The Benefits of Using Orbiter Finance’s Decentralized Cross-Rollup Bridge for Ethereum-Native Assets

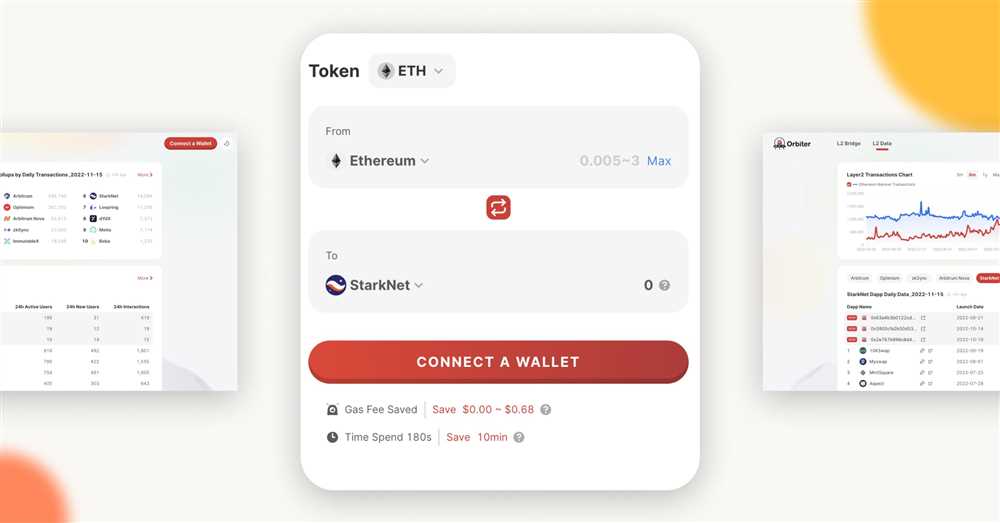

As the decentralized finance (DeFi) space continues to grow and evolve, the need for interoperability between different blockchain networks becomes increasingly important. Orbiter Finance has recognized this need and developed a decentralized cross-rollup bridge for Ethereum-native assets that offers a wide range of benefits for users.

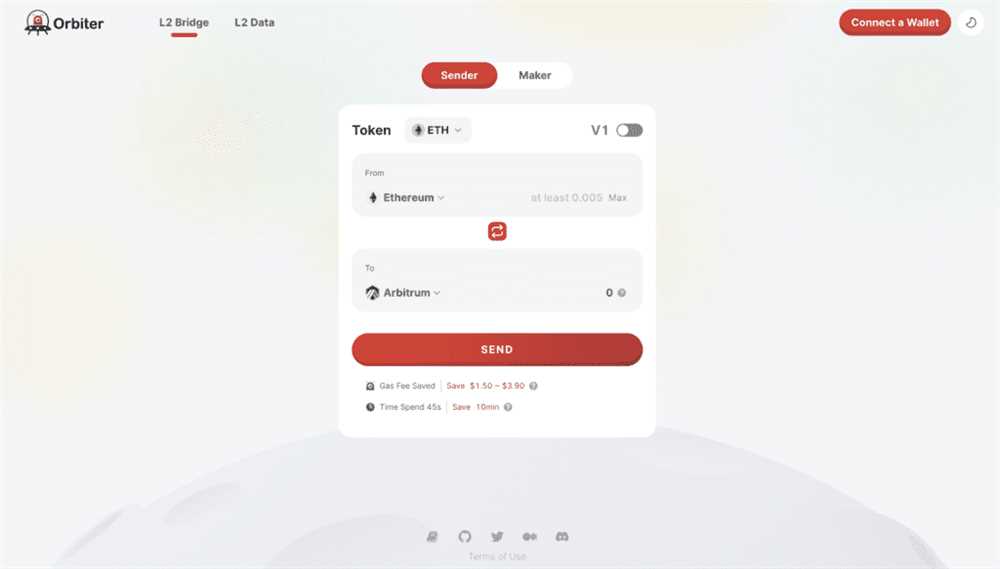

One of the key advantages of Orbiter Finance’s cross-rollup bridge is its ability to enable seamless and instant transfers of Ethereum-native assets between various layer 2 solutions and Ethereum mainnet. This means that users can enjoy faster and more cost-effective transactions, while still benefiting from the security and decentralization of the Ethereum network.

