Decentralized finance, or DeFi, has emerged as one of the most exciting and promising sectors in the world of cryptocurrency. With its ability to disrupt traditional financial systems and empower individuals, DeFi has captured the attention of investors, technologists, and enthusiasts alike. One project that is making waves in the DeFi space is Orbiter Finance.

Orbiter Finance is a decentralized protocol that aims to provide users with a seamless and secure platform for borrowing, lending, and investing in various assets. Built on the Ethereum blockchain, Orbiter Finance leverages the transparency and security of smart contracts to enable users to interact with the platform in a trustless and efficient manner.

One of the key features of Orbiter Finance is its decentralized governance model. Unlike traditional financial institutions that are controlled by a central authority, Orbiter Finance allows users to participate in the decision-making process through a transparent voting system. This not only enhances the democratic nature of the platform but also ensures that the interests of the community are prioritized.

Furthermore, Orbiter Finance offers users a wide range of financial products and services, including flash loans, staking, yield farming, and more. Whether you are a borrower looking for competitive interest rates or an investor seeking lucrative opportunities, Orbiter Finance has something to offer for everyone.

In conclusion, the rise of decentralized finance has opened up a world of possibilities for individuals to take control of their financial future. Orbiter Finance stands out as a leading player in this space by providing a user-friendly platform, a decentralized governance model, and a diverse range of financial products. As DeFi continues to gain traction and reshape the financial landscape, Orbiter Finance is poised to be a key player in the decentralized revolution.

The Rise of Decentralized Finance:

Decentralized finance, commonly known as DeFi, has emerged as one of the most exciting and innovative areas of the blockchain industry. With its promise to disrupt and revolutionize traditional financial systems, DeFi has attracted immense attention and investment in recent years.

What is DeFi?

