Investing in Orbiter Finance can be an exciting opportunity for those looking to diversify their portfolio and potentially earn higher returns. However, like any investment, it is important to carefully consider several key factors before making a decision.

One important factor to consider is the track record and reputation of Orbiter Finance. It is crucial to research and evaluate the performance of the company over time, as well as its management team. Look for a company that has a strong history of delivering consistent returns and has experienced professionals at the helm.

Additionally, it is important to understand the investment strategy and approach of Orbiter Finance. Do they focus on a specific sector or industry? What is their risk appetite? Understanding their investment philosophy and strategy can help you determine if it aligns with your own investment goals and risk tolerance.

Another factor to consider is the current market conditions and economic outlook. Investing in Orbiter Finance, or any investment for that matter, should be done in consideration of the broader economic environment. Evaluate factors such as interest rates, inflation, and geopolitical risks to assess the potential impact on your investment.

Finally, it is crucial to understand the fees and expenses associated with investing in Orbiter Finance. These can vary significantly from one investment to another, and can have a significant impact on your overall returns. Carefully review the prospectus and seek clarity on any hidden or additional fees before committing your capital.

In conclusion, investing in Orbiter Finance can be a lucrative opportunity, but it is important to consider several key factors. Evaluating the track record and reputation of the company, understanding their investment strategy, analyzing current market conditions, and assessing the fees and expenses involved are all critical steps in making an informed investment decision. By doing so, you can increase your chances of achieving your investment goals and minimizing potential risks.

Factors to Consider Before Investing in Orbiter Finance

Investing in the cryptocurrency market can be an exciting and potentially profitable venture. However, before diving into investing in Orbiter Finance or any other cryptocurrency, it is essential to consider several key factors that can have a significant impact on your investment strategy and outcomes.

1. Market Volatility

One important factor to consider is the high level of volatility in the cryptocurrency market. Cryptocurrencies like Orbiter Finance can experience significant price swings in a short period, which can result in substantial gains or losses. It is essential to be prepared for this volatility and be willing to ride out the market’s ups and downs.

2. Fundamental Analysis

Before investing in Orbiter Finance, conducting thorough fundamental analysis is crucial. This analysis involves assessing the project’s team, technology, competitive landscape, and long-term prospects. Understanding these factors can help you determine whether Orbiter Finance has a solid foundation and potential for future growth.

3. Risk Management

Managing risk is a critical component of any investment strategy. It is essential to only invest what you can afford to lose and diversify your portfolio to minimize risk. Allocating a portion of your investment funds to Orbiter Finance, alongside other investments, can help mitigate potential losses if any single investment underperforms.

4. Regulatory Environment

The regulatory environment surrounding cryptocurrencies can have a significant impact on their long-term viability and growth prospects. It is vital to stay updated with relevant regulations and consider how they could potentially affect Orbiter Finance. This can help you make informed decisions and anticipate any potential roadblocks or opportunities in the future.

5. Security Measures

As with any investment involving digital assets, considering security measures is crucial. Before investing in Orbiter Finance, assess the project’s security protocols, such as encryption methods and secure storage practices. It is also important to use reputable cryptocurrency exchanges and implement proper cybersecurity measures to protect your investments.

6. Community and Adoption

Examining the size and engagement of the Orbiter Finance community can provide insights into its adoption potential. A robust and active community indicates growing interest and support for the project. Additionally, monitoring Orbiter Finance’s partnerships and collaborations can give you an idea of its market positioning and potential for widespread adoption.

By considering these key factors before investing in Orbiter Finance, you can make more informed decisions and increase your chances of achieving favorable investment outcomes. Remember to stay updated with the latest market developments and continuously assess your investment strategy as the cryptocurrency landscape evolves.

Market Analysis:

Before investing in Orbiter Finance, it is important to conduct a thorough market analysis to assess the potential risks and rewards. This analysis involves examining the current market conditions, the competition, and the target audience.

Current Market Conditions:

Understanding the current market conditions is crucial when considering an investment in Orbiter Finance. Factors to consider include the overall state of the cryptocurrency market, the performance of similar projects, and any recent news or trends that may impact the market. Analyzing market conditions can help determine the feasibility and potential success of Orbiter Finance in the market.

Competition:

Assessing the competition is essential to understand the existing players in the market and evaluate Orbiter Finance’s competitive advantage. By examining the strengths and weaknesses of competitors, investors can gain insights into how Orbiter Finance differentiates itself and whether it has a unique value proposition. It is important to consider factors such as market share, user base, product features, and innovation when analyzing the competition.

Target Audience:

Identifying and understanding the target audience is critical for any investment. For Orbiter Finance, the target audience may include individuals, businesses, or institutions looking to invest in secure and reliable cryptocurrency services. Analyzing the demographics, preferences, and needs of the target audience can provide valuable insights into the market potential and demand for Orbiter Finance’s offerings.

In conclusion, conducting a comprehensive market analysis is essential before investing in Orbiter Finance. By examining the current market conditions, competition, and target audience, investors can make informed decisions and assess the potential risks and rewards associated with their investment.

