Orbiter Finance: Utilizing Sender and Maker Roles for Efficient Transactions

With the rapid growth of decentralized finance (DeFi) and the increasing popularity of blockchain technology, new solutions are constantly emerging to address the challenges and limitations of traditional financial systems. One such solution is Orbiter Finance, a platform that leverages the sender and maker roles to optimize transactions and improve efficiency.

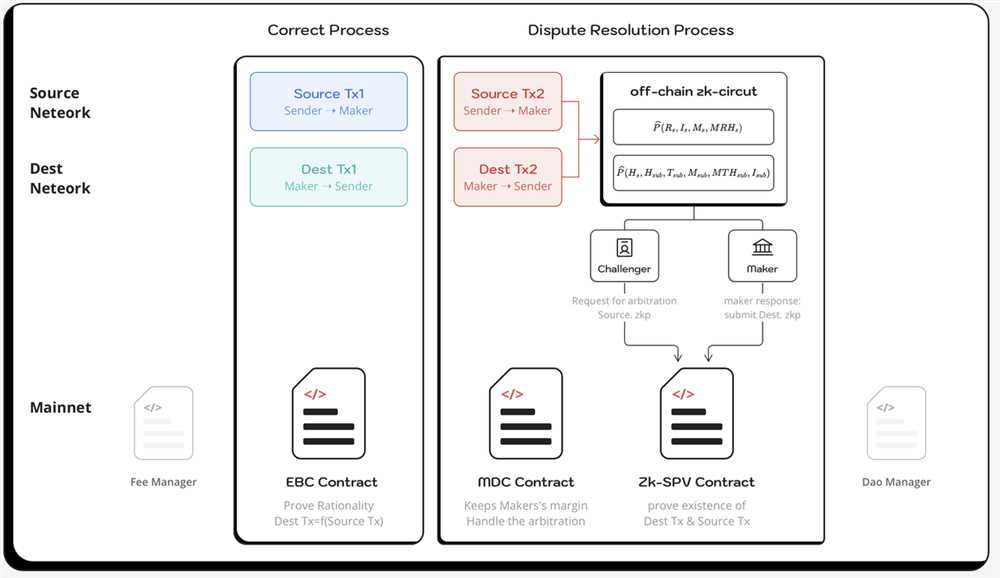

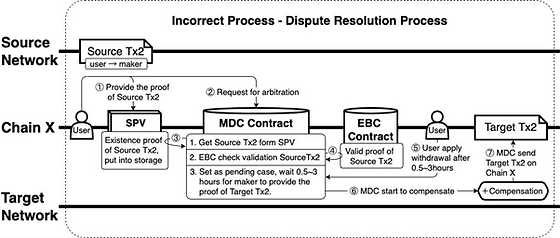

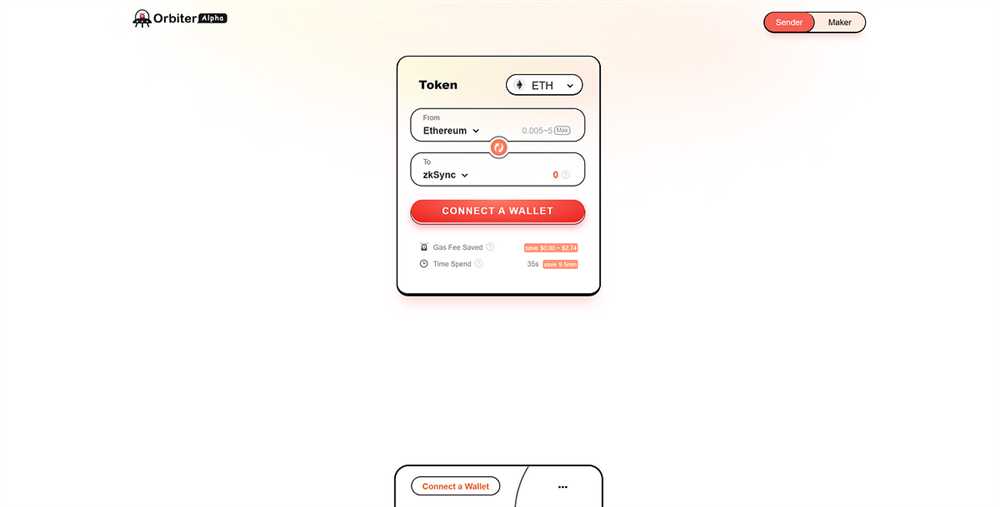

Orbiter Finance introduces a unique approach to transaction processing, where participants can take on either the sender or maker role. The sender initiates a transaction by specifying the desired tokens and the desired rate, while the maker supplies the requested tokens and determines the rate. This innovative system allows for decentralized and trustless transactions to occur seamlessly, without the need for intermediaries or centralized exchanges.

By leveraging the sender and maker roles, Orbiter Finance achieves several key benefits. Firstly, it enables participants to optimize transaction costs. The sender can choose from a pool of available makers, each offering different rates, and select the most favorable option. This flexibility ensures that participants can get the best value for their transactions, saving both time and money.

Additionally, Orbiter Finance enhances liquidity and market depth by attracting a diverse range of makers. Makers have the opportunity to earn fees by providing liquidity to the platform, which incentivizes their participation. This results in a large and diverse pool of makers, ensuring that sufficient liquidity is always available for transactions, even during periods of high demand.

In conclusion, Orbiter Finance revolutionizes transaction processing in the DeFi space by leveraging the sender and maker roles. This innovative approach optimizes transaction costs, enhances liquidity, and eliminates the need for intermediaries. As blockchain technology continues to evolve, solutions like Orbiter Finance are paving the way for a more efficient and decentralized financial future.

Optimizing Transactions with Orbiter Finance

