Understanding Cross-Rollup and Its Role in Improving Security on the Orbiter Finance Platform

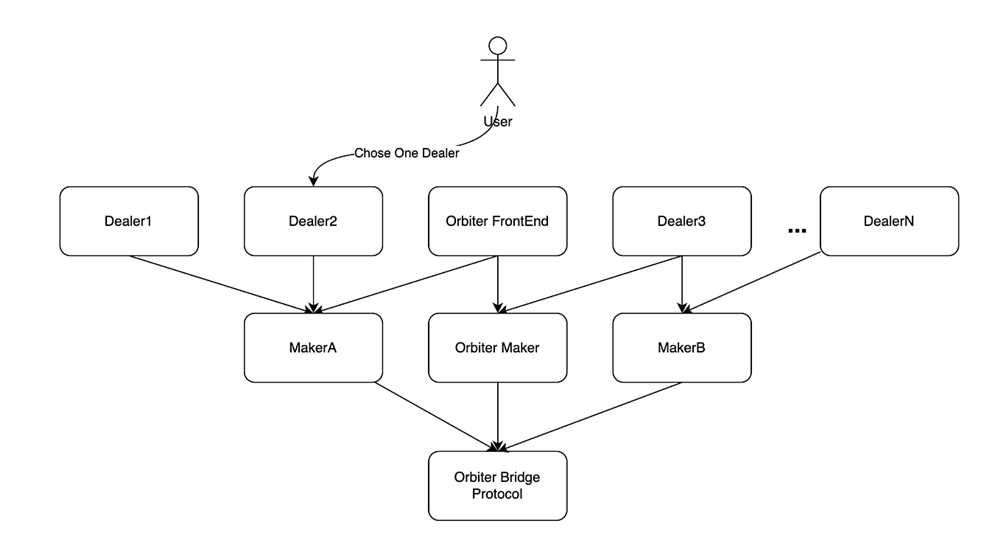

Cross-rollup technology has emerged as a key solution for enhancing security on decentralized finance (DeFi) platforms. At the forefront of this technology is the Orbiter Finance platform, which has recognized the importance of incorporating cross-rollup solutions to ensure the safety of user funds and transactions.

