Orbiter Finance vs. Traditional Money Management: Which is Right for You?

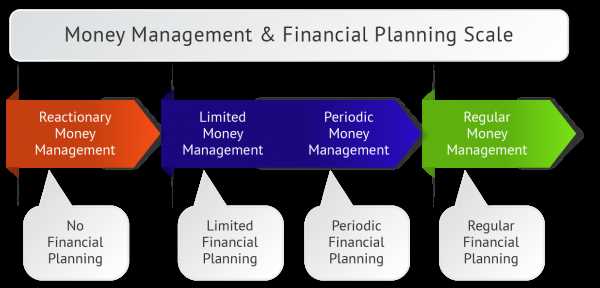

Managing your money is a critical aspect of personal finance. Whether you are looking to invest your savings or simply want to make sure your monthly bills are paid on time, choosing the right money management strategy can have a significant impact on your financial future.

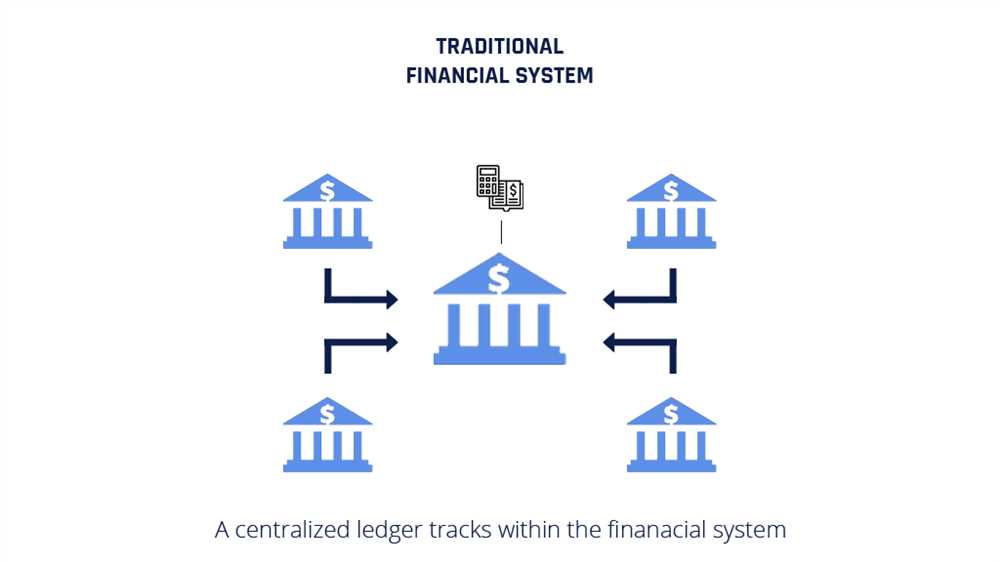

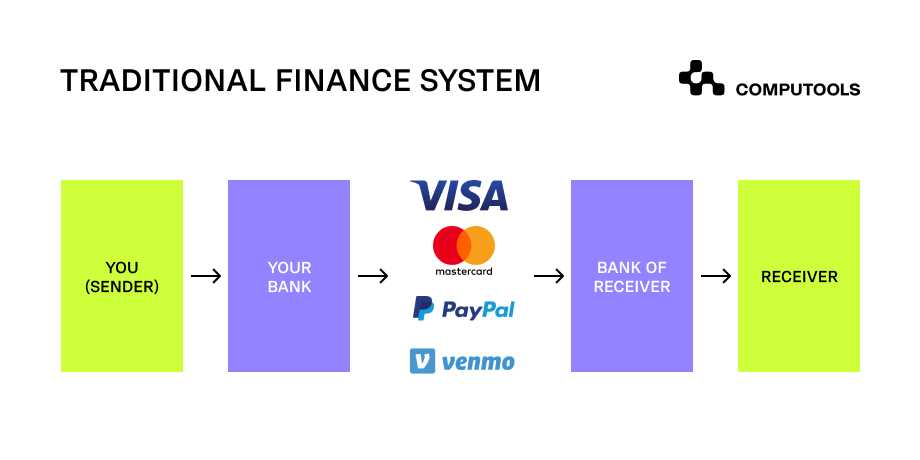

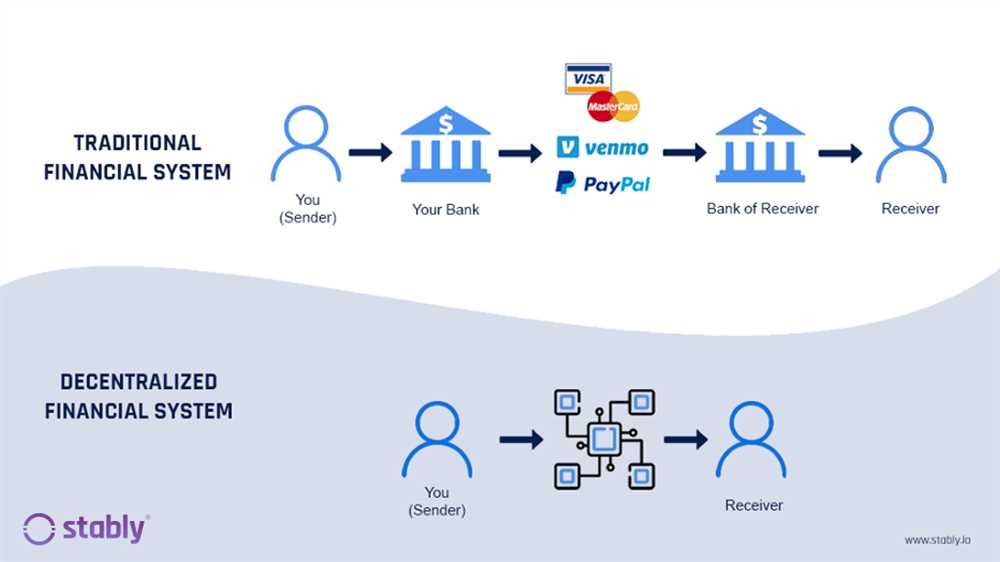

Traditionally, individuals have relied on banks and financial advisors to help them manage their finances. This approach involves handing over control to professionals who make decisions on your behalf. However, a new trend is emerging in the form of digital money management platforms like Orbiter Finance.

