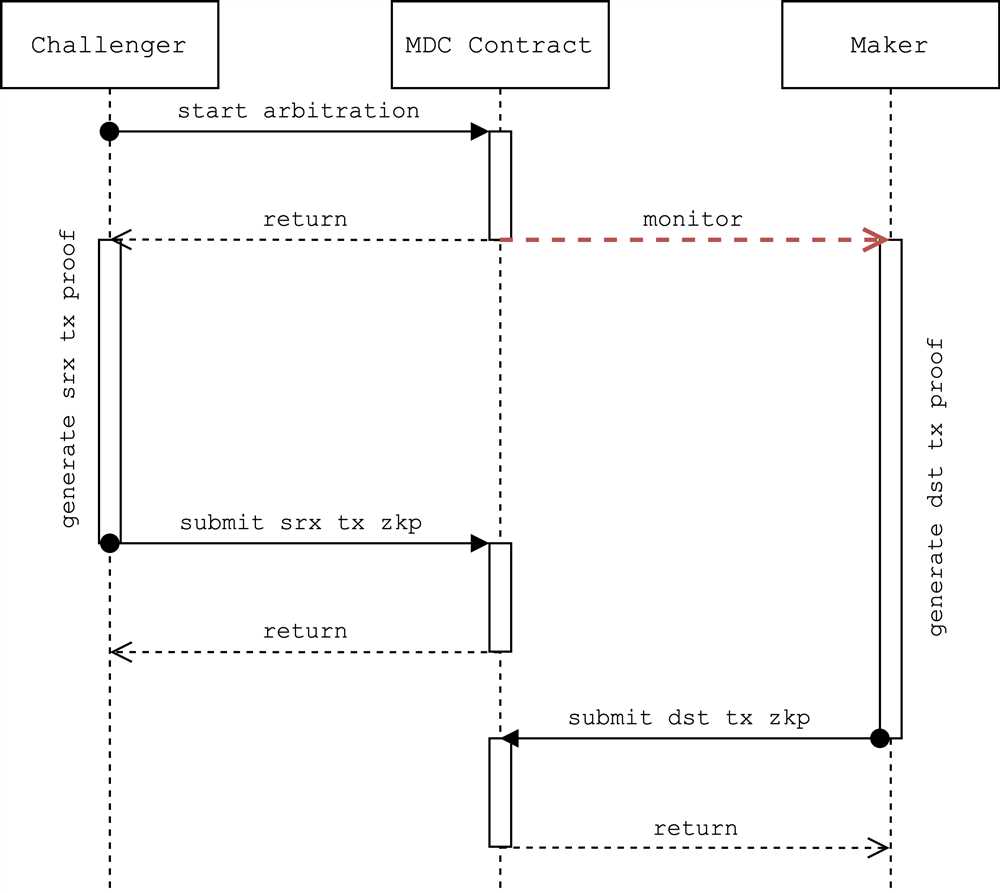

Transactions are first submitted to the rollup chain, where they are processed and verified by a set of validators. Once the transactions are validated, a summary of the transactions is created and stored on the main blockchain network. This summary acts as a proof that the transactions were processed correctly and can be verified by anyone.

Users can interact with the rollup chain by submitting transactions and querying the state of the network. The rollup chain periodically submits the transaction summaries to the main blockchain network, ensuring that the final state is securely recorded on the blockchain.

Benefits of Cross-Bridge Rollup

The Cross-Bridge Rollup technology offers several benefits:

| Benefit | Description |

|---|---|

| Scalability | By processing transactions off-chain, the Cross-Bridge Rollup technology significantly increases the scalability of blockchain networks, allowing for a larger number of transactions to be processed simultaneously. |

| Cost-effectiveness | The off-chain processing reduces the cost of transactions, as the fees associated with executing transactions on the main blockchain network are minimized. |

| Faster transactions | The rollup chain can process transactions much faster than the main blockchain network, leading to quicker confirmation times and improved user experience. |

| Interoperability | The Cross-Bridge Rollup technology can be applied to various blockchain networks, ensuring interoperability and enabling cross-chain transactions. |

Overall, the Cross-Bridge Rollup technology is a game-changer in the blockchain space, providing a scalable and cost-effective solution to the challenges faced by existing blockchain networks.

The Decentralized Nature of Orbiter Finance

One of the key features of Orbiter Finance is its decentralized nature. Unlike traditional financial systems that are controlled by centralized entities, Orbiter Finance operates on a decentralized cross-bridge rollup protocol.

This decentralized approach ensures that no single entity has complete control over the platform. Instead, decisions are made collectively and transparently by the community through a governance mechanism.