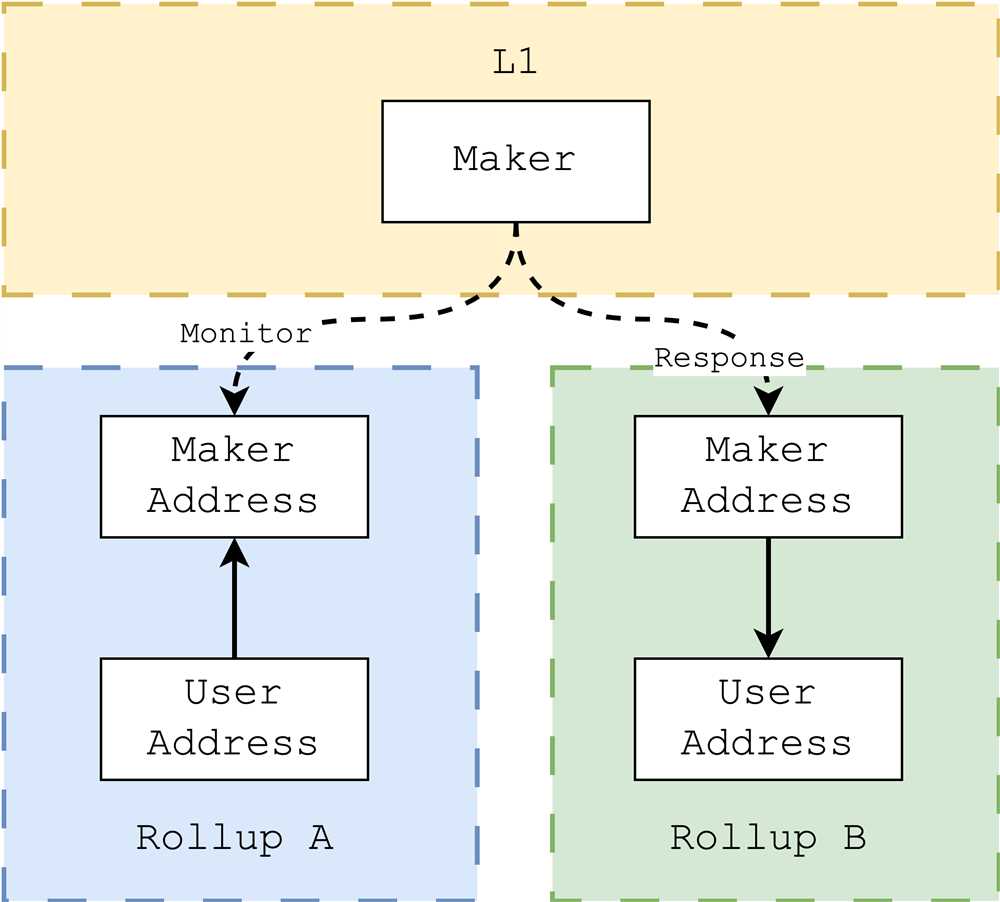

But what exactly is cross-rollup? Cross-rollup is a scaling technique that allows users to interact with multiple layer-two (L2) solutions simultaneously. It enables seamless movement of assets between different rollups, enhancing liquidity and reducing transaction costs. By leveraging this technology, Orbiter Finance aims to improve the overall user experience while ensuring the platform remains secure.

The role of cross-rollup in improving security is a critical aspect. Cross-rollup solutions enable the aggregation of different L2 solutions, thereby dispersing the risk associated with a single L2 solution. This means that if one L2 solution becomes compromised, assets can be quickly moved to another secure L2 solution, minimizing potential losses for users.

Orbiter Finance’s focus on security is reinforced by its strategic implementation of cross-rollup technology. By incorporating multiple L2 solutions, Orbiter Finance is able to diversify its security measures, making it increasingly difficult for attackers to exploit vulnerabilities. This approach not only provides peace of mind for users but also strengthens the overall security of the platform.

In conclusion, cross-rollup technology plays a crucial role in improving security on the Orbiter Finance platform. By leveraging this innovative technique, Orbiter Finance enhances the safety of user funds and transactions, ultimately creating a more secure DeFi environment. With the continuous evolution of DeFi, cross-rollup technology is set to become an integral part of the broader ecosystem, protecting users and ensuring the sustainability of decentralized finance.

The Importance of Cross-Rollup for Improved Security

One of the key components of the Orbiter Finance platform’s security infrastructure is its implementation of cross-rollup technology. Cross-rollup plays a crucial role in enhancing the overall security and resilience of the platform, making it a vital feature for users and developers.

Cross-rollup refers to the process of securely transferring assets and data between different rollup chains. This enables Orbiter Finance to leverage the benefits of different rollup solutions while maintaining a high level of security for its users. By utilizing cross-rollup technology, the platform minimizes the risk of potential security vulnerabilities associated with a single rollup chain.

An important advantage of cross-rollup is that it allows Orbiter Finance to distribute assets across multiple rollup chains, reducing the impact of potential attacks or network disruptions. This ensures that users’ funds remain secure even if there is a temporary issue with one of the rollup chains. By spreading assets across multiple chains, Orbiter Finance can significantly increase the overall security and availability of its platform.

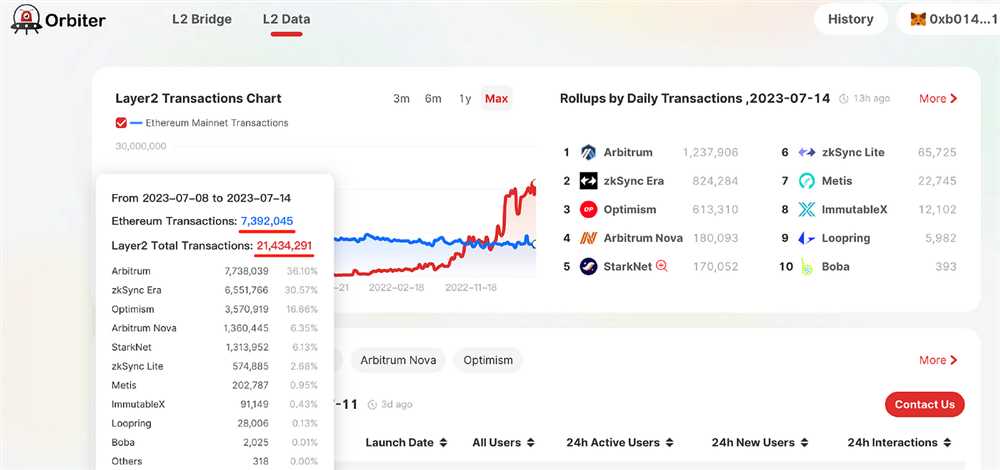

In addition to enhancing security, cross-rollup also improves the scalability of the Orbiter Finance platform. By utilizing multiple rollup chains, the platform can process a larger number of transactions in a shorter amount of time. This scalability is crucial for ensuring a smooth user experience and accommodating the growing demand for decentralized finance (DeFi) applications.