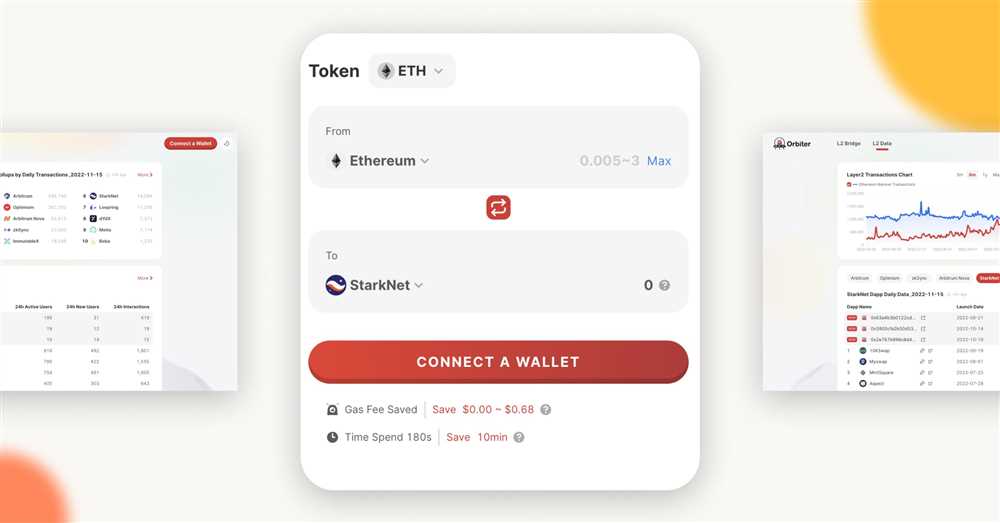

Orbiter Finance offers a unique solution for individuals who want more control over their money. With this platform, you can track your income and expenses, set financial goals, and make investment decisions at your convenience. No longer are you at the mercy of financial institutions; instead, you have the power to manage your finances directly.

So, which option is the best for you? Traditional money management may be suitable for those seeking a hands-off approach or who lack the time and knowledge to manage their own investments. On the other hand, Orbiter Finance may be a better fit for individuals who want more control and are comfortable making their own financial decisions.

