Are you tired of the limitations and complexities of traditional banking? Look no further than Orbiter Finance – a revolutionary financial platform that is here to change the game.

Why settle for the same old banking experience when you can enjoy a seamless and user-friendly interface with Orbiter Finance? Say goodbye to long queues and endless paperwork, and say hello to a smarter way of managing your money.

Unparalleled Convenience

With Orbiter Finance, you have the power to control your finances anytime, anywhere. Say farewell to restrictive banking hours and embrace the freedom of 24/7 access to your accounts. Whether you’re in the comfort of your home or on-the-go, our innovative technology ensures that your financial needs are just a few taps away.

Transparent and Affordable

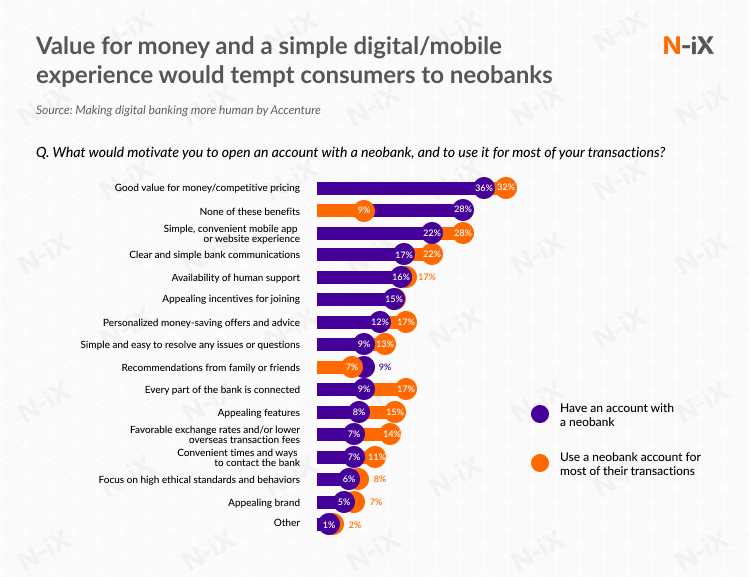

Traditional banking often comes with hidden fees and unpredictable charges that can quickly eat into your hard-earned money. At Orbiter Finance, we believe in transparency and affordability. Enjoy competitive interest rates and minimal fees, allowing you to make the most out of your money.

Personalized Service

Unlike traditional banks that treat you like just another account number, Orbiter Finance understands that your financial goals are unique and deserve personalized attention. Our team of experienced advisors is ready to assist you every step of the way, providing tailored solutions to help you achieve your financial dreams.

Discover the Orbiter Finance difference today and experience a banking revolution like no other. Open your account now and take control of your financial future!

What is Orbiter Finance?

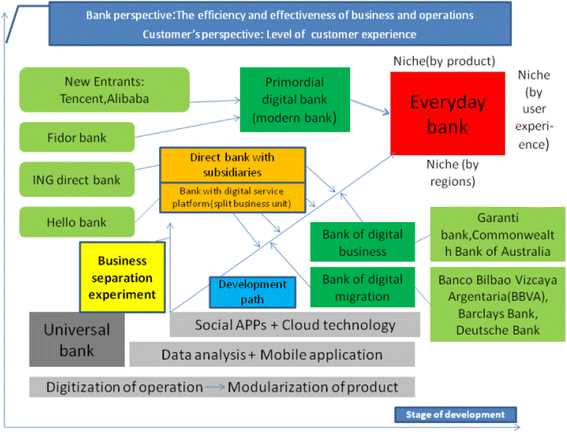

Orbiter Finance is a cutting-edge financial technology company that revolutionizes the way people manage their money. By harnessing the power of blockchain technology, Orbiter Finance provides innovative solutions that bridge the gap between traditional banking and the decentralized nature of cryptocurrencies.

With Orbiter Finance, you can enjoy a range of financial services, including secure and convenient transactions, loans, savings accounts, and investment opportunities. Our platform allows you to seamlessly navigate the world of digital assets and take control of your financial future.

Blockchain Technology

At the core of Orbiter Finance is blockchain technology. This technology allows for transparent and secure transactions, as well as a decentralized ledger system that eliminates the need for intermediaries like banks or financial institutions. By using blockchain technology, Orbiter Finance ensures that your financial information is protected and that transactions are executed in a fast and efficient manner.

The Benefits of Orbiter Finance

1. Security: Orbiter Finance prioritizes the security of your financial information. All transactions and data are encrypted, ensuring that your personal and financial details are kept confidential.

