Tips and Tricks for Getting the Most Out of Orbiter Finance’s Budgeting Tools

Welcome to Orbiter Finance, the ultimate solution for managing your personal finances. With our powerful budgeting tools, you can take control of your expenses and savings, and achieve your financial goals faster than ever before. To help you make the most out of our budgeting tools, we have compiled a list of tips and tricks that will supercharge your financial planning. Whether you are just starting to budget or are a seasoned pro, these strategies will help you maximize your results and get the most bang for your buck.

Tips for Maximizing Budgeting Tools Results

When it comes to managing your finances effectively, using budgeting tools can make a significant difference. Here are some tips to help you maximize the results you get from Orbiter Finance’s budgeting tools:

- Set clear financial goals: Before you start using the budgeting tools, take the time to set clear financial goals for yourself. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having specific goals will help you stay motivated and focused.

- Track your expenses: Make sure to track all your expenses accurately. Whether it’s a cup of coffee or a monthly bill, recording every expense will give you an accurate picture of where your money is going. Use Orbiter Finance’s budgeting tools to categorize and analyze your expenses.

- Create a realistic budget: Based on your income and expenses, create a realistic budget that suits your lifestyle. Don’t forget to include savings and investments in your budget plan. Orbiter Finance’s budgeting tools can help you visualize your budget and identify areas where you can cut back.

- Regularly review your budget: Review your budget regularly to see if any adjustments need to be made. Life circumstances can change, so it’s essential to update your budget accordingly. Use Orbiter Finance’s budgeting tools to monitor your progress and make necessary changes.

- Identify spending patterns: Analyzing your spending patterns can provide valuable insights into where you tend to overspend. Orbiter Finance’s budgeting tools offer data visualization and reports that can help you identify areas where you can cut back and save money.

- Stay disciplined: Discipline is key when it comes to budgeting. Stick to your budget and avoid unnecessary splurges. Orbiter Finance’s budgeting tools make it easy to track your progress and see how well you’re sticking to your financial goals.

- Stay motivated: Finally, stay motivated on your financial journey. Celebrate small milestones and rewards yourself when you achieve your financial goals. Orbiter Finance’s budgeting tools can help you visualize your progress and keep you motivated along the way.

By following these tips and using Orbiter Finance’s budgeting tools, you can gain better control over your finances and achieve your financial goals.

Organize Your Finances

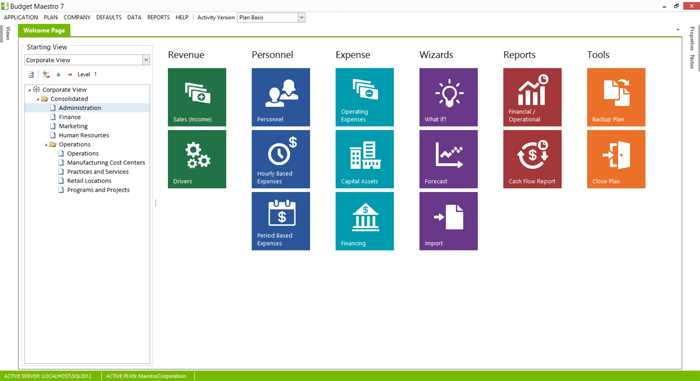

Managing your finances can be overwhelming, especially if you have multiple accounts and expenses to keep track of. Luckily, Orbiter Finance provides a range of budgeting tools to help you stay organized and in control of your money.

Start by creating a comprehensive budget that outlines your income and expenses. This will give you a clear picture of where your money is going and help you identify areas where you can cut back on spending.

