Predictions and Trends for Orbiter Finance in the Coming Years: What to Expect

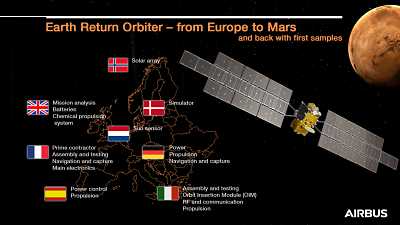

As technology continues to advance at an unprecedented rate, the finance industry is not immune to these changes. One area in particular that is poised for significant growth and innovation is orbiter finance. Orbiter finance refers to the use of orbital satellites and other advanced technologies to gather and analyze financial data from around the world, enabling faster and more accurate predictions and trends. In this article, we will explore the future of orbiter finance and discuss some of the trends and predictions that we can expect to see in the coming years.

One of the key benefits of orbiter finance is the ability to access real-time data from a global perspective. Traditional financial data sources, such as government reports and company filings, often have time lags and limitations. With the use of orbital satellites, financial institutions and investors can access up-to-the-minute data on markets, currencies, and other financial indicators from anywhere in the world. This real-time data will enable more informed decision-making and allow for faster reactions to market changes.

In addition to real-time data, orbiter finance also offers the potential for enhanced predictive analytics. By analyzing vast amounts of financial data collected from orbiters, machine learning algorithms can identify patterns and trends that may not be readily apparent to human analysts. This will enable more accurate predictions of market movements, asset valuations, and other key factors that determine investment strategies. The use of artificial intelligence in orbiter finance will revolutionize the industry by greatly increasing the speed, accuracy, and efficiency of financial predictions.

Furthermore, orbiter finance has the potential to democratize access to financial information. Currently, financial data and insights are mostly available to large institutions and wealthy investors. However, with the increased accessibility and affordability of orbiter technology, this valuable data can be made available to a wider range of market participants. Small investors, entrepreneurs, and individuals will have access to the same data and insights as the big players, leveling the playing field and opening up new opportunities for wealth creation.

Emerging Trends in Orbiter Finance

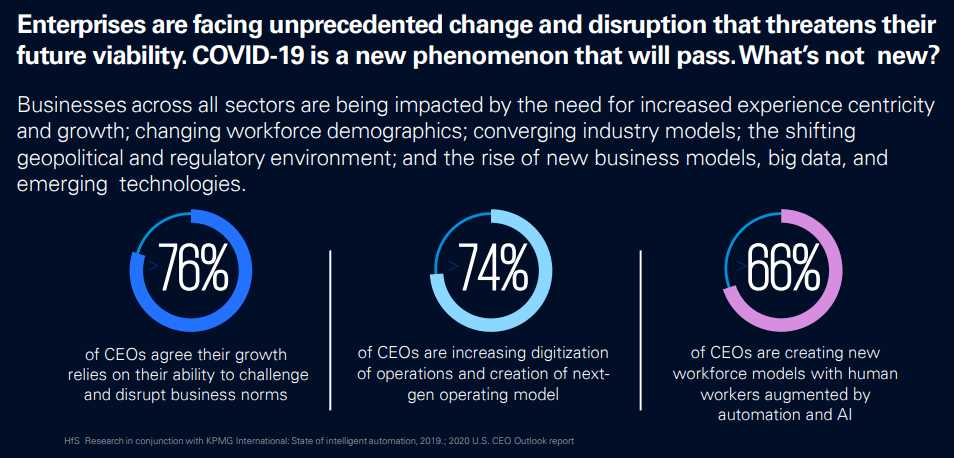

As the field of orbiter finance continues to evolve, there are several emerging trends that are shaping the industry. These trends are driven by advancements in technology, changes in consumer behavior, and shifts in global market dynamics. Understanding these emerging trends is crucial for businesses and investors in order to stay ahead of the curve and capitalize on new opportunities.

1. Decentralized Finance (DeFi)

One of the most notable emerging trends in orbiter finance is the rise of decentralized finance, or DeFi. DeFi refers to financial applications and services that are built on blockchain technology, allowing for peer-to-peer transactions without the need for intermediaries such as banks or traditional financial institutions. This trend has the potential to revolutionize the way financial transactions are conducted, offering increased security, transparency, and accessibility.

2. Artificial Intelligence (AI) and Machine Learning (ML)

Another emerging trend in orbiter finance is the integration of artificial intelligence and machine learning technologies. AI and ML algorithms can analyze vast amounts of data and identify patterns or anomalies that human analysts might miss. This can help financial institutions and investors make more informed decisions and mitigate risks. AI and ML also have the potential to automate various processes, increasing efficiency and reducing costs in the orbiter finance industry.