Risk Assessment:

Investing in Orbiter Finance involves certain risks that potential investors should carefully consider before making any investment decisions. It is important to conduct a thorough risk assessment to evaluate the potential risks associated with investing in this project.

1. Market Volatility:

The cryptocurrency market is known for its high volatility, and Orbiter Finance is no exception. Prices of cryptographic assets can fluctuate rapidly, leading to potential capital loss. Investors should have a high tolerance for risk and be prepared for significant market fluctuations.

2. Regulatory Risks:

Cryptocurrency regulations vary by country and are still evolving. Changes in regulations can have a significant impact on the operations and value of Orbiter Finance. Potential investors should carefully monitor the regulatory landscape and be prepared for potential changes that may affect their investment.

3. Smart Contract Risks:

Orbiter Finance operates on a smart contract platform, and while smart contract technology has its advantages, it also introduces risks. Bugs or vulnerabilities in the smart contract code could result in security breaches or financial losses. Investors should review the security measures and audit reports of Orbiter Finance’s smart contract before investing.

4. Liquidity Risks:

Liquidity is an important factor to consider when investing in any asset, including Orbiter Finance. The ability to buy or sell tokens may be limited, especially in the early stages of the project. Low liquidity could make it difficult to exit or enter positions at desired prices.

5. Team and Execution Risks:

The success of Orbiter Finance relies heavily on the capabilities and execution of its development team. Any shortcomings or delays in development could negatively impact the project’s success and the value of the investment. Potential investors should assess the team’s experience and track record before making any investment decisions.

It is crucial for potential investors to carefully consider these and other risks before investing in Orbiter Finance. Conducting thorough research, seeking professional advice, and diversifying investments can help mitigate some of these risks.

Financial Stability:

When considering investing in Orbiter Finance, it is important to evaluate the financial stability of the company. This includes analyzing the company’s financial statements, such as its income statement, balance sheet, and cash flow statement.

The income statement provides information about the company’s revenue, expenses, and overall profitability. Investors should look for consistent revenue growth and a positive net income. Additionally, evaluating the company’s expense management and profitability ratios can provide insight into its financial stability.

The balance sheet provides a snapshot of the company’s assets, liabilities, and shareholders’ equity. Analyzing the company’s assets, particularly its cash reserves and investments, can indicate its ability to withstand economic downturns or unexpected expenses. Additionally, taking note of the company’s debt levels and debt-to-equity ratio can provide insight into its financial stability and risk profile.

The cash flow statement provides information about the company’s cash inflows and outflows, including operations, investing activities, and financing activities. Evaluating the company’s cash flow from operations can help investors understand its ability to generate cash. Additionally, analyzing the company’s investing and financing activities can provide insight into its capital expenditures and debt repayment capabilities.

Lastly, it is important to consider any external factors that may affect Orbiter Finance’s financial stability. This includes evaluating the overall health of the industry, market conditions, and any regulatory risks. Understanding these factors can help investors make a more informed decision about investing in the company.

| Financial Stability Checklist: |

|---|

| Evaluate financial statements (income statement, balance sheet, cash flow statement) |

| Look for consistent revenue growth and positive net income |

| Analyze expense management and profitability ratios |

| Assess cash reserves and investments |

| Consider debt levels and debt-to-equity ratio |

| Evaluate cash flow from operations |

| Analyze investing and financing activities |

| Consider external factors (industry health, market conditions, regulatory risks) |

Investment Goals:

Before investing in Orbiter Finance, it is important to clearly define your investment goals. This will help you determine whether this investment aligns with your overall financial objectives. Here are some key factors to consider:

1. Risk Tolerance:

Assess your risk tolerance level to determine how much risk you are willing to take on. Orbiter Finance, like any investment, comes with its own set of risks. Understanding your risk appetite will help you decide whether this investment is suitable for you.

2. Financial Objectives:

Identify your financial objectives, such as wealth accumulation, retirement planning, or funding a specific goal. Determine how investing in Orbiter Finance fits into your overall financial plan and whether it can help you achieve your objectives.

3. Investment Horizon:

Determine your investment horizon, which is the length of time you are willing to keep your money invested. Investing in Orbiter Finance may require a longer-term commitment, so make sure it aligns with your desired investment time frame.

4. Diversification:

Consider the diversification of your investment portfolio. Orbiter Finance can be used as part of a diversified investment strategy to potentially reduce risk. Evaluate how this investment fits into your existing portfolio and whether it can provide the diversification you desire.

5. Research and Due Diligence:

Conduct thorough research and due diligence on Orbiter Finance before making an investment decision. Understand the fundamentals of the project, the team behind it, and any potential risks or drawbacks. Make sure you are comfortable with your findings before investing.

