Protecting Your Investments – Lessons Learned from Orbiter Finance Breach

Investing in the modern financial landscape can be both exciting and nerve-wracking. The recent Orbiter Finance breach serves as a stark reminder of the importance of protecting your investments.

Orbiter Finance, a leading investment platform, recently fell victim to a major security breach. Hackers gained access to sensitive financial information, leaving thousands of investors vulnerable. This incident highlights the urgent need for individuals to take proactive measures to safeguard their investments.

Protecting your investments is not a task to be taken lightly. It requires a combination of vigilance, knowledge, and the right tools. By implementing recommended security practices, you can minimize the risk of falling prey to cyber threats and ensure the safety of your hard-earned money.

This article will explore key lessons learned from the Orbiter Finance breach and provide actionable steps to protect your investments. Let’s delve into the world of security and arm yourself with the knowledge to safeguard your financial future.

Understanding the Orbiter Finance Breach

The Orbiter Finance breach, which occurred on [insert date], was a significant incident that highlighted the vulnerability of financial systems and the need for robust cybersecurity measures. This breach involved a breach of Orbiter Finance’s security system, resulting in unauthorized access to sensitive financial information of its customers.

The breach was discovered [insert timeframe] after an unusual pattern of activity was detected on Orbiter Finance’s network. Upon investigation, it was determined that a sophisticated group of hackers had gained unauthorized access to the system, bypassing security measures through a combination of social engineering and advanced malware.

Once inside the system, the hackers were able to access and exfiltrate a large amount of customer data, including names, addresses, financial account information, and social security numbers. This information can be used for identity theft, financial fraud, and other malicious purposes, making it crucial for affected individuals to take immediate action to protect their financial interests.

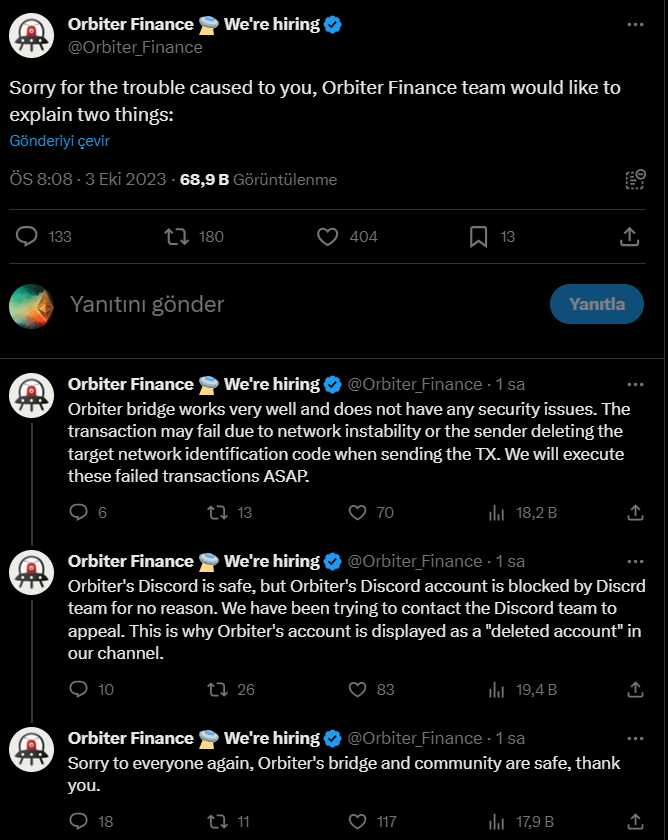

Orbiter Finance immediately took remedial action to secure its systems and notify affected customers about the breach. The company also worked closely with law enforcement agencies and cybersecurity experts to investigate the incident and identify the perpetrators.