The integration of cross-rollup technology also contributes to increased interoperability within the broader DeFi ecosystem. By connecting multiple rollup chains, Orbiter Finance enables seamless asset transfers and interactions with other decentralized applications (DApps) and protocols. This fosters greater synergy and collaboration between different projects, ultimately driving innovation and growth in the DeFi space.

In conclusion, cross-rollup technology plays a pivotal role in improving the security and overall functionality of the Orbiter Finance platform. By leveraging multiple rollup chains, the platform enhances security, scalability, and interoperability, providing users with a robust and secure environment for their financial activities.

Increasing the Safety of Transactions on the Orbiter Finance platform

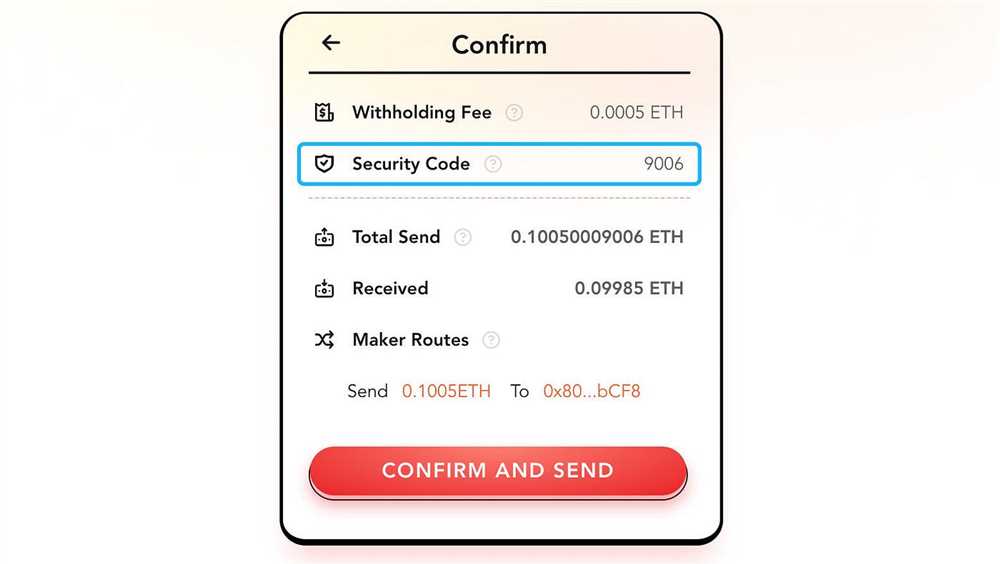

Ensuring the security of transactions is of utmost importance in the world of decentralized finance (DeFi). The Orbiter Finance platform takes this commitment seriously and employs various measures to increase the safety of transactions for its users.

Multi-Signature Wallets

One way Orbiter Finance enhances the safety of transactions is by utilizing multi-signature wallets. These wallets require multiple individuals or entities to approve a transaction before it can be executed. This significantly reduces the risk of unauthorized or fraudulent transactions, as it requires the consensus of multiple parties.

Decentralized Identity Verification

Another important aspect of transaction safety on the Orbiter Finance platform is decentralized identity verification. By leveraging decentralized identity protocols, Orbiter Finance ensures that each user’s identity is securely verified without relying on centralized authorities. This helps prevent identity theft and unauthorized access to user accounts, thereby enhancing the overall safety of transactions.

In addition to these measures, Orbiter Finance regularly conducts in-depth security audits and assessments to identify and address any potential vulnerabilities in its platform. By staying proactive and continuously improving its security protocols, Orbiter Finance aims to provide its users with a safe and secure environment to carry out their transactions.