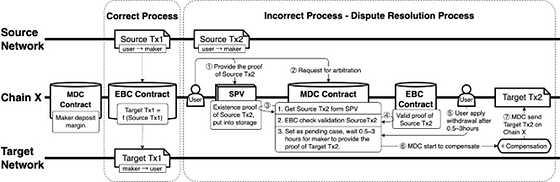

Furthermore, Orbiter Finance’s cross-rollup bridge is completely trustless and non-custodial, ensuring that users retain full control over their assets at all times. This eliminates the need for intermediaries and minimizes the risk of funds being lost or stolen. Users can confidently transfer their assets knowing that they are protected by the security measures inherent in blockchain technology.

In addition, Orbiter Finance’s cross-rollup bridge is designed to be highly scalable, capable of handling a large volume of transactions without compromising on performance. This scalability is crucial in ensuring that the DeFi ecosystem can continue to grow and thrive, with users being able to transact quickly and efficiently even during periods of high network congestion.

Overall, Orbiter Finance’s decentralized cross-rollup bridge for Ethereum-native assets offers a multitude of benefits for users. From faster and more cost-effective transactions to enhanced security and scalability, this bridge is set to revolutionize the way in which Ethereum-native assets are transferred and utilized within the DeFi space.

Enhancing Security and Trustlessness

The decentralized cross-rollup bridge developed by Orbiter Finance offers enhanced security and trustlessness for Ethereum-native assets. Through a combination of innovative protocols and smart contract technology, the bridge ensures that users’ assets are secure and transactions are conducted in a trustless manner.

Secure Asset Transfer

Orbiter Finance’s cross-rollup bridge utilizes advanced cryptographic algorithms to securely transfer assets between different blockchains. The bridge leverages the security guarantees provided by Ethereum’s network, ensuring that assets transferred through the bridge are protected from potential vulnerabilities.

Furthermore, the bridge employs a multi-signature mechanism to enhance security during asset transfers. This mechanism requires multiple signatures from different parties involved in the transaction, reducing the risk of unauthorized access and ensuring the integrity of the transfer process.

Trustless Transactions

One of the key benefits of the cross-rollup bridge is its ability to facilitate trustless transactions. By utilizing smart contracts, the bridge eliminates the need for intermediaries and enables direct peer-to-peer asset transfers.

Smart contracts act as self-executing agreements that automatically validate and enforce the terms of a transaction. This removes the reliance on a centralized authority, reducing the potential for manipulation or fraud. With the cross-rollup bridge, users can confidently transact with others without having to trust a third party.

| Benefits | Explanation |

|---|---|

| Increased Security | The bridge’s cryptographic algorithms and multi-signature mechanism ensure the secure transfer of assets. |

| Reduced Dependency | By eliminating the need for intermediaries, the bridge allows direct peer-to-peer transactions. |

| Elimination of Manipulation | Smart contracts eliminate the potential for manipulation or fraud during transactions. |

Improving Liquidity and Accessibility

The decentralized cross-rollup bridge developed by Orbiter Finance brings significant benefits in terms of improving liquidity and accessibility for Ethereum-native assets. By enabling efficient and seamless interoperability between different layer 2 solutions, this bridge opens up new opportunities for investors and traders.

