As more and more people enter the world of cryptocurrency trading, the need for smart risk management strategies becomes paramount. One of the most effective tools in this regard is the stop-loss mechanism, which allows traders to protect their capital by automatically selling or buying assets at a predetermined price. On Orbiter Finance, a decentralized trading platform, stop-loss orders are an essential feature that can help investors minimize losses and maximize profits.

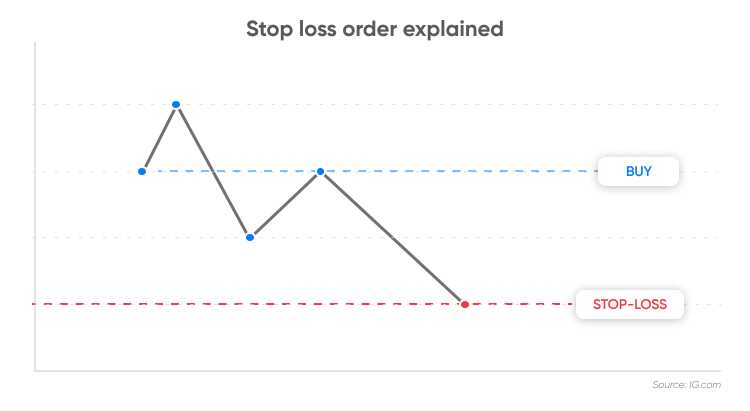

Stop-loss orders work by setting a threshold for when a trade should be automatically executed. For example, if a trader places a stop-loss order to sell a particular cryptocurrency at 5% below its current price, the system will automatically execute the sale when the price reaches or falls below that threshold. This allows traders to limit potential losses by exiting positions before they deteriorate further.

Orbiter Finance offers a variety of stop-loss options to cater to different risk appetites and trading styles. Traders can choose between a regular stop-loss order, where the asset is sold or bought at the specified price, or a trailing stop-loss order, where the threshold is set as a certain percentage or dollar amount below the highest reached price. This latter option allows for some flexibility in capturing potential gains while still protecting against major fluctuations.

Understanding how to properly set stop-loss orders is crucial for preserving capital and maintaining a healthy trading portfolio. It’s important to consider the volatility of the asset, historical price movements, and individual risk tolerance when deciding on the stop-loss threshold. By utilizing the stop-loss mechanisms on Orbiter Finance and implementing smart risk management strategies, traders can safeguard their investments and navigate the cryptocurrency market with confidence.

How Stop-Loss Mechanisms Work: A Detailed Explanation

Stop-loss mechanisms are an essential component of preserving capital and managing risk in the financial markets. Understanding how these mechanisms work is crucial for investors looking to protect their investments and limit potential losses. In this article, we will provide a detailed explanation of how stop-loss mechanisms function and their importance in preserving capital.

At its core, a stop-loss mechanism is a predetermined price level at which an investor decides to sell or exit a position in order to limit potential losses. This mechanism acts as a safety net, automatically triggering the sale of an asset when its price reaches or falls below the specified stop-loss level. By doing so, investors can protect themselves from significant losses in the event of a sudden market downturn or adverse price movement.

Stop-loss mechanisms typically involve setting a stop-loss order with a broker or trading platform. This order instructs the broker to execute a market sell order when the asset’s price reaches or falls below the predetermined stop-loss level. The stop-loss level is determined based on various factors, including the investor’s risk tolerance, investment strategy, and market conditions.

One common approach to determining the stop-loss level is by using a percentage-based or trailing stop. A percentage-based stop-loss order is set at a certain percentage below the asset’s current market price. For example, an investor may set a stop-loss order at 5% below the current price. If the asset’s price falls by 5% or more, the stop-loss order would be triggered, and the asset would be sold.

A trailing stop is another popular approach that adjusts the stop-loss level as the asset’s price increases. This type of stop-loss order is set at a certain percentage or dollar amount below the highest price reached since the position was opened. The trailing stop continuously updates the stop-loss level to protect profits as the asset’s price rises, while also limiting potential losses if the price reverses.

| Advantages of Stop-Loss Mechanisms | Disadvantages of Stop-Loss Mechanisms |

|---|---|

| – Limits potential losses and protects capital – Provides a predetermined exit strategy – Helps remove emotions from trading decisions – Can be customized based on individual risk tolerance |

– May result in being stopped out of a position too soon – Does not guarantee protection against extreme market conditions or gaps – Can lead to selling assets at a loss during temporary price fluctuations |

While stop-loss mechanisms offer numerous benefits, it is important to note their limitations and potential disadvantages. For example, stop-loss orders may lead to being stopped out of a position too soon if the asset’s price experiences temporary price fluctuations. Additionally, market conditions such as extreme volatility or price gaps can result in a stop-loss order being executed at a price significantly different from the expected stop-loss level.

In conclusion, stop-loss mechanisms are vital tools for preserving capital and managing risk in the financial markets. By setting a predetermined stop-loss level, investors can protect their investments and limit potential losses. However, it is crucial to carefully consider the advantages and disadvantages of stop-loss orders and adapt them to individual risk tolerance and investment strategies.

The Benefits of Using Stop-Loss Mechanisms on Orbiter Finance

Investing in the volatile crypto market can be a thrilling but risky endeavor. Orbiter Finance understands the importance of managing that risk and preserving capital for investors. That’s why the platform offers robust stop-loss mechanisms, which can be an invaluable tool for traders.

1. Protecting Against Significant Losses

One of the primary benefits of using stop-loss mechanisms on Orbiter Finance is the ability to protect against significant losses. By setting a stop-loss order, traders can automatically sell their assets if they reach a predetermined price level. This feature helps limit the impact of sudden market downturns and reduces the risk of substantial financial losses.