2. Convenience: With Orbiter Finance, managing your finances has never been easier. Our user-friendly interface allows you to access your accounts, make transactions, and monitor your investments from any device, anywhere in the world.

3. Flexibility: Orbiter Finance offers a range of financial services tailored to your individual needs. Whether you want to save for the future, invest in cryptocurrencies, or take out a loan, our platform has you covered.

4. Innovation: By combining blockchain technology with traditional banking services, Orbiter Finance is at the forefront of financial innovation. We strive to provide our customers with the latest advancements in financial technology, giving you a competitive edge in the ever-evolving world of finance.

Join Orbiter Finance today and experience the future of banking. Embrace the power of blockchain and take control of your financial destiny.

What is Traditional Banking?

Traditional banking refers to the conventional way of banking, which includes physical bank branches, face-to-face interactions with bank tellers, and paper-based transactions. It is a system that has been in place for many years and is still widely used today.

In traditional banking, customers visit their local bank branches to open accounts, deposit and withdraw cash, apply for loans, and perform various financial transactions. The banks employ tellers and customer service representatives who assist customers with their banking needs.

Traditional banking relies on a network of physical branches that are spread across different locations. These branches act as the main point of contact between the bank and its customers.

One of the key features of traditional banking is the use of physical cash for transactions. Customers can deposit and withdraw money in the form of cash, and checks are commonly used for transferring funds between different accounts.

Traditional banks also offer various financial products and services, such as savings accounts, checking accounts, loans, mortgages, and credit cards. Customers can access these services through their bank branches or through online banking portals.

While traditional banking has its advantages, such as a physical presence for face-to-face interactions and cash transactions, it also has limitations. These include limited banking hours, long wait times, and the need to visit a physical branch for certain transactions.