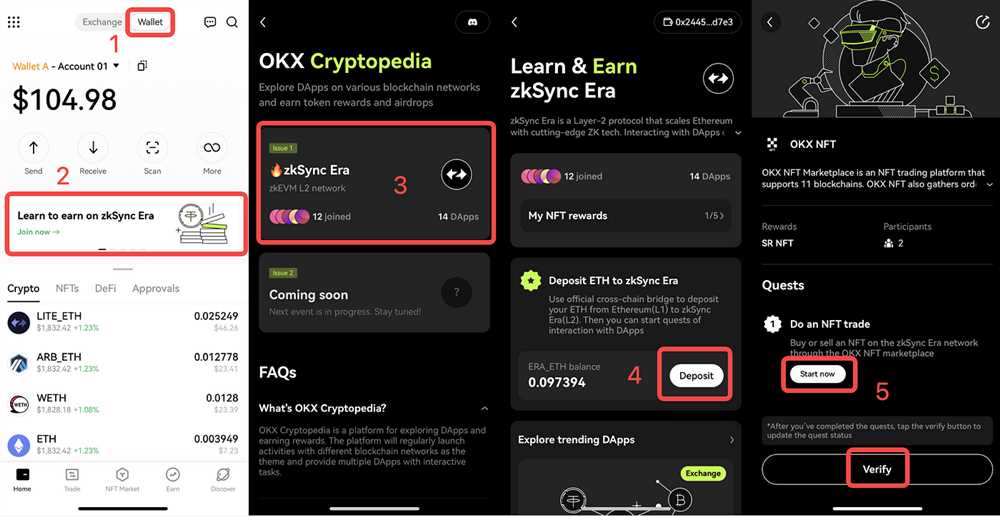

One of the key advantages of the bridge is that it allows users to easily move their assets between different layer 2 networks, such as Optimistic Ethereum, Arbitrum, or zkSync. This means that users can access a wider range of decentralized applications (dApps) and take advantage of various yield opportunities across different networks.

In addition, the bridge enhances liquidity for Ethereum-native assets by allowing users to trade these assets across different layer 2 networks. This increased liquidity improves the overall trading experience and reduces slippage, making it easier for traders to execute their desired trades at favorable prices.

The cross-rollup bridge also improves accessibility by reducing the barriers to entry for users who want to interact with layer 2 solutions. With the bridge, users can freely move their assets from the Ethereum mainnet to layer 2 networks, without the need for complex and time-consuming processes. This makes it easier for users to participate in the growing ecosystem of layer 2 solutions.

| Benefits of Orbiter Finance’s Cross-Rollup Bridge |

|---|

| Efficient and seamless interoperability between different layer 2 networks |

| Access to a wider range of decentralized applications and yield opportunities |

| Improved liquidity for Ethereum-native assets |

| Reduced slippage and better trading experience |

| Lower barriers to entry for users |

In conclusion, the decentralized cross-rollup bridge developed by Orbiter Finance greatly enhances liquidity and accessibility for Ethereum-native assets. By enabling seamless interoperability between layer 2 networks and reducing entry barriers, this bridge opens up new possibilities for users and contributes to the growth and development of the decentralized finance ecosystem.

Expanding Interoperability and Scalability

As the Ethereum ecosystem continues to grow, the need for interoperability and scalability becomes increasingly important. The current limitations of Ethereum’s layer one solutions have led to congestion and high fees, making it difficult for developers and users to access and utilize the network.

Orbiter Finance’s decentralized cross-rollup bridge offers a solution to these challenges. By leveraging the Layer 2 technology of rollups, the bridge expands the interoperability and scalability of Ethereum-native assets. This enables faster, cheaper, and more efficient transactions, without compromising security.

Interoperability

Orbiter Finance’s cross-rollup bridge allows assets to be seamlessly transferred between different rollup chains and Ethereum’s layer one. This interoperability opens up new possibilities for developers and users, as they can now tap into the benefits of various rollup solutions, such as Arbitrum, Optimism, and more.

With the bridge, users can easily move their assets between these different rollups, without the need to go through layer one. This not only reduces the transaction costs and processing times but also minimizes the congestion on Ethereum’s mainnet.