Orbiter Finance is a revolutionary platform that aims to optimize transactions with its unique features and functionalities. By leveraging the Sender and Maker roles, Orbiter Finance provides an efficient and streamlined way to execute transactions in various financial markets.

The Sender Role

The Sender role in Orbiter Finance refers to the user who initiates a transaction. This could be an individual or an institution looking to buy or sell assets. The Sender role is responsible for providing the necessary details of the transaction, such as the asset, quantity, and desired price.

One of the key advantages of the Sender role is the ability to set specific parameters for the transaction. This includes setting a price limit, defining the acceptable quantity range, or specifying certain conditions for the transaction to be executed. By having control over these parameters, senders can optimize their transactions to meet their specific goals and requirements.

The Maker Role

The Maker role in Orbiter Finance refers to the user who responds to the transaction initiated by the Sender. Makers are responsible for providing liquidity to the market by offering assets for sale or purchase. Makers play a crucial role in optimizing transactions by offering competitive prices and flexible terms.

Being a Maker in Orbiter Finance comes with its own set of benefits. Makers have the flexibility to adjust their prices and terms based on market conditions and demand. This allows them to attract more transactions and maximize their profits. Additionally, Makers can also set certain conditions for the transaction, such as a minimum quantity requirement or a specific timeframe for execution.

Orbiter Finance optimizes transactions by connecting Senders and Makers in a decentralized and secure manner. By leveraging the unique features of the Sender and Maker roles, Orbiter Finance enables seamless transactions with improved efficiency, transparency, and flexibility.

Whether you are a Sender looking to execute a transaction or a Maker providing liquidity, Orbiter Finance offers the tools and functionalities you need to optimize your transactions and achieve your financial goals.

Leveraging the Sender Role

When using Orbiter Finance, the Sender role plays a crucial role in optimizing transactions. As a Sender, you have the ability to initiate a transaction by sending funds to another address or smart contract. This role allows you to control the transaction and tailor it to your specific needs.

