Spotting Scams: How to Stay Vigilant in the Wake of Orbiter Finance Discord Server Hack

The recent hack of the Orbiter Finance Discord server serves as a stark reminder that scams are becoming increasingly sophisticated and prevalent in the world of cryptocurrency. This breach highlights the importance of staying vigilant and informed to protect oneself from falling victim to such scams.

Orbiter Finance, a popular decentralized finance project, was hit by a malicious attack that compromised their Discord server. This breach allowed the hackers to impersonate administrators and moderators, leading to unsuspecting users being deceived and potentially losing their hard-earned funds.

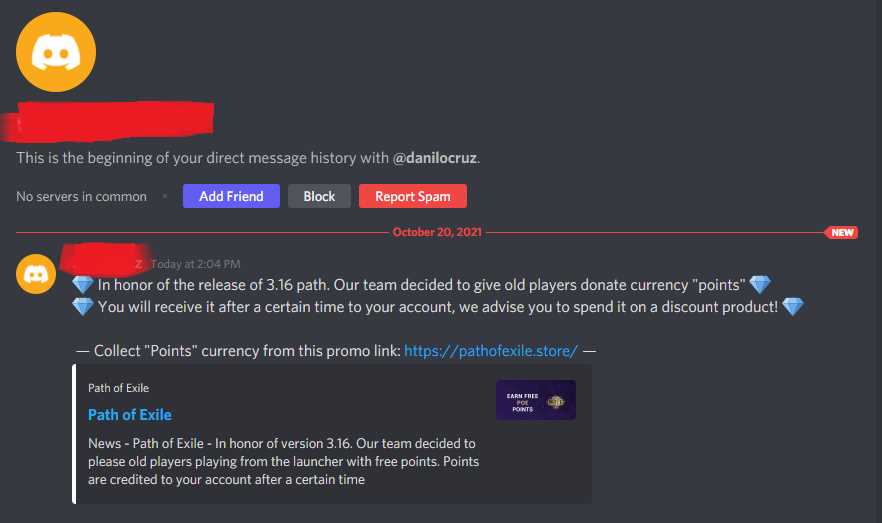

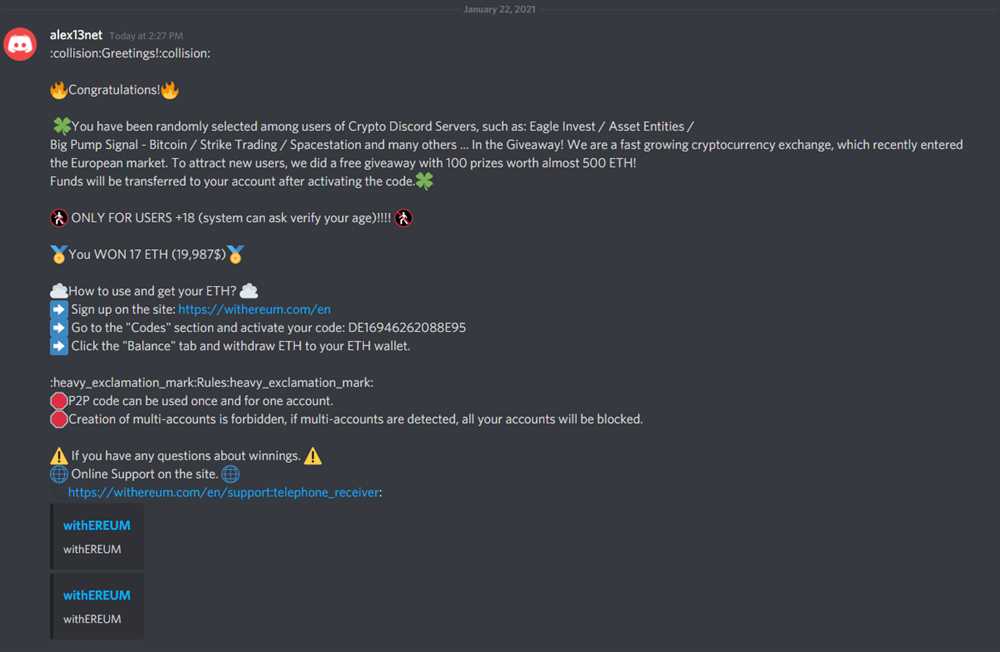

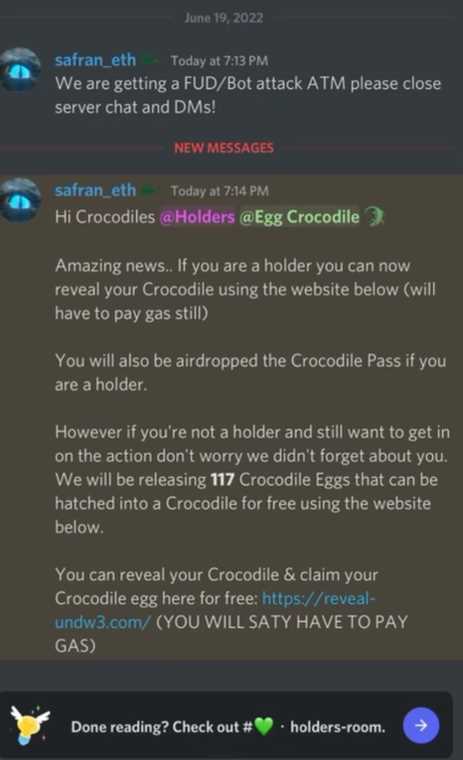

Scammers often take advantage of people’s trust in online communities and exploit their vulnerabilities. They employ various tactics, including phishing scams, fake giveaways, and impersonation, to trick individuals into revealing sensitive information or sending their cryptocurrency to fraudulent addresses. It is crucial to remain cautious and skeptical when interacting with unknown individuals or platforms.

