Have you ever wondered how space explorations and missions are funded? The world of orbiter finance can be complex and overwhelming, with its unique set of challenges and intricacies. Whether you are a space enthusiast or someone looking to invest in this exciting industry, it is important to understand the basics of orbiter finance.

Orbiter finance refers to the financial management and funding strategies involved in the development, launch, operation, and maintenance of orbiters and spacecraft. This includes everything from securing funding from government agencies and private investors to managing the ongoing expenses associated with space missions.

One of the key factors to consider in orbiter finance is the substantial cost involved in space missions. Building, launching, and maintaining an orbiter can cost billions of dollars. Therefore, it is essential to have a clear understanding of the sources of funding and how they are allocated.

Government funding plays a significant role in the financing of orbiters. Government agencies, such as NASA in the United States, allocate a portion of their budget to space exploration. This funding is often used to develop and launch new missions, as well as to cover the ongoing costs of operating orbiters and conducting scientific research in space.

In addition to government funding, the private sector has also become increasingly involved in orbiter finance. Companies like SpaceX and Blue Origin have entered the space industry as commercial providers of space transportation and tourism services. These companies raise funds through a combination of private investments, partnerships, and contracts with government agencies. Their involvement has opened up new opportunities for funding space missions and has introduced a level of competition and innovation in the industry.

Understanding the complexities of orbiter finance is crucial for anyone interested in the space industry. By grasping the basics of funding sources, allocation strategies, and the role of both government and the private sector, you can navigate the financial landscape and make informed decisions when it comes to investing or supporting space missions. So, whether you dream of exploring the cosmos or have a passion for space technology, dive into the world of orbiter finance and embark on an exciting journey into the realm of space exploration.

What Is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) protocol built on the Ethereum blockchain. It aims to provide users with a platform for decentralized borrowing, lending, and trading of digital assets. The protocol operates without intermediaries, allowing for peer-to-peer transactions and reducing costs and inefficiencies associated with traditional financial systems.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, refers to financial applications and systems that operate on blockchain networks, primarily Ethereum. These applications are built with smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

DeFi platforms like Orbiter Finance leverage the transparency, security, and programmability of blockchain technology to provide users with financial services traditionally offered by banks and other intermediaries. These services include borrowing and lending, trading, yield farming, and liquidity provision, among others.

Key Features of Orbiter Finance

Orbiter Finance offers several key features that differentiate it from traditional financial systems:

1. Peer-to-Peer Transactions: Orbiter Finance enables direct peer-to-peer transactions without the need for intermediaries such as banks or brokers. This allows for faster and more cost-effective transactions.

2. Decentralized Borrowing and Lending: Users can borrow and lend digital assets directly through smart contracts on the Orbiter Finance platform. This eliminates the need for a centralized lending institution and allows for greater accessibility and flexibility.

3. Yield Farming: Orbiter Finance provides users with the opportunity to earn passive income through yield farming. This involves lending or staking digital assets in liquidity pools to earn interest rates or governance tokens as rewards.

4. Trading: Users can trade digital assets on the Orbiter Finance platform through decentralized exchanges (DEXs) or automated market makers (AMMs). These trading mechanisms allow for efficient and secure asset exchanges.

By offering these features, Orbiter Finance aims to democratize access to financial services and provide users with greater control over their digital assets.

The Benefits of Orbiter Finance

Orbiter Finance offers a wide range of benefits to individuals and businesses looking to navigate the complexities of financial management. Here are some key advantages:

1. Streamlined Financial Planning

With Orbiter Finance, you can streamline your financial planning process. The platform provides tools and resources to help you set financial goals, create budgets, track expenses, and monitor investments. This simplifies the process and allows you to make more informed decisions about your financial future.

2. Comprehensive Financial Analysis

Orbiter Finance enables you to conduct comprehensive financial analysis. The platform aggregates data from your various financial accounts and provides insights into your spending patterns, investment performance, and overall financial health. This allows you to identify areas where you can improve and make adjustments to optimize your financial situation.

The platform also offers access to financial advisors who can provide personalized recommendations based on your unique circumstances and goals.

3. Secure and Reliable

Orbiter Finance prioritizes the security and reliability of your financial information. The platform uses advanced encryption and security measures to protect your data from unauthorized access. Additionally, regular system updates and maintenance ensure that the platform operates smoothly and efficiently.

By entrusting your financial management to Orbiter Finance, you can have peace of mind knowing that your sensitive information is in safe hands.

In conclusion, Orbiter Finance offers many benefits for individuals and businesses seeking to navigate the complexities of financial management. Whether you’re looking to streamline your financial planning, conduct comprehensive financial analysis, or ensure the security and reliability of your financial information, Orbiter Finance has you covered.

