The Importance of Risk Management in Orbiter Finance Safeguarding User Funds

Do you want to protect your hard-earned money? Look no further than Orbiter Finance – the leading financial institution dedicated to safeguarding user funds and minimizing risk through innovative risk management strategies.

At Orbiter Finance, we understand that your financial security is of utmost importance. With the ever-increasing complexity of the financial landscape, it is crucial to have a trusted partner that puts risk management at the forefront of its operations.

But why is risk management vital for your financial well-being?

Ensure Stability: By implementing robust risk management practices, Orbiter Finance ensures the stability of your investments, protecting them from unforeseen market fluctuations and volatilities.

Preserve Capital: Our expert team employs various risk analysis techniques to assess and mitigate potential threats to your capital. By identifying and addressing risks in advance, we help preserve and grow your wealth.

Enhance Profitability: Effective risk management strategies not only protect your funds but also open doors to new opportunities. By carefully evaluating risk-reward ratios, Orbiter Finance helps you take calculated risks that can lead to increased profitability.

Build Trust: With a solid risk management framework in place, Orbiter Finance instills confidence in its clients. We believe in transparency and take pride in our ability to protect your funds, earning your trust and loyalty.

Don’t let uncertainty compromise your financial future. Join Orbiter Finance today and experience the peace of mind that comes with having a trusted partner dedicated to safeguarding your funds through effective risk management.

The Importance of Risk Management

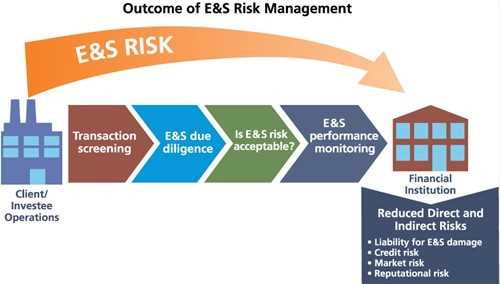

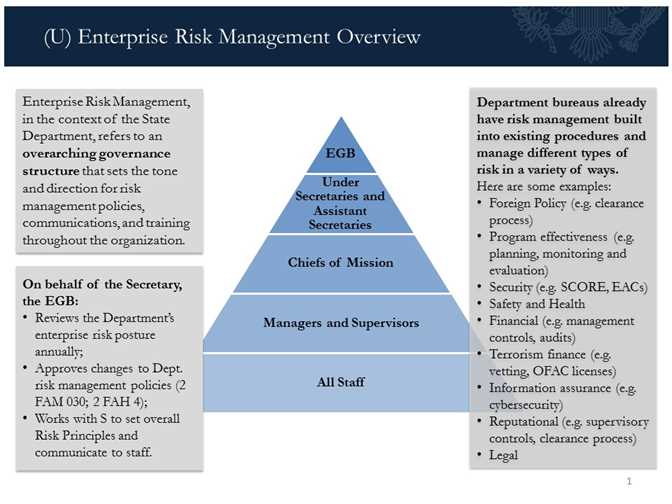

In the world of finance, risk management plays a vital role in safeguarding user funds and ensuring their protection. It is a crucial practice that helps organizations identify, analyze, and mitigate potential risks that could affect the stability and security of their operations.

