The Advantages of Orbiter Finance: Enhancing Cross-Rollup Transfers with a Decentralized Bridge

Orbiter Finance is revolutionizing the way we transfer assets between different rollup networks. With the rise of layer 2 solutions, there is a growing need for efficient and secure bridges that enable seamless cross-rollup transfers. Orbiter Finance aims to address this need by providing a decentralized and user-friendly solution.

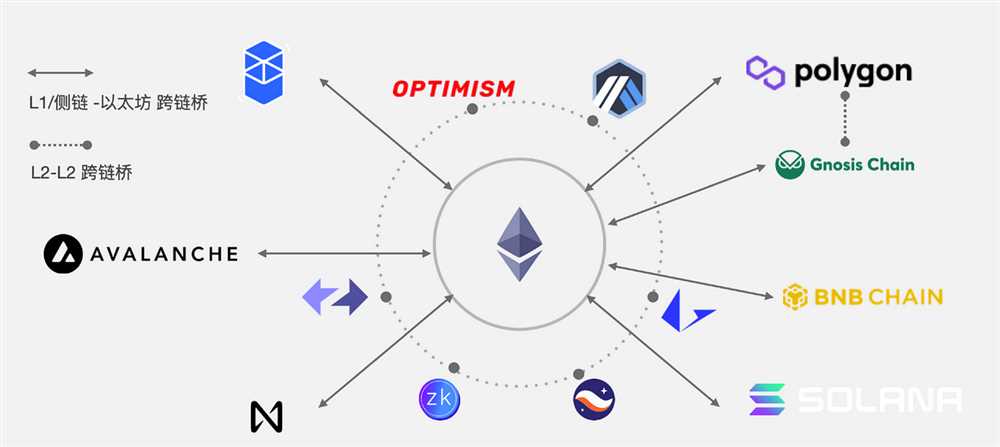

By leveraging the power of blockchain technology, Orbiter Finance allows users to transfer assets across multiple rollup networks with ease. Whether you want to move your tokens from Ethereum to Optimism, Arbitrum, or any other rollup network, Orbiter Finance has got you covered.

One of the key benefits of Orbiter Finance is its decentralized nature. Unlike traditional centralized exchanges or bridges, Orbiter Finance operates on a peer-to-peer network, eliminating the need for intermediaries. This ensures that your assets are secure and that you have full control over your transfers.