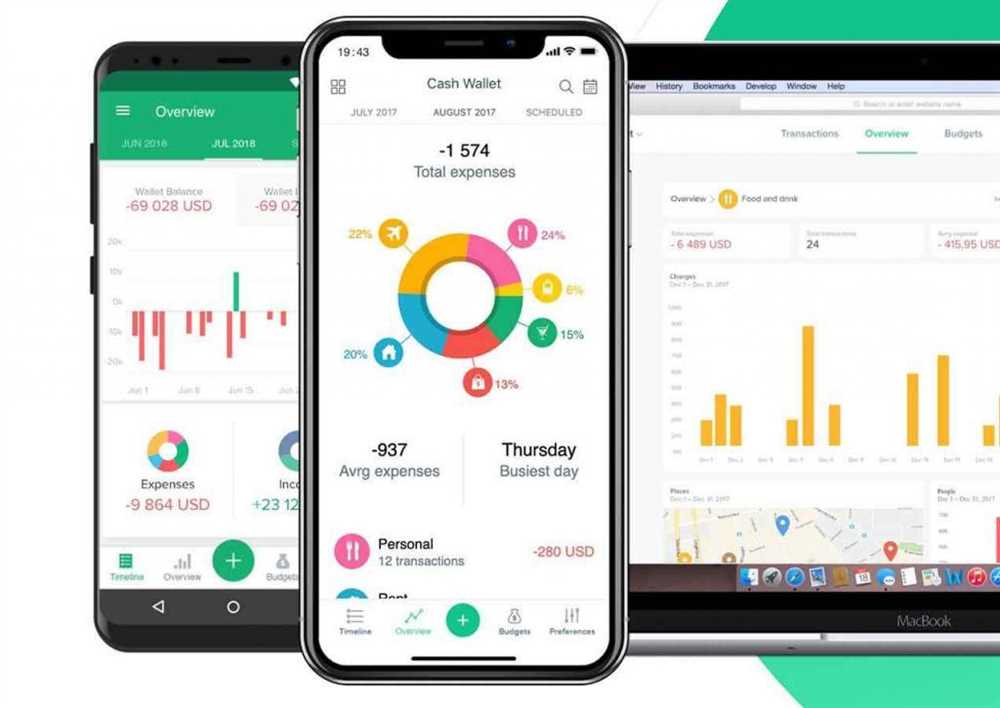

Next, consider using Orbiter Finance’s expense tracking feature. This tool allows you to categorize and monitor your expenses, making it easier to see where your money is being spent. By keeping tabs on your spending habits, you can make smarter financial decisions and avoid overspending.

Another great way to organize your finances is to set up automatic payments. Orbiter Finance’s bill pay feature allows you to schedule automatic payments for recurring expenses, such as rent or utilities. This not only ensures that your bills are paid on time but also eliminates the hassle of manual bill payments.

Additionally, Orbiter Finance offers a goal setting feature that can help you achieve your financial objectives. Whether you’re saving for a vacation, a down payment on a house, or a rainy day fund, setting specific goals can provide you with a roadmap for success and keep you motivated along the way.

Finally, don’t forget to regularly review and update your financial information. Orbiter Finance’s account aggregation feature allows you to view all of your accounts in one place, making it easy to stay up to date on your financial health. Take the time to review your transactions, update your budget, and make any necessary adjustments to your financial plan.

By following these tips and utilizing Orbiter Finance’s budgeting tools, you can effectively organize your finances and achieve your financial goals. With a clear understanding of your finances, you’ll be able to make better financial decisions and enjoy peace of mind knowing that your money is working for you.

