Are you tired of settling for average returns on your investments? Look no further than Orbiter Finance, the leading financial services provider that can help you achieve the success you’ve always dreamed of.

At Orbiter Finance, we understand that maximizing returns is the key to financial prosperity. With our team of experienced professionals and innovative strategies, we can help you navigate the complex world of finance and unlock your true investment potential.

Whether you’re a seasoned investor or just starting out, our tailor-made solutions can meet your unique needs. We offer a wide range of investment options, from stocks and bonds to real estate and cryptocurrencies, all carefully analyzed and selected to ensure maximum returns.

Why choose Orbiter Finance?

Expert guidance: Our team of financial experts will provide you with personalized guidance and support every step of the way, ensuring that your investment decisions are well-informed and aligned with your goals.

Innovative strategies: With our cutting-edge strategies and constant market analysis, we stay ahead of the curve and identify the most lucrative investment opportunities for our clients.

Risk management: We understand that managing risk is crucial to successful investing. Our risk management techniques and diversification strategies help protect your investments while maximizing returns.

Transparent and reliable: At Orbiter Finance, we believe in building long-term relationships based on trust and transparency. We provide clear and concise information about our services, fees, and performance, so you can make informed decisions with confidence.

Don’t settle for average returns when you can achieve so much more. Join Orbiter Finance today and start maximizing your returns for a brighter financial future.

Introducing Orbiter Finance

Welcome to Orbiter Finance, your trusted partner in maximizing your financial returns. We understand that navigating the complexities of the modern financial landscape can be overwhelming, but with Orbiter Finance by your side, success is within reach.

At Orbiter Finance, we believe that financial success is not exclusive to the experts. We have developed innovative strategies and cutting-edge tools that empower individuals, like you, to take control of their financial future. Whether you are a seasoned investor or a novice just getting started, we have the resources and expertise to help you achieve your financial goals.

Our team of experienced financial advisors are here to guide you every step of the way. We offer personalized advice tailored to your unique situation and goals. By understanding your specific needs, we can help you develop a customized portfolio management strategy that maximizes your returns and minimizes risk.

With Orbiter Finance, you gain access to a wide range of investment opportunities. From stocks and bonds to real estate and alternative investments, we provide you with the tools and knowledge you need to diversify your portfolio and capitalize on market trends.

Our commitment to transparency and integrity sets us apart from the competition. We believe in building long-term relationships with our clients, based on trust and mutual success. You can rely on Orbiter Finance to always act in your best interest, putting your financial goals first.

Are you ready to maximize your returns and achieve financial success? Join Orbiter Finance today and let us be your guide on your financial journey.

The Key to Maximizing Returns

When it comes to maximizing returns on your investments, having a solid strategy is essential. At Orbiter Finance, we understand that every investor has unique goals and risk tolerances. That’s why we offer a wide range of strategies designed to help you achieve your financial objectives.

Diversification

One key strategy we recommend is diversification. By spreading your investments across different asset classes, sectors, and regions, you can reduce risk and potentially increase returns. Our team of experts will work with you to develop a diversified portfolio that aligns with your investment goals and risk tolerance.