Benefits of the Sender Role

By leveraging the Sender role in Orbiter Finance, you can:

- Customize transaction settings: As a Sender, you can choose the gas price and limit for your transaction, allowing you to prioritize speed or cost efficiency based on your requirements.

- Set transaction deadlines: You have the ability to set a deadline for your transaction to be executed. If the transaction is not confirmed within the specified timeframe, it will automatically be canceled, reducing the risk of funds being stuck in limbo due to network congestion.

- Manage transaction failures: In the event that a transaction fails, you have the option to try again or revert it completely, giving you control over the outcome and minimizing potential losses.

Best Practices for Senders

When leveraging the Sender role, it is important to adhere to best practices to ensure optimized transactions:

- Monitor gas prices: Keep an eye on current gas prices to determine the optimal gas price to use for your transaction. This will enable you to strike a balance between speed and cost efficiency.

- Consider network congestion: Take into account the current network congestion when setting your transaction’s gas limit and deadline. Adjust these parameters accordingly to avoid delays or potential failures.

- Use testnets: Before initiating transactions on the mainnet, test your transactions on a testnet to ensure everything is working as expected. This will help you identify any potential issues or errors before risking actual funds.

By leveraging the Sender role effectively, you can optimize your transactions on Orbiter Finance and ensure a seamless and efficient experience.

Maximizing Efficiency with the Maker Role

In the world of decentralized finance, maximizing efficiency is essential for users looking to optimize their transactions. One way to achieve this efficiency is by leveraging the Maker role within the Orbiter Finance platform. By understanding the benefits and responsibilities of the Maker role, users can make the most of their transactions and ensure smooth execution.

What is the Maker Role?

The Maker role refers to the participant in a decentralized finance transaction who provides liquidity to the market. In other words, the Maker is the one who supplies the assets that are used in the transaction. This role is essential for facilitating trading and ensuring that there is enough liquidity in the market for transactions to be executed.

Benefits of the Maker Role

By taking on the Maker role, users can enjoy several benefits that contribute to maximizing efficiency in their transactions:

- Lower transaction costs: As a Maker, users can contribute liquidity to the market and potentially receive incentives in return, such as reduced transaction fees.

- Improved trade execution: By providing liquidity, Makers help ensure that there is enough supply to meet demand, reducing the likelihood of price slippage and improving trade execution.

- Access to additional features: Some decentralized finance platforms offer additional features and privileges to Makers, such as earning staking rewards or participating in governance decisions.

Overall, the Maker role provides users with the opportunity to contribute to the efficiency and stability of the decentralized finance market while enjoying various benefits in return.

Responsibilities of the Maker Role

While the Maker role offers many advantages, it also comes with certain responsibilities. These responsibilities include:

- Providing liquidity: Makers must ensure that they have sufficient assets available to supply to the market. This involves maintaining an appropriate balance and considering the potential risks and rewards of providing liquidity.

- Monitoring market conditions: Makers need to stay informed about the state of the market, including factors such as supply and demand dynamics, price movements, and transaction volume. This information helps Makers make informed decisions about their liquidity provision strategies.

- Adhering to platform rules: Each decentralized finance platform may have its own set of rules and guidelines for Makers. It is important for Makers to understand and comply with these rules to ensure smooth operations and maintain platform integrity.

By fulfilling these responsibilities, Makers play a crucial role in maintaining the efficiency and stability of decentralized finance transactions.

In conclusion, the Maker role offers users the opportunity to maximize efficiency in their transactions through liquidity provision. By understanding the benefits and responsibilities associated with the Maker role, users can make well-informed decisions and optimize their decentralized finance experience.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance protocol that aims to optimize transactions by leveraging the sender and maker roles.

How does Orbiter Finance optimize transactions?

Orbiter Finance optimizes transactions by introducing the sender and maker roles. The sender role allows for gas optimization and reduces transaction costs, while the maker role allows for optimizing liquidity and reducing slippage.