Scalability

By utilizing the Layer 2 technology of rollups, Orbiter Finance’s bridge significantly improves the scalability of Ethereum-native assets. Transactions can be processed off-chain, on the rollup chains, allowing for a higher throughput and reduced fees.

The bridge also helps alleviate the issue of network congestion, as more transactions can be processed simultaneously on the rollup chains. With increased scalability, developers can build and deploy decentralized applications that can handle higher transaction volumes, without sacrificing the security and decentralization that Ethereum provides.

Overall, Orbiter Finance’s decentralized cross-rollup bridge offers a powerful solution for expanding the interoperability and scalability of Ethereum-native assets. By leveraging the benefits of Layer 2 technology, the bridge enables faster, cheaper, and more efficient transactions, while still maintaining the security and decentralization of the Ethereum network.

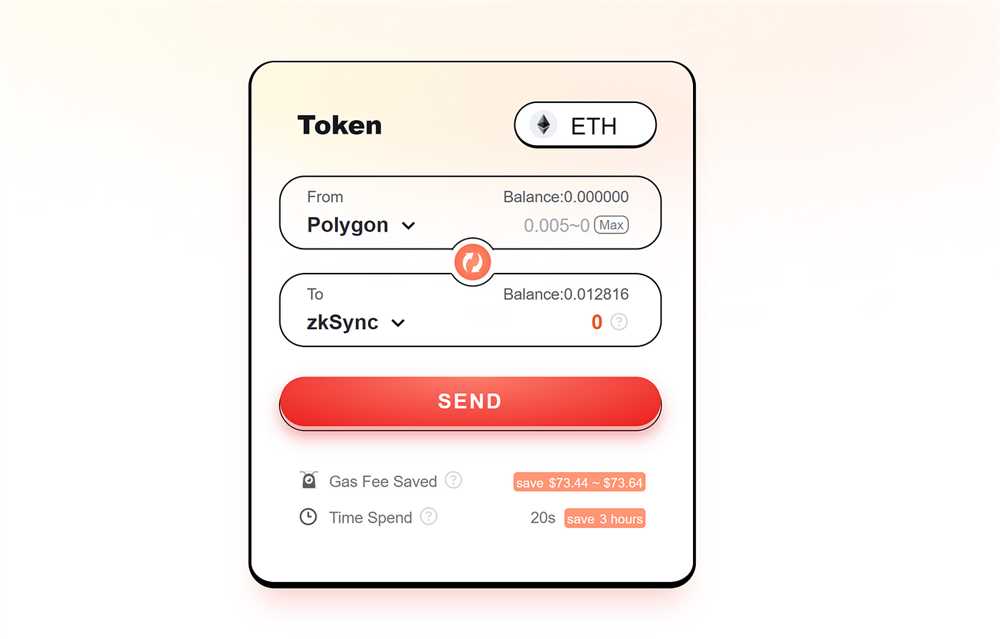

Enabling Efficient and Cost-Effective Asset Transfers

Orbiter Finance’s decentralized cross-rollup bridge for Ethereum-native assets provides a solution to the challenges faced by asset transfers in the blockchain ecosystem. By leveraging the power of cross-rollup technology, this bridge enables efficient and cost-effective transfers of assets between different rollups on the Ethereum network.

Efficiency in Asset Transfers

Traditional methods of asset transfers on the Ethereum network often face challenges such as high gas fees, slow transaction confirmation times, and limited scalability. Orbiter Finance’s cross-rollup bridge addresses these issues by utilizing a combination of rollup technology and decentralized infrastructure.

With this bridge, asset transfers can be performed quickly and efficiently, reducing the time and cost associated with on-chain transactions. By aggregating multiple transfers into a single batch, the bridge minimizes gas fees and optimizes network resources, resulting in faster and more cost-effective transfers.