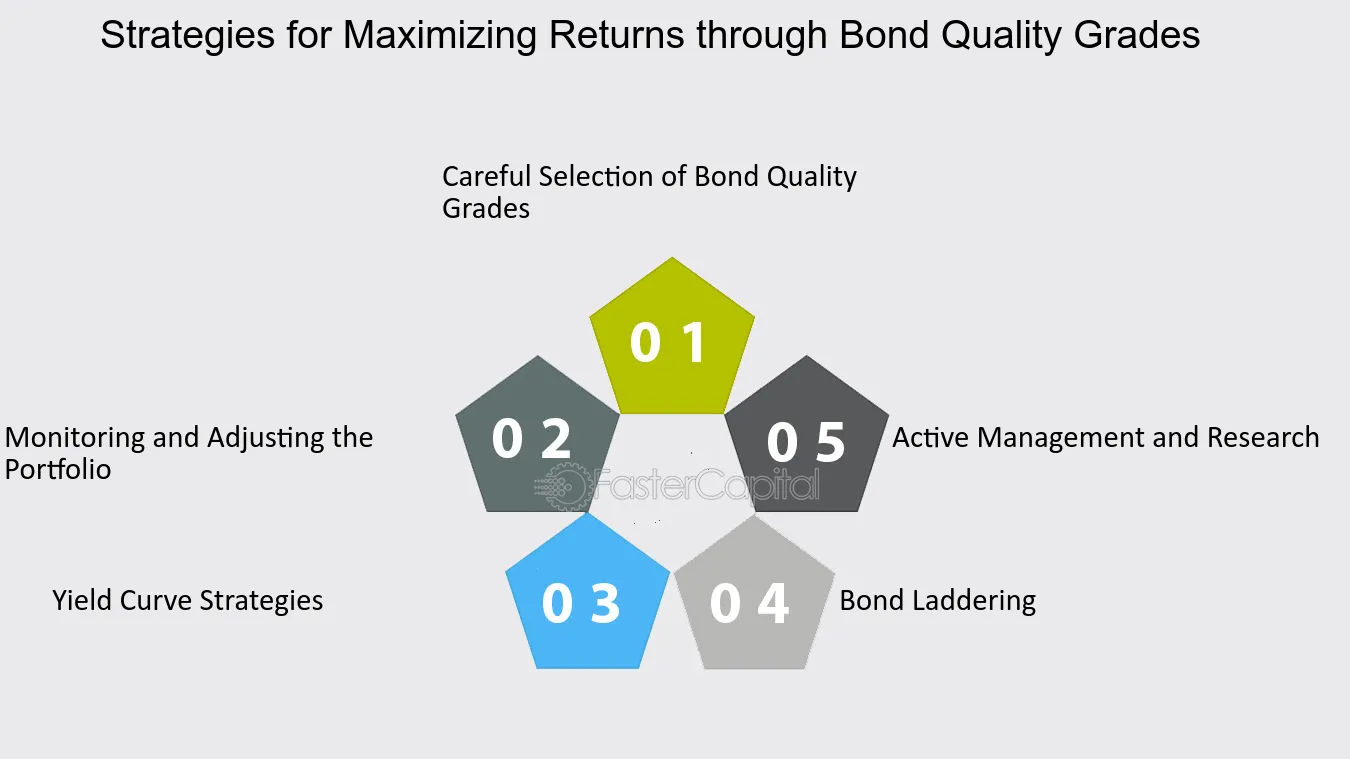

Active Management

Another crucial factor in maximizing returns is active management. Our experienced portfolio managers closely monitor market trends and make strategic adjustments to your portfolio to take advantage of potential opportunities. This proactive approach ensures that your investments are always positioned to generate optimal returns.

Additionally, our active management style allows us to react quickly to changing market conditions, mitigating potential losses and maximizing returns.

Technology-driven Approach

At Orbiter Finance, we leverage cutting-edge technology in our investment strategies. By utilizing advanced analytics and machine learning algorithms, we are able to identify investment opportunities that may be overlooked by traditional approaches. This technology-driven approach gives us a competitive edge, allowing us to maximize returns for our clients.

Whether you’re a seasoned investor or just starting your investment journey, Orbiter Finance has the strategies and expertise to help you maximize returns. Contact us today to learn more about our services and start achieving your financial goals.

| Benefits of working with Orbiter Finance: |

|---|

| Customized investment strategies tailored to your goals and risk tolerance |

| Expert portfolio managers with extensive market knowledge |

| Proactive approach to optimize returns and mitigate risks |

| Access to cutting-edge technology for advanced investment analysis |

| Personalized support and guidance from our dedicated team |

The Importance of a Strategy

When it comes to maximizing returns on your investments, having a solid strategy is crucial. Without a clear plan, you may find yourself making impulsive decisions based on emotions or short-term trends, which can lead to financial losses.

A well-defined strategy helps you stay focused on your long-term goals and keeps you on track even when the market is fluctuating. It provides you with a framework to make informed decisions and take advantage of opportunities that align with your objectives.