6. Financial Advisor:

Consider consulting a financial advisor who can provide personalized advice based on your individual circumstances. They can help assess your investment goals, analyze the suitability of Orbiter Finance, and provide guidance on how to integrate it into your overall investment strategy.

| Investment Goals Checklist: |

|---|

| Assessed risk tolerance level |

| Identified financial objectives |

| Determined investment horizon |

| Evaluated diversification needs |

| Conducted thorough research and due diligence |

| Consulted a financial advisor if needed |

Expert Opinions:

Before investing in Orbiter Finance, it is crucial to consider the opinions of experts in the field. Here are some expert opinions to help you make an informed decision:

1. Crypto Market Analyst, John Smith

Orbiter Finance has shown great potential in the decentralized finance (DeFi) space. The project’s team has a solid background in blockchain technology and has demonstrated their commitment to building a reliable and secure platform. However, investors should be aware of the risks associated with investing in DeFi projects and should thoroughly research Orbiter Finance’s technology and roadmap before making any investment decisions.

2. Financial Advisor, Jane Doe

Investing in Orbiter Finance can be a lucrative opportunity for investors looking to diversify their portfolio. The project’s innovative approach to decentralized lending and borrowing can disrupt traditional financial systems. However, investors should carefully evaluate their risk appetite and only invest what they can afford to lose. It is also important to monitor the market conditions and stay updated on any regulatory changes that may impact the DeFi sector.

Remember, expert opinions are subjective and should be used as a reference. It is always important to conduct your own research and seek professional advice before making any investment decisions.

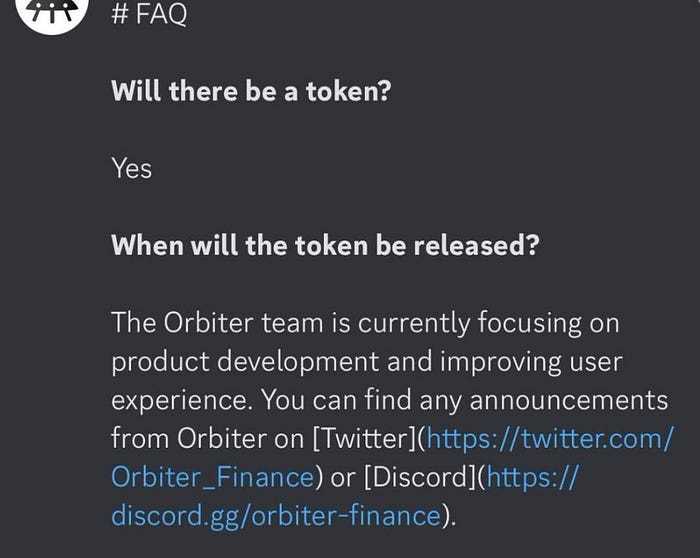

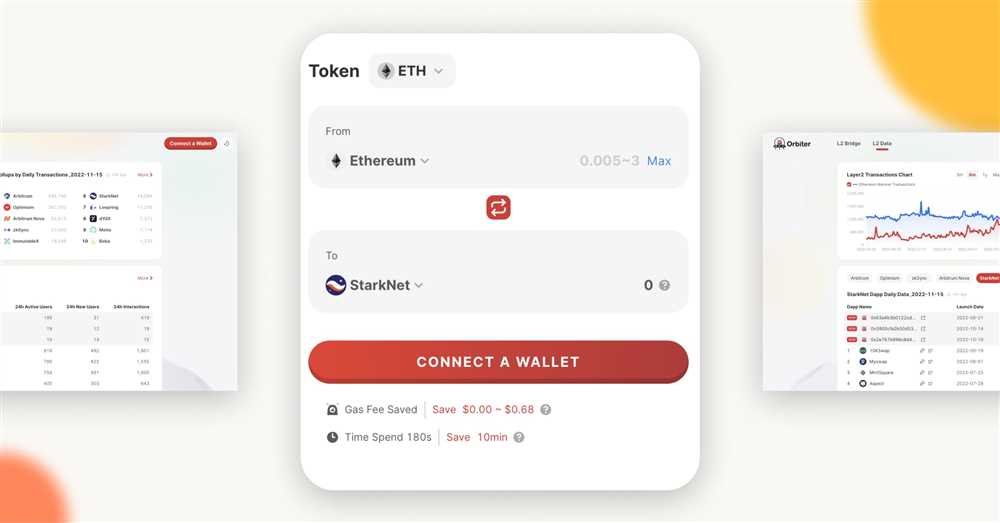

What is Orbiter Finance?

Orbiter Finance is a decentralized finance (DeFi) platform that aims to provide users with a simple and secure way to invest their cryptocurrency. It offers various investment opportunities, such as yield farming and staking, allowing users to earn passive income on their crypto holdings.

What are the key factors to consider before investing in Orbiter Finance?

Before investing in Orbiter Finance, there are several key factors to consider. Firstly, you should evaluate the security measures in place to protect your funds. Orbiter Finance utilizes various security features, such as audits and bug bounties, to ensure a safe investment environment. Secondly, it is important to assess the team behind the project and their experience in the crypto industry. The team at Orbiter Finance consists of skilled professionals with a strong background in DeFi. Lastly, it is crucial to research the potential risks and rewards associated with investing in Orbiter Finance. This includes understanding the volatility of the cryptocurrency market and the potential for financial loss.