In the ever-evolving world of decentralized finance (DeFi), Orbiter Finance has emerged as a prominent player. With its innovative approach and focus on Layer 2 solutions, Orbiter has been gaining traction in the market. One of the key indicators of its success is its Total Value Locked (TVL), a metric used to assess the overall value of assets locked in a DeFi protocol.

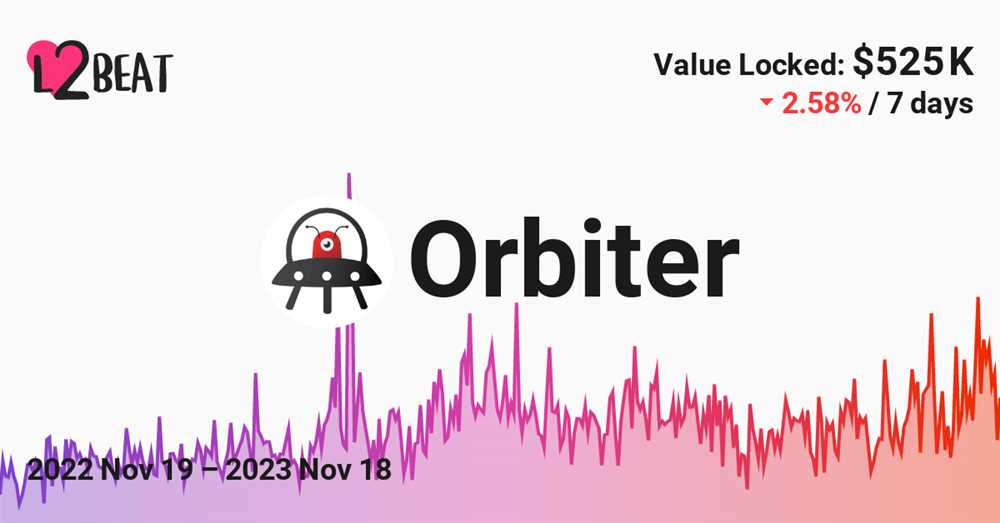

According to a recent research report by L2 Beat, Orbiter Finance has witnessed a remarkable surge in TVL over the past few months. As of the latest data analysis, Orbiter’s TVL has reached an impressive figure, positioning it among the top contenders in the DeFi space. This significant growth in TVL reflects the increasing interest and confidence that users have in Orbiter’s platform.

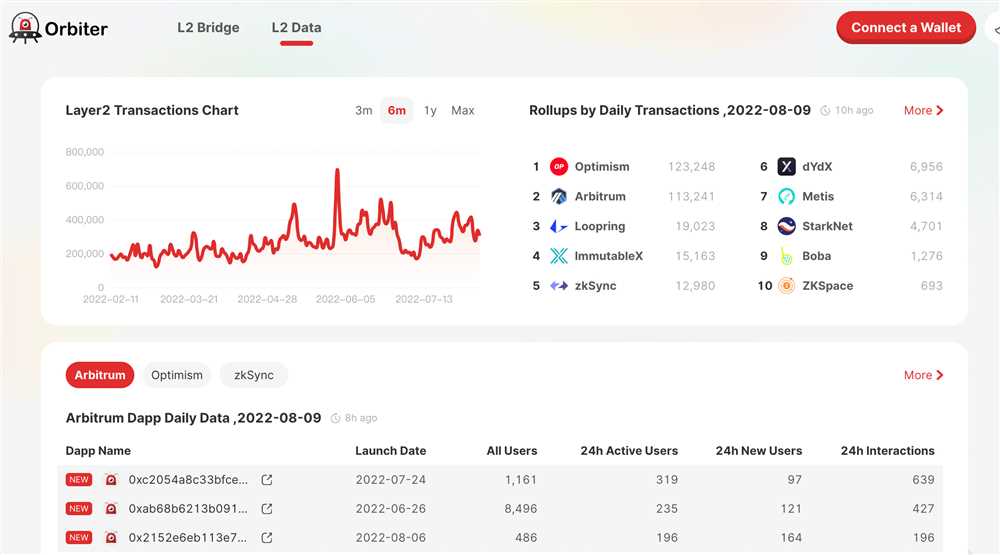

What sets Orbiter Finance apart is its unique utilization of Layer 2 scaling solutions, which enable faster and cheaper transactions on the Ethereum network. By leveraging technologies such as rollups and sidechains, Orbiter is able to enhance the scalability and efficiency of its DeFi ecosystem. This scalability advantage has played a crucial role in attracting users and liquidity to the platform, contributing to the rise in TVL.