Conclusion

The safety of transactions is a top priority for the Orbiter Finance platform. Through the implementation of measures such as multi-signature wallets and decentralized identity verification, Orbiter Finance strives to create a secure ecosystem where users can transact with confidence. Continuous security audits further ensure that the platform remains robust and resilient against potential threats. With these efforts in place, the Orbiter Finance platform aims to set the standard for transaction safety in the DeFi industry.

Enhancing User Protection with Cross-Rollup

In order to enhance user protection and improve security on the Orbiter Finance platform, the implementation of cross-rollup technology has been introduced. Cross-rollup is a mechanism that allows users to securely transfer assets between different rollups, ensuring that their funds are safe and protected at all times.

Through the use of cross-rollup, users are able to diversify their risk by moving assets between different rollups, reducing the risk of a single rollup being compromised or experiencing a security breach. This is especially important in the decentralized finance (DeFi) space, where security is a top concern for users.

With cross-rollup, users can also take advantage of the unique features and benefits offered by each rollup. Whether it’s lower fees, faster transaction times, or access to specific decentralized applications (dApps), cross-rollup allows users to easily navigate between different rollups and maximize their experience on the Orbiter Finance platform.

Furthermore, cross-rollup provides an additional layer of protection against potential attacks. By spreading their assets across different rollups, users can mitigate the impact of any potential security breaches, ensuring that their funds remain safe and secure.

Overall, the implementation of cross-rollup technology is a significant step towards enhancing user protection and improving security on the Orbiter Finance platform. By allowing users to securely transfer assets between different rollups, cross-rollup provides users with greater control and flexibility over their funds, while also reducing the risk of a single rollup being compromised. As the DeFi space continues to grow, cross-rollup will play a crucial role in ensuring the security and protection of user assets.

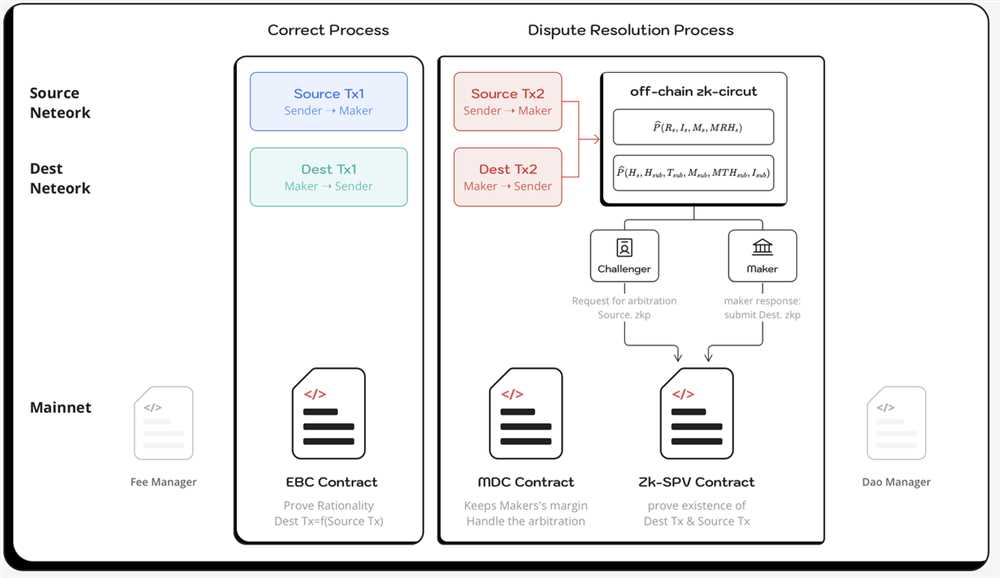

Preventing Attacks through Cross-Rollup Implementation

One of the main challenges in the decentralized finance (DeFi) space is ensuring the security of users’ funds. With the increasing number of attacks targeting DeFi platforms, it has become imperative for projects to implement robust security measures to protect their users. Orbiter Finance recognizes this need and has implemented cross-rollup technology to enhance the security of its platform.