Why Choose Orbiter Finance?

When it comes to navigating the complexities of orbiter finance, there are many options to consider. However, Orbiter Finance stands out from the crowd for several key reasons.

First and foremost, Orbiter Finance has a team of expert financial advisors who specialize in the unique challenges and opportunities that come with orbiter finance. Whether you’re new to the field or an experienced investor, having access to their knowledge and expertise can make a world of difference.

In addition to their expertise, Orbiter Finance also offers a wide range of financial products and services tailored specifically for orbiter companies and organizations. From investment solutions to risk management strategies, Orbiter Finance has you covered.

Furthermore, Orbiter Finance prides itself on its clear and transparent communication. They understand that navigating the complexities of orbiter finance can be overwhelming, so they strive to make the process as smooth and understandable as possible. They will work closely with you to ensure that you have a clear understanding of your financial options and can make informed decisions.

Another reason to choose Orbiter Finance is their track record of success. They have helped countless orbiter companies and organizations achieve their financial goals and objectives. By choosing Orbiter Finance, you can tap into their proven strategies and expertise to maximize your chances of success.

Finally, Orbiter Finance is committed to building long-term relationships with their clients. They understand that every individual and organization is unique, and they take the time to understand your specific needs and goals. This personalized approach sets them apart from other financial institutions and ensures that you receive the best possible guidance and support.

In conclusion, if you’re looking to navigate the complexities of orbiter finance, Orbiter Finance should be your top choice. With their expert team, tailored financial products and services, transparent communication, track record of success, and personalized approach, they have everything you need for success in the world of orbiter finance.

Getting Started with Orbiter Finance

Orbiter Finance is a complex financial software designed to help individuals and businesses navigate the intricacies of personal and corporate finance. Whether you are a beginner or an experienced finance professional, Orbiter Finance offers a wide range of tools and features to assist you in managing your finances effectively.

To get started with Orbiter Finance, you will need to create an account on our website. Simply visit our homepage and click on the ‘Sign Up’ button. Fill in the required information, such as your name, email address, and password. Make sure to choose a strong password to protect your account.

Once you have created your account, you will be able to log in and access the Orbiter Finance dashboard. Here, you will find an overview of your financial status, including your income, expenses, and savings. You can also set financial goals and track your progress towards achieving them.

Orbiter Finance offers a variety of tools to help you manage your finances. One of the key features is the budgeting tool, which allows you to create a budget based on your income and expenses. This will help you stay on track and avoid overspending.

Another useful tool is the investment tracker. Here, you can keep track of your investments and monitor their performance in real-time. You can also analyze various investment options and make informed decisions based on market trends.

In addition to these tools, Orbiter Finance also provides educational resources to help you improve your financial literacy. We offer articles, tutorials, and webinars to help you understand complex financial concepts and make informed financial decisions.

Getting started with Orbiter Finance may seem overwhelming at first, but with a little time and practice, you will become familiar with the platform and its features. Remember to take advantage of the educational resources available to expand your knowledge and make the most of Orbiter Finance.

By using Orbiter Finance, you can gain a better understanding of your financial situation and make informed decisions to achieve your financial goals. Sign up today and start navigating the complexities of Orbiter Finance!