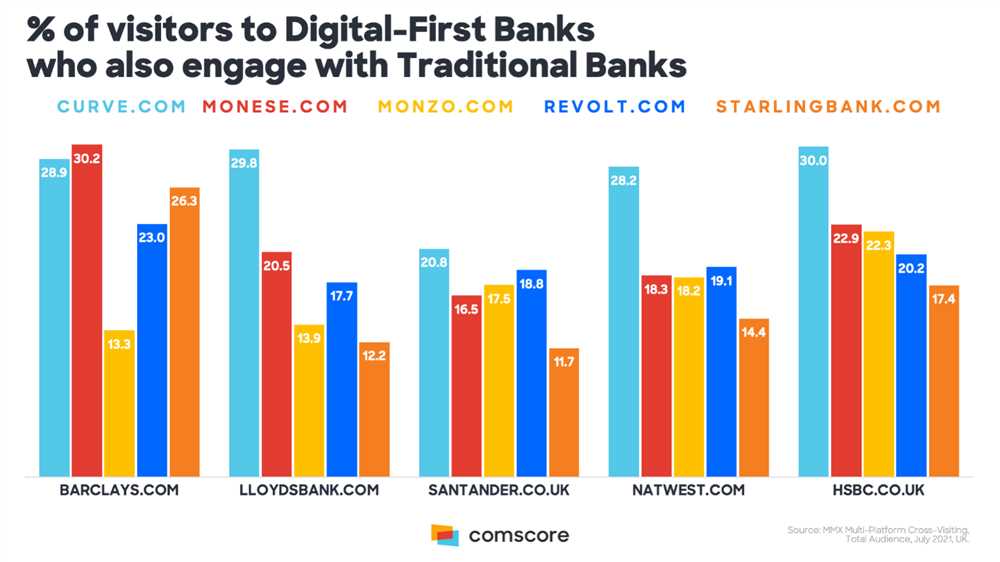

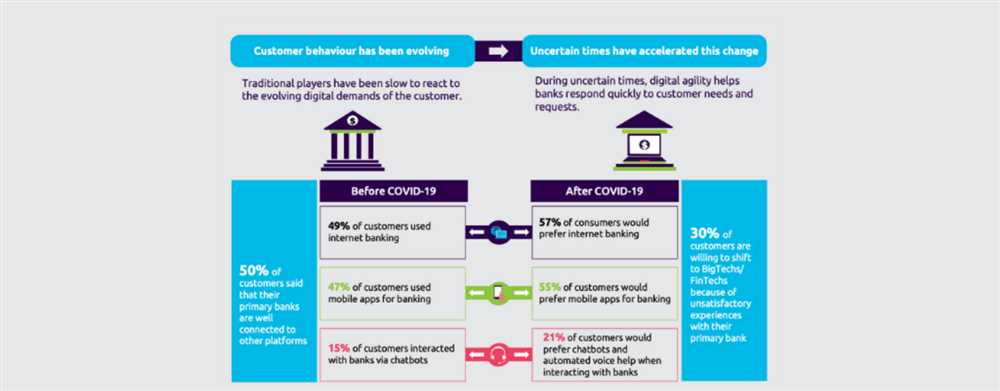

With the advancements in technology, online and mobile banking have become popular alternatives to traditional banking. These digital banking solutions offer convenience, accessibility, and a wider range of services compared to traditional banking.

Overall, traditional banking is a tried and tested system that has served the needs of customers for many years. However, with the evolving demands of the digital age, alternative banking options like Orbiter Finance provide a modern and innovative approach to managing financial transactions.

Comparison of Services

When it comes to the services offered, Orbiter Finance and traditional banking differ significantly.

Orbiter Finance Services

1. Robust Digital Platform: Orbiter Finance provides a state-of-the-art digital platform that allows users to easily manage their finances online. From account tracking to transferring funds, all banking needs can be conveniently handled from the comfort of your home.

2. Transparent Fees: Orbiter Finance believes in transparency and charges minimal fees for its services. Customers have a clear understanding of the fees involved and are not caught off guard by hidden charges.

3. Instantaneous Transactions: With Orbiter Finance, transactions are processed almost instantaneously, allowing for quick access to funds and time-sensitive transfers.

Traditional Banking Services

1. Physical Branches: Traditional banks offer physical branch locations where customers can visit for their banking needs. This provides a face-to-face interaction and assistance from bank representatives.

2. A Wide Range of Products: Traditional banks often offer a wide range of products and services. These include checking and savings accounts, mortgage loans, investment opportunities, and more.

3. Personalized Support: Traditional banks provide personalized support to their customers, offering guidance and advice regarding their financial decisions. Bank representatives can assist with various banking matters and offer solutions tailored to individual needs.

In conclusion, Orbiter Finance stands out with its user-friendly digital platform, transparency in fees, and fast transaction processing. Traditional banks, on the other hand, offer the benefits of physical branches, a wide range of products, and personalized support. Choosing between the two depends on the customer’s preferences and financial needs.

Interest Rates and Fees

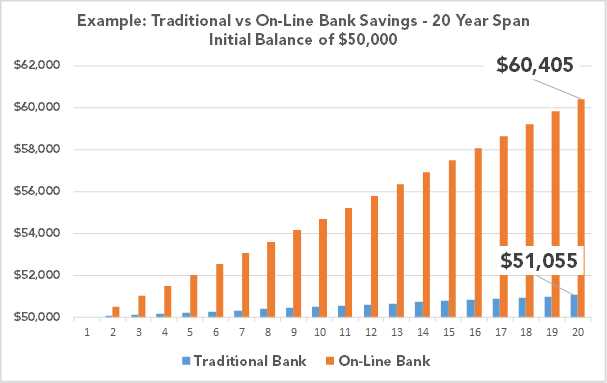

When it comes to interest rates and fees, Orbiter Finance offers a comprehensive and transparent approach, setting itself apart from traditional banking institutions. With Orbiter Finance, you can expect competitive interest rates and minimal fees, making it a cost-effective choice for all your financial needs.

Competitive Interest Rates

Orbiter Finance understands the importance of competitive interest rates for its customers. Whether you are looking for a personal loan, a mortgage, or a line of credit, Orbiter Finance offers attractive interest rates that are designed to suit your financial goals and help you achieve them more efficiently.

By leveraging advanced data analytics and technology, Orbiter Finance is able to offer personalized interest rates based on your creditworthiness and financial profile. This means that you can benefit from rates that are tailored to your unique circumstances, potentially saving you thousands of dollars in interest over the lifetime of your loan.

Minimal Fees

In addition to competitive interest rates, Orbiter Finance also prioritizes minimal fees to ensure that you are not burdened with unnecessary costs. Unlike traditional banks that often charge a multitude of fees for various services, Orbiter Finance takes a transparent and simplified approach.