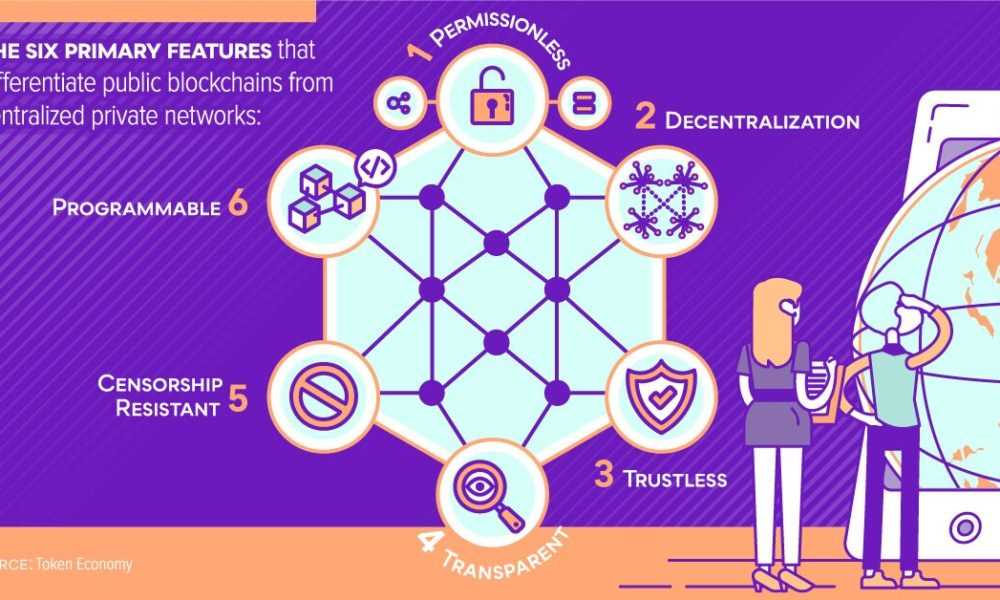

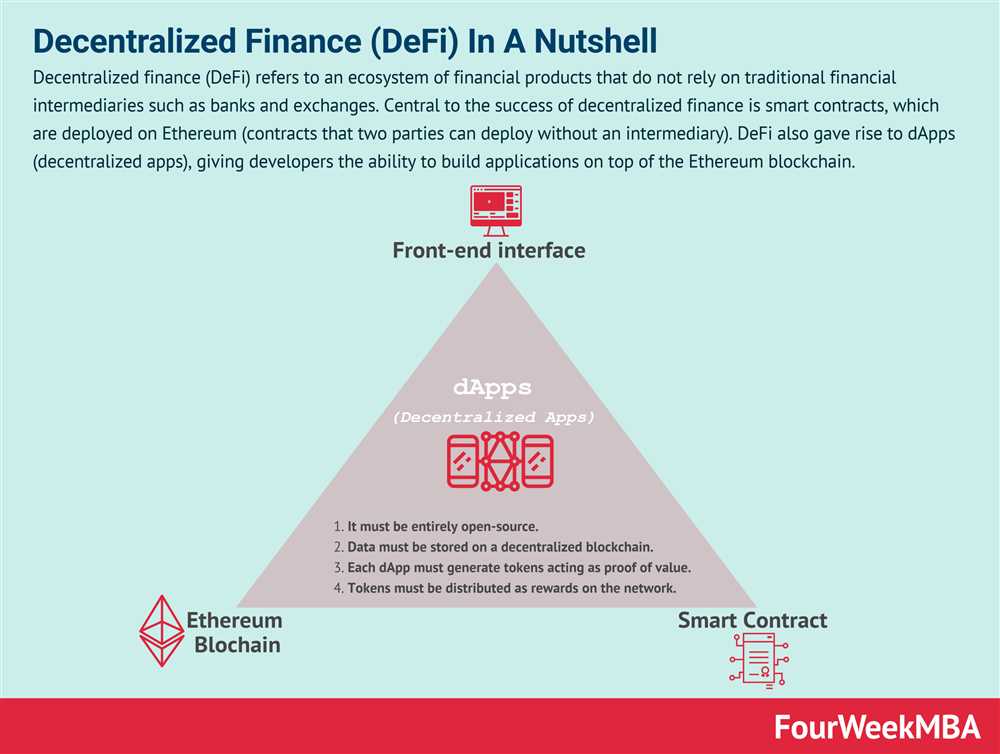

DeFi refers to a collection of financial applications and services built on blockchain technology. Unlike traditional finance, which relies on centralized intermediaries such as banks, DeFi operates on decentralized networks and smart contracts. This fundamentally changes the way financial transactions are conducted and eliminates the need for intermediaries.

By leveraging the transparency, security, and efficiency of blockchain technology, DeFi offers a range of financial services, including lending, borrowing, trading, asset management, and more. These services are accessible to anyone with an internet connection and can be utilized without the need for a trusted third party.

The Benefits of DeFi

DeFi brings several key benefits to the financial sector:

| 1. Trustless Transactions | DeFi eliminates the need for intermediaries, allowing users to transact directly with each other. This reduces counterparty risk and increases trust in financial transactions. |

| 2. Financial Inclusion | DeFi opens up financial services to the unbanked and underbanked populations, who may not have access to traditional banking facilities. Anyone with an internet connection can participate in DeFi and access a wide range of financial services. |

| 3. Transparency | All transactions on the blockchain are transparent and can be audited in real-time. This enhances accountability and reduces the potential for fraud or manipulation. |

| 4. Programmable Money | DeFi enables the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This opens up possibilities for automated financial services and complex financial instruments. |

These benefits have contributed to the rapid growth and adoption of DeFi. As more individuals and institutions recognize the potential of decentralized finance, the ecosystem continues to expand, attracting new projects and investors.

The Future of DeFi

The rise of DeFi has sparked a wave of innovation and experimentation in the financial industry. With its ability to provide financial services in a more efficient, inclusive, and transparent manner, DeFi is poised to disrupt traditional finance and reshape the global economy.

However, challenges remain, such as scalability, regulatory concerns, and user experience. As the industry matures, these issues are being addressed, paving the way for the mass adoption of decentralized finance.

In conclusion, the rise of decentralized finance represents a paradigm shift in the way we think about and interact with money. By leveraging the power of blockchain technology, DeFi has the potential to democratize finance, empower individuals, and reshape the global financial landscape.

A closer look at Orbiter Finance

Orbiter Finance is a decentralized finance (DeFi) protocol that aims to revolutionize the way we think about traditional financial systems. It is built on the Ethereum blockchain and offers a wide range of financial services, including lending, borrowing, and yield farming.

One of the key features of Orbiter Finance is its focus on user privacy and security. Unlike traditional financial institutions, Orbiter Finance allows users to transact and interact with the platform without revealing their personal information. This is made possible through the use of smart contracts and encryption technologies.

Another notable aspect of Orbiter Finance is its community-driven governance model. It allows token holders to participate in the decision-making process by voting on proposals and changes to the protocol. This ensures that the platform remains decentralized and transparent, as the power is in the hands of the community.

Orbiter Finance also offers unique opportunities for investors through its yield farming program. Users can stake their tokens in liquidity pools and earn rewards in the form of additional tokens. This incentivizes users to contribute to the liquidity of the platform and helps to ensure its stability.