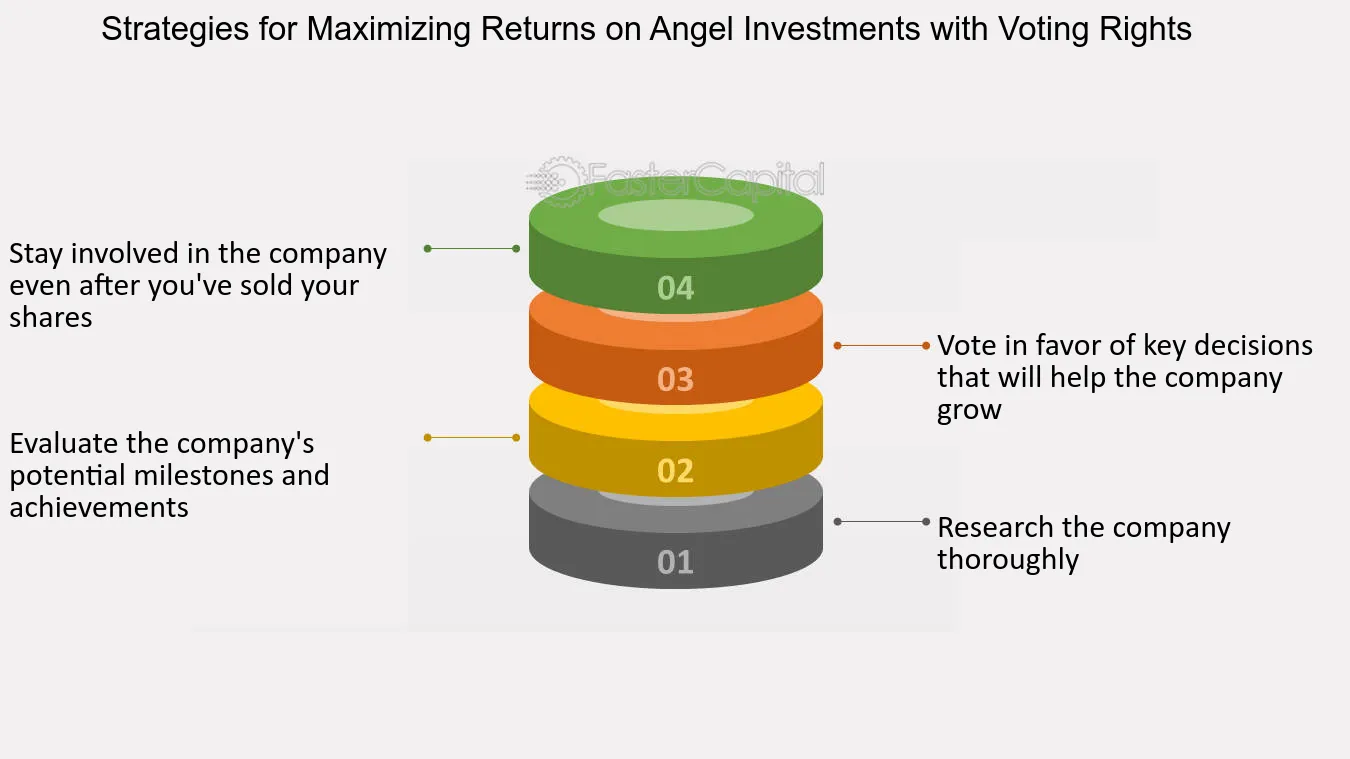

1. Setting Clear Goals

Developing a strategy starts with setting clear and achievable financial goals. Whether you’re aiming for retirement savings, buying a home, or starting a business, having specific targets in mind will help you determine the best investment vehicles and risk tolerance.

By clearly defining your goals, you can create a roadmap that outlines the steps needed to achieve them. This roadmap will serve as a guide throughout your investment journey and help you stay focused during uncertain times.

2. Managing Risk

Investing comes with inherent risks, and having a strategy allows you to effectively manage those risks. By diversifying your portfolio and allocating your assets wisely, you can minimize the impact of market volatility and potentially maximize returns.