With Orbiter Finance, you can expect transparent and upfront fee structures, allowing you to fully understand the cost of borrowing. Whether it’s an origination fee, an annual fee, or a late payment fee, you can trust that Orbiter Finance will provide you with clear and concise information regarding the fees associated with your financial products.

| Service | Fee |

|---|---|

| Personal Loan Origination Fee | $50 |

| Mortgage Application Fee | $150 |

| Line of Credit Annual Fee | $25 |

| Late Payment Fee | $15 |

These fees are just examples and may vary based on your specific financial products and terms. However, rest assured that Orbiter Finance strives to keep fees as low as possible, ensuring that you receive great value for your money.

With Orbiter Finance, you can enjoy competitive interest rates and minimal fees, giving you the peace of mind and financial flexibility you need to achieve your goals. Say goodbye to hidden charges and surprise fees – Orbiter Finance is committed to providing you with transparency and a fair financial experience.

Accessibility and Convenience

When it comes to accessibility and convenience, Orbiter Finance takes the lead over traditional banking in several key aspects.

24/7 Access

With Orbiter Finance, you can access your accounts and manage your finances anytime, anywhere. Our online platform and mobile app allow you to check your balances, make transfers, and pay bills 24/7. No need to visit a branch during limited business hours or wait in long queues.

Easy Account Opening

Opening an account with Orbiter Finance is fast and straightforward. Forget about the lengthy paperwork and multiple document requirements typically associated with traditional banks. With Orbiter Finance, you can open an account online in just a few simple steps.

Moreover, unlike traditional banks that may reject applicants based on their credit history or employment status, Orbiter Finance offers a more inclusive approach. We believe in providing equal access to financial services for everyone, regardless of their background or financial situation.

Accessibility for Persons with Disabilities

Orbiter Finance is committed to making our services accessible to persons with disabilities. We strive to ensure that our online platform and mobile app are compatible with assistive technologies, such as screen readers, to enhance accessibility for visually impaired individuals.

At Orbiter Finance, we understand the importance of accessibility and convenience in today’s fast-paced world. We aim to provide our customers with seamless and user-friendly financial solutions that cater to their needs and preferences.

Security and Privacy

Security and privacy are key concerns when it comes to choosing a financial institution. At Orbiter Finance, we prioritize the safety and protection of our customers’ personal and financial information.

Secure Transactions: Orbiter Finance employs state-of-the-art encryption technology to ensure that all transactions made through our platform are secure and protected from unauthorized access. We understand the importance of keeping your sensitive financial data safe and take extra measures to ensure its confidentiality.

Data Protection: We adhere to strict data protection regulations and privacy policies. Your personal information is kept confidential and is never shared with third parties without your explicit consent. We are committed to maintaining the highest standards of data security and protection.

Fraud Prevention: Orbiter Finance implements robust fraud detection and prevention measures to safeguard our customers’ accounts and detect any suspicious activity. Our dedicated team is continuously monitoring transactions to identify and prevent any unauthorized access or fraudulent behavior.

Privacy Controls: With Orbiter Finance, you have full control over your privacy settings. You can customize your privacy preferences and choose what information you want to share with other users or the public. We empower you to manage your own privacy and ensure that your personal information is only disclosed according to your preferences.

Transparent Policies: Our security and privacy policies are transparent and easily accessible. We believe in providing our customers with clear and concise information about how we handle their personal and financial data. If you have any questions or concerns regarding our policies, our customer support team is available to assist you.

Choose Orbiter Finance for a secure and private banking experience that puts your safety and peace of mind first.

What is the difference between Orbiter Finance and traditional banking?

Orbiter Finance is a decentralized finance platform that operates on the blockchain, while traditional banking is a centralized system regulated by financial institutions. Orbiter Finance offers users more control over their finances and the ability to transact directly with other users without intermediaries.

What advantages does Orbiter Finance have over traditional banking?

Orbiter Finance has several advantages over traditional banking. Firstly, it allows for faster and more efficient transactions, thanks to its decentralized nature. Secondly, it offers users higher interest rates on their savings through various investment opportunities. Lastly, it provides a more secure and transparent system through the use of blockchain technology.

Can I access my funds anytime with Orbiter Finance?

Yes, with Orbiter Finance you can access your funds anytime. Since it is a decentralized platform, you have full control over your finances and can make transactions or withdrawals whenever you want, without having to rely on traditional banking hours or restrictions.

Is Orbiter Finance regulated like traditional banks?

No, Orbiter Finance is not regulated in the same way as traditional banks. Traditional banks are subject to various government regulations and oversight, while Orbiter Finance operates on the blockchain and is not controlled by any centralized authority. However, Orbiter Finance still ensures security and transparency through smart contracts and other blockchain technologies.