Understanding Cross-Rollup

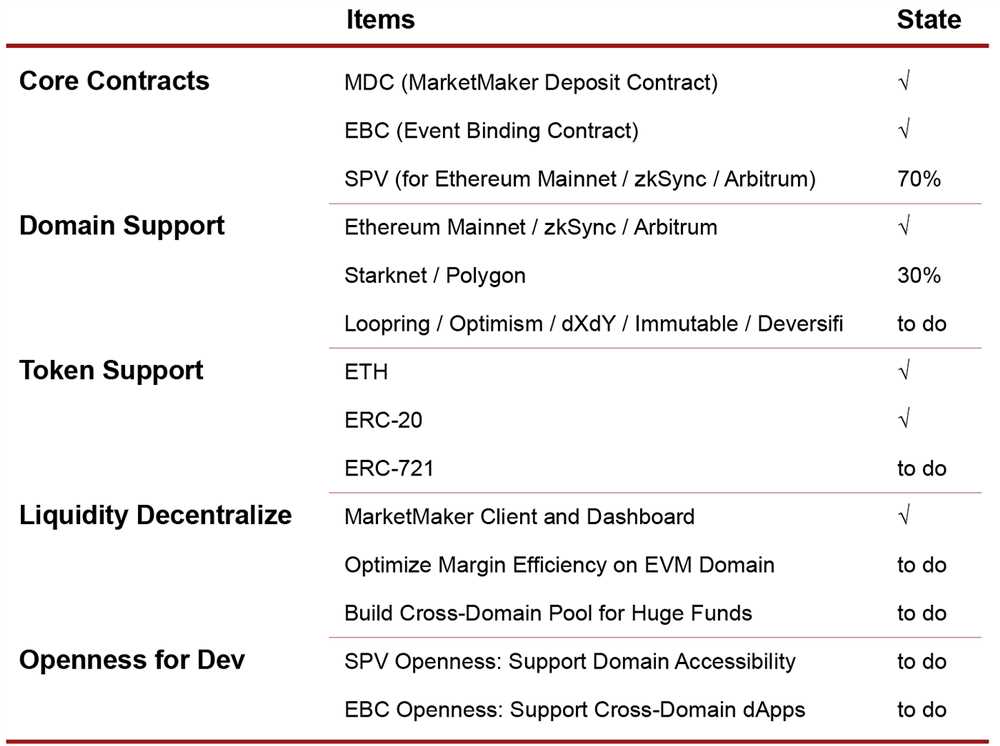

Cross-rollup is a technology that allows for the interconnection of multiple rollup chains. A rollup chain is a layer 2 scaling solution that aggregates multiple transactions into a single batch and submits them to the Ethereum mainnet. By connecting multiple rollup chains, cross-rollup enables seamless transfer of assets and data between these chains, creating a more robust and scalable ecosystem.

Orbiter Finance has leveraged cross-rollup technology to improve the security of its platform. By employing multiple rollup chains, the platform distributes user funds across different chains, minimizing the risk of a single point of failure. This means that even if one chain is compromised, the majority of users’ funds remain secure on other chains.

Enhanced Security through Isolation

In addition to distributing funds across multiple chains, Orbiter Finance implements stringent security measures to ensure the isolation and protection of user assets. Each rollup chain operates independently, with its own unique set of validators and smart contracts. This isolation prevents any potential attack on one chain from affecting others.

Furthermore, Orbiter Finance employs a robust governance mechanism to ensure the integrity of the validators on each rollup chain. Validators are responsible for validating transactions and maintaining the security of the chain. Through a decentralized governance model, Orbiter Finance ensures that validators are selected based on their reputation and track record, minimizing the risk of malicious actors compromising the security of the platform.

Benefits of Cross-Rollup for Security

The implementation of cross-rollup technology on the Orbiter Finance platform brings several benefits for security:

| Improved Resilience | By distributing user funds across multiple rollup chains, Orbiter Finance reduces the risk of a single point of failure, making it more resilient against potential attacks. |

|---|---|

| Isolation of Assets | Each rollup chain operates in isolation, preventing attacks on one chain from affecting others and providing enhanced security for user assets. |

| Selection of Validators | Through a decentralized governance mechanism, Orbiter Finance ensures that validators are reputable and trustworthy, reducing the risk of malicious actors compromising the security of the platform. |

In conclusion, the integration of cross-rollup technology on the Orbiter Finance platform significantly enhances the security of user funds. By employing multiple rollup chains and implementing strict security measures, Orbiter Finance provides a robust and secure environment for users to transact and store their assets.

Securing Users’ Funds on the Orbiter Finance platform

Security is a top priority on the Orbiter Finance platform, and ensuring the safety of users’ funds is paramount. To achieve this, the platform implements various measures and technologies, including cross-rollup.

