The Significance of Collateral in Ensuring Secure and Reliable Cross-Rollup Transfers in Orbiter Finance’s Contract

Discover the Key to Protecting Your Assets and Ensuring Seamless Transactions

Are you concerned about the security and reliability of your digital assets during cross-rollup transfers?

Look no further than Orbiter Finance’s groundbreaking contract that offers a comprehensive solution to safeguarding your investments. Our innovative technology provides unparalleled protection by leveraging the significance of collateral.

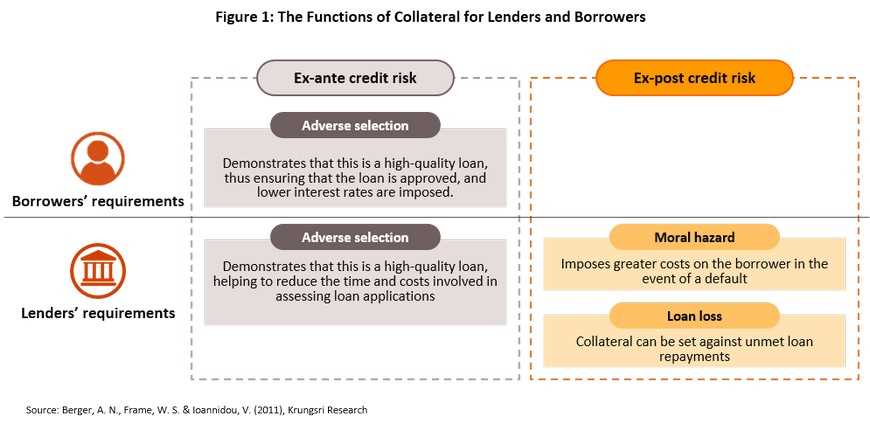

What is collateral and why is it crucial?

Collateral refers to an asset or property that is pledged as security for a loan or obligation. In the context of cross-rollup transfers, collateral acts as a guarantee against potential risks, ensuring seamless and reliable transactions.

With Orbiter Finance’s contract, you can rest assured knowing that your assets are protected.

The benefits of collateral-backed cross-rollup transfers:

- Security: By providing collateral, parties involved in the transfer can mitigate the risk of fraudulent activities, ensuring a secure environment for asset exchange.

- Reliability: Collateral-backed transfers offer increased reliability by minimizing the possibility of transaction failures or delays, providing users with a seamless experience.

- Economic Efficiency: Leveraging collateral allows for more efficient and cost-effective transactions, reducing the need for complex mechanisms or intermediaries.

Choose Orbiter Finance for secure and reliable cross-rollup transfers!

Don’t compromise on the safety and reliability of your digital assets. Trust Orbiter Finance’s contract and the significance of collateral to protect your investments and enjoy a seamless cross-rollup transfer experience. Take advantage of our innovative technology and join the future of secure asset transfers today!

The Importance of Collateral

Collateral plays a crucial role in secure and reliable cross-rollup transfers within Orbiter Finance’s contract. It serves as a safeguard to protect against potential default or loss, providing reassurance to both lenders and borrowers.

Protection Against Default

One of the primary reasons why collateral is essential in cross-rollup transfers is its ability to mitigate the risk of default. By requiring borrowers to pledge collateral, lenders can rest assured knowing that they have a form of repayment in the event of a default. This significantly reduces the risk associated with lending, making it a more attractive option for lenders to participate in cross-rollup transfers.

Collateral offers a layer of security by providing a tangible asset that can be liquidated or sold to recover the lender’s investment. This ensures that lenders are not left empty-handed in case the borrower is unable to fulfill their repayment obligations. Without collateral, cross-rollup transfers would carry a higher risk of default, discouraging lenders from participating and hindering the growth of secure and reliable financial ecosystems.

Increasing Borrower Confidence

Collateral not only benefits lenders but also increases borrower confidence. By providing collateral, borrowers demonstrate their commitment and confidence in their ability to repay the borrowed funds. This reassures lenders that the borrower has a stake in the success of the cross-rollup transfer and reduces the likelihood of default.