Ultimately, the best option depends on your personal financial goals and comfort level with managing your own money. It is important to carefully consider both options before making a decision. Whether you choose traditional money management or embrace the digital revolution with Orbiter Finance, the key is to take control of your financial future and make the choices that align with your goals.

Understanding Orbiter Finance

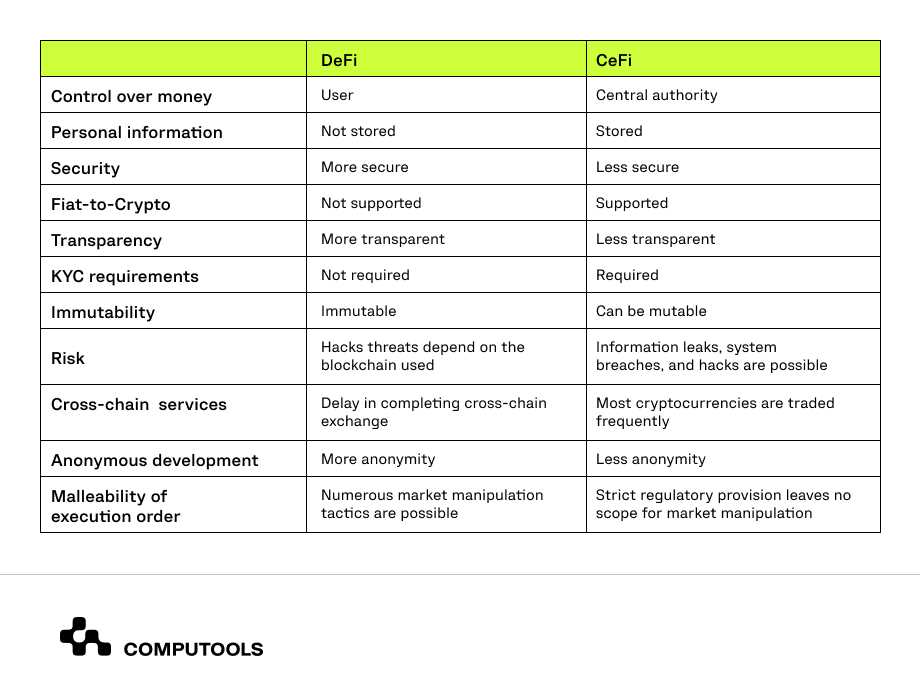

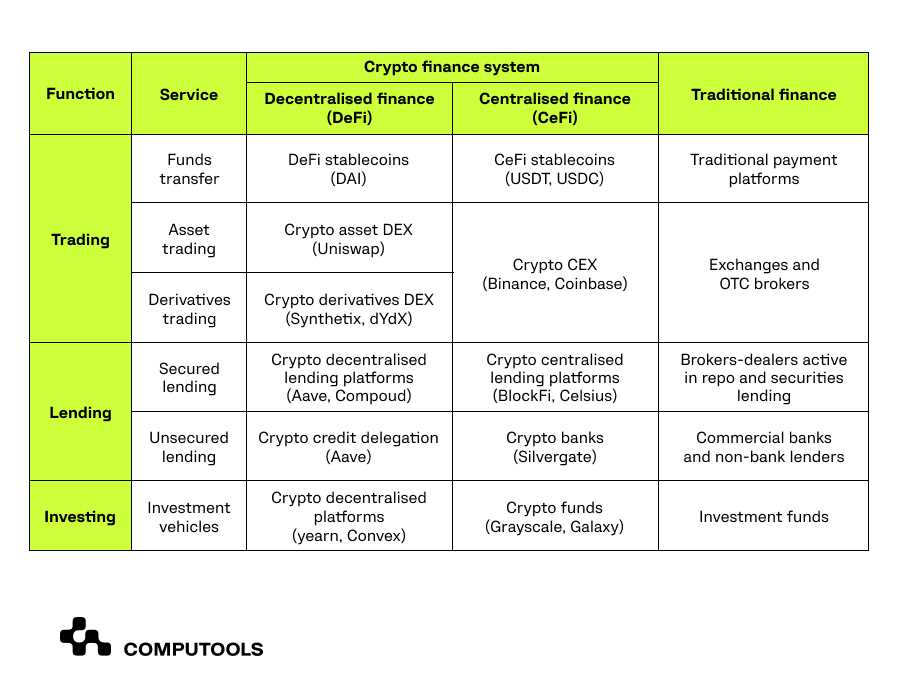

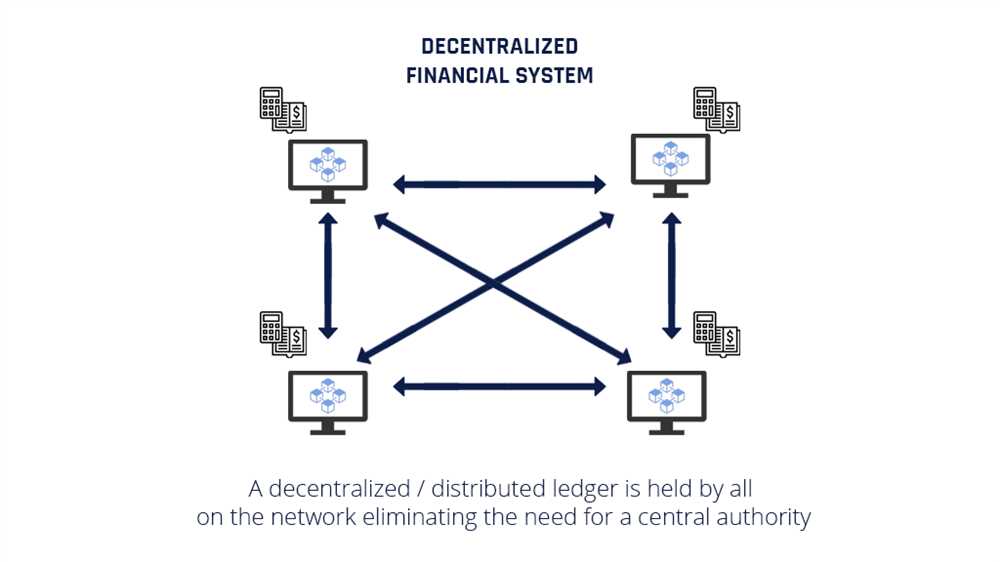

Orbiter Finance is a revolutionary platform that aims to transform the traditional way of managing money. It offers users a decentralized financial ecosystem powered by blockchain technology.

The main goal of Orbiter Finance is to provide individuals with greater control over their finances and investment opportunities. Through its decentralized nature, users can access a wide range of financial services without relying on intermediaries such as banks or financial institutions.

Key Features of Orbiter Finance

Orbiter Finance offers several key features that set it apart from traditional money management:

- Decentralized Governance: Orbiter Finance is governed by its community of users, who have a say in the decision-making process. This ensures a fair and transparent system where everyone’s interests are taken into consideration.

- Liquidity Provision: Users can contribute their digital assets to the platform’s liquidity pools and earn rewards for providing liquidity. This creates a vibrant and dynamic ecosystem where users can easily trade and exchange assets.

- Automated Portfolio Management: Orbiter Finance offers automated portfolio management services through smart contracts. This eliminates the need for manual intervention and allows users to optimize their investment strategies.

- Yield Farming: Users can earn additional income through yield farming, which involves staking their assets in liquidity pools to earn rewards in the form of tokens.

Advantages of Orbiter Finance

Orbiter Finance offers several advantages over traditional money management:

| Greater Financial Freedom: | Users have the ability to control their finances without being dependent on banks or financial institutions. |

| Lower Fees: | With Orbiter Finance, users can benefit from lower transaction fees compared to traditional financial systems. |

| Global Access: | Orbiter Finance is accessible to anyone with an internet connection, providing greater financial inclusion globally. |

| Increased Transparency: | As a decentralized platform, Orbiter Finance offers transparent and auditable transactions for its users. |

In conclusion, Orbiter Finance provides a decentralized and innovative approach to money management. It offers a wide range of features that empower individuals to take control of their finances and gain access to new investment opportunities. With the advantages it offers over traditional money management, Orbiter Finance is a compelling option for those seeking greater financial freedom.