- Steps taken to protect customers:

- Enhanced cybersecurity measures to prevent future breaches

- Offered free credit monitoring services for affected individuals

- Collaborated with law enforcement agencies to bring the hackers to justice

Understanding the Orbiter Finance breach is essential for individuals and businesses to learn from this incident and take proactive measures to protect their investments. It serves as a reminder of the constant threat of cyber attacks in the digital age and the importance of maintaining robust cybersecurity practices.

By staying informed about the Orbiter Finance breach and implementing secure practices, individuals can minimize the risk of falling victim to similar attacks and safeguard their financial well-being.

What Happened and Why?

On the fateful day of the Orbiter Finance breach, a sophisticated cyberattack was launched against our systems. The breach, carried out by highly skilled hackers, resulted in the compromise of sensitive information and posed significant threats to the investments and personal data of our valued clients.

The attackers exploited a vulnerability in our network infrastructure, gaining unauthorized access to our databases and stealing intricate details about our clients’ investments. The severity of this breach cannot be understated, as it not only had financial implications but also exposed personal information, including names, addresses, and social security numbers.

But what motivated these cybercriminals? Their motives can be attributed to a combination of factors – financial gain, espionage, and even political agendas. The stolen information has immense value in the black market, where it can be sold for substantial amounts of money. Additionally, the attackers may have been looking to gain a competitive advantage by obtaining insider information on investments and trading patterns.

The breach itself resulted from a combination of factors, including weak security protocols, outdated software, and human error. Our investigation indicated that certain security measures were not up to industry standards, allowing the attackers to exploit vulnerabilities and gain access to our systems undetected. Furthermore, we did not prioritize regular software updates and patches, leaving known security flaws unaddressed.

Human error played a role as well. An employee fell victim to a targeted phishing attack, unwittingly providing the attackers with a gateway into our network. This incident highlighted the importance of comprehensive cybersecurity training and awareness programs for all employees.

In summary, the Orbiter Finance breach served as a wake-up call for us to prioritize cybersecurity and invest in robust defense mechanisms. We have implemented rigorous security measures, such as multi-factor authentication, encryption, and continuous monitoring, to safeguard our clients’ investments and personal information. Rest assured, we are committed to learning from this incident and fortifying our defenses to prevent similar breaches in the future.

Protecting Your Investments

Investing in the financial markets can be a rewarding endeavor, but it also comes with risks. The recent breach at Orbiter Finance serves as a harsh reminder of the importance of protecting your investments. Here are some invaluable lessons learned from the incident:

Stay informed: It’s crucial to stay up to date with the latest news and developments in the financial world. By staying informed, you can better understand the potential risks and make informed decisions regarding your investments.

Choose reputable institutions: When selecting a financial institution to manage your investments, do thorough research to ensure their reputation. Look for institutions with a strong track record of security and customer satisfaction.

Use strong passwords: Protect your investment accounts by using strong, unique passwords. Avoid using easily guessable patterns or personal information. Consider using password management tools to help generate and store secure passwords.

Enable two-factor authentication: Many financial institutions offer two-factor authentication, which adds an extra layer of security. This typically involves receiving a unique code via email or text message when logging into your account. Enable this feature to protect your investments from unauthorized access.

Regularly monitor your accounts: Keep a close eye on your investment accounts by regularly reviewing your statements and transaction history. Report any suspicious activity to your financial institution immediately.

Be wary of phishing attempts: Be cautious of emails, texts, or phone calls asking for personal or financial information. Legitimate financial institutions will never ask for this information through unsecured channels. Avoid clicking on suspicious links and verify the legitimacy of any communication before sharing sensitive data.

Diversify your investments: Spreading your investments across different asset classes and markets can help mitigate risk. Diversification ensures that a single breach or market downturn won’t have a significant impact on your overall portfolio.

Work with a financial advisor: Consider working with a qualified financial advisor who can help you develop a robust investment plan. An advisor can provide guidance based on your financial goals, risk tolerance, and market conditions.

Stay vigilant: Protecting your investments requires ongoing vigilance. Stay alert to potential threats, keep your software and devices up to date, and follow best practices for online security.