While cryptocurrency offers numerous opportunities for financial growth and innovation, it also attracts cybercriminals who seek to exploit the decentralized and pseudonymous nature of digital assets. It is imperative for cryptocurrency enthusiasts to educate themselves about potential threats and exercise caution in their online activities.

By staying informed, using hardware wallets, verifying the authenticity of websites and community channels, and avoiding sharing personal information without proper verification, individuals can significantly reduce the risk of falling victim to scams. Remember, vigilance is key in this ever-evolving landscape of digital finance.

Protecting Yourself from Scams: How to Stay Alert Following the Orbiter Finance Discord Server Hack

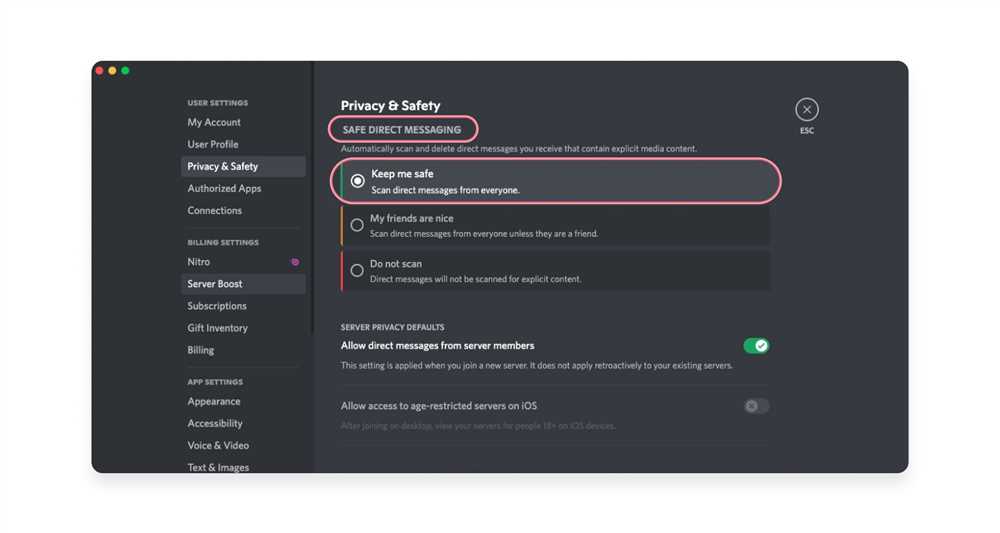

After the recent Orbiter Finance Discord Server hack, it is essential to stay vigilant and protect yourself from potential scams. Here are some tips to help you stay alert:

1. Be cautious of phishing attempts: Scammers may use the hacked server information to send phishing emails or messages pretending to be from Orbiter Finance. Be extra careful when clicking on links or providing personal information online. Always double-check the sender’s email address and domain before taking any action.

2. Update your passwords: As a precautionary measure, update your passwords for all your online accounts, especially if you have used the same password on different platforms. Use strong, unique passwords that include a combination of letters, numbers, and symbols. Consider using a password manager to securely manage your passwords.

3. Enable two-factor authentication: Two-factor authentication adds an extra layer of security to your accounts by requiring a second form of verification, such as a code sent to your mobile device. Enable this feature wherever possible to prevent unauthorized access to your accounts.

4. Monitor your financial accounts: Keep a close eye on your bank and credit card statements for any unauthorized transactions. Report any suspicious activity immediately to your bank or financial institution.

5. Stay updated: Follow official announcements and updates from Orbiter Finance and other trusted sources. Scammers may try to exploit the situation by spreading misinformation or creating fake websites. Verify information before taking any actions or providing personal information.

6. Educate yourself: Learn about common scam techniques and red flags to recognize potential scams. Be cautious of unsolicited calls, requests for money or personal information, and promises of unrealistic returns. Trust your instincts and don’t hesitate to question or verify any suspicious communications.

By following these steps, you can protect yourself from potential scams and stay alert even after the Orbiter Finance Discord Server hack. Remember, the key is to be cautious, skeptical, and proactive when it comes to your personal information and online security.

Recognizing the Danger: Understanding the Risks of Online Scams

Online scams have become increasingly prevalent in today’s digital age, posing a significant threat to individuals and organizations alike. Understanding the risks associated with these scams is crucial for safeguarding personal information and financial security.

Types of Online Scams

There are various types of online scams, each designed to deceive unsuspecting victims. Some common examples include:

| Scam Type | Description |

|---|---|

| Phishing | Scammers pose as legitimate organizations or individuals in an attempt to trick victims into revealing sensitive information, such as passwords or credit card details. |

| Ransomware | Malicious software that encrypts a victim’s data, holding it hostage until a ransom is paid. |

| Advance Fee Fraud | Scammers trick victims into paying an upfront fee or providing a financial contribution in exchange for a promised reward, such as a lottery win or inheritance. |

| Online Shopping Scams | Fraudulent websites or sellers offering products or services at too-good-to-be-true prices, but never delivering the goods. |

Warning Signs

Recognizing the warning signs of online scams is essential in avoiding falling victim. Some common red flags include:

- Requests for personal or financial information via email or social media.

- Unsolicited emails or messages claiming to offer unexpected rewards or prizes.

- Websites with poor design, spelling errors, or suspicious URLs.

- Pressure to act quickly or provide funds urgently.

- Offers that seem too good to be true or involve guaranteed returns.

By remaining vigilant and cautious, individuals can minimize their risk of falling victim to online scams. It is important to be skeptical of unsolicited messages or requests and to verify the authenticity of any websites or individuals before providing personal or financial information.

Taking Action: Essential Steps to Protect Your Financial Security

Following the recent hack of the Orbiter Finance Discord server, it is crucial to take immediate action to ensure the security of your financial information. Scammers and hackers are becoming increasingly sophisticated, and it is essential to stay vigilant and proactively safeguard your financial well-being.

1. Change Your Passwords

The first step in protecting your financial security is to change all of your passwords, especially those related to your banking and investment accounts. Create strong passwords that include a combination of letters, numbers, and special characters, and avoid using easily guessable information such as birthdays or names of family members.