A strategy also helps you determine your risk tolerance and make informed decisions about asset allocation. It ensures that you’re not overly exposed to any single investment and allows you to make adjustments to your portfolio as needed.

Remember: a well-constructed strategy takes into account your risk tolerance, time horizon, and financial goals.

Investing without a strategy is akin to sailing without a compass. It’s important to ensure that your financial decisions are based on careful planning and a solid understanding of your objectives.

At Orbiter Finance, we understand the importance of a strategy in achieving financial success. Our expert team can help you develop a personalized investment plan tailored to your goals and risk tolerance. Contact us today to get started on your journey towards maximizing returns.

Developing a Successful Plan

When it comes to maximizing returns, having a well-defined plan is crucial. Developing a successful plan requires careful consideration and a thorough understanding of your financial goals and risk tolerance. Here are some key steps to help you create a plan that will lead to success:

1. Set Clear Goals

The first step in developing a successful plan is to set clear and achievable financial goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Whether your goal is to save for retirement, buy a house, or pay off debt, clearly defining your objectives will help guide your investment decisions.

2. Assess Your Risk Tolerance

Understanding your risk tolerance is crucial in creating a successful plan. Your risk tolerance will determine the level of risk you are comfortable taking with your investments. It is important to assess your risk tolerance objectively and consider factors such as your age, financial situation, and investment experience.

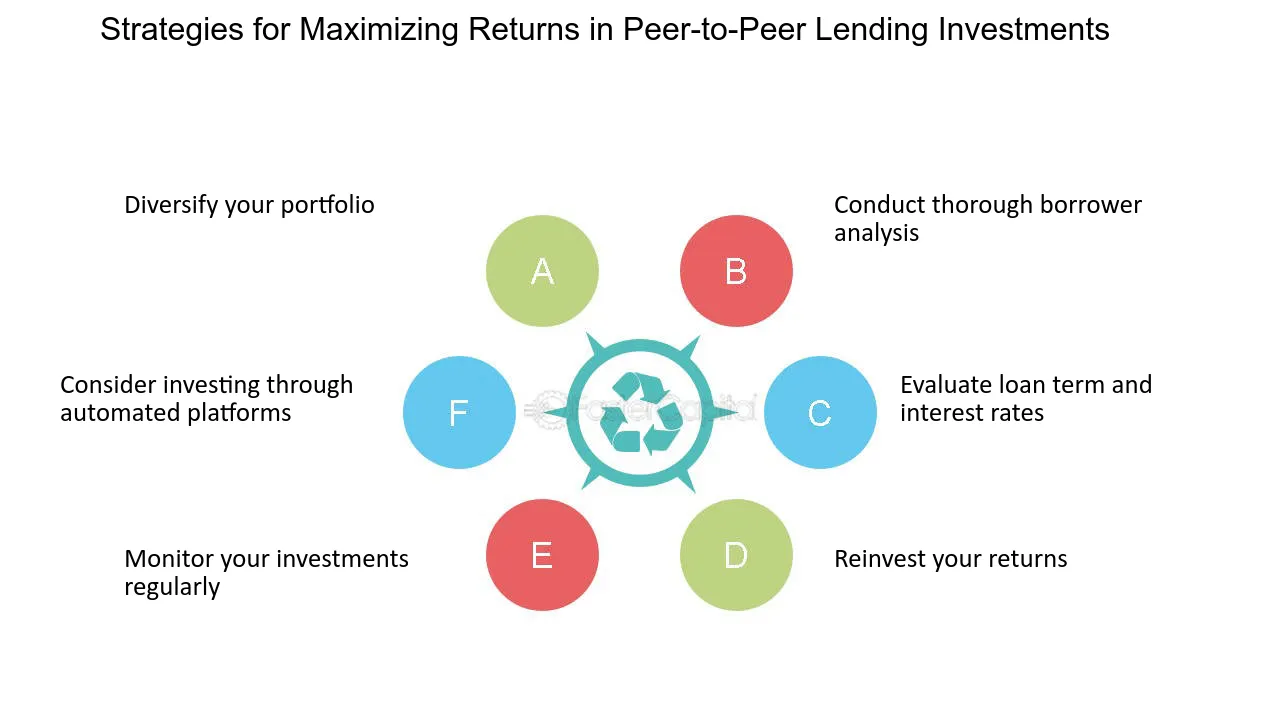

3. Diversify Your Portfolio

Diversification is a key strategy for maximizing returns while minimizing risk. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of any one investment on your overall portfolio. This helps to ensure that your returns are not overly dependent on the performance of a single investment.