Overall, Orbiter Finance represents a promising development in the world of decentralized finance. With its focus on privacy, security, and community governance, it offers users a more inclusive and transparent financial system. As DeFi continues to gain traction, Orbiter Finance is well-positioned to play a significant role in shaping the future of finance.

An overview of decentralized finance

Decentralized finance, also known as DeFi, refers to the use of blockchain technology and smart contracts to provide financial services without the need for traditional intermediaries such as banks or insurance companies. DeFi aims to create a more inclusive and accessible financial system, empowering individuals to have more control over their assets and participate in global financial markets.

One of the main features of decentralized finance is the ability to perform various financial activities on decentralized platforms, which are built on top of blockchain networks. These platforms enable users to lend and borrow funds, trade assets, earn interest, and participate in other financial activities without the involvement of centralized authorities.

Decentralized finance leverages the transparency, security, and efficiency of blockchain technology to eliminate the need for third-party intermediaries. By using smart contracts, which are self-executing agreements stored on the blockchain, DeFi applications can automate processes and ensure that transactions are executed according to predefined rules without the need for human intervention.

Another key aspect of decentralized finance is the concept of open finance. Open finance refers to the idea that the underlying infrastructure and protocols of DeFi are open source and accessible to anyone. This means that developers can build on top of existing protocols and create new applications, fostering innovation and allowing for the development of new financial instruments and services.

Decentralized finance has gained significant traction in recent years, with a wide range of applications and platforms being developed. These include decentralized exchanges, decentralized lending platforms, stablecoins, prediction markets, and decentralized insurance. The growth of DeFi has been driven by the increasing demand for financial services that are more transparent, efficient, and inclusive.

| Advantages of decentralized finance | Challenges of decentralized finance |

|---|---|

|

|

As decentralized finance continues to evolve, it has the potential to disrupt and transform traditional financial systems. However, it also faces various challenges, including regulatory hurdles, security risks, and scalability issues. Nonetheless, the growth and innovation in the DeFi space are paving the way for a more open, accessible, and inclusive financial future.

The benefits of decentralized finance

Decentralized finance, or DeFi, has gained significant traction in recent years. This innovative approach to financial services offers a number of benefits that traditional centralized systems cannot match.

1. Open and transparent

One of the key advantages of decentralized finance is its openness and transparency. Unlike traditional financial systems, which often operate behind closed doors, DeFi allows anyone to access and audit the underlying smart contracts and transactions on the blockchain. This transparency helps to build trust and ensures that there are no hidden fees or unfair practices.

2. Increased financial inclusion

Decentralized finance has the potential to greatly increase financial inclusion, especially for the unbanked and underbanked populations. By removing the need for intermediaries such as banks, DeFi opens up access to financial services to anyone with an internet connection. This can help individuals and businesses in underserved communities to access loans, make investments, and participate in the global economy.

3. Lower costs and fees

Traditional financial systems are often burdened with high costs and fees due to the involvement of intermediaries and regulatory requirements. In contrast, DeFi operates on a decentralized network, which reduces the need for intermediaries and minimizes transaction costs. This can result in lower fees for users, making financial services more affordable and accessible.

4. Improved security

Decentralized finance is built on blockchain technology, which offers a high level of security. The decentralized nature of the blockchain makes it difficult for hackers to manipulate or compromise transactions, as there is no central point of failure. Additionally, DeFi protocols often incorporate advanced security features such as multi-signature wallets and smart contract audits, further enhancing the security of funds.

| Benefits | Traditional Finance | Decentralized Finance |

|---|---|---|

| Openness and transparency | Operates behind closed doors | Accessible and auditable |

| Financial inclusion | Limited access for unbanked | Accessible to anyone with internet |

| Lower costs and fees | High costs and fees | Minimized transaction costs |

| Improved security | Subject to hacking and fraud | Highly secure blockchain technology |

Orbiter Finance: A disruptive force in decentralized finance

Decentralized finance (DeFi) has been one of the most transformative innovations in the world of finance in recent years. It has enabled individuals to access financial services without the need for intermediaries such as banks. With the rise of DeFi, a number of platforms have emerged to offer various decentralized financial solutions. One platform that has been gaining significant attention is Orbiter Finance.

Orbiter Finance is a decentralized finance platform that aims to revolutionize the way individuals can earn and manage their assets. It provides a range of innovative and user-friendly financial products that are built on blockchain technology. By leveraging smart contracts and decentralized applications (dApps), Orbiter Finance offers users the ability to earn passive income, participate in liquidity pools, and access a variety of other financial services.