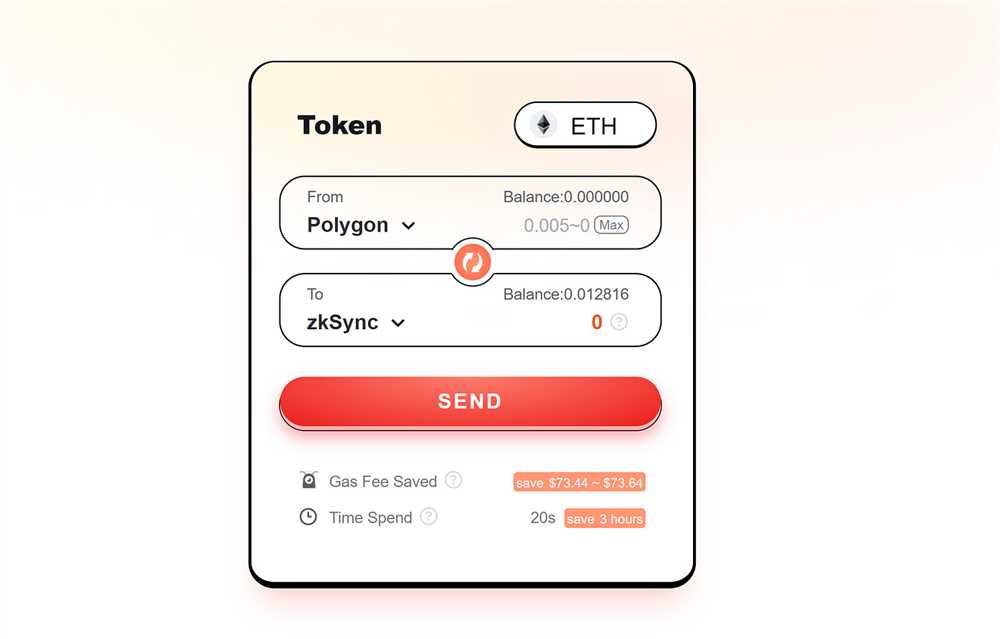

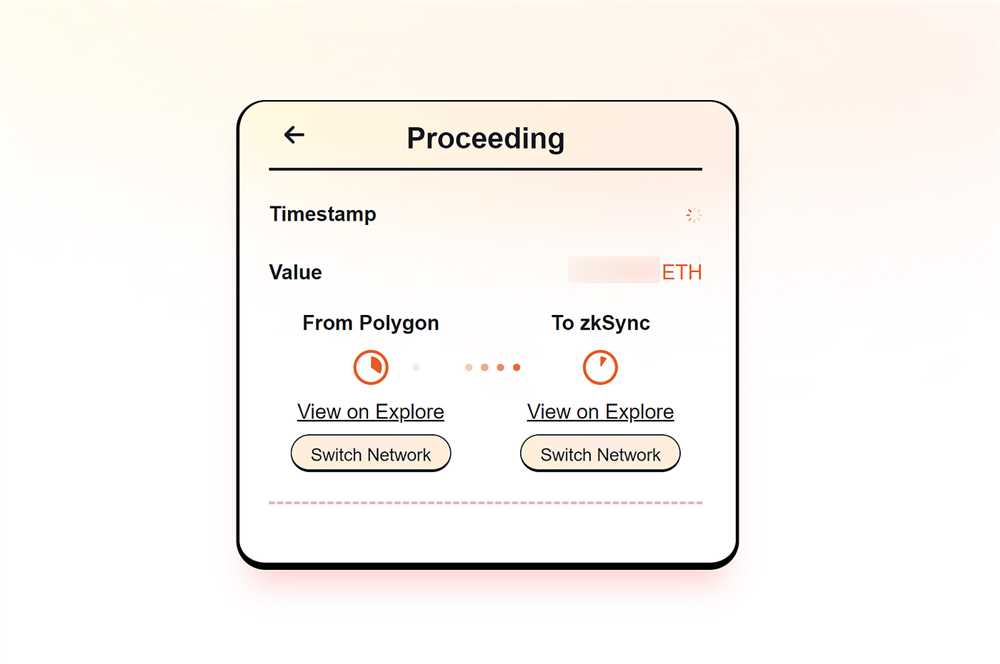

Another advantage of Orbiter Finance is its user-friendly interface. With intuitive design and simple instructions, even newcomers to the world of blockchain can easily navigate through the process of transferring assets between rollup networks. Say goodbye to complex and confusing interfaces, and hello to a seamless and enjoyable experience.

In conclusion, Orbiter Finance is shaping the future of cross-rollup transfers. With its decentralized architecture and user-friendly interface, Orbiter Finance provides a secure and efficient solution for transferring assets between different rollup networks. Whether you are a seasoned blockchain enthusiast or a newcomer to the space, Orbiter Finance is a bridge worth exploring.

Understanding Orbiter Finance

Orbiter Finance is a decentralized bridge that facilitates cross-rollup transfers in the Ethereum ecosystem. It provides a seamless and efficient way to transfer assets between different layer 2 solutions, enabling users to access a wider range of decentralized applications and DeFi protocols.

At its core, Orbiter Finance is built on the principles of decentralization, security, and interoperability. It leverages the power of smart contracts and blockchain technology to ensure the safe and reliable transfer of assets across multiple layer 2 networks.

How does Orbiter Finance work?

Orbiter Finance acts as a bridge between different layer 2 networks, allowing users to transfer assets from one network to another. It operates by creating liquidity pools that hold assets from different layer 2 solutions, ensuring there is always enough liquidity to facilitate transfers.