4. Monitor and Adjust

A successful plan is not a one-time event but an ongoing process. Regularly monitoring your investments and reviewing your progress against your goals is essential. Make adjustments to your plan as necessary, whether it’s rebalancing your portfolio or making changes to your asset allocation. Staying proactive and adaptable will help you stay on track towards achieving your financial goals.

Remember, developing a successful plan takes time and effort. It’s important to consult with a financial advisor or investment professional who can provide expert guidance tailored to your specific needs. With the right plan in place, you can maximize your returns and achieve long-term financial success.

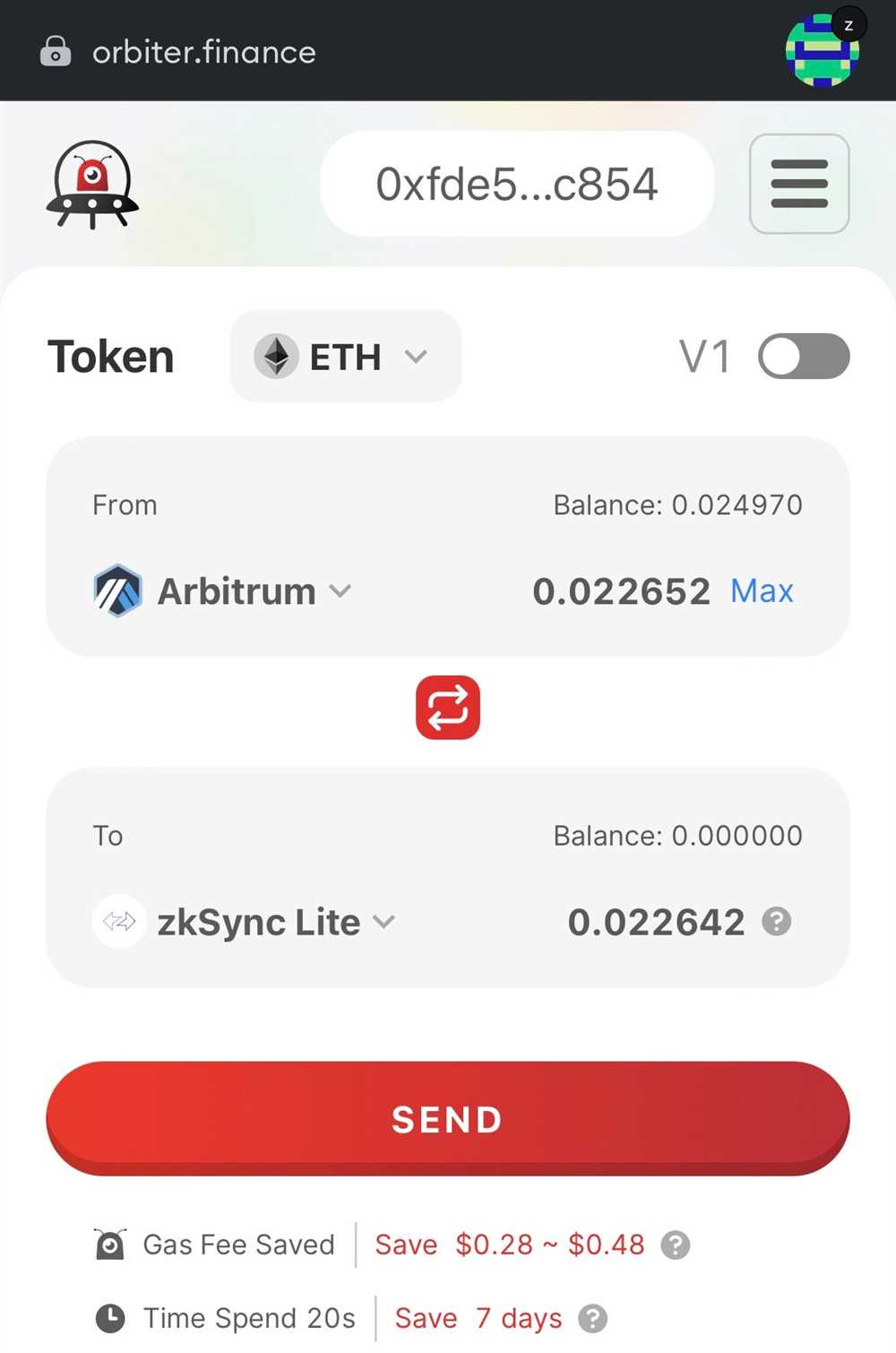

Implementing Orbiter Finance

Implementing Orbiter Finance strategies is a crucial step towards maximizing returns on your investments. Here are some key steps to help you get started:

1. Set Clear Financial Goals

Before you begin implementing Orbiter Finance, it’s important to define your financial goals. Determine what you want to achieve with your investments, whether it’s saving for retirement, funding your child’s education, or buying a new home.

2. Assess Your Risk Tolerance

Understanding your risk tolerance is essential when implementing Orbiter Finance strategies. Evaluate how comfortable you are with fluctuations in the market and adjust your investment portfolio accordingly.

3. Create a Diversified Portfolio

One of the key principles of Orbiter Finance is diversification. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk and maximize potential returns.

4. Regularly Monitor and Rebalance Your Portfolio

Keep a close eye on your investments and make necessary adjustments to maintain the desired asset allocation. Rebalancing your portfolio periodically ensures that it stays aligned with your financial goals.

5. Stay Informed and Seek Professional Advice

Stay updated on market trends, economic news, and investment strategies. Consider consulting with a financial advisor who specializes in Orbiter Finance to get personalized advice based on your individual circumstances.

By implementing Orbiter Finance, you can make informed investment decisions and optimize your returns, ultimately achieving financial success.

Tips for Success