3. Digital Currencies and Cryptocurrencies

The rise of digital currencies and cryptocurrencies, such as Bitcoin and Ethereum, is another significant trend in orbiter finance. These digital assets offer advantages such as fast and low-cost transactions, global accessibility, and potential for investment gains. They also present challenges for regulators and traditional financial institutions, as they operate outside traditional banking systems. As digital currencies become more mainstream, they are likely to play a larger role in orbiter finance.

In conclusion, the future of orbiter finance is bound to be shaped by emerging trends such as decentralized finance, artificial intelligence and machine learning, and the rise of digital currencies. Businesses and investors must adapt to these changes in order to stay competitive and seize new opportunities. Keeping a close eye on these trends and their potential impact is crucial for success in the ever-evolving orbiter finance landscape.

Decentralized Finance (DeFi) Revolution

The emergence of blockchain technology has paved the way for the decentralized finance (DeFi) revolution. DeFi refers to the use of blockchain, smart contracts, and decentralized applications (DApps) to transform traditional financial systems.

Unlike traditional finance that relies heavily on intermediaries such as banks and other financial institutions, DeFi aims to democratize finance by eliminating the need for intermediaries. This is achieved through the use of smart contracts, which are self-executing contracts with predefined conditions. Smart contracts automatically execute transactions when specific conditions are met, without the need for a third party.

One of the main benefits of DeFi is the transparency and security it offers. Since transactions are recorded on a decentralized blockchain, they are visible to all participants, reducing the risk of fraud and manipulation. Additionally, the use of smart contracts eliminates the need for trust in counterparties, as the contracts are automatically enforced.

DeFi has seen significant growth in recent years, with various platforms and applications emerging in the market. These platforms offer a wide range of financial services, including lending and borrowing, decentralized exchanges, stablecoins, and yield farming.

Lending and borrowing platforms, such as Compound and Aave, allow users to lend their cryptocurrencies and earn interest or borrow cryptocurrencies by collateralizing their assets. These platforms leverage smart contracts to automate the lending and borrowing process, removing the need for intermediaries.

Decentralized exchanges (DEXs), such as Uniswap and SushiSwap, are platforms that allow users to trade cryptocurrencies directly with each other without the need for a centralized intermediary. DEXs utilize automated market-making algorithms and liquidity pools to facilitate seamless and secure trading.

Stablecoins, such as DAI and USDC, are cryptocurrencies pegged to a stable asset, such as the US dollar. These stablecoins enable users to hold a cryptocurrency that maintains a stable value, reducing the volatility associated with other cryptocurrencies.

Yield farming, also known as liquidity mining, is a practice where users provide liquidity to DeFi platforms in exchange for rewards. Users contribute their cryptocurrencies to liquidity pools, and in return, they earn additional tokens as a form of incentive. Yield farming has gained popularity as a way to generate passive income in the DeFi space.

Overall, the DeFi revolution is transforming the traditional financial landscape by enabling peer-to-peer transactions, reducing the reliance on intermediaries, and empowering individuals with more control over their financial assets. As the DeFi ecosystem continues to evolve, it is expected to disrupt various sectors of the financial industry and reshape the way we think about finance.

Tokenization and the Future of Asset Management

Tokenization is revolutionizing the way assets are managed, bought, and sold. It represents a fundamental shift in the financial industry, enabling the fractional ownership of assets and increasing liquidity in traditionally illiquid markets.

With tokenization, real-world assets such as real estate, art, and even intellectual property can be converted into digital tokens that can be easily traded on blockchain-based platforms. This process allows for greater accessibility and inclusivity, as more individuals can now invest in high-value assets that were previously out of reach.

Benefits of Tokenization in Asset Management

Tokenization brings numerous benefits to the field of asset management:

1. Increased Liquidity:

By digitizing assets, tokenization enhances liquidity in traditionally illiquid markets. Investors can now buy and sell fractional ownership of assets, allowing for easier and faster transactions.

2. Improved Accessibility:

Tokenization enables smaller investors to gain exposure to high-value assets that were previously reserved for institutional investors. By breaking down assets into fractional ownership, the barrier to entry is significantly lowered.

3. Enhanced Transparency:

Blockchain technology provides a transparent and immutable ledger of transactions, ensuring that ownership records and investment details are securely stored. This increased transparency builds trust among investors and eliminates the need for intermediaries.