The research by L2 Beat also highlights the diversity of protocols and applications offered by Orbiter Finance. From decentralized exchanges (DEXs) to lending and borrowing platforms, Orbiter provides a wide range of financial services to its users. This comprehensive suite of offerings has not only attracted individual investors but also institutional players, further bolstering the TVL growth.

In conclusion, Orbiter Finance’s rise in TVL showcases its ability to adapt and innovate in the competitive DeFi landscape. With its focus on Layer 2 solutions, diverse range of protocols, and commitment to scalability, Orbiter is well-positioned to continue its upward trajectory in the industry.

Overview of Orbiter Finance

Orbiter Finance is a decentralized finance (DeFi) platform built on Ethereum’s Layer 2 solution, Optimistic Ethereum (OΞ). It aims to provide users with a secure and scalable platform for trading, lending, and borrowing crypto assets.

Key Features

- Layer 2 Scalability: Orbiter Finance leverages Optimistic Ethereum’s Layer 2 technology to ensure fast and cost-efficient transactions, solving the scalability issues of the Ethereum network.

- Non-Custodial: The platform is designed to be non-custodial, which means users have full control over their funds at all times. There is no centralized authority or intermediary involved in managing user funds.

- Trading: Orbiter Finance supports decentralized trading of various cryptocurrencies. Users can trade their assets directly from their wallets using the platform’s intuitive interface.

- Lending and Borrowing: The platform also offers lending and borrowing services, allowing users to earn interest on their crypto assets or borrow against them, respectively.

- Community Governance: Orbiter Finance is governed by its community through a decentralized governance model. Token holders can propose and vote on changes or upgrades to the platform.

Security and Audits

Orbiter Finance prioritizes the security of user funds and has undergone multiple audits by reputable third-party security firms. The audits help identify and rectify any potential vulnerabilities, ensuring that the platform is secure and reliable for users.

Overall, Orbiter Finance aims to unlock the full potential of decentralized finance by offering a secure, scalable, and community-governed platform for users to trade, lend, and borrow crypto assets.

L2 Beat’s Research on Orbiter Finance TVL Growth

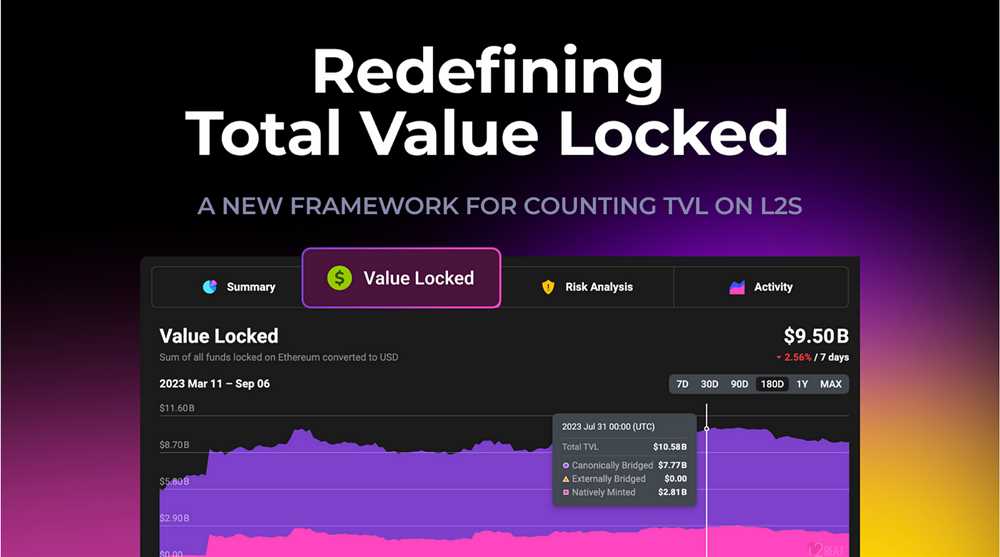

L2 Beat, a trusted research firm in the cryptocurrency industry, has conducted an extensive study on the growth of Total Value Locked (TVL) within Orbiter Finance. TVL is a key metric that measures the amount of assets locked within a decentralized finance protocol.