When it comes to maximizing your returns with Orbiter Finance, there are several key tips for success that you should keep in mind. By following these strategies, you can increase your chances of achieving your financial goals:

1. Diversify Your Portfolio

One of the most important tips for success is to diversify your portfolio. By investing in a variety of assets, you can spread your risk and minimize the impact of any individual investment’s performance. Consider investing in different asset classes such as stocks, bonds, real estate, and commodities to ensure a well-balanced portfolio.

2. Stay Updated on Market Trends

To stay ahead in the ever-changing financial market, it is crucial to stay updated on the latest market trends. By keeping a close eye on economic indicators, industry news, and market analysis, you can make informed investment decisions. Subscribe to financial publications, follow reputable financial websites, and attend industry conferences to stay informed.

In addition to these tips, it is also essential to have a clear investment plan, set realistic goals, and regularly review and adjust your portfolio. Remember, investing involves risks, and it is crucial to consult with a financial advisor before making any investment decisions. With the right strategies and careful planning, you can maximize your returns and achieve financial success with Orbiter Finance.

What is Orbiter Finance?

Orbiter Finance is a platform that provides strategies for maximizing returns on investments.

How can Orbiter Finance help me maximize my returns?

Orbiter Finance offers various investment strategies and tools to help you make informed decisions and optimize your investment portfolio.

Are the strategies provided by Orbiter Finance suitable for beginners?

Yes, Orbiter Finance offers strategies suitable for both beginners and experienced investors. They provide educational resources to help beginners understand investment concepts.

Do I need any prior knowledge or experience in finance to use Orbiter Finance?

No, you do not need any prior knowledge or experience in finance to use Orbiter Finance. The platform is designed to be user-friendly and accessible to users of all levels.

Can Orbiter Finance guarantee high returns on investments?

No, Orbiter Finance cannot guarantee high returns on investments. The platform provides strategies and tools to help increase the likelihood of maximizing returns, but actual returns will depend on market conditions and individual investment choices.