When a user wants to transfer assets between layer 2 networks, they can simply initiate a transaction through the Orbiter Finance interface. The transaction is then processed by the liquidity pools, which ensure that the appropriate amount of assets is transferred from one network to another.

Orbiter Finance also provides a mechanism for users to earn rewards by participating in the liquidity pools. Users can deposit their assets into the pools and earn a share of the transaction fees generated by the bridge. This incentivizes users to provide liquidity and helps ensure the availability of assets on different layer 2 networks.

The benefits of Orbiter Finance

Orbiter Finance offers several benefits to users and developers in the Ethereum ecosystem. Firstly, it enables seamless cross-rollup transfers, allowing users to access a wider range of decentralized applications and DeFi protocols. This enhances the overall usability and versatility of layer 2 solutions.

Secondly, Orbiter Finance provides increased liquidity for layer 2 networks. By creating liquidity pools and incentivizing users to participate, it ensures that assets are readily available for transfers, reducing the risk of slippage and improving overall transaction efficiency.

Lastly, Orbiter Finance contributes to the overall decentralization and security of the Ethereum ecosystem. By leveraging the power of smart contracts and blockchain technology, it eliminates the need for centralized intermediaries and ensures the safe and reliable transfer of assets.

In conclusion, Orbiter Finance is a groundbreaking decentralized bridge that opens up new possibilities for cross-rollup transfers in the Ethereum ecosystem. With its focus on decentralization, security, and interoperability, it is poised to play a crucial role in the growth and expansion of the layer 2 ecosystem.

Exploring the Benefits of a Decentralized Bridge for Cross-Rollup Transfers

A decentralized bridge for cross-rollup transfers offers numerous benefits and advantages for the cryptocurrency ecosystem. By enabling seamless and secure transfers between different rollup solutions, this decentralized bridge can enhance scalability, interoperability, and overall user experience.

One of the key benefits of a decentralized bridge is enhanced scalability. By allowing users to transfer their assets across different rollups, the bridge effectively increases the network’s capacity to process transactions. This can alleviate congestion and enable faster, more efficient transfers, even during periods of high demand.

Additionally, a decentralized bridge for cross-rollup transfers enhances interoperability within the cryptocurrency ecosystem. Different rollups often have unique features, capabilities, and protocols. By enabling transfers between these rollups, the bridge allows users to leverage the strengths of multiple solutions, without being limited to a single platform. This promotes flexibility and choice for users, while also facilitating collaboration and innovation within the broader ecosystem.

Furthermore, a decentralized bridge offers increased security and trust. By utilizing smart contracts and cryptographic mechanisms, the bridge ensures the integrity and immutability of cross-rollup transfers. Users can have confidence that their assets are protected and that transactions are executed as intended, without relying on a centralized intermediary. This trustless nature aligns with the core principles of decentralization and empowers individuals to maintain control over their assets.

Lastly, a decentralized bridge for cross-rollup transfers improves the overall user experience. Instead of having to navigate multiple networks and interfaces, users can conveniently transfer their assets across different rollups through a single bridge. This simplifies the process, reduces complexity, and saves time for users. It also promotes wider adoption and accessibility, as users can seamlessly interact with different rollups without needing to possess an in-depth understanding of each platform’s intricacies.

In conclusion, a decentralized bridge for cross-rollup transfers offers a range of benefits for the cryptocurrency ecosystem. By enhancing scalability, interoperability, security, and user experience, this bridge accelerates the pace of innovation and facilitates the widespread adoption of blockchain technology.

Efficient and Secure Token Transfers Across Different Rollups

Orbiter Finance provides a decentralized bridge that enables efficient and secure token transfers across different rollup solutions. Rollup solutions are layer 2 scaling solutions that help improve the scalability and throughput of blockchain networks.