Exploring the Benefits of Orbiter Finance

When it comes to managing your finances, Orbiter Finance offers a range of advantages that set it apart from traditional money management methods. Whether you are an individual looking to take control of your personal finances or a business owner seeking to optimize your financial operations, Orbiter Finance has a lot to offer. Here are some of the key benefits of using Orbiter Finance:

1. Simplified Financial Tracking

Orbiter Finance provides a user-friendly platform that allows you to easily track all of your financial activities in one place. With its intuitive interface and powerful features, you can effortlessly monitor your income, expenses, investments, and savings. This streamlined approach saves you time and energy, allowing you to focus on other important aspects of your life or business.

2. Advanced Budgeting Tools

One of the standout features of Orbiter Finance is its robust budgeting tools. You can set financial goals, create budgets, and track your progress in real-time. The platform also provides insights and recommendations to help you make informed financial decisions and improve your overall financial health.

3. Automated Bill Payments

Gone are the days of missing bill payments and incurring late fees. Orbiter Finance automates your bill payments, ensuring that your bills are paid on time. You can set up recurring payments, receive reminders, and have peace of mind knowing that your financial obligations are being taken care of.

4. Investment Opportunities

With Orbiter Finance, you gain access to a wide range of investment opportunities. Whether you are interested in stocks, bonds, cryptocurrencies, or real estate, the platform offers a variety of options to suit your investment goals and risk tolerance. Orbiter Finance also provides you with tools to analyze investments, track their performance, and make informed decisions.

| Benefits of Orbiter Finance | Traditional Money Management |

|---|---|

| Simplified financial tracking | Manual record-keeping |

| Advanced budgeting tools | Basic budgeting spreadsheets |

| Automated bill payments | Manual bill payments |

| Investment opportunities | Limited investment options |

Overall, Orbiter Finance offers a convenient and comprehensive approach to managing your finances. Its range of features, automation capabilities, and investment opportunities make it an attractive option for individuals and businesses alike. Whether you are a financial novice or an experienced investor, Orbiter Finance can help you achieve your financial goals.

Diversifying Your Investment Strategy with Orbiter Finance

When it comes to managing your money, diversification is key. By spreading your investments across different asset classes, you reduce your risk and increase your chances of earning higher returns. This is where Orbiter Finance can help.

Orbiter Finance is a cutting-edge platform that allows you to take control of your investments and diversify your portfolio with ease. With Orbiter Finance, you have access to a wide range of investment options, including stocks, bonds, real estate, and cryptocurrencies.

Why diversify with Orbiter Finance?

One of the main advantages of using Orbiter Finance is the access it provides to a variety of investment options. Instead of relying solely on stocks or bonds, you can invest in a mix of assets that align with your risk tolerance and financial goals.

Another benefit of diversifying with Orbiter Finance is the transparency it offers. With Orbiter Finance, you can easily track the performance of your investments and make informed decisions about how to allocate your funds.

How to diversify your portfolio with Orbiter Finance

To diversify your investment strategy with Orbiter Finance, start by assessing your risk tolerance and investment goals. Determine how much risk you are willing to take and what returns you are aiming for. Then, explore the different investment options available on the platform.

Here are some ways you can diversify your portfolio with Orbiter Finance:

1. Invest in different asset classes: Allocate your funds across a mix of stocks, bonds, real estate, and cryptocurrencies to reduce risk and increase potential returns.

2. Consider global investments: Take advantage of Orbiter Finance’s global reach by investing in international stocks and bonds. This can help you diversify your portfolio across different economies and currencies.

3. Use Orbiter Finance’s automated tools: Orbiter Finance offers automated portfolio management tools that can help you diversify your investments based on your risk profile. These tools can rebalance your portfolio periodically to ensure it stays aligned with your desired asset allocation.

Diversifying your investment strategy with Orbiter Finance can help you achieve your financial goals while mitigating risk. Whether you are a seasoned investor or just starting out, Orbiter Finance provides the tools and resources you need to build a diversified portfolio. Start exploring the platform today and take control of your financial future.

Traditional Money Management: Pros and Cons

When it comes to managing your money, traditional money management methods have been around for centuries and have their own set of advantages and disadvantages. Here are some pros and cons of traditional money management:

Pros

1. Familiarity and Trust: Traditional money management methods, such as working with a financial advisor or using a local bank, have been the norm for many people for a long time. This familiarity builds trust, as people feel more comfortable dealing with established institutions and professionals.