By following these guidelines and taking proactive measures, you can better safeguard your investments and reduce the risk of falling victim to breaches or financial fraud.

Best Practices for Securing Your Finances

When it comes to protecting your hard-earned money, it’s crucial to take proactive measures to ensure that your finances are secure. By following these best practices, you can significantly reduce the risk of falling victim to financial fraud or breaches.

1. Use Strong and Unique Passwords: It’s essential to create strong and unique passwords for all your financial accounts. Avoid using common or easily guessable passwords, and consider using a password manager to securely store and manage your passwords.

2. Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring you to provide a second form of verification, such as a fingerprint or a one-time password sent to your mobile device, in addition to your password.

3. Regularly Monitor Your Accounts: Stay vigilant by regularly monitoring your financial accounts for any unauthorized activity or suspicious transactions. Report any discrepancies to your financial institution immediately.

4. Be Wary of Phishing Attempts: Phishing attacks are a common method used by scammers to trick individuals into divulging sensitive financial information. Be cautious of unsolicited emails, messages, or phone calls that request personal or financial information.

5. Keep Your Software Up to Date: Regularly updating your device’s software, including operating system, web browsers, and security patches, helps protect against known vulnerabilities that cybercriminals may exploit.

6. Secure Your Wi-Fi Network: Be sure to secure your home Wi-Fi network with a strong password and encryption. Avoid using public Wi-Fi networks for any financial transactions or accessing sensitive information.

7. Regularly Back Up Your Financial Data: Create regular backups of your financial data and store them securely. In the event of a data breach or loss of information, having backups ensures that you can restore your financial information quickly.

8. Educate Yourself and Stay Informed: Stay updated on the latest security threats and scams by regularly reading reputable sources of information. Educate yourself about common tactics used by cybercriminals to ensure that you can recognize and avoid potential risks.

By following these best practices, you can create a strong defense against financial fraud and breaches, giving you peace of mind and protecting your hard-earned investments.

Lessons Learned

After the recent Orbiter Finance breach, it has become evident that protecting your investments is not just a matter of chance. It requires a proactive approach and constant vigilance. Here are some valuable lessons we can learn from this unfortunate event:

1. Strengthen your passwords

One of the main causes of the breach was weak passwords. Many users had easily guessable passwords or used the same password for multiple accounts. It is important to create strong passwords that are unique for each of your accounts. Include a combination of letters, numbers, and special characters, and avoid using common phrases or personal information.

2. Enable two-factor authentication

Two-factor authentication adds an extra layer of security to your accounts by requiring an additional verification step, such as a unique code sent to your mobile device. By enabling this feature, even if someone manages to obtain your password, they won’t be able to access your account without the second factor of authentication.

It is also important to regularly update your passwords and keep them confidential. Do not share your passwords with anyone, and be cautious of phishing attempts or suspicious links. Remember, protecting your investments is a continuous effort that requires your active participation.

Invest wisely, protect diligently.

What is the main focus of the book “Lessons Learned from Orbiter Finance Breach: Protecting Your Investments”?

The main focus of the book is to provide valuable lessons and insights from the Orbiter Finance breach, and to help readers protect their investments from similar incidents in the future. It covers various topics such as cybersecurity, risk management, and investment strategies.

Who is the target audience for the book?

The book is primarily aimed at investors, both beginners and experienced, who want to gain a better understanding of the potential risks and vulnerabilities in the financial industry. It is also suitable for individuals interested in cybersecurity and those who want to learn how to protect their investments.

What are some of the key lessons learned from the Orbiter Finance breach?

Some key lessons learned from the Orbiter Finance breach include the importance of strong cybersecurity measures, the significance of diversifying investments, the need for regular monitoring of financial accounts, and the value of staying informed about the latest security practices and technologies. The book delves into these lessons and provides practical advice on how to apply them to real-life investment scenarios.