One of the key features of Orbiter Finance is its emphasis on security and transparency. The platform utilizes advanced cryptographic protocols and decentralized governance mechanisms to ensure the safety and privacy of users’ assets. Additionally, all transactions and activities on the platform are recorded on the blockchain, making them tamper-proof and auditable.

Another distinguishing feature of Orbiter Finance is its community-driven approach. The platform encourages active participation from its users by allowing them to propose and vote on changes to its ecosystem. This democratic governance model ensures that users have a say in the development and evolution of the platform, making it truly decentralized.

Orbiter Finance also stands out for its commitment to interoperability. The platform integrates with other decentralized applications and protocols, enabling users to easily access and use a wide range of DeFi services. This interoperability enhances the overall user experience and opens up new opportunities for individuals to maximize the value of their assets.

In conclusion, Orbiter Finance is poised to be a disruptive force in the world of decentralized finance. With its innovative and user-friendly financial products, emphasis on security and transparency, community-driven approach, and commitment to interoperability, Orbiter Finance is set to empower individuals in managing their assets and unlocking new possibilities in decentralized finance.

The future of decentralized finance

Decentralized finance, also known as DeFi, has been making significant waves in the financial industry. With the rise of blockchain technology, DeFi has become a groundbreaking solution that aims to revolutionize traditional financial systems. As we look to the future, there are several key trends and developments that could shape the landscape of decentralized finance.

1. Increased adoption

One of the most significant trends we can expect to see in the future is increased adoption of decentralized finance. As more people become familiar with and educated about blockchain technology and its potential benefits, the demand for DeFi platforms and services will likely skyrocket. This increased adoption will lead to a more widespread integration of DeFi into various sectors, ranging from banking and lending to insurance and asset management.

2. Interoperability and collaboration

Another important aspect of the future of decentralized finance is interoperability and collaboration between different DeFi projects. Currently, many DeFi platforms operate in isolation, with limited interaction between them. However, as the ecosystem continues to mature, we can expect to see increased collaboration and integration among various DeFi projects. This will enable users to seamlessly move assets and liquidity between different platforms, unlocking even more opportunities for innovation and growth.

3. Enhanced security measures

Security is a paramount concern in the world of finance, and decentralized finance is no exception. As the industry continues to evolve, we can anticipate the implementation of enhanced security measures to protect users’ assets and data. This may include advancements in encryption technology, the use of multi-factor authentication, and improved auditing and monitoring systems. These security measures will contribute to building trust and confidence in decentralized finance among both individuals and institutional investors.

4. Regulation and compliance

As decentralized finance gains more traction, regulatory oversight and compliance will inevitably become key considerations. While DeFi aims to provide financial services in a decentralized manner, there is still a need for regulatory frameworks to address issues such as consumer protection, anti-money laundering, and fraud prevention. The future of decentralized finance will likely involve the development of regulatory frameworks that strike a balance between innovation and safeguarding the interests of all stakeholders.

In conclusion, the future of decentralized finance holds immense potential. With increased adoption, interoperability, enhanced security measures, and regulatory compliance, DeFi is poised to transform the way we conduct financial transactions and access various financial services. The journey towards a decentralized financial future is just beginning, and it promises to be an exciting and revolutionary one.

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) platform that aims to provide innovative financial solutions in a decentralized manner.

How does Orbiter Finance work?

Orbiter Finance works by leveraging blockchain technology to enable peer-to-peer transactions and smart contracts. It utilizes a decentralized network of nodes to validate and process transactions, ensuring security and transparency.

What are the advantages of using Orbiter Finance?

There are several advantages of using Orbiter Finance. Firstly, it provides access to a wide range of financial services and products without the need for intermediaries. Additionally, it offers lower fees and faster transactions compared to traditional financial systems. Furthermore, Orbiter Finance promotes transparency and security through its decentralized architecture.

Can I earn passive income with Orbiter Finance?

Yes, you can earn passive income with Orbiter Finance through various methods. One way is by providing liquidity to the platform’s liquidity pools and earning rewards in the form of interest or fees. Additionally, you can participate in the platform’s governance system and earn rewards for voting on proposals.

Is Orbiter Finance safe to use?

Orbiter Finance prioritizes security and has implemented several measures to ensure the safety of user funds. These include utilizing smart contract audits, implementing multi-signature wallets, and practicing strict security protocols. However, it is important to note that decentralized finance carries inherent risks, and users should conduct thorough research and exercise caution when participating in any DeFi platform.