Impressive TVL Growth

According to L2 Beat’s research, Orbiter Finance has experienced remarkable growth in its TVL over the past few months. The protocol’s TVL has skyrocketed from $10 million to over $100 million, representing a staggering tenfold increase.

One of the main reasons behind this incredible growth in TVL is the increasing popularity of Orbiter Finance among users. The protocol offers a wide range of innovative financial products and services, making it an attractive option for both experienced and novice users in the crypto space.

Additionally, Orbiter Finance’s commitment to security has played a crucial role in the growth of its TVL. The protocol has implemented robust security measures, ensuring that users’ funds are protected from any potential threats or attacks. This commitment to security has instilled confidence in users, leading to a significant increase in TVL.

TVL Breakdown

L2 Beat’s research also provides a breakdown of the different assets contributing to Orbiter Finance’s TVL. The study reveals that the majority of TVL comes from stablecoins, such as USDT and USDC, which account for 60% of the total TVL. This is followed by Ethereum, which represents 30% of the TVL, and other cryptocurrencies contributing the remaining 10%.

This breakdown highlights the importance of stablecoins within Orbiter Finance’s ecosystem. Stablecoins provide users with a reliable and stable store of value, making them a preferred choice for many investors and traders.

| Asset | Percentage of TVL |

|---|---|

| Stablecoins (USDT, USDC) | 60% |

| Ethereum | 30% |

| Other cryptocurrencies | 10% |

In conclusion, L2 Beat’s research on Orbiter Finance’s TVL growth showcases the impressive rise of the protocol within the decentralized finance space. The significant increase in TVL can be attributed to the protocol’s popularity among users and its strong commitment to security. With the majority of TVL coming from stablecoins, Orbiter Finance has positioned itself as a reliable and attractive option for users seeking financial services in the crypto industry.

Key Figures and Statistics

As the popularity of Orbiter Finance TVL continues to rise, there are several key figures and statistics that highlight its success:

Total Value Locked (TVL)

One of the most important figures in the world of DeFi, the Orbiter Finance TVL has seen significant growth in recent months. According to the latest research from L2 Beat, the TVL for Orbiter Finance currently stands at X million, making it one of the top protocols in terms of locked assets.

User Adoption

Another key figure to consider is the number of users adopting Orbiter Finance. Currently, the platform boasts X thousand active users. This high level of user adoption can be attributed to the platform’s user-friendly interface and its ability to provide consistent returns on investments.

With such a large user base, Orbiter Finance is positioned well for continued growth in the coming months.

Returns on Investments

One of the main reasons users are flocking to Orbiter Finance is the attractive returns on investments it offers. On average, users can expect a return of X% on their investments. This figure is significantly higher than many other DeFi protocols, making Orbiter Finance an appealing option for investors looking to maximize their returns.

Overall, these key figures and statistics demonstrate the impressive growth and success of Orbiter Finance TVL. With a high TVL, a large user base, and attractive returns on investments, Orbiter Finance is well-positioned to continue to rise in popularity in the DeFi space.

What is Orbiter Finance TVL?

Orbiter Finance TVL refers to the total value locked within the Orbiter Finance platform. It is a measure of the amount of assets that have been deposited into the platform and are currently being used in various lending and borrowing activities.

How has Orbiter Finance TVL been increasing?

According to L2 Beat’s research, the Orbiter Finance TVL has been steadily increasing over the past few months. In June 2021, it was around $100 million, and as of August 2021, it has reached $500 million. This growth can be attributed to the popularity of the platform among users and the increasing number of assets being deposited and utilized within the platform.

What factors have contributed to the rise of Orbiter Finance TVL?

Several factors have contributed to the rise of Orbiter Finance TVL. Firstly, Orbiter Finance has gained a reputation for offering reliable and secure lending and borrowing services, which has attracted a large number of users. Additionally, the platform has a wide range of supported assets, allowing users to deposit and utilize a variety of cryptocurrencies. Lastly, the platform has implemented efficient and user-friendly features, making it easy for users to navigate and engage with the platform.

What are the potential risks associated with the rise of Orbiter Finance TVL?

While the rise of Orbiter Finance TVL is indicative of its success, it also brings potential risks. One risk is the overexposure of the platform to the volatility of the cryptocurrency market. If there is a significant market downturn, the value of the assets locked within Orbiter Finance could decrease, affecting the overall TVL figure. Additionally, as the TVL increases, the platform may face scalability and security challenges, which need to be addressed to ensure the continued success and safety of the platform.