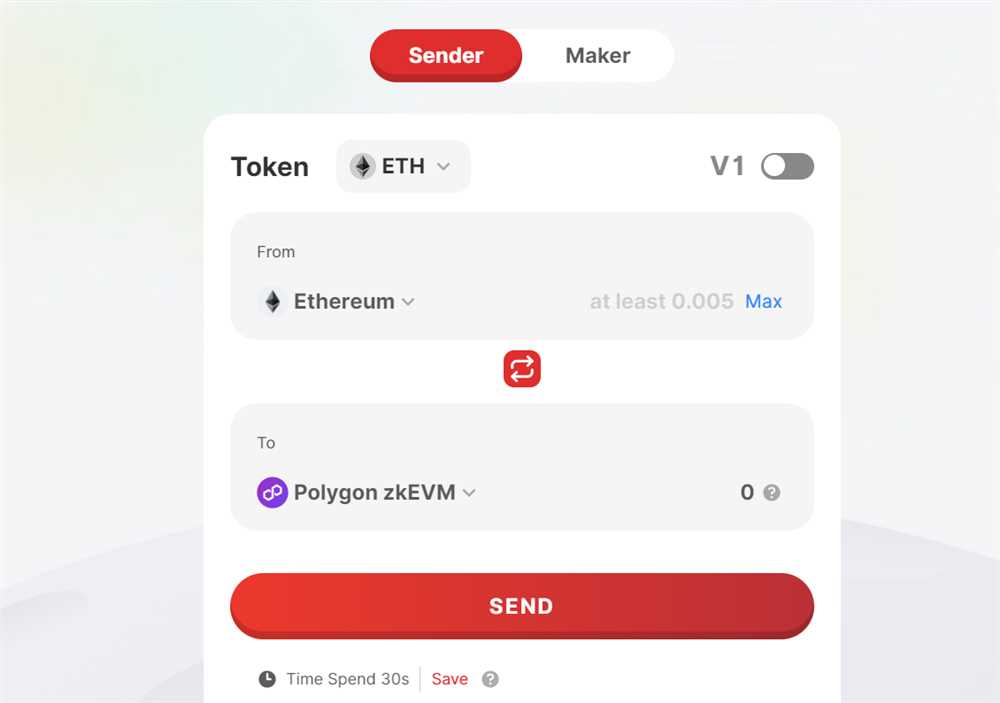

Step-by-Step Guide to Using Orbiter Finance

Orbiter Finance is a powerful tool for managing your financial portfolio. Whether you are a beginner or an experienced investor, this step-by-step guide will help you navigate the complexities of Orbiter Finance and make the most of its features.

Step 1: Sign up for an Account

To start using Orbiter Finance, you will need to create an account. Visit the Orbiter Finance website and click on the “Sign Up” button. Fill in the required information, such as your name, email address, and password. Once you have completed the sign-up process, you will receive a confirmation email with further instructions.

Step 2: Connect Your Financial Accounts

Once you have successfully signed up for an account, you can connect your financial accounts to Orbiter Finance. This will allow the platform to securely import your account balances, transactions, and other relevant information. To connect an account, click on the “Connect Account” button and follow the on-screen instructions. Orbiter Finance supports connections to a wide range of banks, brokerages, and credit card providers.

Step 3: Set Up Your Portfolio

After connecting your financial accounts, you can start setting up your portfolio in Orbiter Finance. This involves entering information about your assets, such as stocks, bonds, mutual funds, and real estate holdings. You can also specify the allocation percentages for each asset class to create a diversified portfolio. Orbiter Finance provides tools and calculators to help you make informed decisions about your investment allocation.

Step 4: Track Your Investments

Once you have set up your portfolio, Orbiter Finance provides a comprehensive dashboard where you can track the performance of your investments. The platform displays real-time data and analytics, including charts and graphs, to give you insights into the performance of individual assets, as well as your overall portfolio. You can set up alerts and notifications to stay informed about any significant changes in your investments.

Step 5: Analyze and Optimize

Orbiter Finance offers powerful analysis and optimization tools to help you make informed decisions about your investments. The platform provides tools for risk analysis, portfolio rebalancing, tax optimization, and more. You can run simulations and scenarios to test different investment strategies and evaluate their potential impact on your portfolio’s performance. Orbiter Finance also offers personalized recommendations based on your investment goals and risk tolerance.

Step 6: Stay Informed

As a user of Orbiter Finance, it is crucial to stay informed about the latest market trends and news. The platform offers a wide range of educational resources, including articles, videos, and webinars, to help you expand your financial knowledge. You can also join the Orbiter Finance community to connect with other investors, share insights, and learn from their experiences.

By following this step-by-step guide, you will be able to effectively use Orbiter Finance to manage your financial portfolio and make informed investment decisions. Happy investing!

What is the purpose of orbiter finance?

The purpose of orbiter finance is to manage the financial aspects of running a space mission. This includes budgeting, fundraising, and financial reporting.

How can I get started with orbiter finance?

To get started with orbiter finance, you can begin by familiarizing yourself with basic accounting principles and financial management practices. It’s also important to understand the specific financial requirements and regulations related to space missions.

What are some common challenges in orbiter finance?

Some common challenges in orbiter finance include securing funding for space missions, managing budget constraints, and dealing with the complexities of financial reporting in the space industry. Additionally, navigating international financial regulations can also pose challenges.

Why is financial reporting important in orbiter finance?

Financial reporting is important in orbiter finance as it allows for transparency and accountability in the use of funds. It helps stakeholders, such as government agencies and investors, understand how resources are being allocated and whether the mission is being financially responsible.

What are some strategies for successful orbiter finance?

Some strategies for successful orbiter finance include creating a detailed budget and fundraising plan, diversifying sources of funding, regularly monitoring and adjusting financial activities, and staying informed about changes in financial regulations and best practices in the space industry.