Cost-Effectiveness in Asset Transfers

The decentralized nature of Orbiter Finance’s cross-rollup bridge eliminates the need for intermediaries and reduces transaction costs. By using this bridge, asset holders can bypass expensive centralized exchanges and directly transfer their assets between different rollups.

Furthermore, the cross-rollup bridge reduces the need for multiple on-chain transactions, which can accumulate hefty gas fees. Instead, the bridge allows for multiple transfers to be bundled into a single transaction, significantly reducing the overall cost of asset transfers on the Ethereum network.

In summary, Orbiter Finance’s cross-rollup bridge for Ethereum-native assets enables efficient and cost-effective asset transfers by leveraging cross-rollup technology and decentralized infrastructure. This bridge provides a scalable and affordable solution for asset transfers, revolutionizing the way assets are transferred within the blockchain ecosystem.

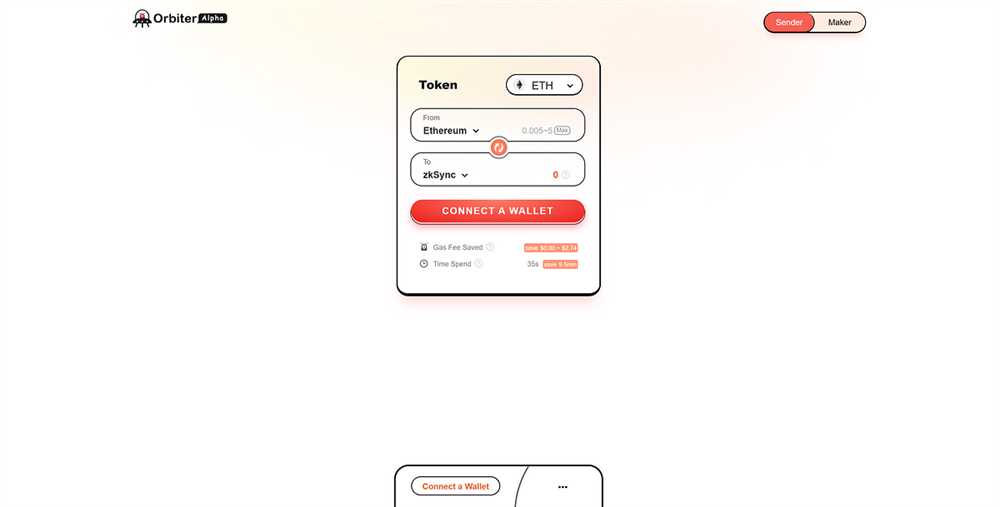

What is Orbiter Finance’s Decentralized Cross-Rollup Bridge?

Orbiter Finance’s Decentralized Cross-Rollup Bridge is a technology that allows for the seamless transfer of Ethereum-native assets between different Layer 2 solutions and mainnet Ethereum.

How does the Orbiter Finance’s Decentralized Cross-Rollup Bridge work?

The bridge works by using a combination of smart contracts and cryptographic algorithms to securely lock assets on one Layer 2 solution and mint wrapped tokens on another Layer 2 solution or Ethereum mainnet.

What are the benefits of using Orbiter Finance’s Decentralized Cross-Rollup Bridge?

Using the bridge enables liquidity and interoperability between different Layer 2 solutions, which improves overall efficiency and reduces costs for users. It also allows for the easy transfer of assets between Layer 2 solutions and mainnet Ethereum.

Can Orbiter Finance’s Decentralized Cross-Rollup Bridge be used with any Ethereum-native assets?

Yes, the bridge supports the transfer of any Ethereum-native assets, including popular tokens such as ETH, ERC-20 tokens, and ERC-721 tokens.

Why is cross-rollup bridging important for the Ethereum ecosystem?

Cross-rollup bridging is important because it allows for greater scalability and flexibility within the Ethereum ecosystem. It enables users to freely move assets and liquidity between different Layer 2 solutions, promoting a more connected and efficient decentralized finance (DeFi) ecosystem.