Having collateral also enables borrowers to access larger loan amounts or more favorable interest rates. Lenders are more willing to provide larger loans or offer better terms when there is collateral involved, as it provides additional security for their investment. This, in turn, opens up opportunities for borrowers to leverage their assets and participate in more significant cross-rollup transfers.

In conclusion, the importance of collateral cannot be understated in secure and reliable cross-rollup transfers. It provides protection against default, reduces risk for lenders, and increases borrower confidence. Collateral serves as a cornerstone in developing a robust financial ecosystem, enabling growth and facilitating the seamless flow of capital.

Secure and Reliable Cross-Rollup Transfers

In the world of decentralized finance, secure and reliable cross-rollup transfers are essential for the smooth operation of Orbiter Finance’s contract. These transfers allow users to seamlessly move their assets across different rollup chains, ensuring optimal liquidity and accessibility.

One of the key aspects of ensuring the security and reliability of cross-rollup transfers is the use of collateral. Collateral acts as a guarantee for the transferred assets, providing an additional layer of protection against potential risks and vulnerabilities.

Collateral plays a crucial role in mitigating the risk of fraudulent activities such as double spending and unauthorized transfers. By requiring users to provide collateral, Orbiter Finance’s contract can ensure that any transfer of assets is backed by a sufficient amount of value. This helps to prevent malicious actors from manipulating the system and ensures the integrity of the cross-rollup transfers.

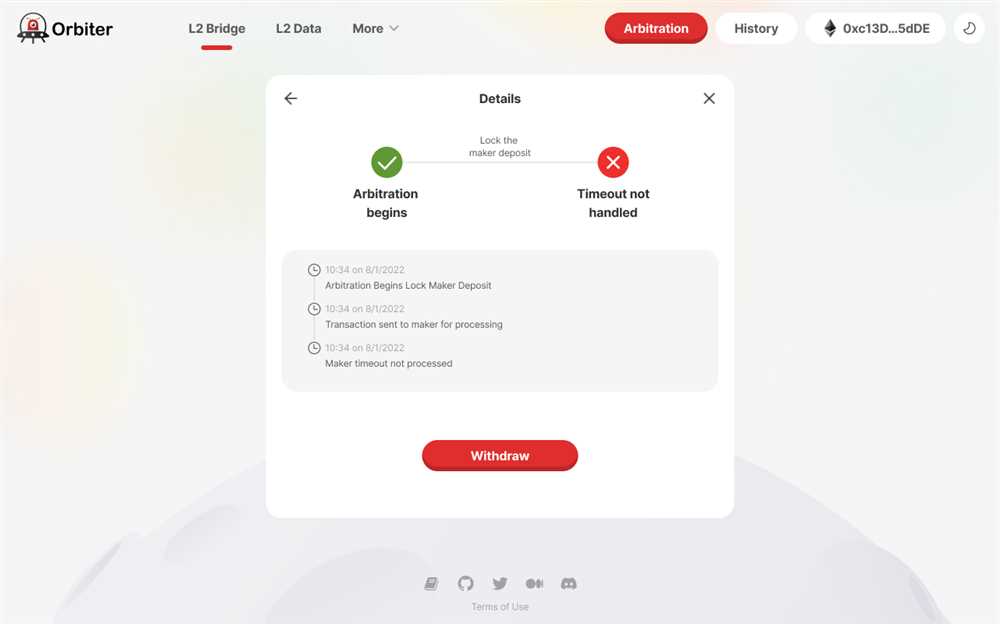

Collateral also provides a mechanism for resolving disputes in case of any unforeseen issues or conflicts during the cross-rollup transfer process. In the event of a dispute, the collateral can be used to compensate the affected parties and restore the trust in the system.

Furthermore, by requiring collateral, Orbiter Finance’s contract can incentivize users to act in a responsible manner and maintain the overall stability of the cross-rollup transfer ecosystem. Users have a vested interest in maintaining the value of their collateral, which encourages them to conduct transactions fairly and honestly.

In addition to collateral, Orbiter Finance’s contract employs various security measures to ensure the secure and reliable nature of cross-rollup transfers. These measures include encryption protocols, multi-factor authentication, and regular auditing to detect and prevent any potential vulnerabilities.