For example, if a trader sets a stop-loss order at 10% below the current market price, the system will automatically sell their assets when the price reaches that level. This ensures that any potential losses are capped at 10%, allowing traders to exit a trade before the market further deteriorates.

2. Emotion-Free Decision Making

Another benefit of stop-loss mechanisms is that they help eliminate emotional decision making. When the market is highly volatile, fear and panic can often cloud a trader’s judgment. By setting a stop-loss order in advance, traders can make rational decisions based on preset parameters, without being influenced by short-term market fluctuations.

Emotion-free decision making is crucial for long-term success in the crypto market. Stop-loss mechanisms on Orbiter Finance provide traders with peace of mind, knowing that their investments are protected from sudden price crashes.

Summary:

Stop-loss mechanisms on Orbiter Finance offer several benefits for traders in the crypto market. They protect against significant losses and provide a sense of security in volatile market conditions. By using stop-loss orders, traders can make rational decisions based on preset parameters, without letting emotions cloud their judgment. This ultimately helps preserve capital and improves overall investment outcomes.

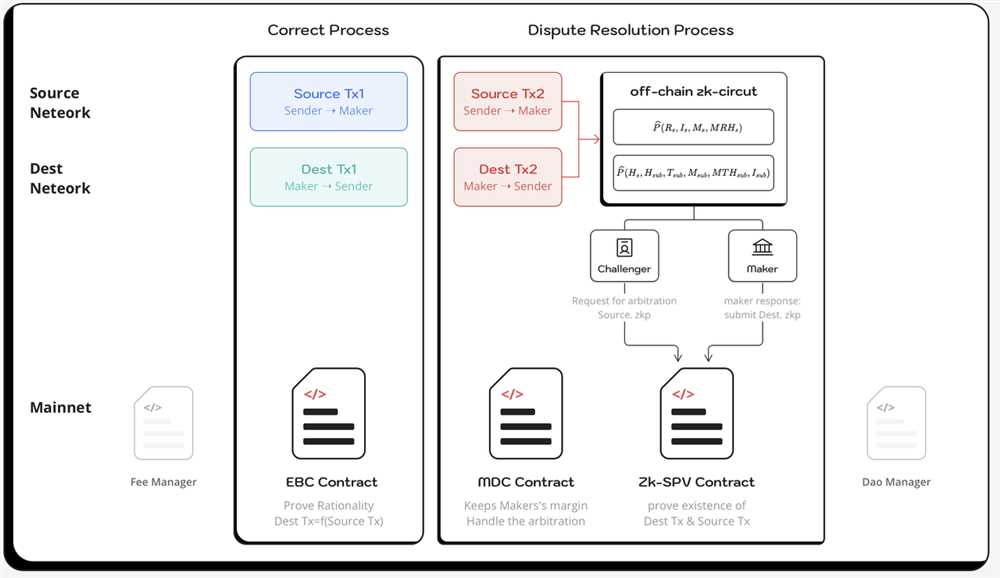

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) platform that offers various financial services such as lending, borrowing, and trading to users on the Ethereum blockchain.

What is a stop-loss mechanism?

A stop-loss mechanism is a risk management tool used in trading and investing to protect capital by automatically selling a position when it reaches a predetermined price level. It helps limit potential losses and preserve capital.

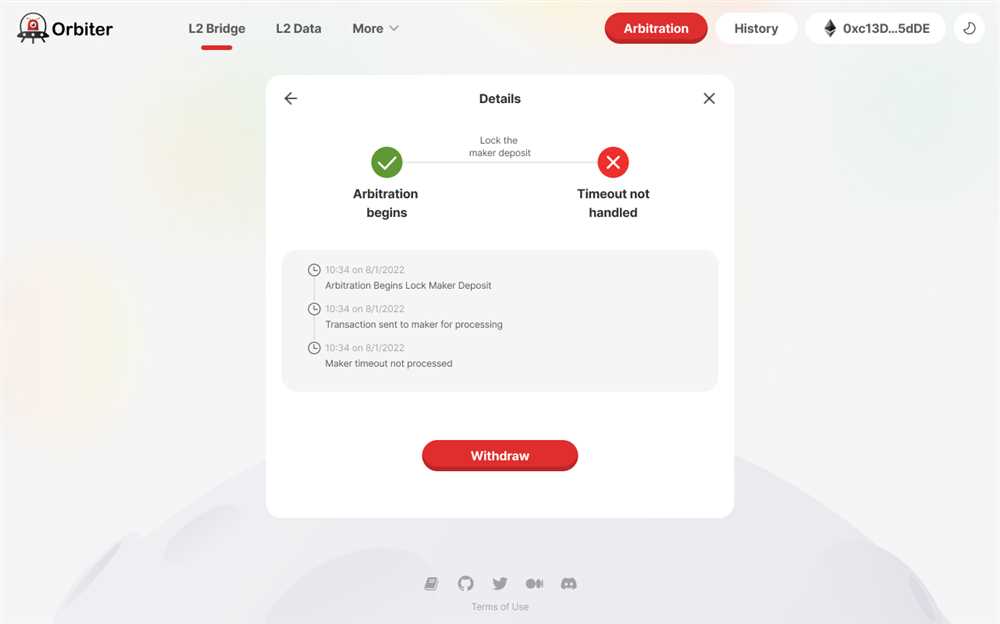

How does the stop-loss mechanism work on Orbiter Finance?

On Orbiter Finance, the stop-loss mechanism is implemented through smart contracts. Users can set a stop-loss order by specifying the token, the trigger price, and the amount to be sold. When the trigger price is reached, the smart contract automatically executes the sell order, helping users minimize losses.