The Future of Asset Management with Tokenization

As tokenization continues to gain traction, the future of asset management looks promising. Here are a few predictions on how this trend will shape the industry:

1. Democratization of Investments:

Tokenization will democratize investments, giving individuals from all walks of life the opportunity to invest in a wider range of assets. This increased accessibility will empower retail investors and foster financial inclusion.

2. Expansion of Tradable Assets:

As more assets become tokenized, the range of tradable assets will expand. From real estate and art to intellectual property and collectibles, investors will have a broader choice of investments, resulting in a more diverse and vibrant market.

3. Increased Efficiency and Cost Reduction:

By eliminating intermediaries and streamlining processes, tokenization will increase efficiency in asset management. Smart contracts can automate various aspects of asset ownership, reducing administrative overheads and lowering costs for both asset managers and investors.

Tokenization is poised to revolutionize asset management, unlocking new opportunities for investors and transforming the way assets are bought and sold. As the trend continues to evolve, it is crucial for market participants to adapt and embrace the potential of tokenization to stay ahead in the rapidly changing financial landscape.

Artificial Intelligence and Machine Learning in Orbiter Finance

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the field of finance, and Orbiter Finance is at the forefront of utilizing these technologies to revolutionize the industry. AI and ML techniques have the potential to greatly improve financial analysis, decision-making processes, and risk management in the world of finance.

Enhanced Data Analysis and Processing

One of the key benefits of AI and ML in Orbiter Finance is their ability to process and analyze vast amounts of financial data in real-time. By leveraging AI algorithms and machine learning models, Orbiter Finance can efficiently analyze market trends, predict future fluctuations, and identify profitable investment opportunities.

These advanced technologies enable Orbiter Finance to collect, store, and analyze data from various sources, including financial statements, news articles, social media posts, and even satellite imagery. By integrating data from multiple sources and applying machine learning algorithms, Orbiter Finance can gain valuable insights that were previously unattainable.

Automated Trading and Investment Strategies

In addition to data analysis, AI and ML also play a crucial role in automating trading and investment strategies in Orbiter Finance. By using sophisticated algorithms, Orbiter Finance can make faster and more accurate trading decisions, minimizing human error and emotions that can often lead to suboptimal outcomes.

Machine learning models can be trained to recognize complex patterns in historical market data, enabling Orbiter Finance to develop robust trading strategies. By continuously learning from past successes and failures, these models can adapt and optimize their investment approaches over time.

Orbiter Finance also utilizes AI-powered predictive models to forecast market trends and assess the potential risks associated with different investment opportunities. By predicting market movements, Orbiter Finance is better equipped to make informed investment decisions that can maximize returns while mitigating risks.

Conclusion:

The integration of artificial intelligence and machine learning in Orbiter Finance is transforming the way financial analysis and decision-making are conducted. These technologies enable Orbiter Finance to gain valuable insights from vast amounts of data, automate trading strategies, and improve risk management processes. As AI and ML continue to advance, Orbiter Finance will further enhance its capabilities and stay ahead in the ever-evolving landscape of finance.

Blockchain Technology: Disrupting the Financial Landscape

Blockchain technology has emerged as a revolutionary force in the financial industry, disrupting traditional systems and processes. Its decentralized nature and immutability make it a game-changer for various financial applications, including payments, identity verification, smart contracts, and asset management.

Decentralization and Transparency

At the core of blockchain technology is its decentralized nature, which means that there is no central authority controlling the system. Instead, transactions are verified and recorded through a network of computers, known as nodes, spread across the globe. This eliminates the need for intermediaries, such as banks or clearinghouses, and reduces the risk of fraud or tampering.

In addition, the transparency of blockchain transactions is another key feature that disrupts the traditional financial landscape. All transactions are recorded on a public ledger, known as the blockchain, which is accessible to anyone. This transparency enhances trust among participants and reduces the need for audits or third-party verifications.

Smart Contracts and Automation

Smart contracts, built on blockchain technology, have the potential to revolutionize contract management and automation. These self-executing contracts automatically verify and enforce the terms and conditions of an agreement. By eliminating the need for intermediaries or lawyers, smart contracts can streamline processes, reduce costs, and minimize the risk of human error or fraud.

Furthermore, the use of blockchain technology enables automation in various financial tasks, such as payments, settlements, and reconciliations. By leveraging smart contracts and programmable money, transactions can be executed automatically, reducing the time and effort required for manual processing.