2. Enable Two-Factor Authentication

Many online platforms and financial institutions offer two-factor authentication, which adds an extra layer of security to your accounts. Enable this feature wherever possible, as it requires you to provide a second form of verification, such as a code sent to your phone, in addition to your password.

3. Monitor Your Accounts Regularly

Regularly monitor your bank statements, credit card transactions, and investment accounts to identify any suspicious activity. If you notice any unauthorized transactions or discrepancies, contact your financial institution immediately.

4. Be Wary of Phishing Attempts

Be cautious of emails, messages, or phone calls that ask for personal or financial information. Scammers often try to lure victims by posing as official organizations. Always verify the legitimacy of the request before providing any sensitive information.

5. Install Security Software

Install reliable antivirus and anti-malware software on all of your devices. Regularly update this software to protect against the latest threats and ensure you have a firewall enabled for an added layer of protection.

6. Educate Yourself about Scams

Stay informed about the different types of scams and techniques used by scammers. Research common tactics and red flags to help you recognize and avoid suspicious situations or requests.

7. Use Secure Networks

Avoid conducting financial transactions or accessing sensitive information on public Wi-Fi networks. These networks are often unsecured and can easily be compromised by hackers. Instead, use a secure and private network, such as a home or work network, whenever possible.

8. Keep Your Software Updated

Regularly update your operating system, web browsers, and other software to ensure you have the latest security patches. These updates often include fixes for vulnerabilities that could be exploited by hackers.

| Actions to Protect Financial Security | Not Recommended Actions |

|---|---|

| Changing passwords | Using easily guessable passwords |

| Enabling two-factor authentication | Disabling security features |

| Regularly monitoring accounts | Ignoring suspicious activities |

| Being wary of phishing attempts | Providing personal information to unknown sources |

| Installing security software | Downloading software from untrusted sources |

| Educating oneself about scams | Believing every too-good-to-be-true offer |

| Using secure networks | Using public Wi-Fi for financial transactions |

| Keeping software updated | Ignoring software updates |

By taking these essential steps and remaining proactive, you can significantly reduce the risk of falling victim to scams or having your financial information compromised. Stay vigilant and prioritize your financial security for peace of mind.

Learning from Others: Case Studies and Lessons from Past Scams

One of the best ways to protect yourself from scams is to learn from the experiences of others. By studying past cases and the lessons that can be drawn from them, you can gain valuable insights into how scammers operate and what red flags to watch out for.

Here are a few case studies that highlight common tactics used by scammers:

Ponzi Scheme: Bernie Madoff

Bernie Madoff ran one of the largest Ponzi schemes in history. He promised high returns to investors and used new investments to pay off old investors. Eventually, the scheme collapsed, causing billions of dollars in losses. Lessons learned from this case include the importance of conducting thorough due diligence on investment opportunities and being wary of overly consistent returns.

Email Phishing: John Podesta

John Podesta, chairman of Hillary Clinton’s 2016 presidential campaign, fell victim to a phishing attack. Hackers sent him an email that appeared to be from Google, asking him to change his password. Podesta clicked on the link and entered his credentials, unknowingly giving the hackers access to his email account. This case teaches us to be cautious when clicking on email links and to verify the authenticity of requests before providing personal information.

By studying these and other case studies, you can develop a better understanding of the tactics scammers use and the vulnerabilities they exploit. This knowledge will help you stay vigilant and protect yourself from falling victim to scams.

What happened to the Orbiter Finance Discord server?

The Orbiter Finance Discord server was hacked by scammers who gained access to the server and attempted to trick users into providing their personal information and cryptocurrency funds.

How did the scammers gain access to the Discord server?

The specific details of how the scammers gained access have not been disclosed, but it is believed that they used phishing techniques to trick an administrator or moderator into providing login credentials or gained access through other means.

What did the scammers try to do once they gained access?

Once the scammers gained access to the Orbiter Finance Discord server, they posed as administrators and moderators and tried to trick users into providing their private keys, seed phrases, and personal information. They also attempted to convince users to send their cryptocurrency funds to fake addresses.