One of the challenges in cross-rollup transfers is the compatibility of tokens between different rollup platforms. Orbiter Finance addresses this challenge by creating a standardized token bridge that allows tokens to be transferred seamlessly between different rollup networks.

By using Orbiter Finance’s token bridge, users can easily transfer their tokens between different rollup networks without the need for complex and time-consuming processes. This significantly enhances the efficiency of token transfers and reduces transaction costs for users.

Moreover, Orbiter Finance ensures the security of token transfers by implementing a trustless and decentralized mechanism. The token bridge utilizes smart contracts to facilitate token transfers, ensuring that the transfers are transparent, immutable, and tamper-proof.

Additionally, the decentralized nature of Orbiter Finance’s token bridge eliminates the need for intermediaries, reducing the risk of centralized points of failure or potential security vulnerabilities. This gives users peace of mind knowing that their token transfers are secure and protected.

In conclusion, Orbiter Finance’s decentralized bridge offers efficient and secure token transfers across different rollup solutions. By providing a standardized token bridge and implementing a trustless mechanism, Orbiter Finance enhances the efficiency and security of cross-rollup transfers, making it a valuable solution for users seeking seamless interoperability between different rollup platforms.

Unlocking Financial Opportunities with Orbiter Finance Bridge

Orbiter Finance Bridge is a decentralized bridge that enables cross-rollup transfers, allowing users to seamlessly move their assets between different rollup chains. This innovative solution opens up a world of financial opportunities for users, empowering them to take full advantage of the benefits offered by various rollup chains.

With the Orbiter Finance Bridge, users can easily bridge their assets from one rollup chain to another, without the need for complicated and time-consuming processes. This seamless transfer of assets enables users to take advantage of the unique characteristics and benefits of different rollup chains, such as low fees, fast transactions, and enhanced scalability.

Expanding Access to DeFi

By unlocking cross-rollup transfers, Orbiter Finance Bridge facilitates increased access to the decentralized finance (DeFi) ecosystem. Users can now seamlessly connect to various DeFi protocols and platforms across different rollup chains, opening up a world of possibilities for yield farming, liquidity provision, and lending and borrowing activities.

With access to a wider range of DeFi opportunities, users can optimize their strategies, diversify their portfolios, and maximize their returns. They can explore different DeFi platforms, take advantage of the highest yield opportunities, and navigate the rapidly evolving DeFi landscape with ease.

Enhancing Liquidity and Flexibility

The Orbiter Finance Bridge also enhances liquidity and flexibility for users. By enabling the transfer of assets between different rollup chains, users can tap into a larger pool of liquidity and access a wider range of trading options. This increased liquidity and flexibility empower users to execute their trades more efficiently and effectively.

Additionally, the Orbiter Finance Bridge enables users to respond swiftly to market dynamics and take advantage of arbitrage opportunities seamlessly. Users can quickly move their assets to capitalize on price disparities, ensuring they stay ahead of the market and maximize their trading profitability.

In conclusion, the Orbiter Finance Bridge revolutionizes the way users interact with different rollup chains, unlocking a new level of financial opportunities and possibilities. It expands access to DeFi, enhances liquidity and flexibility, and empowers users to optimize their strategies and maximize their returns. With the Orbiter Finance Bridge, users can explore the full potential of the decentralized finance ecosystem and take their financial endeavors to new heights.

What is Orbiter Finance?

Orbiter Finance is a decentralized bridge that enables cross-rollup transfers, allowing users to seamlessly move their assets between different Layer 2 solutions.

Why are cross-rollup transfers important?

Cross-rollup transfers are important because they allow users to take advantage of the benefits offered by different Layer 2 solutions. Users can move their assets between rollups to access different features, such as lower fees, faster transaction times, or specific functionalities.

How does Orbiter Finance work?

Orbiter Finance works by using a decentralized network of validators and relayers to facilitate cross-rollup transfers. Validators verify the transactions on each rollup, while relayers help with the transfer of assets between different rollups. This allows users to seamlessly move their assets from one rollup to another, without the need for complex manual processes.