Efficiency and Cost Savings

One of the main advantages of blockchain technology is its potential to improve efficiency and reduce costs in the financial sector. By removing the need for intermediaries and streamlining processes, blockchain-based systems can significantly reduce transaction times, eliminate redundant processes, and lower operational costs.

Moreover, blockchain technology can enable faster cross-border transactions by removing the need for multiple intermediaries and reducing the reliance on traditional banking systems. This has the potential to revolutionize remittances and global money transfers, making them faster, cheaper, and more accessible.

In conclusion, blockchain technology is disrupting the financial landscape by offering decentralization, transparency, smart contracts, automation, efficiency, and cost savings. As the technology continues to evolve and mature, it is likely to drive further innovations and reshape the future of Orbiter finance.

The Rise of Stablecoins: Stable, Secure, and Transparent

The world of digital finance is constantly evolving, and one of the most promising developments in recent years has been the rise of stablecoins. Unlike traditional cryptocurrencies like Bitcoin, stablecoins are designed to maintain a stable value, making them ideal for everyday transactions and financial services.

Stablecoins achieve their stability by pegging their value to an underlying asset, such as a fiat currency like the US Dollar or a basket of commodities. This ensures that the value of a stablecoin remains relatively constant, eliminating the volatility that is often associated with other cryptocurrencies.

One of the key benefits of stablecoins is their enhanced security. As stablecoins are backed by real-world assets, they provide a level of stability and trust that is lacking in many other forms of digital currency. This makes stablecoins an attractive option for investors and financial institutions looking to mitigate risk and safeguard their funds.

In addition to their stability and security, stablecoins also offer enhanced transparency. The blockchain technology underlying stablecoins allows for the tracking and verification of every transaction, ensuring that all information is readily available and cannot be altered. This transparency fosters trust among users and contributes to the overall stability of the stablecoin ecosystem.

The Future of Stablecoins

As the demand for stablecoins continues to grow, we can expect to see several trends and developments shaping their future. Firstly, we anticipate the emergence of more regulatory frameworks and guidelines to govern the operation of stablecoins, ensuring their compliance with existing financial regulations.

Furthermore, we can expect to see increased adoption of stablecoins in various industries, such as e-commerce and cross-border transactions. The stability and low transaction fees offered by stablecoins make them an attractive alternative to traditional payment methods, especially in areas with limited banking infrastructure.

Lastly, the rise of stablecoins may also have a significant impact on the global financial landscape. By offering a stable and secure means of transferring value, stablecoins have the potential to challenge traditional currencies and reshape the way we conduct financial transactions.

In Conclusion

The rise of stablecoins is revolutionizing the world of digital finance, offering stability, security, and transparency that is lacking in many other forms of cryptocurrency. As we look to the future, it is clear that stablecoins will play a significant role in shaping the financial landscape and the way we conduct transactions.

With the potential to challenge traditional currencies and provide a more efficient means of transferring value, stablecoins are paving the way for a more inclusive and accessible financial system.

What are some emerging trends in the field of Orbiter finance?

Some emerging trends in the field of Orbiter finance include the use of blockchain technology for secure transactions, the rise of decentralized finance (DeFi) platforms, and the increasing integration of artificial intelligence and machine learning in financial processes.

How do you predict the future of Orbiter finance?

Predicting the future of Orbiter finance is challenging, but there are some key trends that are likely to shape the industry. These include the continued adoption of blockchain technology, the growth of decentralized finance platforms, and the increasing importance of data analytics and automation in financial processes.

What impact will artificial intelligence have on Orbiter finance?

Artificial intelligence is expected to have a significant impact on Orbiter finance. It can automate manual tasks, identify patterns and trends in data, and make predictions based on complex algorithms. This will improve efficiency, reduce costs, and enable more informed decision-making in the field of Orbiter finance.

How will decentralized finance (DeFi) platforms change the Orbiter finance industry?

Decentralized finance platforms have the potential to disrupt the traditional Orbiter finance industry by providing an open and transparent alternative to centralized financial systems. These platforms allow for peer-to-peer transactions, eliminate the need for intermediaries, and enable greater financial inclusivity by providing access to financial services for individuals who are unbanked or underbanked.

What challenges does Orbiter finance face in the future?

Orbiter finance faces several challenges in the future, including cybersecurity threats, regulatory compliance, and the need to adapt to rapidly evolving technology. Additionally, the industry must navigate the complex ethical and legal implications of artificial intelligence and automation in finance.