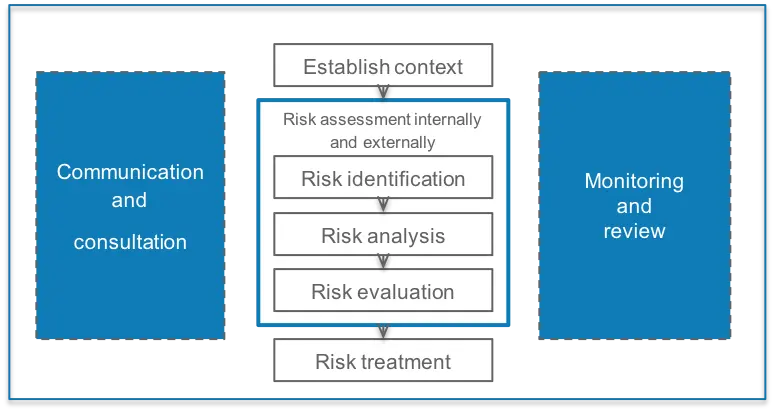

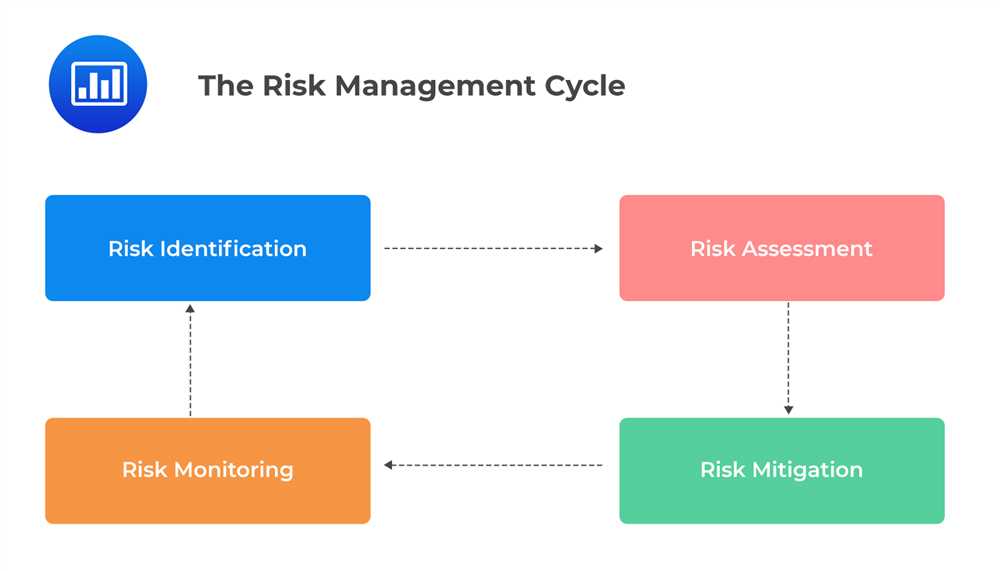

Risk management involves identifying potential risks, assessing their likelihood and impact, and implementing strategies to reduce or eliminate them. By continuously monitoring and evaluating risks, organizations can stay ahead of potential threats and take proactive measures to minimize their impact.

One of the primary benefits of risk management is the safeguarding of user funds. By implementing robust risk management practices, organizations can ensure that customer assets are well protected from potential threats such as cyber attacks, theft, or fraudulent activities. This instills confidence in users, reassuring them that their funds are in safe hands.

Moreover, risk management helps organizations in maintaining financial stability. By identifying potential risks and implementing appropriate measures, organizations can avoid financial losses, maintain profitability, and sustain growth. It also helps in avoiding reputational damage, which can have long-lasting effects on an organization’s operations.

Risk management is not only important for protecting user funds and maintaining stability, but it also enables organizations to make informed decisions. By understanding the potential risks involved in various operations or investments, organizations can weigh the potential rewards against the risks and make well-informed decisions that align with their goals and objectives.

In conclusion, risk management is of utmost importance in the financial sector. It not only safeguards user funds but also ensures financial stability and enables informed decision-making. Organizations that prioritize risk management can build trust with their users, protect their assets, and enhance their overall performance in the market.

In Orbiter Finance

In Orbiter Finance, we take the importance of risk management seriously. Our primary focus is safeguarding user funds and ensuring that our platform remains secure and reliable for all users.

One of the ways we achieve this is through a comprehensive risk management system. This system involves a combination of robust processes, advanced technology, and experienced professionals who are dedicated to maintaining the highest level of security throughout our platform.

At Orbiter Finance, we understand that the world of finance can be unpredictable and volatile. That’s why we have implemented various risk management strategies to identify and mitigate potential risks.