Utilize Advanced Features

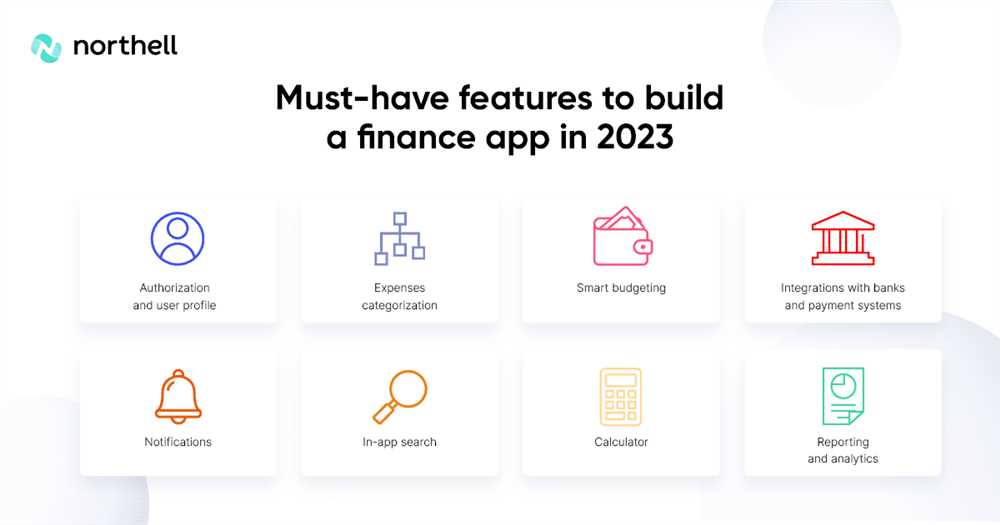

Orbiter Finance’s budgeting tools offer a range of advanced features that can greatly enhance your financial planning and management. By taking advantage of these features, you can make the most out of your budget and achieve your financial goals more efficiently.

Customizable Categories and Tags

One of the advanced features offered by Orbiter Finance’s budgeting tools is the ability to customize categories and tags. This allows you to personalize your budget based on your specific needs and preferences. By creating customized categories and tags, you can track your expenses more accurately and gain better insights into your spending habits.

Automated Transactions and Reminders

Another powerful feature of Orbiter Finance’s budgeting tools is the ability to set up automated transactions and reminders. This feature eliminates the need for manual entry of recurring expenses or income, saving you time and effort. You can also set up reminders for bill payments, due dates, and other important financial tasks to ensure you never miss a deadline.

With these advanced features, Orbiter Finance’s budgeting tools provide you with the flexibility and convenience to manage your finances efficiently. Take full advantage of the customizable categories and tags, as well as the automated transactions and reminders, to maximize your financial planning and achieve your financial goals with ease.

Improve Accuracy and Efficiency

When it comes to managing your finances, accuracy and efficiency are key. Orbiter Finance’s budgeting tools are designed to help you achieve just that.

Automated Tracking: Our budgeting tools can automatically track your income and expenses, eliminating the need for manual data entry. This not only saves you time but also reduces the chance of errors that can result from entering information manually.

Real-time Updates: With Orbiter Finance, your budget is always up-to-date. As soon as you make a transaction, the tool updates your budget instantly, giving you an accurate picture of your financial situation at any given moment.

Customized Categories: Personalize your budget by creating customized categories that reflect your unique spending habits. By categorizing your expenses accurately, you can identify areas where you may be overspending and make the necessary adjustments to stay on track.

Goal Tracking: Set financial goals and track your progress with Orbiter Finance’s goal tracking feature. Whether you’re saving up for a vacation or trying to pay off debt, our tools provide insights into your progress, motivating you to stay focused and achieve your goals faster.

Visual Reports: Gain a comprehensive understanding of your financial situation with our visual reports. These reports provide clear, easy-to-understand graphs and charts that visualize your income, expenses, and savings over time. This enables you to identify trends and patterns, making it easier for you to make informed financial decisions.

Seamless Integration: Orbiter Finance seamlessly integrates with your bank accounts, credit cards, and other financial institutions, ensuring that all your transactions are automatically synced and categorized. This integration eliminates the need for manual data entry and reduces the chance of errors.

With Orbiter Finance’s budgeting tools, improving accuracy and efficiency in managing your finances has never been easier. Take control of your financial future and start maximizing your budget today!

Does Orbiter Finance offer any budgeting alerts and notifications?

Yes, Orbiter Finance offers budgeting alerts and notifications to help you stay on track with your budget. These alerts can be set up to notify you of any overspending, upcoming bills, or savings goals. You can customize the alerts based on your preferences and receive them via email or through the Orbiter Finance mobile app.

How often should I review and analyze my budget with Orbiter Finance’s budgeting tools?

It is recommended to review and analyze your budget with Orbiter Finance’s budgeting tools on a regular basis. This can vary depending on your financial situation, but a monthly review is a good starting point. During this review, you can assess your progress, identify any areas where you may need to make adjustments, and ensure that you are staying on track with your financial goals.