With the significance of collateral and the implementation of robust security measures, Orbiter Finance’s contract provides a trusted and efficient platform for secure and reliable cross-rollup transfers. Users can confidently move their assets between different rollup chains, knowing that their transfers are protected and backed by a reliable system.

Orbiter Finance’s Contract

As the world of decentralized finance continues to evolve, Orbiter Finance’s Contract stands out as a reliable and secure solution for cross-rollup transfers. By utilizing the power of smart contracts and collateralization, Orbiter Finance’s Contract ensures the seamless transfer of assets across different layer-2 scaling solutions.

Collateralization: Ensuring Security and Reliability

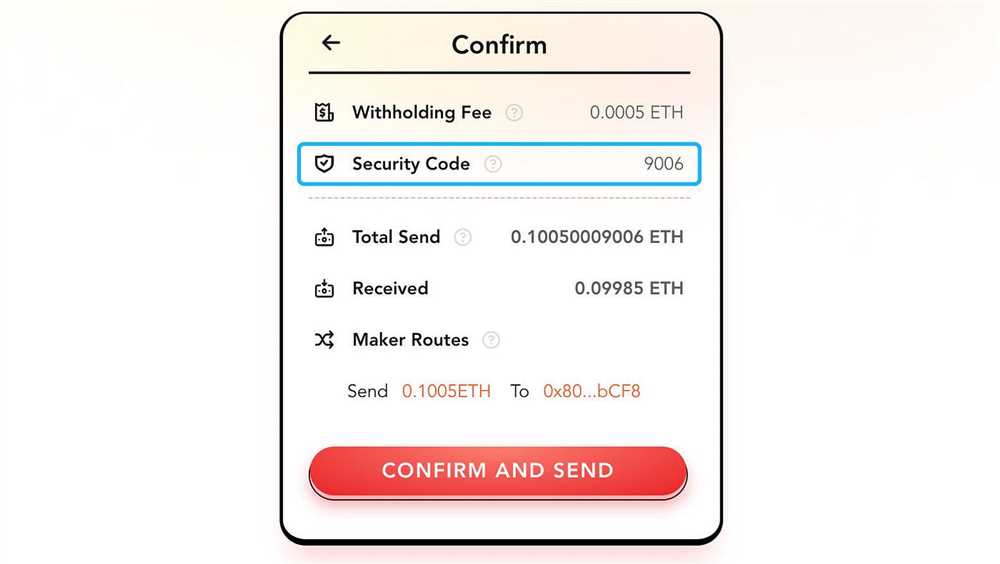

Collateralization is a key element in Orbiter Finance’s Contract, providing a vital layer of security and reliability. When initiating a cross-rollup transfer, users are required to lock up a certain amount of collateral as a guarantee. This collateral acts as insurance, mitigating the risk of potential fraud or malicious activities.

By requiring collateral, Orbiter Finance’s Contract creates a strong incentive for users to act in good faith and ensures that any potentially malicious behavior would come at a significant cost. This not only provides peace of mind to users but also protects the overall integrity of the cross-rollup transfer process.

Smart Contracts: Enabling Trustless Transactions

Orbiter Finance’s Contract leverages the power of smart contracts to enable trustless and transparent cross-rollup transfers. Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

By utilizing smart contracts, Orbiter Finance’s Contract eliminates the need for intermediaries and ensures that transactions are executed only when predetermined conditions are met. This reduces the risk of human error or manipulation, providing a higher level of trust and security.

Through the use of smart contracts, Orbiter Finance’s Contract opens up a world of possibilities for decentralized finance, allowing for the seamless transfer of assets across different layer-2 scaling solutions without compromising security or reliability.

Discover the power of Orbiter Finance’s Contract and join the future of secure and reliable cross-rollup transfers in decentralized finance.

What is Orbiter Finance’s Contract?

Orbiter Finance’s Contract is a smart contract that enables secure and reliable cross-rollup transfers. It ensures that assets can be transferred between different rollups in a decentralized manner.

Why is collateral significant in secure and reliable cross-rollup transfers?

Collateral is significant in secure and reliable cross-rollup transfers because it acts as a guarantee for the value of the transferred assets. By requiring collateral, Orbiter Finance’s Contract ensures that both parties involved in the transfer have skin in the game and reduces the risk of malicious or fraudulent actions.