Our risk management team continuously monitors market conditions, trends, and potential threats to identify any potential risks that may impact user funds. Through our diligent monitoring and proactive approach, we can quickly respond to any changes in the market and take appropriate actions to minimize any potential negative impacts.

Furthermore, we have implemented strict security measures, such as encryption protocols and multi-factor authentication, to ensure the safety of user funds. These measures not only protect against potential external threats but also provide users with peace of mind and confidence in our platform.

Additionally, we regularly conduct internal and external audits to assess our risk management practices and identify areas for improvement. By constantly evaluating and refining our processes, we can stay ahead of emerging risks and provide an even safer environment for our users.

| Risk Assessment | Risk Mitigation |

|---|---|

| We assess potential risks through data analysis and market research. | Implement risk mitigation strategies, such as diversification and hedging. |

| We monitor market conditions and trends to identify potential risks. | Take timely actions to minimize potential negative impacts on user funds. |

| We conduct regular audits to assess our risk management practices. | Refine and improve our processes to stay ahead of emerging risks. |

In conclusion, risk management is a top priority at Orbiter Finance. We believe that by implementing robust risk management strategies and maintaining a strong focus on security, we can provide our users with the confidence and peace of mind they deserve when using our platform.

Safeguarding User Funds

At Orbiter Finance, we prioritize the safety and security of our users’ funds. We understand the importance of risk management in the world of finance and the potential risks that users may face. That is why we have implemented stringent measures to safeguard your funds and provide you with peace of mind.

Secure Storage

We employ industry-standard practices for secure storage of user funds. Our platform utilizes advanced encryption techniques to ensure that your funds are protected from unauthorized access. Additionally, we have implemented multi-signature wallets, which require multiple signatures for transactions, adding an extra layer of security.

Regular Audits

As part of our commitment to transparency and security, we conduct regular audits of our financial systems. These audits are performed by independent third-party auditors who thoroughly review our processes and procedures to ensure that your funds are safe and secure. Any vulnerabilities or risks identified during these audits are addressed promptly to maintain the highest level of security.

Cold Storage and Offline Wallets

To further enhance the security of user funds, a significant portion of our funds are stored in cold storage. Cold storage keeps funds offline and disconnected from the internet, reducing the risk of hacking or unauthorized access. This offline storage, combined with our robust security protocols, ensures that your funds are protected even in the event of a security breach.

In addition to cold storage, we also utilize offline wallets for added security. These wallets are disconnected from the internet and are only used for initiating transactions, minimizing the risk of exposure to potential threats.

Continuous Monitoring and Risk Assessment

We have a dedicated team of security experts who continuously monitor our systems for any suspicious activities or potential security threats. By leveraging advanced monitoring technology and implementing robust risk assessment protocols, we are able to identify and mitigate any risks to user funds promptly.

At Orbiter Finance, safeguarding your funds is our top priority. We are committed to providing you with a secure and reliable platform where you can confidently manage and grow your finances. With our comprehensive risk management practices and advanced security measures, you can rest assured knowing that your funds are in safe hands.

Ensuring Financial Security

At Orbiter Finance, we understand the importance of safeguarding user funds and ensuring financial security. We have implemented robust risk management practices to protect our users’ investments and provide them with peace of mind.

Advanced Security Measures

We employ state-of-the-art security measures to mitigate the risks associated with financial transactions. Our platform utilizes advanced encryption protocols to safeguard user data and prevent unauthorized access. Additionally, our servers are hosted in secure data centers with multiple layers of physical security, ensuring the utmost protection of our users’ funds and information.

Diverse Investment Strategies

To further enhance financial security, we employ diverse investment strategies that aim to minimize risk and maximize returns. Our team of experienced finance professionals carefully assesses market conditions and employs a combination of strategies, including asset diversification and risk hedging, to protect user investments from market fluctuations.

Regular Audits and Compliance

Transparency and accountability are at the core of our commitment to financial security. We undergo regular audits by independent third-party firms to ensure compliance with industry standards and regulations. By maintaining a high level of transparency, we provide our users with confidence and trust in our platform.