2. Personalized Advice: Traditional money management often provides the opportunity for personalized advice. Working with a financial advisor allows you to discuss your financial goals and objectives and receive tailored recommendations based on your specific situation. This personalized approach can be beneficial for individuals with complex financial needs.

3. Face-to-Face Interaction: Traditional money management methods give you the opportunity to have face-to-face interactions with professionals who can provide guidance and support. This can be particularly helpful for individuals who prefer personal interactions and find it easier to discuss their financial concerns in person.

Cons

1. Higher Costs: Traditional money management often comes with higher costs compared to newer digital alternatives. Financial advisors may charge fees for their services, and traditional banks may have higher transaction fees and account maintenance fees. These costs can eat into your investment returns or savings.

2. Limited Accessibility: Traditional money management methods may not be accessible to everyone, especially those in remote areas or with limited mobility. The need for in-person meetings or physical visits to a bank branch can make it difficult for some individuals to access traditional money management services.

3. Lack of Transparency: Another drawback of traditional money management is the potential lack of transparency. Some individuals may find it challenging to understand the fees and charges associated with their accounts or investments. It can be harder to track and manage your finances effectively without a clear understanding of the costs involved.

In conclusion, traditional money management methods offer familiarity, trust, personalized advice, and face-to-face interaction. However, they may come with higher costs, limited accessibility, and a lack of transparency. It’s important to weigh the pros and cons and consider your individual needs and preferences before deciding on the best option for managing your money.

Assessing the Benefits of Traditional Money Management

Traditional money management has long been the go-to option for individuals and businesses looking to effectively manage their finances. While Orbiter Finance offers a modern and innovative approach to financial management, it is important to consider the benefits of traditional money management before making a decision.

One of the key advantages of traditional money management is the relationship-based approach. With traditional money management, clients have the opportunity to work closely with a dedicated advisor who can provide personalized guidance and support. This level of personalization allows for a greater understanding of individual financial goals and the creation of tailored strategies to achieve them.

Another benefit of traditional money management is the access to a wide range of financial products and services. Traditional management firms often have established relationships with various financial institutions, which allows them to offer a diverse selection of investment options. This can include stocks, bonds, mutual funds, and other investment vehicles that may not be available through Orbiter Finance or other digital platforms.

Furthermore, traditional money management firms often have a long-standing reputation and track record of success. This can provide clients with a level of confidence and trust, knowing that their finances are being handled by experienced professionals with a proven history of delivering results. This reputation also means that traditional money management firms may have established connections and partnerships that can benefit their clients.

An additional advantage of traditional money management is the ability to provide comprehensive financial planning services. Many traditional firms offer services beyond investment management, such as estate planning, tax planning, retirement planning, and insurance recommendations. This holistic approach ensures that all aspects of a client’s financial life are taken into consideration and properly managed.

Lastly, traditional money management allows for a more hands-off approach for clients who prefer to delegate the responsibility of managing their finances. With a trusted advisor handling the day-to-day financial decisions, individuals and businesses can focus on other areas of their lives, knowing that their money is being professionally managed.

| Benefits of Traditional Money Management |

|---|

| Relationship-based approach |

| Access to a wide range of financial products and services |

| Established reputation and track record of success |

| Comprehensive financial planning services |

| Ability to delegate financial management responsibilities |

What is Orbiter Finance?

Orbiter Finance is a new type of money management platform that utilizes artificial intelligence and machine learning algorithms to optimize investment strategies and provide personalized financial advice.

How does Orbiter Finance compare to traditional money management services?

Unlike traditional money management services, Orbiter Finance uses advanced technology to analyze market data and tailor investment portfolios to individual goals and risk tolerances. It offers a more efficient and personalized approach to managing money.

Is Orbiter Finance suitable for all types of investors?

Orbiter Finance is designed to cater to a wide range of investors, from beginners to experienced individuals. The platform provides customized investment strategies and advice that are tailored to each individual’s financial goals and risk profiles.

What are the advantages of using Orbiter Finance?

One of the main advantages of using Orbiter Finance is the ability to receive personalized financial advice and investment strategies that are based on advanced algorithms and analysis of market data. The platform also offers a user-friendly interface and utilizes automation to offer efficient and cost-effective money management solutions.