By being decentralized, Orbiter Finance offers several benefits. First, it eliminates the need for intermediaries, reducing costs and improving efficiency. Second, it enhances security as no central point of failure exists. Finally, it fosters trust and fosters a sense of ownership among community members.

Orbiter Finance’s decentralized model also extends to its cross-chain functionality. It allows users to seamlessly transfer assets between different blockchain networks, eliminating the need for centralized exchanges or custodians.

Furthermore, Orbiter Finance is built on open-source technology, making it accessible and adaptable for developers and users. This openness encourages innovation and collaboration, contributing to the growth and sustainability of the project.

In conclusion, the decentralized nature of Orbiter Finance sets it apart from traditional financial systems and offers numerous benefits. By promoting transparency, security, and community governance, Orbiter Finance aims to transform the way people interact and transact in the decentralized finance landscape.

Controversy Surrounding Orbiter Finance

Orbiter Finance, a decentralized cross-bridge rollup project, has recently come under fire due to controversy surrounding its operations and governance.

Token Distribution

One of the main points of contention is the initial token distribution of Orbiter Finance. Critics argue that the distribution was heavily skewed towards insiders and early backers, limiting the opportunity for broader participation and creating a concentration of power.

Additionally, concerns have been raised about the transparency of the token distribution process, with allegations of favoritism and unfair practices. These accusations have led to skepticism about the project’s intentions and raised doubts about its long-term viability.

Governance Structure

Another source of controversy is the governance structure of Orbiter Finance. Critics argue that the project’s decision-making process is highly centralized, with a small group of individuals holding significant control over key decisions.

This centralization of power has raised concerns about the project’s ability to truly operate in a decentralized manner and serve the interests of all token holders. Some community members have called for greater transparency and inclusivity in the governance process to ensure a fair representation of the project’s stakeholders.

The controversy surrounding Orbiter Finance highlights the important challenges that decentralized projects face in maintaining transparency, fairness, and decentralization. As the project moves forward, it will be crucial for stakeholders to address these concerns and work towards building a more inclusive and decentralized ecosystem.

The Future of Orbiter Finance

Despite the recent controversy surrounding the Decentralized Cross-Bridge Rollup project Orbiter Finance, the future looks promising for this innovative platform. The team behind Orbiter Finance is committed to resolving any issues and ensuring the success of their project.

Building Trust with the Community

Orbiter Finance understands the importance of trust in the decentralized finance (DeFi) ecosystem. To regain the trust of the community, Orbiter Finance plans to provide complete transparency and regular updates on project developments. They will also establish better communication channels, fostering an open dialogue with the community to address any concerns or suggestions.

The team emphasizes that they are taking the necessary steps to evaluate and address the controversy head-on. They are conducting thorough audits and implementing additional security measures to ensure the integrity of the platform and the safety of users’ funds.

Expanding Features and Services

Orbiter Finance has an ambitious roadmap for the future, focusing on expanding the platform’s features and services. They plan to introduce new modules that enable seamless integration with other DeFi protocols, providing users with more opportunities for liquidity mining, token swapping, and other yield-generating activities.

The team is also exploring the integration of advanced functionalities like NFT support and cross-chain compatibility to expand the platform’s capabilities and appeal to a wider audience. These additions will firmly position Orbiter Finance as a versatile and comprehensive DeFi solution.

The team’s vision is to establish Orbiter Finance as a leading decentralized cross-bridge rollup platform and a trusted hub for secure and efficient DeFi transactions.

By prioritizing security, transparency, and community engagement, Orbiter Finance aims to rebuild its reputation and become a cornerstone of the DeFi market. With its strong focus on innovation, the team is well-prepared to navigate any challenges and continue driving the evolution of decentralized finance.

What is Orbiter Finance?

Orbiter Finance is a decentralized cross-bridge rollup project that aims to provide efficient and secure bridging of digital assets between different blockchain networks.

What is a cross-bridge rollup project?

A cross-bridge rollup project is a solution that enables the transfer of digital assets between different blockchain networks by utilizing a separate blockchain called a rollup chain. It helps to improve scalability and interoperability in the decentralized finance (DeFi) ecosystem.

What kind of controversy is Orbiter Finance facing?

Orbiter Finance is facing controversy due to concerns raised by some community members about the project’s tokenomics and governance structure. There are debates about the fairness and decentralization of the project, which has led to a divide among participants and investors.

How does Orbiter Finance address the controversy?

Orbiter Finance is actively engaging with the community and addressing the controversy through open discussions, transparency, and making changes to its tokenomics and governance structure based on community feedback. The project aims to establish a fair and decentralized system that involves active participation from its users.