Rest assured that at Orbiter Finance, your financial security is our top priority. We are dedicated to providing a secure and reliable platform for managing your funds, ensuring that your investments are protected at all times.

Minimizing Potential Losses

At Orbiter Finance, we understand that the safety of your funds is of utmost importance. That’s why we have implemented various measures to minimize any potential losses that may occur.

1. Robust Risk Assessment

Our team of experts performs a rigorous risk assessment on all the investment opportunities available on the Orbiter Finance platform. This ensures that only projects with a high potential for success are considered, reducing the risk of losses due to failed ventures.

2. Diversification of Investments

In order to reduce the impact of any singular event on the overall portfolio, we emphasize the importance of diversification. By allocating your funds across multiple projects and asset classes, we help to lower the risk of significant losses from any one investment.

Pro Tip: By diversifying your investments, you can mitigate the risk of potential losses and increase the likelihood of achieving long-term financial goals.

It’s important to note that while diversification can lower the overall risk in your portfolio, it does not guarantee profits or protect against losses entirely. Therefore, we continuously monitor the performance of the projects to ensure they meet our stringent risk management criteria.

3. Advanced Risk Management Techniques

Orbiter Finance utilizes cutting-edge risk management techniques to identify and mitigate potential risks. Through regular monitoring and analysis, we are able to react swiftly to any unfavorable market conditions or emerging risks, minimizing potential losses for our users.

Additionally, our risk management team stays updated with the latest regulatory requirements and industry best practices, allowing us to adapt our risk management strategies accordingly.

By prioritizing risk management, we strive to safeguard your user funds and provide you with a secure investment platform. Orbiter Finance is committed to minimizing potential losses and ensuring the long-term stability of your investments.

Evaluating Risk Factors

When it comes to evaluating risk factors, Orbiter Finance takes a comprehensive approach to ensure the safety and security of user funds. We understand that risk is an inherent part of any investment, and it is crucial to understand and analyze the potential risks associated with our platform and the financial markets as a whole.

1. Market Risk

One of the key risk factors to consider is market risk. The financial markets can be volatile and unpredictable, with factors such as economic conditions, geopolitical events, and market sentiment influencing asset prices. Orbiter Finance employs a team of experienced analysts who constantly monitor and assess market conditions to make informed decisions and mitigate potential risks.

2. Operational Risk

Operational risk is another significant factor that needs to be evaluated. It refers to the risk of loss resulting from inadequate or failed internal processes, systems, or human error. Orbiter Finance has implemented robust risk management systems and procedures to identify and address operational risks. Our platform undergoes regular audits and security assessments to ensure the highest level of protection for user funds.

3. Credit Risk

Credit risk is the potential loss arising from the failure of a counterparty to fulfill their financial obligations. When evaluating risk factors, Orbiter Finance thoroughly assesses the creditworthiness and financial stability of our partners and counterparties. We work with reputable financial institutions and employ advanced credit risk analytics to minimize credit risk exposure.

4. Regulatory Risk

Regulatory risk encompasses the potential impact of changes in laws and regulations on our operations and the financial markets. Orbiter Finance closely monitors regulatory developments and ensures compliance with all applicable laws. We have a team of legal experts who stay up to date with regulatory changes and proactively adapt our risk management strategies to mitigate regulatory risk.

By evaluating these and other risk factors, Orbiter Finance is committed to safeguarding user funds and providing a secure and reliable investment platform. We prioritize risk management to ensure the long-term success and trust of our users.

What is risk management in finance?

Risk management in finance refers to the process of identifying, analyzing, and mitigating or minimizing potential risks that could impact the financial performance or stability of an individual or organization. It involves assessing the potential risks, developing strategies to manage and control those risks, and implementing measures to safeguard against them.

Why is risk management important in finance?

Risk management is crucial in finance because it helps individuals and organizations protect their financial resources and investments. By identifying and analyzing potential risks, risk management allows for the implementation of strategies and measures to minimize or mitigate those risks, helping to ensure the financial stability and success of an individual or organization.