Cross-rollup: A Layer of Protection

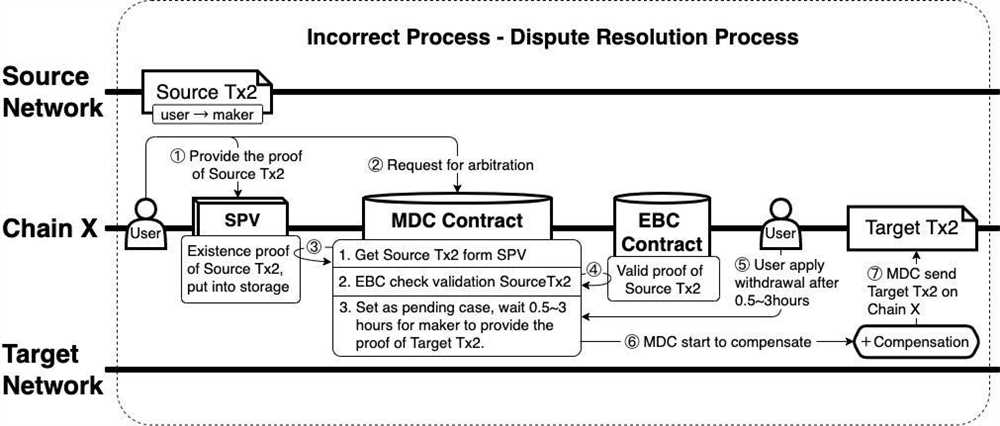

Cross-rollup is a mechanism that enhances security by facilitating the transfer of funds between different rollups. Essentially, it allows users to move their assets from one rollup to another, providing an additional layer of protection against potential security risks.

By utilizing cross-rollup, Orbiter Finance minimizes possible vulnerabilities associated with a single rollup. In case of any security breach or hacking attempt on one rollup, users’ funds can be quickly moved to another rollup, helping to mitigate potential losses and ensure the safety of the assets.

Immutable Smart Contracts and Audits

Another important aspect of securing users’ funds on the Orbiter Finance platform is the implementation of immutable smart contracts and rigorous third-party audits. Smart contracts are designed to be tamper-proof and cannot be altered once deployed, ensuring the integrity and security of users’ funds.

Furthermore, Orbiter Finance works with reputable auditing firms to conduct regular security audits of its smart contracts. These audits help identify and address any potential vulnerabilities or weaknesses, providing assurance to users that their funds are secure and protected.

Additionally, Orbiter Finance encourages bug bounties, where users are rewarded for identifying and reporting any security vulnerabilities they may discover. This crowdsourced approach further enhances the security of the platform and helps identify and fix any potential weaknesses.

In conclusion, ensuring the security of users’ funds on the Orbiter Finance platform is a top priority. Through the implementation of cross-rollup, immutable smart contracts, third-party audits, and bug bounties, Orbiter Finance provides a robust and secure environment for users to transact and store their assets.

What is cross-rollup?

Cross-rollup is a mechanism that allows for the seamless transfer of assets between different rollup chains. It enables users to move their assets from one rollup chain to another, facilitating interoperability and scalability within the Orbiter Finance platform.

What is the role of cross-rollup in improving security on the Orbiter Finance platform?

Cross-rollup plays a crucial role in enhancing security on the Orbiter Finance platform by reducing the single point of failure. By allowing users to move their assets between rollup chains, it minimizes the risk of a single chain being compromised or attacked. This improves the overall security of the platform and protects user assets from potential threats.

How does cross-rollup improve scalability on the Orbiter Finance platform?

Cross-rollup improves scalability on the Orbiter Finance platform by enabling the parallel processing of transactions across multiple rollup chains. This means that more transactions can be processed simultaneously, increasing the platform’s capacity to handle a higher volume of transactions. This scalability enhancement ensures a smoother user experience and avoids congestion on the network during peak periods.

Can you explain the interoperability aspect of cross-rollup?

Interoperability is a key aspect of cross-rollup on the Orbiter Finance platform. It allows for the seamless transfer of assets and data between different rollup chains, even if they are using different protocols or have different functionalities. This interoperability ensures that users can leverage different rollup chains for different purposes, while still being able to easily move their assets and data between them, creating a more flexible and efficient ecosystem.